Agriculture Subsidies are provided to farmers on farm inputs like fertilisers, seeds, farm machinery and electricity. These subsidies have been under attack from the economists and international organisations like WTO.

In this section, we will provide you with all the updates and concepts linked to agriculture subsidies.

Updates and news on agriculture subsidies for UPSC/IAS examination:

What is Maharashtra’s “Beed model” of crop insurance?

Contents

Contents

- 0.0.1 What is the news?

- 0.0.2 Why was the Beed Model of Crop Insurance launched?

- 0.0.3 What is the Beed Model of Crop Insurance?

- 0.0.4 Benefits of Beed Model for Government

- 0.0.5

- 0.0.6 What is the news?

- 0.0.7 Report on Farmers Protests:

- 0.0.8 Other key Findings of State of Environment Report:

- 0.0.9 Suggestions from State of Environment Report:

- 0.0.10 About Seed Minikit Programme:

- 0.0.11 Pulses and Oilseeds Production in India:

- 0.0.12 About National Food Security Mission(NFSM):

- 0.0.13 Introduction

- 0.0.14 Current Scenario

- 0.0.15 About DAP

- 0.0.16 Fertilizer Subsidy in India

- 0.0.17 Nutrient Based Subsidy(NBS) regime for Non-Urea fertilizers

- 0.0.18 Need for increasing the fertilizer subsidy on DAP

- 0.0.19 Steps to taken by Government to prevent fertilizer overuse

- 0.0.20 Issues associated with fertilizer subsidy

- 0.0.21 Suggestions

- 0.0.22 Conclusion

- 0.0.23

- 0.0.24 What is the News?

- 0.0.25 Mission for Integrated Development of Horticulture(MIDH):

- 0.0.26 Funding: Under the scheme,

- 0.0.27 Introduction:

- 0.0.28 Some unique steps under KALIA Scheme:

- 0.0.29 Advantages of the KALIA Scheme’s three-step framework:

- 1

What is the news?

Maharashtra Chief Minister has asked the Prime Minister for state-wide implementation of the ‘Beed model’ of the Pradhan Mantri Fasal Bima Yojana (PMFBY).

About Pradhan Mantri Fasal Bima Yojana (PMFBY)

- The scheme was launched in 2016 by the Ministry of Agriculture and Farmers Welfare.

- Aim: To provide comprehensive insurance cover against failure of the crop thus helping in stabilising the income of the farmers.

- Coverage of crops: It covers

- food crops

- oilseed crops

- annual commercial/horticultural crops

- Premium: The prescribed premium is

- 2% for Kharif crops

- 1.5% for Rabi crops

- 5% for commercial and horticultural crops.

- Completely voluntary: The enrollment under the scheme is 100% voluntary for all farmers.

- Earlier, the scheme was compulsory for loanee farmers.

Problems with the Scheme

- Delay in claim settlement

- Failure to recognize localized weather events

- Stringent conditions for claims

- Alleged profiteering by insurance companies

Why was the Beed Model of Crop Insurance launched?

- Beed is a drought-prone district in Maharashtra. Farmers here have repeatedly lost crops either to failure of rains or too heavy rains.

- Due to this, insurance companies have sustained losses given high payouts. Moreover, the state government also had a difficult time getting bids for tenders to implement the scheme in Beed.

- Hence, the Maharashtra Government decided to modify the crop insurance guidelines for the district.

Also read: Flash Droughts in India What is the Beed Model of Crop Insurance?

- Under this model, the insurance company provides a cover of 110% of the premium collected.

- In case the compensation amount exceeds the 110% mark, the state government would pay the bridge amount.

- But if the compensation was less than the premium collected, the insurance company would keep 20% of the amount as handling charges and reimburse the rest to the state government.

Benefits of Beed Model for Government

- In a normal season where farmers report minimal losses, the state government is expected to get back money that can form a corpus to fund the scheme for the following year.

- However, the state government would have to bear the financial liability in case of losses due to extreme weather events.

- Hence, in the model, the profit of the company is expected to reduce, and the state government would have access to another source of funds.

Source: Indian Express

“State of Environment Report” says “Farmer protests” increased fivefold since 2017

Contents

What is the news?

The Centre for Science and Environment (CSE) has released the State of Environment Report, 2021 in February recently. This article focuses upon the data related to farmer protests as mentioned in the report.

Report on Farmers Protests:

- Farmers Protests in India have registered an almost five-fold increase since 2017.

- In 2017, there were 34 major protests across 15 States. The number has now increased to 165 protests in 2020.

- Among these, 12 are pan-India protests, including 11 against the three farm reform laws.

- Reasons for Farm Protests:

- Contentious Central farm laws

- Procurement and agricultural market price-related failures

- Protests against inadequate Budget allocations for the agricultural sector.

- Battles against the acquisition of farmland for development projects

- Loan Waivers or poor insurance coverage among others.

- States: Numerous farmer protests have taken place in the States of Odisha, Andhra Pradesh and Telangana.

Read Also :-Prevalence of Bonded Labour in India

Other key Findings of State of Environment Report:

Farm Labourers:

India has more farm labourers than landowning farmers and cultivators.

- This has been found in 52% of the country’s districts.

- Among States, Bihar, Kerala and Puducherry have more farm labourers than farmers in all their districts.

Read Also :-Child Labour in India

Farmer’s Suicides:

- Every day, over 28 farm labourers and cultivators commit suicide in our country.

- In 2019, there were 5,957 farmer suicides along with an additional 4,324 farm labourers who died by suicide.

Suggestions from State of Environment Report:

- The report has called for better maintenance of agricultural data. It said that 14 States had witnessed a deterioration in the quality of their land records.

Source: The Hindu

- Farmers Protests in India have registered an almost five-fold increase since 2017.

Govt Launches “Seed Minikit Programme”

What is the News?

The Ministry of Agriculture has launched the Seed Minikit Programme.

About Seed Minikit Programme:

- Seed Minikit Programme aims to distribute high yielding varieties of seeds of pulses and oilseeds to farmers.

- Nodal Agencies: The seed mini-kits are being provided by the following central agencies –

- National Seeds Corporation(NCS)

- NAFED

- Gujarat State Seeds Corporation

- Funding: The programme is wholly funded by the Center through the National Food Security Mission.

- Significance: This programme is a major tool for introducing new varieties of seeds in fields and instrumental in increasing the seed replacement rate.

- Seed Replacement Rate (SRR): Out of the total area of a crop planted in a season, SRR is the percentage of total area sown using certified/quality seeds other than the farm-saved seed (the practice of saving seeds to plant in the next season).

Pulses and Oilseeds Production in India:

- The Government of India in collaboration with states has been implementing programmes to enhance the production of pulses and oilseeds under the National Food Security Mission.

- Since 2014-15, there has been a renewed focus on increasing the production of pulses and oilseeds. The efforts have yielded good results.

- Oilseeds production has increased from 27.51 million tonnes in 2014-15 to 36.57million tonnes in 2020-21.

- On the other hand, pulses production has increased from 17.15 million tonnes in 2014-15 to 25.56 million tonnes in 2020-21.

- However, India still imports a lot of pulses and edible oils to meet domestic demand.

About National Food Security Mission(NFSM):

- The National Food Security Mission(NFSM) was launched in 2007-08 by the Ministry of Consumer Affairs.

- Aim: To increase the production of rice, wheat and pulses through

- area expansion and productivity enhancement

- restoring soil fertility and productivity

- Creating employment opportunities and

- enhancing farm level economy.

- Coarse cereals were also included in the Mission from 2014-15 under NFSM.

Source: PIB

Issue of fertilizer subsidy in India – Explained, Pointwise

Contents

- 1 Introduction

- 2 Current Scenario

- 3 About DAP

- 4 Fertilizer Subsidy in India

- 5 Nutrient Based Subsidy(NBS) regime for Non-Urea fertilizers

- 6 Need for increasing the fertilizer subsidy on DAP

- 7 Steps to taken by Government to prevent fertilizer overuse

- 8 Issues associated with fertilizer subsidy

- 9 Suggestions

- 10 Conclusion

Introduction

The subsidy allows an individual to buy a product or use a service at a lower price than its market cost. The government in India has been providing a host of price subsidies on kerosene, cooking gas, water, electricity, fertilizer, etc. in order to support the vulnerable sections.

The farmers have been getting the benefits of fertilizer subsidies since the era of the Green revolution. It has become a core component of providing input support to the agricultural sector.

