Ensuring Other sectors availability is a crucial aspect of the Industrial growth of a nation. In this section, we will cover all the updates issues and concepts related to the Other sectors of India

NITI Aayog releases “Fast Tracking Freight in India” Report

What is the News?

NITI Aayog and Rocky Mountain Institute(RMI) has released a report titled “Fast Tracking Freight in India: A Roadmap for Clean and Cost-Effective Goods Transport”.

Contents

Contents

- 1 Objectives of the Fast Tracking Freight in India Report:

- 2 India’s Logistics Sector:

- 3 Measures need to accommodate more urban citizens:

- 4 Other measures recommended by the Fast Tracking Freight in India Report:

- 5 What is the News?

- 6 India’s Healthcare Industry:

- 7 Introduction:

- 8 About the Insurance (Amendment) Bill, 2021:

- 9 Concerns with the Insurance (Amendment) Bill:

- 10 Government’s response to the concerns:

- 11 Introduction

- 12 About the recent spectrum auction

- 13 What is spectrum?

- 14 What is a spectrum auction?

- 15 History of spectrum auctions

- 16 Need of spectrum auctions

- 17 Issues in spectrum auctions

- 18 Suggestions to improve Spectrum Auctions

- 19 Conclusion

Objectives of the Fast Tracking Freight in India Report:

- Establish a coherent vision for a cost-effective, clean, and optimised freight transport system in India.

- Quantify the economic, environmental, and public health benefits of the freight system.

- Describe techno-economically feasible solutions that would collectively deliver those benefits.

India’s Logistics Sector:

- Currently, India’s logistics sector represents 5% of India’s Gross Domestic Product (GDP). The sector employs around 2.2 crore people.

- India handles 6 billion tonnes of goods each year, amounting to a total annual cost of INR 9.5 lakh crore.

- These goods represent a variety of domestic industries and products:

- 22% are agricultural goods,

- 39% are mining products and

- 39% are manufacturing-related commodities.

- Trucks and other vehicles handle most of the movement of these goods. Railways, coastal and inland waterways, pipelines, and airways account for the rest.

Read Also :-Important Articles for Interview – 2020-21

Measures need to accommodate more urban citizens:

- India’s freight activity will grow five-fold by 2050 and about 400 million citizens move to cities. So, a whole system transformation can help uplift the freight sector.

- This transformation will be defined by tapping into opportunities such as:

- Increasing share of rail-based transport

- Optimisation of logistics and supply chains.

- Shift to electric and other clean-fuel vehicles.

- These solutions can help India save Rs. 311 lakh crore cumulatively over the next three decades

Other measures recommended by the Fast Tracking Freight in India Report:

The Logistic sector can reduce its rising CO2 emissions and high logistic costs by following measures:

- Increasing the rail network’s capacity

- Promoting intermodal transport

- Improving warehousing and trucking practices

- Policy measures and pilot projects for clean technology adoption and

- Stricter fuel economy standards.

Benefits of these measures: These measures will lead to the following benefits:

- Reduces the logistics cost by 4% of GDP

- Achieves 10 gigatonnes of cumulative CO2 emissions savings between 2020 and 2050

- Reduces nitrogen oxide (NOx) and particulate matter (PM) emissions by 35% and 28%, respectively until 2050.

Read Also :-Mobilising Electric Vehicle Financing in India

Source: PIB

NITI Aayog Releases “Investment Opportunities in India’s Healthcare Sector” report

What is the News?

NITI Aayog released a report titled, ‘Investment Opportunities in India’s Healthcare Sector’.

Purpose of the Investment Opportunities in India’s Healthcare Sector Report:

- The report outlines the range of investment opportunities in various segments of India’s healthcare sector. This includes hospitals, medical devices and equipment, health insurance, telemedicine, home healthcare, and medical value travel.

