For Example

Q.1 What precautions must be taken by the candidates for claiming OBC reservation before applying for an Examination? (Ans. Candidates seeking reservation/ relaxation benefits available for OBC category must ensure that they are entitled to such reservation/ relaxation in accordance with the eligibility prescribed in the Examination Rules issued by the Government/Examination Notice issued by the UPSC.)

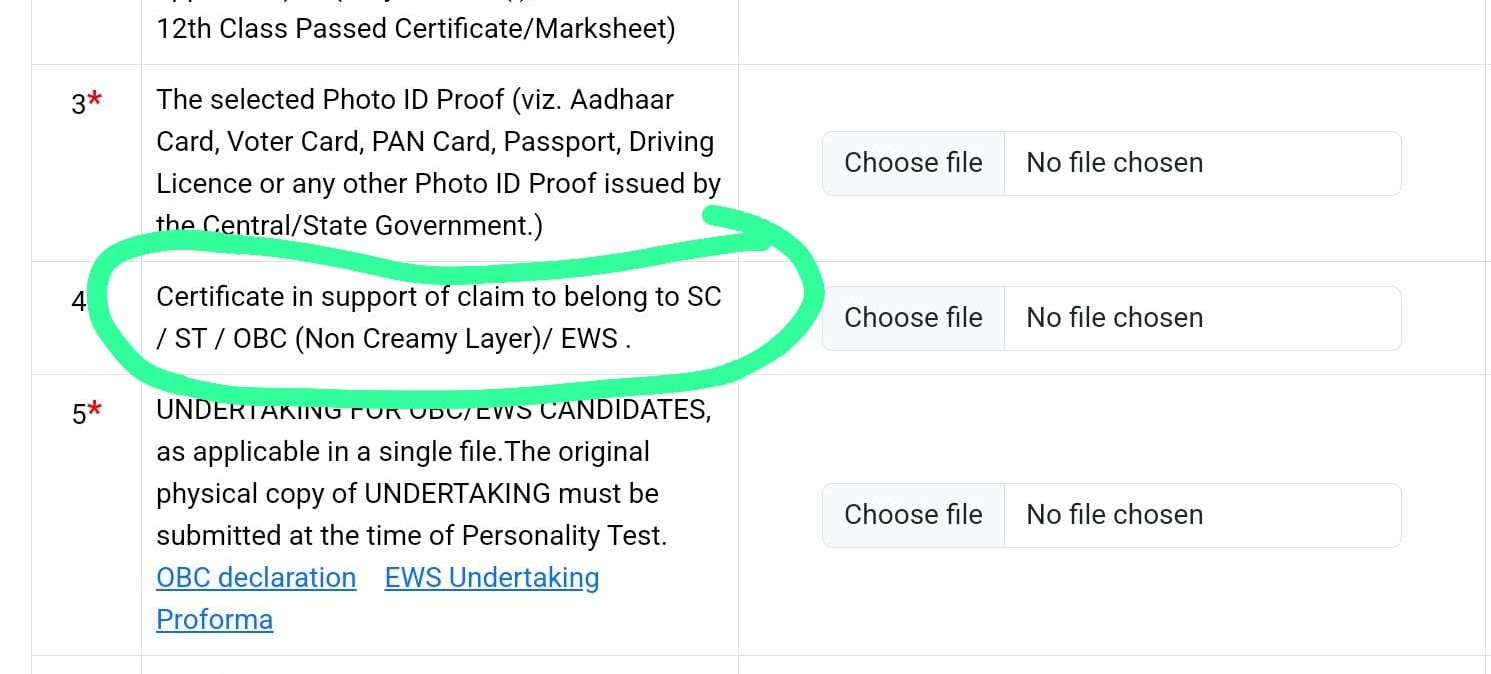

Q.2 Who is competent to issue an OBC certificate?( Ans. OBC certificate should be issued by any of the following authorities:

(a) District Magistrate/Additional District Magistrate/ Collector/ Deputy Commissioner/Additional' Deputy Commissioner/ 1st Class Stipendiary Magistrate/ Sub-Divisional Magistrate/ Taluka Magistrate/Executive Magistrate/ Extra Assistant Commissioner

(b) Chief Presidency Magistrate/Additional Chief Presidency Magistrate/ Presidency Magistrate

(c) Revenue Officer not below the rank of Tehsildar and

(d) Sub-Divisional Officer of the area where the candidate and/or his

family normally resides(e) Administrator/Secretary to the Administrator/Development

Officer (Lakshadweep)

Q.3 Whether Migration Clause/Para should be part of the OBC certificate?(Ans. Migration Clause/Para should be the part of OBC certificate, in case certificate is issued by a State other than that to which his/her father originally belongs.)

@YuvarajK Yes, income mentioned in income certificate

Sir, according to ITR the annual income is 4.5L, it would not contradict?

Hello sir

1.My OBC-NCL is signed by Revenue officer in Bihar. As per notification competent authority is "Revenue Officer not below the rank of tehsildar". I wanted to know is revenue officer in bihar a competent authority

2. Also I applied for my certificate last which came late on 2nd april 2024. So as per Date it is valid but since i applied for during last financial year iteself it is based on last year 2022-23 financial year. Is this valid.?

If both are employed by the Government as Group B, before age 40, you are Creamy Layer.

@NareshMentor Sir, Can you please check you inbox?

I have send you my query over there.

@NareshMentor Sir, for 8 lac limit, which of the two in ITR should be considered - Gross Salary or Gross Total Income? Gross Salary = 8.3 makes me ineligible; Gross Total Income = 7.7 makes me eligible. What should I fill?