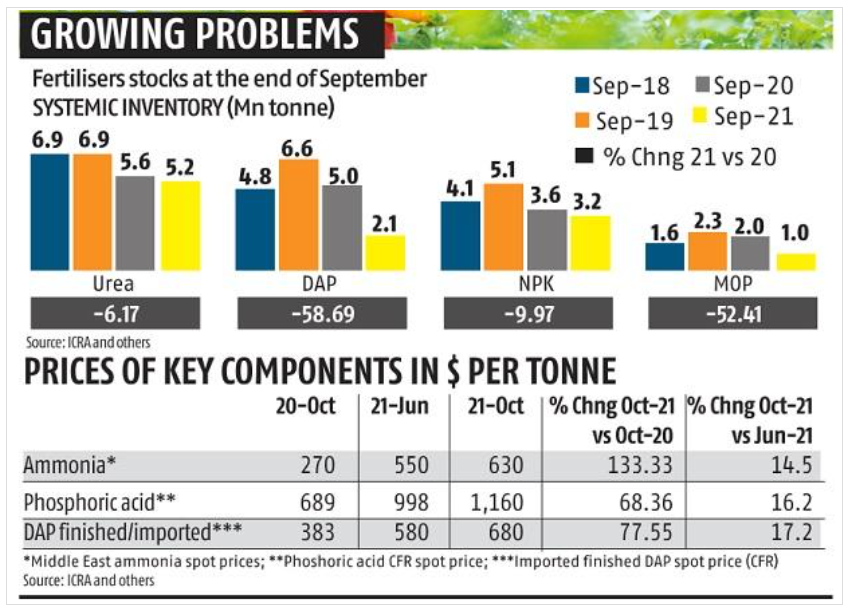

Recently, the government has announced an increase of 140% in the subsidy amount of DAP (Diammonium phosphate) fertilizer. It is expected to provide a sigh of relief to the farming community who is already facing severe pandemic stress. They have lost their loved ones and are battling the double jeopardy of rising healthcare bills and reduced urban remittances. This move would bring temporary relief to the sector but a permanent solution warrants long term reforms to make the agriculture sector more lucrative.

Current Scenario

Source: Business Standard - Recently, a committee headed by PM took a decision to increase the subsidy on DAP (Diammonium phosphate) fertilizer. The subsidy was increased by 140% from Rs 500 per bag to Rs 1200 per bag.

- Till last year, the actual price of DAP was 1700. The farmers were getting one bag for 1200 and a 500 rupee subsidy was given to companies.

- However, now the actual price of DAP is 2400 as international prices of phosphoric acid, ammonia etc. used in DAP have increased. Therefore in order to prevent companies from selling DAP at 1900 rupees, the government enhanced the subsidy.

- The Department of Fertilizers has further notified a higher per-kg NBS (Nutrient Based Subsidy) rate for P. It increased to Rs 45.323/kg while the earlier rate was Rs 14.888/kg.

About DAP

- It is the second most commonly used fertilizer in India. It has sales of 119.13 lakh tonnes (lt) in 2020-21 next only to the urea. Furthermore, it is applied just before or at the time of sowing by the farmers.

- The fertilizer is high in phosphorus (P) that stimulates root establishment and development. It contains 46% P and 18% nitrogen (N). Without DAP, the plants cannot grow to their normal size or will take too long to mature.

- It is similar to urea and muriate of potash (MOP), which again have very high N and potassium (K) content of 46% and 60%, respectively.

Fertilizer Subsidy in India

- Under the subsidy regime, farmers buy fertilizers at Maximum Retail Prices (MRP). However, this MRP is below the normal supply-and-demand-based market rates or what it costs to produce/import them.

- While, the MRP for urea is controlled/fixed by the government, it is decontrolled for other fertilizers including DAP, MOP, etc.

- The maximum retail price (MRP) of urea is currently fixed at Rs 5,378 per tonne or Rs 242 for a 45-kg bag. Since companies have to sell at this controlled rate (fixed MRP), the subsidy is variable. It means subsidy depends upon the market price or costing of Urea. Government has to pay the difference between controlled price and market price.

- In other fertilizers, the government only gives a fixed per-tonne subsidy. This means the subsidy is fixed, while the MRPs are variable. Thus, MRP of Decontrolled fertilizers is way above urea MRP and attract lower subsidy. For some of the non-urea fertilizers, government launched nutrient-based subsidy or NBS scheme.

Nutrient Based Subsidy(NBS) regime for Non-Urea fertilizers

- Under this, a fixed amount of subsidy is calculated for each fertilizer based on its nutrient composition. The government decides the rates for nutrients like Nitrogen (N), Phosphorous (P), Potassium (K), Sulphur (S), etc. which then are used for calculating a flat per ton rate.

- It means subsidy will be different for the fertilisers having different proportions of NPK. It means one tonne of DAP which contains 460 kg of P and 180 kg of N will get more subsidy compared to 10:26:26’ NPK fertiliser due to the difference in nutrient compositions.

- It allows the manufacturers, marketers, and importers to fix the MRP of the Phosphatic and Potassic (P&K) fertilizers at reasonable levels.

- The domestic and international cost of P&K fertilizers is considered along with the country’s inventory levels and the currency exchange rate in order to decide the MRP.

Need for increasing the fertilizer subsidy on DAP

- Cushioning the farmers from Price rise: The rise in subsidy would protect the farmers from the price rise. The fertilizer companies have enhanced the MRP of DAP from 1200 to 1900 as international prices of phosphoric acid, ammonia, etc. raw materials have increased.

- They would still pay 1200 rupees per bag despite the fact that the international prices of phosphoric acid, ammonia, etc. used in DAP have gone up by 60% to 70%.

- Boost Production: DAP is a crucial fertilizer for growing cotton and soybean in the western and northern regions of India. With sufficient subsidy, the farmers would be able to grow more produce in the Kharif season.

- Tackle the Covid impact: The farmers are undergoing severe stress due to the challenges posed to them by the Covid-19 pandemic. This includes loss of urban remittances, the rising cost of healthcare, and death of bread earners in the family. The increased subsidy would provide some relief to them.

- Political Considerations: Some experts are also viewing the rise in subsidies as a move to prevent the resurgence of the farmer’s protest amid the second wave of Covid 19.

Steps to taken by Government to prevent fertilizer overuse

- Compulsory neem-coating of all urea from December 2015.

- Making fertilizer subsidy payment to companies conditional upon actual sales to farmers being registered on point-of-sale machines from 2018. Under this, a valid sale requires a biometric authentication aadhar card or kisan credit card number.

- There is an upcoming plan to cap the total number of subsidised fertilizer bags that any person can purchase during an entire cropping season.

Issues associated with fertilizer subsidy

- No Denial Policy: Currently anybody can purchase any quantity of fertilizers through the PoS machines. There is a limit of 100 bags per transaction, but no limit is placed on the number of transactions. This enhances the diversion of fertilizers towards unintended beneficiaries.

- For instance, urea’s super subsidized and multiple usage nature makes it highly prone to diversion.

- It can be used as a binder by plywood/particle board makers, cheap protein source by animal feed manufacturers or adulterant by milk vendors. Further, it is also smuggled to Nepal and Bangladesh.

- Environment Degradation: The subsidies have enabled the over utilisation of fertilizers on agricultural lands. This is especially true for the super cheap urea which has witnessed a minor price rise since the last decade.

- The bulk of urea applied to the soil is lost as NH3 (Ammonia) and Nitrogen Oxide due to poor Nitrogen use efficiency of Indian Soils. This leads to contamination of groundwater, soil, land, etc.

- Economic Costs: The Central Government spends about Rs 80,000 crore on subsidies for chemical fertilizers every year. With the increase in subsidy in DAP, the government will spend an additional Rs 14,775 crore as subsidy in Kharif season.

- Health impacts: Over use of fertilizers also pollutes groundwater. Infants who drink water with high levels of nitrate (or eat foods made with nitrate-contaminated water) may develop the blue baby syndrome.

- It refers to a number of conditions that affect oxygen transportation in the blood, resulting in the blueness of the skin in babies.

Suggestions

- First, the government should consider alternative ways for helping the farmers like the use of Direct Benefit transfer instead of subsidies. This would curb its diversion for non-agricultural use and reduce the number of fraudulent beneficiaries.

- Until then, there should be a cap on the total number of subsidised fertilizer bags that any person can buy during an entire kharif or rabi cropping season.