India’s Healthcare Industry:

- Firstly, Healthcare Sector Growth Rate: India’s healthcare industry is growing at a Compound Annual Growth Rate (CAGR) of around 22% since 2016. At this rate, it is expected to reach USD 372 Billion in 2022.

- Secondly, Employment: In 2015, the healthcare sector became the fifth-largest employer. It employed around 4.7 million people directly.

- As per estimates of the National Skill Development Corporation (NSDC), healthcare can generate 2.7 Million additional jobs in India between 2017-22.

- Thirdly, India’s FDI Regime for Healthcare Sector: India’s Foreign Direct Investment(FDI) regime in the Health Sector has been liberalised extensively.

- Currently, FDI is permitted up to 100% under the automatic route for the hospital sector and manufacture of medical devices.

Automatic route: The non-resident investor or Indian company does not require prior approval from the Government of India for the investment. - Further, in the pharmaceutical sector, FDI is permitted up to 100% in greenfield projects. For the brownfield projects, it is up to 74% under the automatic route.

- Currently, FDI is permitted up to 100% under the automatic route for the hospital sector and manufacture of medical devices.

- Fourthly, FDI Inflows: India’s FDI in the Healthcare Sector has increased considerably over the last few years. The FDI has increased from USD 94 Million (2011) to USD 1,275 Million (2016), This is a jump of over 13.5 times.

Source: PIB

Concerns with the Insurance (Amendment) Bill, 2021

Synopsis:The Insurance (Amendment) Bill, 2021 has few important concerns. But the move is a welcome step to the Insurance sector.

Contents

Introduction:

The Lok Sabha has passed the Insurance (Amendment) Bill, 2021. The Bill had earlier been cleared by the Rajya Sabha also. Now it only requires the presidential assent to become a law.

About the Insurance (Amendment) Bill, 2021:

- The Bill amends the Insurance Act,1938. The Bill seeks to increase the maximum foreign investment allowed in an Indian insurance company from 49% to 74%.

- However, such foreign investment may be subject to additional conditions as may be prescribed by the Central Government. The conditions include,

- The majority of directors on the Board and key management persons in health and general insurance companies has to be resident Indians.

- At least 50% of directors of the Insurance companies have to be independent directors.

- The bill also removes restrictions on ownership and control.

Click Here to Read more about the Insurance (Amendment) Bill

Concerns with the Insurance (Amendment) Bill:

There are certain key concerns raised by the critics of the bill. These include,

- The present actual share of FDI in the insurance sector is less than the current limit of 49%. Further, the present target was aimed to achieve within 5 years. But that is not achieved so far. Hence, there is no justification for increasing the limit to 74%.

- Infusion of market funds in the insurance sector is not viable. The critics mention the time when financial institutions like DHFL, Yes Bank have collapsed, infusing market funds might lead to the collapse of insurance institutions also.

- The Bill does not have a provision to prevent financially weak foreign companies from entering into the Indian insurance sector.

- Many Indian insurance companies are already in Joint Venture with foreign companies. Hence, the Government’s claim that foreign investment is needed for bringing newer technology to the country is not substantiated.

Government’s response to the concerns:

- The bill is aimed at solving some long-term capital availability issues in the insurance sector.

- The banking and insurance industry fall under the strategic sectors according to the government’s strategic disinvestment policy. The 74% cap is just a limit posed on the FDI. Hence, there should be no apprehension on privatization.

- The bill will increase competition in the insurance sector. This will in turn facilitate affordable schemes for middle-class people.

- Half of the market share of the Indian insurance sector is already held by private companies. The public sector insurance market share is merely 38.78%. On the other hand, the private sector enjoys 48.03% of the market share. So the increase in FDI is essential to improve the insurance penetration further.

The Insurance (Amendment) Bill might facilitate insurance penetration among middle-class Indians. But the adequate safety mechanisms have to put in place to check the insurance companies.

Source: The Hindu

Spectrum Auctions in India – Explained, Pointwise

Contents

Introduction

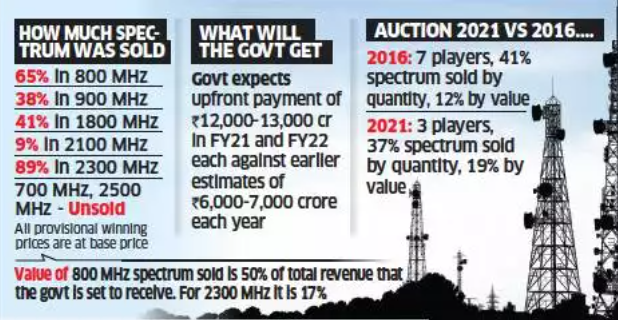

The department of telecommunication (DoT) successfully conducted the spectrum auctions in March 2021. The government generated over Rs 77,000 crore from the auction as compared to Rs 45,000 crore expected

However, the government has skipped the sale of the much-coveted 5G airwaves in this round. Auctions for that would be done in the future.

Similarly, even though the spectrum auctions earned crores of money to the government, Only 37% of the airwaves found buyers in the recent auction due to various issues. In this article, we will explain the various issues with Spectrum auctions.

Source: Economic Times

About the recent spectrum auction

- The DoT offered spectrums across the 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz and 2500 MHz bands. The last auction took place in 2016.

- Both Indian and Foreign companies were eligible to bid for the auction. Foreign companies required to

- Either set up a branch in India and register as an Indian company or

- Tie-up with an Indian company to be able to retain the airwaves after winning them.

- The three largest telecom service providers in India(Jio, Airtel, and Vodafone Idea) brought the majority of the spectrum.

- The successful bidders will have to pay 3% of Adjusted Gross Revenue (AGR) as spectrum usage charges.

- AGR is divided into spectrum usage charges and licensing fees that are fixed between 3-5% and 8% respectively.

What is spectrum?

- Devices such as cellphones, radio, wifi, etc. require signals to connect with one another. These signals are carried on airwaves. These airwaves must be sent at designated frequencies to avoid any kind of interference.

- Such airwaves are called the spectrum. The various frequencies are subdivided into bands.

- Frequency is the number of repetitions of the wave that one can see in a period.

- If a wave repeats slowly, it is low frequency. If the wave repeats more, then it is called high frequency. Hertz(Hz) is the unit of Frequency.

- Range of various devices:

- Radio – 100-200 Megahertz (Mhz)

- Telecom – 800 Mhz – 2300 Mhz

- Wifi – Earlier it was 2.4 Ghz and now enhanced to 5 Ghz.

What is a spectrum auction?

- The Union government owns all the publicly available assets within the geographical boundaries of the country. This includes the airwaves also. So the government has the right to sell the airwaves.

- The selling of airwaves as a band for a certain period is known as Spectrum Auctions. The central government through the DoT(Department of Telecom) auctions these airwaves from time to time.

- The government performs spectrum auctions after dividing the entire country into telecom circles. Presently India is divided into 22 telecom circles.

- All these spectrums are sold for a certain period of time, after which their validity lapses, which is generally set at 20 years.

- With the expansion in the number of cellphones, wireline telephone and internet users, the need to provide more space for the signals arises from time to time.

- Telecom companies are willing to set up the required infrastructure to use the waves once they auctioned the particular spectrum.

History of spectrum auctions

- The first spectrum auction in India was conducted for a 900MHz band, in 1994.

- After the 2001 auction, the government switched to an administrative allocation model. Under this, the government would select the companies best suited for developing India’s telecom infrastructure.

- However, this didn’t yield a positive result, and the spectrum was licensed at far lower rates than what was raised by auction.

- Post 2G spectrum case, the government again switched to the spectrum auction method.

Need of spectrum auctions

- Prohibit Interference: The primary objective is to prevent interference in signal transmission. Dedicated bandwidth in a spectrum ensures smooth transmission for radio, cellular and wifi services.