- Second, urea should be included under the NBS scheme in order to reduce the fiscal burden of fertilizer subsidy on the government. This was recommended by the Sharad Pawar Committee in 2012.

- Third, the focus should now be placed on discouraging the use of chemical fertilizers and encouraging the adoption of organic fertilizers like vermicompost, seaweed extracts, etc. This would be in line with sustainable development and prevent land degradation.

- Fourth, in the long run, the government needs to augment the agricultural income of farmers so that they voluntarily give up their subsidies in the future. This would happen with better implementation of schemes like E-NAM, SAMPADA, PM Fasal Bima Yojana, etc.

Conclusion

The subsidies are like a dole to the farmer, it is saving his body but destroying its spirit. The ultimate solution is to make agriculture more lucrative and remunerative which would gradually lead to the withdrawal of subsidies and relieve the government of their fiscal burden.

“Mission for Integrated Development of Horticulture”(MIDH) Scheme

Contents

What is the News?

The Ministry of Agriculture and Farmers Welfare has provided an enhanced allocation of Rs. 2250 Crore for the year 2021-22 for ‘Mission for Integrated Development of Horticulture’(MIDH).

Mission for Integrated Development of Horticulture(MIDH):

- The mission for Integrated Development of Horticulture(MIDH) is a Centrally Sponsored Scheme for the holistic growth of the horticulture sector.

- Nodal Ministry: Ministry of Agriculture & Farmers Welfare is implementing the MIDH scheme since 2014-15.

- Part of: The scheme is being implemented as a part of the Green Revolution – Krishonnati Yojana.

- Coverage: The scheme covers fruits, vegetables, root and tuber crops. The scheme also covers mushrooms, spices, flowers, aromatic plants, coconut, cashew and cocoa.

Sub Schemes under MIDH: The mission has the following sub-schemes as its component:

- National Horticulture Mission (NHM)

- Horticulture Mission for North East & Himalayan States (HMNEH)

- National Horticulture Board (NHB)

- Coconut Development Board (CDB)

- Central Institute for Horticulture (CIH), Nagaland.

Funding: Under the scheme,

- The government of India(GOI) contributes 60% of the total outlay for developmental programmes in all the states except states in the North East and the Himalayas.

- In the case of the North-Eastern States and the Himalayan States, GOI contributes 90%.

- In the case of the following the GOI contributes 100%.

- National Horticulture Board(NHB),

- Coconut Development Board(CDB),

- Central Institute for Horticulture(CIH)

- The National Level Agencies(NLA)

- Further, the scheme also provides for technical and administrative support to State Governments/ State Horticulture Missions(SHMs). It also provides technical and administrative support for the Saffron Mission and other horticulture-related activities.

Performance of the scheme: MIDH scheme has played a significant role in increasing the area under horticulture crops such as:

- Area and production under horticulture crops during the years 2014 – 15 to 2019 – 20 has increased by 9% and 14% respectively.

- During the year 2019-20, the country recorded its highest ever horticulture production of 320.77 million tonnes from an area of 25.66 million hectares.

- However, the sector is still facing a lot of challenges. Such as,

- High post-harvest loss

- Gaps in post-harvest management

- Supply chain infrastructure.

Source: PIB

KALIA scheme of Odisha and its lesson for India

Synopsis: The Odisha government’s KALIA scheme aims to provide Direct Income Support(DIS) to farmers. The design and implementation of the scheme offer some important lessons to the DIS schemes everywhere.

Introduction:

In India, the Agricultural reforms generally aim to find new solutions to the structural challenges facing farmers. The shift to direct income support (DIS) from the traditional non-targeted agriculture subsidies is the most important one among them.

Few important schemes in this regard are,

- Odisha’s KALIA scheme – Under the KALIA scheme, Each farmer’s family gets Rs. 5,000 separately in the Kharif and rabi seasons. It is irrespective of the amount of land.

- Telangana’s Rythu Bandhu – In this scheme, the government provides Rs.4000 per acre per farmer per season to cover the input costs

- The Centre’s PM-KISAN scheme – Under this scheme, an amount of Rs.6000/- per year is transferred in three instalments of Rs.2000/- directly to the bank accounts of the landholding farmers’ families.

But the Odisha government’s KALIA scheme offers some important lessons for DIS schemes everywhere.

Some unique steps under KALIA Scheme:

Odisha used a three-step framework for KALIA Scheme. This is called the “Unification-Verification-Exclusion” framework. This framework is used to identify the beneficiaries of the scheme. The important point of the framework are,

- Unification: This is the first step. It involves creating a unified database with “green forms”. These green forms are essential for farmers who wanted to avail benefits under the KALIA Scheme. This has led to the creation of 1.2 crore applicants.

- Verification: In this step, the unified data get verified. The databases like the Socio-Economic Caste Census, National Food Security Act and other databases are used in the verification process. Similarly, Aadhaar and bank account also got verified to avoid duplication.

- Exclusion: In this step, the focus is on the exclusion of ineligible applicants. This includes applicants like government employees, taxpayers, large farmers, and those who voluntarily opted out.

Advantages of the KALIA Scheme’s three-step framework:

- Towards inclusive agricultural policy-making: The use of technology and non-farm databases under the KALIA scheme helped to include sharecroppers, tenant and landless farmers as beneficiaries. This facilitates inclusiveness in agricultural policy.

- World Bank evaluation of the KALIA Scheme suggests that the beneficiaries are less likely to take out crop loans. Further, Those who take crop loans also take only a smaller amount of loans compared to non-beneficiaries.

Lessons from the KALIA scheme:

- Better leverage of data: Any government targeted scheme can use the reliable data collected under the KALIA scheme for service delivery. So the other DIS schemes should aim towards forming such reliable data.

- Proof of Data Security: Odisha government obtained the consent for use of citizen data under the KALIA scheme. The data was also kept under a secure firewall. Further, access to data was only available to relevant officials on a need-to-know basis. Other GovTech platforms must use these “privacy by design” principles in data handling.

- Effective grievance redressal: The KALIA scheme established an online grievance redressal mechanism (GRM). This online platform is accessible to farmers “offline” at the Common Service Centres closest to them. Using this, nearly 10 lakh grievances were received and resolved. The GovTech platforms should establish such an effective redressal mechanism.

The KALIA scheme has more lessons for the governments on the way of constructing a social welfare system for farmers.

Source: The Indian Express

Issue of MSP Calculation and farmer’s demand

Synopsis: As per the government, M S Swaminathan report’s recommendations on MSP are already implemented. However, protesting farmers and farm experts contest the claim.

Introduction

Protesting farmers and farm experts have contested the government’s claim. They say that the government is going by its own formula and farmers’ income not improved yet.

- The farmers are claiming so because the actual amount depends on the method used to calculate the cost of production.

What are the various formulas used to calculate the cost of production in agriculture?

- There are at least six formulas to make that calculation which include A1, A2, B1, B2, C1 and C2.

Formulas used to determine the cost of production Criteria included A1 method all actual expenses in cash. Included the value of hiring human resource, the value of owned machine labour, hired machinery charges, the value of seeds both farm produced and purchased, the value of pesticides etc. A2 method A1 plus rent paid for leased-in-land B1 method A1 and interest on the value of an owned capital asset B2 method B1 plus the rental value of owned land and rent paid for leased-in-land. C1 method B1 and the credited value of family labour C2 method B2 and the credited with the value of Family Labour - M S Swaminathan report had recommended that the MSP should be calculated by including all actual farm costs as C2 along with an additional 50% margin.

What formula does the government use, to calculate MSP?

Different formulas were recommended by different committees formed for calculating MSP. For example, Dr M S Swaminathan Committee recommended C2+50%, Ramesh Chand Committee (RCC) recommended MSP on C2+10% formula.

- First, the government used its own formula A2+ Family Labour as a cost of production. The government then pay farmers 1.5 times the amount of A2+FL. But, the increase in the revenue of farmers did not make any difference in reality.

- Second, a comparison with the government method and Swaminathan report shows that there is a huge difference between A2+FL (Government) and C2 (Swaminathan committee) for the main crops. The value of A2+FL is much lower than the C2.

- Even if the costs suggested by RCC are taken into consideration can also improve the welfare of farmers. But the government is calculating MSP based on their own formula.

The way forward

- Swaminathan report’s MSP formula, C2 plus 50% is better for providing farmers with a higher value for their produce.

- Thus, the government should fix MSP by calculating C2, along with an addition of 50% margin. The MSP for wheat would be Rs 2,787 and paddy Rs 3,116 per quintal.

- If the RCC formula (C2 +10%) is adopted, then the MSP should be fixed at Rs 2,044 (wheat) and Rs 2,285 (paddy), respectively.

The Cost of Guaranteed MSP

Source: click here

Syllabus: GS 3

Synopsis: Farmers want to guarantee MSP which has no legal backing as of now. It is feasible and won’t cost very high for the government.

Introduction

Farmer unions are protesting to achieve two fundamental demands.

- The first demand is to take back the three agricultural reform laws enacted by the Centre.

- The second demand is to provide a legal guarantee for the minimum support prices (MSPs).

How can MSP be made legally mandatory?

This can be done in 2 ways:

- First, the private buyers are enforced to pay it and then no crop can be bought below the MSP. It would also act as the floor price for bidding in mandi auctions.

- For instance, in sugarcane, mills have to pay farmers the Centre’s “fair and remunerative price” within 14 days of supply as per the law.

- Second, the government itself has to buy at MSP, the entire crop that farmers grow.

- First, the private buyers are enforced to pay it and then no crop can be bought below the MSP. It would also act as the floor price for bidding in mandi auctions.

How much of farmers’ produce can the government buy at MSP?

MSP is currently applicable on 23 farm commodities including 7 cereals, 5 pulses, 7 oilseeds and 4 commercial crops. The MSP value of all 23 commodities was around Rs 10.78 lakh crore in 2019-20.

- However, the entire produce is not marketed as farmers retain a part of it for self-consumption, as a seed for the next season’s sowing and for feeding their animals.

- Therefore, the MSP value for the marketable crop which farmers actually sell would be around Rs 8 lakh crore.

What would be the government expenditure to ensure MSP?

The earlier mentioned amount will not be the amount the government has to spend because of the following reasons:

- Firstly, sugarcane should be excluded from the calculations. MSP for sugarcane is paid by sugar mills and not the government.

- Secondly, the government is already buying several crops like paddy, wheat, cotton, pulses and oilseeds which made the combined MSP value of these crops more than Rs 2.7 lakh crore in 2019-20.

- Thirdly, the Government need not buy the entire produce of farmers. Even if the government buys a quarter or third of the crops available in the market, it is enough to lift the prices.

- For example, CCI has so far bought 87.85 lakh bales of cotton out of the current year’s projected crop of 358.50 lakh bales. This has led to open market prices crossing the MSPs.

- Fourthly, the crop bought by the government also gets sold. The profits gathered from sales would partially balance the costs from MSP procurement.

- Lastly, the maximum amount the government has to spend on buying crops to guarantee MSP to farmers, will not be more than Rs 1-1.5 lakh crore per year.

Government buying crops at MSP is a better option rather than forcing private buyers.

Way forward

Economists suggest guaranteeing minimum incomes instead of minimum prices to farmers. This can be done by direct cash transfers either on a flat per-acre like done in the Telangana government’s Rythu Bandhu scheme or per-farm household basis, under the Centre’s Pradhan Mantri Kisan Samman Nidhi.

Rs. 1,364 crore given to wrong beneficiaries of PM-Kisan

News: According to an Right to Information (RTI) reply, Union government has paid Rs 1,364 crore to 20.48 lakh ineligible beneficiaries under the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme till July 2020.

Facts:

- There were two categories of undeserving beneficiaries who received PM-KISAN payouts namely the “ineligible farmers” and “income tax payee farmers”.

- More than half (55.58%) of these undeserving persons belong to the income tax payee category. The remaining 44.41% belong to the ineligible farmer’s category. However, in terms of the amount paid, 72% of the fund went to income tax payee.

- Punjab (23%), Maharashtra (17%) and Assam (14%) account for more than half of the beneficiaries of wrong payments followed by Gujarat and Uttar Pradesh with 8% each.

Additional Facts:

- PM KISAN: It was launched in 2019.It is the Centre’s flagship scheme to provide income support worth Rs. 6,000 a year to farming families. Earlier, it was meant to cover only small and marginal farmers who owned less than two hectares. Later that year, large farmers were included in the scheme as the government removed the land size criteria.

Further Read on PM KISAN: https://forumias.com/blog/pradhan-mantri-kisan-samman-nidhipm-kisan-scheme/

Read Also :upsc current affairs

Contradictions between farm laws and the MSP system

This article has been created based on the Indian Express article “Misunderstanding the MSP”

Synopsis- Mere amendments to farm laws will not solve the MSP issue, as the MSP system may not be able to face the private system of farm laws.

Syllabus– GS Paper III (Issues related to direct and indirect farm subsidies and minimum support prices)

Introduction- Recent negotiations between the farmers’ organisations and the Centre are stuck on the issue of MSP and repeal of farm laws. Although the government offered an amendment to address flaws in the three farming laws. But the farmers demanding, laws themselves need to be repealed.

Understanding the aspects related to the MSP system

- MSP Package: MSP alone is not remunerative for farmers. Remuneration is facilitated by a combination of 1.MSP, 2. Public Procurement System (PPS) and 3. Strict time-bound purchase of output brought to the PPS (By APMC, mandi yards).

- If any one of the above factors is missing from the combination, farmers will not be able to get the intended benefits.

- For example; Gaurang Sahay of the TISS, Mumbai reported that in MP, the absence of timely purchase of vegetables led to farmers feeding cauliflower and aubergine to their animals. i.e., one missing aspect from the combination.

- Availability of package: The government system of announcing and implementing MSPs is inadequate.

- MSP is announced for 23 crops but PPS and timely public procurement, are provided mainly for two crops, wheat and rice.

- For other 21 crops, the full package is not available and the market price falls way below MSP.

- It is the reason behind the demand for MSP continuation by Wheat and Rice farmers.

- Definition of MSP is another contested issue– Farmers’ organisations are insisting on the Swaminathan Committee formula of C2+50 percent, also announced by BJP government in its 2014 election manifesto, but not yet implemented.

- The MSP announced by the government is based on the A2+Fl+50 percent formula, which, unlike the C2+50 percent formula, does not cover all the costs of farming.

- This led to Farmers’ lack of trust in the government regarding its “assurance” on MSP.

Components of MSP Calculation: - A2: the actual expenses paid by farmers in cash and kind for seeds, fertilisers, pesticides, paid labour, irrigation, etc.

- A2+FL: the A2 cost along with an adjustment for the costs of unpaid family labour (given traditional Indian farming practices involve families).

- C2: A2+FL along with all other production costs, including loans, rentals, cost of land and other fixed capital assets, i.e. a comprehensive cost of production.

How has the significance of MSP/PPS system changed over time?

At the launch of the Green Revolution, MSP and PPS were designed to

- incentivize farmers to produce cereals — mainly wheat and rice —and

- achieve food self-sufficiency, which was met by the early Seventies.

At present, the purpose of MSP, PPS/APMC are:

- To maintain food self-sufficiency because crop diseases and extreme weather conditions can lead to food shortages.

- To ensure a reasonable, assured income to the farmers.

The 2nd purpose of ensuring reasonable income to farmers becomes crucial as 86 per cent of India’s farming households are either marginal (cultivating less than one hectare of land) or small (cultivating between one hectare and two hectares of land).

The above fact has been totally ignored by many pro-farm bill experts and even the Shanta Kumar Committee in its 2015 report by suggesting the dismantlement of FCI public procurement.

Can MSP system co-exist with the Private market system?

Government argument of Coexistence of MSP/APMC with big agribusiness-controlled private markets doesn’t look promising, due to the following factors.

- Firstly, Contract with the private trader, once entered into by a farmer, he will not be legally allowed to use the APMC mandi system for a better price than that contracted with the trader.

- Secondly, Dispute Resolution Mechanism doesn’t favor farmers. In case a farmer tries to use the other avenues providing better remuneration, private entities will take the non-compliant farmer to court.

- Third, Farmers will not be able to win a legal battle due to the structural inequities of legal resources and social-cultural capital under the dispute resolution mechanism.

- Fourth, Lack of choice for farmers– The proposed dispute resolution mechanism increases the choice of the trader to trade i.e. can trade with n number of farmers but not of the farmers i.e. can enter into agreement with a single trader.

- Fifth, genesis of Centre-State conflict- As central law will prevail in the private markets, while state laws in the APMC mandis., it will create conditions for perpetual Centre-state conflicts.