- Determine Fair Value of Spectrum: Spectrum auctions will help in determining the right value of airwaves and creates a spirit of competition in the telecom sector.

- Source of Revenue: The government is able to earn substantial revenue from spectrum auctions. For example, in the latest spectrum auctions, the government earned more than 77000 crore due to the higher demand for spectrums.

- Rising Population: United Nations Population report has predicted that India would surpass China as the most populous country in the future. With this, more spectrum would be required to serve a growing user base.

- Technological Advancement: The movement from 4G to 5G would require allocating more spectrum for new services. The proposed 5G allocation in 2022 would see the debut of airwaves in the 3300MHz-3600MHz band.

- Expiring Licences: The spectrum is generally allocated for a 20-year period. After that, it is imperative to conduct spectrum auctions. For example, Various licenses of telecom companies like Jio were expiring in July 2021. So the government has to perform spectrum auctions for those spectrums before the licences got expired.

Issues in spectrum auctions

- High Reserve Price: The government before conducting auctions, reserves a price for a spectrum. Telecom companies have to place bids for spectrum above the reserve price only. But the government usually fixes a higher reserve price, so spectrum attracts only fewer buyers.

For example, Only 37% of the airwaves found buyers in the recent auction due to the high reserve price. The 700 MHz band failed to attract buyers as the reserve price was placed at 1.97 lakh crore. - Obsolete Auction Format: The government has not updated the spectrum auction format for a long time. Due to which a persistent fall in the number of bidders is witnessed.

- Competition from Voice Over Internet Protocol (VoIP) subscribers: Over The Top (OTT) providers are providing substitute goods such as VoIP.

- This allows them to capture a greater share of customers while remaining somewhat invisible to government regulators.

- This hinders the position of telecoms and reduces their willingness to pay more in spectrum action.

- Allocation of unlicensed spectrum for Wi-Fi: Wi-Fi shares the load of the carrier network and reduces the demand for mobile network capacity.

- If the government wants to expand the Wi-Fi facilities, it needs to keep more spectrum unlicensed. The more the unlicensed spectrum allocation, the lower will be the demand for licensed spectrum.

- Clarity over Future Spectrum Auctions: The amount of spectrum that will be allocated for the 5G auction is not clear. It is creating confusion among companies like acquiring the spectrum now or waiting for subsequent auctions.

- Regulatory Framework: The poor framework has resulted in the forceful exit of various players from the telecom sector. This automatically impacts the potential of spectrum auction as more bidders mean better prices.

- High Upfront Fees: Some experts are also demanding rationalisation of 50% upfront fees on some spectrum bands. High fees place a greater financial burden on telecoms which impairs their functioning.

Suggestions to improve Spectrum Auctions

- Grossly unrealistic pricing of the spectrum should be rationalized. The Department of Telecommunications(DoT) should consult with TRAI and other stakeholders for rationalising the price.

- The government should release more unlicensed spectrum for multiplying Wi-Fi as a suitable supplement to the carrier network. This will increase the placements of the Public Wi-Fi project which got the approval of the cabinet recently.

- The government should provide clarity about future auctions, especially the 5G spectrum bands.

- Further, the government should release guidelines on future Spectrum Auctions. It will enable the telcos and OTTs to join hands in providing superior and better services for the benefit of the consumers.

- The time frame for paying spectrum fees should be enhanced so that the financial burden on telecom operators gets reduced.

Conclusion

Spectrum is a perishable scarce resource and loses its value if left unused. It is important for the government to ensure that the spectrum put on the block is sold in the most optimum way. This can be rightly done by balancing the interests of business, government and consumers.

Cabinet clears “74% FDI in Insurance Sector”

What is the news?

The Union Cabinet has approved a proposal to amend the Insurance Act, 1938. It will increase the foreign direct investment (FDI) limit in the insurance sector to 74% from 49%.