How to improve MSP system in India?

NITI aayog in its report provided with the following recommendations to improve the MSP system in India:

- Awareness among the farmers needs to be increased and the information disseminated at the lowest level so that the knowledge would increase the bargaining power of the farmers.

- Prompt payment: The delay in payment needs to be corrected and immediate payment should be ensured. For sustainability of farming prompt payment at remunerative rates should be made.

- Timing of MSP announcement: MSP should be announced well in advance of the sowing season so as to enable the farmers to plan their cropping.

- Transport and storage: More god owns should be set up and maintained properly for better storage and reduction of wastage. Transport facility (say, in the form of providing two wheelers) for Purchase Officers may be considered to help them effectively discharge their work.

- Updated criterion for fixing MSP: The criteria for fixing MSP should be current data and based on more meaningful criteria rather than C3.

- The small and marginal farmers can be provided with Procurement Centres in the village itself to avoid transportation costs.

MSP has been very helpful in keeping agriculture in our country alive and we have been able to become self-sufficient in food grains due to it. It becomes crucial for government to provide some solid assurance to farmers that it won’t be allowed to die down.

Farmer welfare in Kerala, in the absence of Mandi system

Synopsis: Absence of Madi system in Kerala has not impacted the farmer’s welfare in the state.

Background:

Thousands of farmers have assembled to protest against the 3 farm bills and have established a new way of life at Singhu, Tikri, Ghazipur, Noida and Shahjahanpur borders.

- Farmers have made all necessary arrangements for food, shelter, clothing, and sanitation. They have been gathering a countrywide support.

- A tussle among various political parties is also ongoing on the issue of support or opposition to farmer’s demand.

- Meanwhile, in all this debate, example of Kerala was used by some big politicians that the states with no Mandi system is also siding with the farmers.

- However, ground realities and facilities for farmers in Kerala suggest that the same model can be applied at other places too for the welfare of farmers.

Download :-Free upsc syllabus pdf

How Farmer’s Welfare in Kerala assured?

Agricultural Produce Market Committees (APMCs) and mandis although do not exist in Kerala, the needs and interests of farmers are taken care of in the state.

- The central government’s rate for obtaining rice is ₹ 18 a kg whereas the government in Kerala has fixed the price of rice from cultivators at ₹27.48 a kg. This increased basic price is also applicable on fruits and vegetables.

- Basic prices (per Kg) of 16 items are assured by the government. Few examples are tapioca ₹12, banana ₹30, garlic ₹139, pineapple ₹15, tomato ₹8, string beans ₹34, ladies’ fingers ₹20, cabbage ₹11 and potato ₹20.

- Dried coconut also has a much higher procurement rate in Kerala as compared to the rate announced by the central government.

- Apart from crop insurance, paddy cultivators also get the royalty in Kerala at the rate of ₹2,000 per hectare. They get a pension as well, which is a very unique step in the country.

- A debt relief commission was introduced in 2006 by the left government when farmers’ suicides were increasing, this initiative tried to help and save them.

Above facts prove that farmers in Kerala are in a better condition compared to the state of farmers in other states after enacting Farm Laws. Forex; 40% of mandis in Madhya Pradesh have registered only zero transactions after the passing of 3 bills.

Reforming Agriculture sector through FPOs

Synopsis – the present market structure is not favorable for marginal farmers, the government should use the model of Farmers Producers Organisations (FPOs) for assisting farmers.

Background

- A set of three laws passed in September aims to deregulate India’s enormous agriculture sector aimed at “liberating” farmers from the tyranny of middlemen.

- But many farmers fear that they stand to lose more than they could gain from the new regulations and these are the following concerns of farmers-

- End of MSP- Their main worry is about a possible withdrawal of the MSP and a dismantling of the public procurement of grains.

- Promote corporate control– The farmers contend the federal government is making ready to withdraw from the procurement of food grain and hand it over to the company gamers.

Although all of the concerns of farmers are not misplaced, but these concerns have definitely been blown out of proportion for political reasons.

What are the issues in present Agri. Market structure?

Present Agri. Market structure which suffers from the lacunas of MSP system, restrictive Mandi system and APMC market structures, is doing more harm than benefits to the marginalized farmers.

- First, CRIER-OECD study on agricultural policies showed that over the period 2000-01 to 2016-17, Indian agriculture was implicitly taxed to the tune of almost 14 per cent of its value.

- What this implies is that Indian farmers have been implicitly taxed heavily through restrictive marketing and trade policies [export controls, stocking limits and restrictive mandi system]

- Second, the procurement system and MSP mechanism are beneficial particularly for the rich farmers of Punjab and Haryana

- The NSSO’s Situation Assessment Survey [2012-13] revealed that Only 6 per cent of the farmers in India are fully covered and benefitted by the MSP, and 84 per cent are located in the states of Punjab and Haryana.

- The MSP and APMC system primarily helps those who have large surpluses, mainly the large farmers.

How FPOs can be helpful for small and marginal farmers?

In India, 86 per cent of farmers are small and marginal (less than 2 ha), who do not get the benefit of MSP system.

- Farmer’s Producer’s organizations (FPOs) at village level, consisting of small farmers, supplemented by the mechanism of new farm laws will benefit them.

- The creation of an additional 10,000 FPOs and the promised Agri-infra Fund of Rs.1,00,000 Crore will aid this process.

How government can eliminate the fears of agitating farmers?

- First, MSP to be continued– The government need to assure farmers in writing that the new laws discontinue APMC and MSP system.

- Second, Government needs to clarify about the contract farming that that the contract will be for the produce, not the farmers land.

- Third, farmers can take disputes to district courts.

- Forth, Government can also approve 25,000 Crore alternate fund under the Price Stabilization Scheme to support market prices in case when prices fall below 10 percent the MSP

However, The Food Corporation of India is already overloaded with grain stocks that are more than 2.5 times the buffer stock norms.

- To deal with such situation, Government can either limit the quantity of procurement or go for Price deficiency Payment system for those who buy “put options” at MSP to address the gaps in MSP based procurement of crops.

- An expert committee will have to be set up to look into its operational guidelines and further announcement of a diversification package for the Punjab-Haryana region can be done.

Conclusion

- On the one hand, repealing of new farmer’s law would be unfair for small and marginal farmers as they never got any benefit from the MSP system. On another hand, High price to farmers also mean high food prices for consumer.

- Thus, there is a requirement to strike a balance between the interest of various stakeholders of Indian farming system and its consumers.

Pradhan Mantri Kisan Samman Nidhi(PM-KISAN) Scheme

Source: PIB

News: The Prime Minister has released the next instalment of financial benefit under PM Kisan Samman Nidhi through video conference.

Facts:

- PM KISAN: It is a Central Sector scheme launched by the Ministry of Agriculture & Farmers Welfare in 2019.

- Objective: To augment the income of the farmers by providing income support to all landholding farmers’ families across the country and to enable them to take care of expenses related to agriculture and allied activities as well as domestic needs.

- Income Support: Under the Scheme an amount of Rs.6000/- per year is transferred in three 4-monthly installments of Rs.2000/- directly into the bank accounts of the farmers subject to certain exclusion criteria relating to higher income status.

- Coverage: The Scheme initially provided income support to all small and Marginal Farmers’ families across the country, holding cultivable land up to 2 hectares. Its ambit was later expanded to cover all farmer families in the country irrespective of the size of their land holdings.

- Beneficiaries: The entire responsibility of identification of beneficiaries rests with the State / UT Governments.

- Exclusions: Affluent farmers have been excluded from the scheme such as Income Tax payers in last assessment year, professionals like Doctors, Engineers, Lawyers, Chartered Accountants etc. and pensioners drawing at least Rs.10,000/- per month (excluding MTS/Class IV/Group D employees).

- Special Provisions: Special provisions have also been made for the North-Eastern States where land ownership rights are community based, Forest Dwellers and Jharkhand which does not have updated land records and restrictions on transfer of land.

Other Similar programmes by States:

- Krushak Assistance for Livelihood and Income augmentation (KALIA)- Odisha

Each family will get Rs 5,000 separately in the kharif and rabi seasons irrespective of the amount of land. - The Rythu Bandhu scheme- Telangana.

In this scheme the government will provide Rs.4000 per acre per farmer per season to cover the input costs associated in farming like seeds, fertilizers, labour etc.

MSP for other crops

Context: Need to extend MSP for other crops to promote crop diversification.

How India achieved self-sufficiency in food grain production mainly in wheat and rice?

- Ship-to-mouth situation in India: In the early 1960s, near-famine conditions prevailed in India and some 10 million tonnes of wheat had to be imported from the US under the PL480 programme.

- Green Revolution: With the efforts of M S Swaminathan seeds of high-yielding dwarf wheat varieties were procured from Norman Borlaug wheat-improvement programme and were distributed to the Indian Agricultural Research Institutes. These high yielding seeds ushered the era of Green revolution in India.

- Self-sufficiency: With favourable government policies, efforts of agricultural scientists and due to the immense contributions of farmers of Punjab, Haryana and western UP, India achieved self-sufficiency in food grain production mainly in wheat and rice.

Why the farmers from “food bowl “region are against the new farm bills?

- First, the Farmers of the “food-bowl” states have been selling food grains (mainly wheat and rice) at Minimum Support Price (MSP) since the mid-1960s.

- This has helped the central government create a central pool of food grains and the Public Distribution System (PDS) to help the poor.

- However, MSP has not been guaranteed in the newly enacted farm laws, which is the major bone of contention.

- Second, the Agriculture Produce Marketing Committees (APMCs) are under threat from the new farm laws. Many experts feel that MSP and APMC go hand-in-hand. This has created uncertainty in the minds of farmers about the continuation of MSP.

- Third, though the new farm laws are meant to eliminate the “middlemen” (arhtiyas), farmers feel that a new class of middlemen, that is, lawyers belonging to big companies, will emerge leaving small farmers at a distinct disadvantage. (more than 80 per cent of farmers own less than five acres of land).

- Fourth, according to the central government, the new laws will ensure contract farming. However, the farmers feel that the big companies might become monopolies, and exploit both farmers and consumers. Farmers fear being made into labourers.

- Apart from these issues, the manner in which the bills are passed without consultation of stakeholders and lack of discussion in the parliament has provoked a reactionary response from farmers.

What is the way forward?

- Guarantee MSP: A clause should be added in the law to the effect that no matter who buys the producing government or a private entity, the farmer must be given MSP.

- Implementation of MS Swaminathan committee recommendation: The National Farmers’ Commission recommended providing an MSP of 50 percent over and above a farmer’s input expenses must be implemented.

- Need for Special MSP: MSP should be determined on the basis of grain quality. For example, wheat varieties grown in the “food bowl” states contain 11 percent protein compared to 7 percent protein grown elsewhere.

- Promote crop diversification: Government needs to purchase crops produced other than wheat and rice at MSP. This could help conserve underground water and soil fertility.

- Encourage farmers to grow high-value crops: For this to happen the government should set up an adequate cold-chain infrastructure so that perishable products can be kept longer and sold at an appropriate time.

- Discussions, Deliberation, Debate: Including intellectuals like M S Swaminathan, Gurdev S Khush, Surinder K Vasal, and Rattan Lal in the “Agricultural Think Tank” and they should be consulted by Niti Aayog

Guaranteed MSP will claim half the Budget

Context: Procurement of 23 crops at MSP which will amount to ₹17-lakh cr and to support this annual allocation, rich farmers should pay tax.

What is the farmers ’demand?

- The protesters have rejected the offer of amendments to farm laws and are firm on their demand for repeal of the three laws.

- Farmers want MSP guarantee.

Is it feasible to accept demand of MSP guarantee?

- Not economical: India has about 14 crore farmers (as per PM-KISAN enumeration). Cost of procuring all 23 crops is 50 per cent of India’s annual expenditure

- Unsustainable burden: The cost of MSP and subsidised food supplies are being met by heavy borrowings from the National Small Savings Fund (NSSF).

- Rising subsidies: In 2019-20, 11 per cent of the country’s total budget was spent on farmer welfare schemes. Subsidies on food and fertiliser and expenses on irrigation schemes in 2019-20 noticed a 65 per cent jump from 2017-18.

- Direct benefit: introduction of the PM-KISAN scheme resulted in leap in food subsidy.

- Rise in procurement: Procurement of food crops including paddy, wheat, pulses and oilseeds under MSP has seen a dramatic increase. For example, compared to 1,395 lakh tonnes of wheat procured between 2009 and 2014, 1,627 lakh tonne of wheat have been procured in the last five years.

What are the other issues?

- Disparities: MSP’s poor implementation has created problems of equity with large farmers of just two States Punjab and Haryana.

- Faulty policy: As per CACP, more than 95 per cent paddy farmers in Punjab and about 70 per cent farmers in Haryana are covered under MSP operations. States such as Uttar Pradesh (3.6 per cent), West Bengal (7.3 per cent), Odisha (20.6 per cent) and Bihar (1.7 per cent), have only a minuscule number of farmers benefit from procurement.

Why blanket exemption on taxing agriculture income is bad policy?

- Agriculture income including that from sale of farmland is exempt under Section 10 (1) of the Income Tax Act, 1961 without any limit.

- Rich farmers and politically influential people use the provision to convert black money into white.

- Rich farmers include many corporates who run seed companies and whose profits run into crores.

- In 2019, a Comptroller and Auditor General report red-flagged the irregularities in exemptions given by the taxman on agriculture income.

- It said that claims of tax exemption on farm income were given based on “inadequate verification or incomplete documentation” in more than a fifth of the 6,778 cases.

- Exemption was granted in hundreds of cases where land records or proof of farm income was not available.

- According to an article published in the Economic and Political Weekly by Govind Bhattacharjee, a retired Director General from CAG, assesses who had reported agricultural of more than ₹5 lakh each between 2014-15 and 2016-17 were 22,195.

The blanket exemption on agriculture income should be stopped and it should continue for roughly 86 per cent of the peasants of the country. The 14 per cent rich farmers should come forward to help the rest get MSP support.

Why green revolution states should shift from MSP crops to high value crops and Non-farm activities?

Source – Click Here

Context: Green Revolution states are required to shift their focus from MSP crops to high-value crops and Non-farm activities due to the consequences

Punjab, Haryana, and western Uttar Pradesh were early adopters and major beneficiaries of Green Revolution technology and enabled India in becoming a nation close to self-sufficiency in food in just 15 years.

How green revolution states benefitted from the MSP system?

Due to the following factors, the share of rice and wheat in the total cropped area rose from 48% in Punjab and 29% in Haryana in the early 1970s to 84% and 60%, respectively in recent years;

- Firstly, farmers were insulated against any price and market risk due to the Government procurement of marketed surplus of paddy (rice) and wheat at MSP.

- Secondly, the best resources were allocated for technological advancement for rice and wheat crops by public sector agriculture research and development for technological advantage.

- Third, free power, and fertilizer subsidy together with MSP resulted in higher income per unit area from wheat and paddy cultivation.

The above factors made the cultivation of Paddy and Wheat beneficial in terms of productivity, income, price, Land-labour ratio, and yield risk, and ease of cultivation among all the field crops (cereals, pulses, oilseeds).

Then, why green revolution states must shift to Non-farm activities?

Since the Mid-1980s, many reports and policy documents started suggesting the following serious consequences of the continuation of the rice-wheat crop system in general and paddy cultivation in particular;

- On the demand side, Per capita intake of rice and wheat is declining in India and consumers’ preference is shifting towards other foods. For ex; average spending by urban consumers is more on beverages and spices than on all cereals.

- On the supply side, rice production is rising at the rate of 14% per year in Madhya Pradesh, 10% in Jharkhand, and 7% in Bihar.

- On the government procurement side, Rice and wheat procurement in the country has more than doubled after 2006-07 and buffer stocks have expanded to an all-time high, with fewer options available to dispose of such large stocks. It is putting a heavy burden on the government exchequer.

- On the farmer’s side, More than 50 Years of the MSP system has affected the entrepreneurial skills of farmers required to sell the produce in a demand-supply based market system.

- On the resources side, paddy cultivation and availability of free power for pumping out groundwater for irrigation, has resulted in the drastic decline of the water table in 84% of observation wells in Punjab and 75% in Haryana. At this pace, both these states might run out of groundwater in a few years. Stubble burning is also a consequence of this system.

- At present, most of the farm work in green revolution states is being undertaken by migrant labor as the younger generation is not willing to do manual work and looking for better paying salaried jobs in non-farm occupations.

All the above-listed factors do not favour an increase in MSP, which is demanded every year by farmers.