Conditions: The increase in the foreign direct investment(FDI) limit in the insurance sector comes with safeguards such as:

- The majority of directors on the Board and key management persons in health and general insurance companies would be resident Indians. At least 50% of directors will be independent directors.

- The government will also specify a particular percentage of profits to be retained as a general reserve.

Significance of this move: Raising the foreign investment limit(FDI) in the insurance sector may provide the following benefits:

- Improve capital availability in the insurance sector.

- Help in developing the insurance industry as a channel for generating durable funds for the creation of long-term assets.

- An increase in competition in the sector will help in lowering the cost of insurance products.

- It would benefit small insurance players or the ones where the sponsors don’t have the ability to infuse more capital.

- Improve Insurance Penetration in the country.

About Insurance Penetration:

- Insurance penetration is an indicator of insurance sector development within a country. It is the ratio of total insurance premiums to the GDP in a given year.

- Currently, Insurance penetration stands at just 3.71% of the GDP in the country.

Source: Indian Express

Issues in the Process of Spectrum Auction

Synopsis: The government should revisit spectrum auction formats, unrealistic pricing, regulatory norms.

Introduction

The telecommunications’ spectrum auction successfully held in India recently. The winning bids in the auction collectively outdid the government’s own low expectations for receipts from the sale of airwaves.

- The three largest telecom service providers bought only essential airwaves. They bought it either as renewal or for strengthening their network.

- Reliance Jio bought close to 60% of the spectrum. It contributed almost three-fourths of the ₹77,815 crores. Jio’s contribution of ₹57,123 crores by itself surpassed the government’s estimate of ₹45,000-₹50,000 crores from the auction.

However, the concerning fact is that only 37% of the airwaves on offer found buyers.

What are the issues in spectrum auctioning?

- Like the auction of the 2016 spectrum, the auction of 700 MHz this time also is not successful. The high reserve price is a reason behind that. It prohibits buyers from auctioning with a motive of gaining from it.

- The 700 MHz spectrum is a nationally valuable resource. The government’s approach of keeping prices high is hard to understand.

- The relatively low frequency 700 MHz is considered ideal for enhancing network availability in large, densely built-up cities. Here, the issue of poor signal penetration inside buildings is an everlasting problem for users and providers.

- Other than that, the government needs to take care of the following issues:

- The auction format requires updation, it is evident after looking at the severely reduced number of participants.

- Regulatory norms and tax practices will create monopolies in the sector.

What are the steps to be taken?

The country’s telecom authorities shall reconsider the entire policy framework to tackle current persistent insecurity in the industry.

- Firstly, Grossly unrealistic pricing of the spectrum should be rationalized.

- Secondly, the government must ensure it does not end up hurting the telecom sector. This sector has become a key multiplier of economic empowerment and progress.

“India Telecom 2021” Event Inaugurated

What is the News?

Union Minister for Communications inaugurated India Telecom 2021 Event.

About India Telecom 2021:

- Organised by: Telecom Equipment Export Promotion Council(TEPC) under Market Access Initiative Scheme (MAI) of the Department of Commerce.

- The event has the support of the Department of Telecommunications & Ministry of External Affairs.

- Purpose: It is an exclusive international business expo. It aims to provide opportunities to the Indian telecom stakeholders to meet qualified overseas buyers.

- 40 Indian telecom companies and 200 foreign delegates from more than 45 countries are attending the event.

About TEPC:

- Setup by: Ministry of Commerce & Industry and Ministry of Communications

- Aim: To promote and develop Export of Telecom Equipment and Services.

- Functions: The council undertakes several activities aimed at exports promotion such as;

- Commissioning of Studies to find potential markets

- Recommending to the Government for making necessary changes in various policies and procedures for promotion of Exports and Services.

- Holding of National/International Seminars

- Facilitating the participation of exporters in various overseas exhibitions

- Dissemination of trade-related data to its members.