How to shift to non-farm activities?

The government in these states must facilitate the private investment in a large number of area-specific enterprises tailored to State specificities by

- Promotion of food processing in formal and informal sectors;

- A big push to post-harvest value addition and modern value chains;

- A network of agro- and agri-input industries;

- Setting up high-tech agriculture;

- A direct link of production and producers to consumers without involving intermediaries.

Besides agriculture-based industries, State needs large-scale private investments in modern industry, services, and commerce.

Thus, the demand of time is that these traditional Green Revolution States of Punjab and Haryana should focus on innovative development strategy in agriculture and non-agriculture to develop a better future for the farmers and aspiring youth of the state.

How the 1.5-times formula for crops MSP is calculated?

News: The talks between farmer unions and the government failed to reach a resolution.The main bone of contention in these talks is the Minimum Support Price (MSP) for crops which farmers fear the new laws will do away.

Facts:

- MSP: It is the minimum price paid to the farmers for procuring food crops. It is announced by the Government at the beginning of the sowing season.

- How was the MSP calculated before? The Commission for Agricultural Costs & Prices (CACP) would recommend MSPs for 23 crops by taking into account the supply and demand situation for the commodity; market price trends and implications for consumers (inflation), environment and terms of trade between agriculture and non-agriculture sectors.

- What changed with the Union Budget for 2018-19? The Budget for 2018-19 announced that MSPs will be fixed at 1.5 times of the production costs for crops as a predetermined principle.Simply put, the CACP’s job now is only to estimate production costs for a season and recommend the MSPs by applying the 1.5-times formula.

- How is this production cost arrived at? CACP considers both A2+FL and C2 costs while recommending MSP.However, C2 costs are used by CACP primarily as benchmark reference costs (opportunity costs) to see if the MSPs recommended by them at least cover these costs in some of the major producing States.

- A2: It covers all paid-out costs directly incurred by the farmer — in cash and kind — on seeds, fertilisers, pesticides, hired labour, leased-in land, fuel, irrigation, etc.

- ‘A2+FL’: It includes A2 plus an imputed value of unpaid family labour.

- ‘C2’: It is a more comprehensive cost that factors in rentals and interest forgone on owned land and fixed capital assets on top of A2+FL.

Additional Facts:

Commission for Agricultural Costs and Prices (CACP): It is an attached office of the Ministry of Agriculture and Farmers Welfare. It is not a statutory body set up through an Act of Parliament.

Link for our 7PM Editorial of similar article (Why Farmers are protesting and what is MSP system?)

Need for the procurement system

Context- Dismantling the procurement system is neither in the interests of farmers nor the government.

What are the concerns of farmers related to new farmer’s acts?

Farmer’s concern-

- Their main worry is about a possible withdrawal of the Minimum Support Price (MSP) and a dismantling of the public procurement of grains.

- This could corporatize agriculture; threaten the current mandi network and State revenues.

However, the government claims that the farmer’s new laws will-

- Break the monopoly- It allows intra-state and inter-state trade of farmers produce beyond the physical premises of Agricultural Produce and Livestock Market Committee (APMC) markets.

- The MSP-procurement system will continue, and that there is absolutely no plan to dismantle the system.

- Unshackle farmers– increase options for farmers in the output markets

- Boost competition– The competition will increase and private investment will reach villages. Farming infrastructure will be built and new employment opportunities will be generated.

Why farm protests have been highly intense in Punjab, Haryana?

- PDS is the lifeline – The procurement system and MSP mechanism is strong in Punjab and Haryana.

- Nearly 88% of the paddy production and 70% of the wheat production in Punjab and Haryana (in 2017-18 and 2018-19) has been absorbed through public procurement.

- Other states are hardly benefitted from the MSP mechanism.

Does government want this procurement system?

The need for procurement of paddy and wheat to government is even more because-

- To support the needy one– There are nearly 80 crore NFSA (National Food Security Act) beneficiaries and an additional eight crore migrants who need to be supported under the PDS.

- To maintain the PDS – The government needs an uninterrupted supply of grain, particularly from these two States.

- To overcome COVID-19 situation- Due to the onset of the novel coronavirus pandemic and the migrant crisis, government needs to procure a huge quantum of grains than in previous years as the government cannot afford to go to the open market.

What improvements are required in new farmer’s Act?

- Regulatory mechanism– Framework for supervision of all trade (irrespective of its being done on the electronic market or physical market) to ensure fair play by private players vis-à-vis farmers

- Lack of transparency in trade area transactions are two of the major limitations that need to be addressed immediately.

Instituting these safeguards will make the reforms foolproof.

What is the way forward?

- The government has to continue its procurement from Punjab and Haryana even after the COVID-19 situation improves and the migrant crisis abates, as the obligations under the NFSA will continue.

- The government should reach out to the farmer groups and assures them of the indispensability of MSP-procurement system.

Farmer’s protest

Context – Massive communication failure on the part of the central government to explain to farmers what these laws are, and how they are intended to benefit them.

What is the farmer’s and States concern with regard to new farm laws?

- Farmer’s fear- This could corporatize agriculture, threaten the current mandi network and State revenues and dilute the system of government procurement at guaranteed prices.

- States fear- Due to this bill, the revenue earned by the states in the form of market fees will drop drastically. About 13 per cent of the total revenue earned by the Punjab government comes from these mandis.

What are the demands of the farmers?

- Repeal of new agriculture law-Punjab farmer leaders, including two major political parties, demand repeal of these laws.

- However, repealing would mean bringing back mandi system, licence raj and the resultant rent-seeking.

- MSP to be legally binding– Farmers’ second demand is a written assurance in the form of a bill that the MSP and conventional food grain procurement system for the central pool will continue in future.

- Farmers want a legal guarantee that no procurement will happen below MSP anywhere in the country.

However, The Food Corporation of India is already overloaded with grain stocks that are more than 2.5 times the buffer stock norms.

What are the policy options does government have?

- Use of Price Stabilization Scheme – To give a lift to market prices by pro-actively buying a part of the surplus whenever market prices crash, say more than 20 per cent below MSP.

- Decentralization of agriculture system – Decentralization the MSP, procurement, stocking, and public distribution system (PDS). Since agricultural marketing is a state subject.

- The food subsidy can be allocated to states on the basis of their share in all-India poverty/proportion of vulnerable population, all-India wheat and rice production, all-India procurement of wheat and rice

What is the way forward?

- Farmers protest in India is an indication of larger complex issue. Pressure groups play a vital role in generating awareness and reaching a consensus and sustainable solutions to farmer’s problems.

The Finance Commission can work out a formula for distribution funds amongst States, based on some tangible performance indicators and the Centre should get off from MSP, PDS, fertilizer subsidy, and MNREGA.

Why Farmers are protesting and what is MSP system?

Farmer’s protests is not a new phenomenon in India, but in recent years, the frequency of protests has been increased. Major protests reported from states like Madhya Pradesh, Bihar, and UP.

A look at the timeline of farmers’ protest over the last 10 years shows that the minimum support price (MSP) for various crops has been a major grouse.

Another issue has been that of land acquisition, with farmers complaining that compensation for land acquired for industrial projects was not in tune with market rates.

Most recent protests are against the 3 farm bill enacted recently by the government:

- Essential Commodities (Amendment) Bill, 2020: aims to provide government with the tool to regulate agri commodities.

- Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Bill, 2020: aimed to provide a legal contract for farmers to enter into written contracts with companies and produce for them.

- Farmers’ Produce Trade and Commerce (Promotion and Facilitation),(FPTC) bill 2020: aims toBreak the monopoly of government-regulated mandis and provide farmers and traders freedom of choice of sale and purchase of Agri-produce.

The major bone of contention among the 3 bills is the FPTC bill that permits sale and purchase of farm produce outside the premises of APMC mandis. Such trades (including on electronic platforms) shall attract no market fee, cess, or levy “under any State APMC Act or any other State law.

What are objections raised against FPTC bill?

- Much of government procurement at minimum support prices (MSP) takes place in APMC mandis.

- In a situation when more and more trading moves out of the APMCs, these regulated market yards will lose revenues.

- FTPC Bill is not about delivering on the promise of freedom to farmers but the freedom to private capital to purchase agricultural produce at cheaper prices and without any regulation or oversight by the government.

- APMCs though not abolished but the provisions will drive them dysfunctional gradually. It would pave the way for new capitalists based markets.

- Due to this bill, the revenue earned by the states in the form of market fees will drop drastically. About 13 percent of the total revenue earned by the Punjab government comes from these mandis.

- In India, 86 percent of farmers have a land of the size of less than two hectares, they don’t have the resources to carry their produce too far off places to sell. Thus provision allowing interstate trade of produce to farmers, is not well thought out.

Farmers want a legal guarantee that no procurement will happen below MSP anywhere in the country.

What are 2 private member Bills that can be instrumental in easing the ongoing farmer’s protest?

Kisan Union protesting at present are demanding for the enactment of 2 Private member bills, introduced in 2018. Bills were drafted by the members of the All India Kisan Sangharsh Coordination Committee (AIKSCC), the umbrella organisation of 500 farmers’ unions across the country.

- The Farmers’ Freedom from Indebtedness Bill 2018:

- obligates the govt. to waive all loans of all peasants, including landless peasants, agricultural workers, sharecroppers, fishermen which includes declaration of private loans as null and void and payment to the creditors by the govt. without any recovery from the debtors.

- The Farmers’ Right to Guaranteed Remunerative Minimum Support Price (MSP) for Agricultural Commodities Bill 2018:

- Bill obligates to regulate and decrease the cost price of farm inputs including diesel, seeds, fertilizers, insecticides, machinery and equipment

- To ensure through public and private purchasing agencies that the farmers get a guaranteed MSP of C2 + 50%.

Why farm protests have been highly intense in Punjab, Haryana?

- The procurement system and MSP mechanism is strong in Punjab and Haryana.

- Though the government announces MSPs for 23 crops, only wheat and rice are bought in sufficiently large quantities.

- For wheat, MSP mechanism is helpful only in the northern and central states like Punjab, Haryana and Madhya Pradesh.

- For rice, the benefit is accrued by the farmers from the states such as Andhra Pradesh, Chhattisgarh, Punjab and Haryana.

- Other states are hardly benefitted from the MSP mechanism.

- The 70th round of National Sample Survey for 2012–13 revealed that only 32.2% of paddy farmers and 39.2% of wheat growers in the country were aware of MSPs.

How MSP is determined?

The CACP determines the MSP, currently based on a formula that was prescribed by the Swaminathan Commission, a government-formed panel that had submitted several reports between December 2004 and October 2006 which set out suggestions for solving the problems faced by farmers.

The formula requires the assessment of three categories of costs:

- A2: the actual expenses paid by farmers in cash and kind for seeds, fertilisers, pesticides, paid labour, irrigation, etc.

- A2+FL: the A2 cost along with an adjustment for the costs of unpaid family labour (given traditional Indian farming practices involve families).

- C2: A2+FL along with all other production costs, including loans, rentals, cost of land and other fixed capital assets, i.e. a comprehensive cost of production.

The MSP is set at a particular level above the C2 for each crop, and applies across the country. In addition to the current C2 level, the CACP also takes into account demand and supply, domestic and international price trends, inter-crop price parity and the likely implications of MSP on consumers of the crop.

How many crops are covered under MSP?

At present, MSP is provided for 23 crops

7 Cereals: paddy, wheat, maize, sorghum, pearl millet, barley and ragi

5 Pulses: gram, tur, moong, urad, lentil

7 Oilseeds: groundnut, rapeseed-mustard, soyabean, seasmum, sunflower, safflower, nigerseed

4 Commercial Crops: copra, sugarcane, cotton and raw jute

In case of sugarcane, MSP has been assigned a statutory status and as such the announced price is termed as statutory minimum price, rechristened as Fair Remunerative Price (FRP).

On the other hand MSP system is not supported by any law i.e. doesn’t have a statutory status.

How MSP benefits farmers?

MSP help in rescuing farmers from low income trap in the following ways:

- Fixed Remunerations: The farmers are financially secured against the vagaries of price instability in the market.

- Diversification of crops: The MSP announced by the Government of India for the first time in 1966-67 for wheat has been extended to around 24 crops at the present. This will encourage the farmers to grow these diverse crops to maximise their income.

- Prevents Distress-Sale: Farmer rarely has surplus savings for buying inputs for the next cropping season. Access to credit (loans) is also difficult for small and marginal farmers. So, they are forced into distress-sale of produce at throw-away prices, and are not able to buy high quality seeds, fertilisers, pesticides & tractor-rent for next cropping season, which will further decrease their income from the next cycle. MSP prevents this phenomenon.

- Helps informed decision making: Government announces MSP before the sowing season for 23 crops including cereals, pulses, oilseeds & certain cash crops. This advance information helps the farmer to make an informed decision about which crop to sow for maximum economic benefit within the limitations of his farm size, climate and irrigation facilities.

- Acts as a benchmark for private buyers: MSP sends a price-signal to market that if merchants don’t offer higher than MSP prices the farmer may not sell them his produce. Thus it acts as an anchor or benchmark for agro-commodity market. While it doesn’t guarantee that market prices will also be higher than MSP, but atleast it ensures the market prices will not drastically lower than MSP.

How to improve MSP system in India?

NITI aayog in its report provided with the following recommendations to improve the MSP system in India:

- Awareness among the farmers needs to be increased and the information disseminated at the lowest level so that the knowledge would increase the bargaining power of the farmers.

- Prompt payment: The delay in payment needs to be corrected and immediate payment should be ensured. For sustainability of farming prompt payment at remunerative rates should be made.

- Timing of MSP announcement: MSP should be announced well in advance of the sowing season so as to enable the farmers to plan their cropping.

- Transport and storage: More god owns should be set up and maintained properly for better storage and reduction of wastage. Transport facility (say, in the form of providing two wheelers) for Purchase Officers may be considered to help them effectively discharge their work.

- Updated criterion for fixing MSP: The criteria for fixing MSP should be current data and based on more meaningful criteria rather than C3.

- The small and marginal farmers can be provided with Procurement Centres in the village itself to avoid transportation costs.

Conclusion

it was found that the MSP has succeeded in providing floor rate for major food grains like paddy and wheat and other produces such as Gram (black & green), spices and oilseeds (groundnut, mustard, till), sugarcane, jute and cotton, and it did not allow market prices to fall below the MSP fixed for them.

Thus MSP has been very helpful in keeping agriculture in our country alive and we have been able to become self-sufficient in food grains due to it. It becomes crucial for government to provide some solid assurance to farmers that it won’t be allowed to die down.

Farm Bills and MSP

Source: Indian Express

Context: The recently enacted farm bills have triggered debate on the desirability of the MSP regime.

More in news: The period from 2004 to 2012 was the period of high commodity prices, high government procurement and rapid reduction in rural poverty. This shows a causal link between the high prices and decrease in poverty

What is the issue?

- The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) bill allow for free entry of agents (private individuals, producer collectives or cooperatives) to set up markets.

- This means that the Food Corporation of India (FCI) and other associated agencies can procure in the traditional mandis or in a new market established under this law or in their own backyard.

- Critics view that the dismantling of the monopoly of the APMCs as a sign of ending the assured procurement of food grains at minimum support prices (MSP).

Are MSPs irrelevant for the welfare of the farmers?

- According to the supporters of the farm bills the MSPs are irrelevant for most of the farmers in the country as it benefits only a small fraction of farmers (Punjab and Haryana) and procurement has remained confined to only a few crops.

- However, it has indirectly benefited all food grain producers in the country.

- For example, the procurement through MSP significantly exceeds the PDS requirement, this creates additional demand in the food grain market, pushing up the prices especially when the international prices have remained low.

- The RBI’s annual report of 2017-18 on the impact of MSP-based procurement on the food prices conclusively shows that MSP is a leading factor influencing the output prices of the farm produce in the entire country.

- Also, for rain-fed agriculturists, the only state supports these farmers (primarily cotton and pulse producers) have is that of MSPs as they are deprived of irrigation and they don’t benefit from subsidies on electricity and fertiliser.

Relook agriculture subsidies

Context– The dire need to shift the nature of support to farmers from input subsidies to investment subsidies.

What are the main reason of air pollution in India and its impact?

- Stubble Burning – Practice of farmers setting fire to plant debris that remain in farms after harvest.

- It emits large amounts of toxic pollutants in the atmosphere which contain harmful gases like methane, carbon monoxide, volatile organic compounds (VOC) and carcinogenic polycyclic aromatic hydrocarbons.

- Farm fires have been an easy way to get rid of paddy stubble quickly and at low cost for several years.