Market Access Initiative (MAI) Scheme

- Nodal Ministry: Department of Commerce, Ministry of Commerce and Industry

- Objective: It is an Export Promotion Scheme. The scheme aims to act as a catalyst to promote India’s exports on a sustained basis.

- Product and Country Focus Approach: The scheme is formulated on the basis of the product and country focus approach. It will evolve specific markets and specific products through market studies/surveys.

Source: PIB

“PLI Scheme for pharmaceuticals and IT hardware” Approved

What is the News?

Union Cabinet has approved the Production Linked Incentive(PLI) Scheme for the pharmaceuticals and IT hardware sectors.

About PLI Scheme for Pharmaceutical Sector:

- Objective: It will promote the manufacturing of high-value products in the pharmaceutical sector.

- Duration: The duration of the scheme will be for nine years from 2020-21 till 2028-29.

Category of Goods: The scheme shall cover pharmaceutical goods under three categories as mentioned below:

- Category 1: Biopharmaceuticals such as complex generic drugs, patented drugs, Gene therapy drugs, phytopharmaceuticals, and orphan drugs.

- Category 2: It would cover active pharmaceutical ingredients, key starting materials, and drug intermediaries.

- Category 3: Drugs not covered under Category 1 and Category 2.

Significance of the scheme: The scheme will benefit domestic manufacturers. Moreover, it will help to create employment and will make available a wider range of affordable medicines for consumers.

About PLI Scheme for IT hardware sectors:

- Objective: It will boost domestic manufacturing and investments in the value chain of IT Hardware.

- Target Segment: The target sectors under the scheme includes laptops, tablets, all-in-one PCs and servers.

- Incentives: Under the scheme, beneficiaries will be given incentives of 4% to 1% on net incremental sales over the base year(2019-20) for a period of four years.

- Significance: The government expects the scheme to reduce India’s import dependence for IT hardware in a major way. Currently, 80% of the country’s laptop and tablet demand is met through imports.

Click Here to Read about PLI Scheme

Source: The Hindu

Transport Minister launches ‘Go Electric Campaign’

What is the News?

The Union Minister for Road Transport & Highways launches the “Go Electric” Campaign.

Go Electric Campaign:

- It is a campaign of the Bureau of Energy Efficiency (BEE) to promote and spread awareness on electric mobility.

- Objectives:

- It will boost the confidence of electric vehicle manufacturers.

- Furthermore, it will spread awareness about the benefits of e-mobility and EV Charging Infrastructure in India.

- Lastly, the Go Electric Campaign will help in reducing the import dependence of our country in the coming years.

- Implementation: BEE will provide technical support to the State Designated Agencies(SDAs) for its implementation on a state and national level.

Bureau of Energy Efficiency (BEE):

- It is a statutory body. It was established in 2002 under the Energy Conservation Act, 2001.

- Nodal Ministry: Ministry of Power

- Objective: It assists in developing policies and strategies for reducing the energy intensity of the Indian economy.

Click Here to Read about Electric Vehicles

Source: PIB

Read Also:-

Production Linked Incentive (PLI) scheme

What is the News?

The Union Cabinet has approved the production-linked incentive(PLI) scheme for the telecom sector.

About the production-linked incentive(PLI) scheme for the telecom Sector

- Aim of the scheme: It will make India a global hub for manufacturing telecom equipment. Moreover, it will create jobs and reduce imports especially from China.

- Focus of the scheme: The scheme will offset the huge import of telecom equipment worth more than Rs 50,000 crore. By that, it will encourage the foreign manufacturers and domestic manufacturers to set up production units in India.

- Coverage: The scheme will cover domestic manufacturing of equipment such as

- core transmission equipment,

- 4G/5G and next-generation radio access network and wireless equipment,

- Internet of Things (IoT) access devices,

- enterprise equipment such as switches and routers

- Duration of the Scheme: The scheme will be operational from April 1 and will run for the next five years.

- Eligibility: The eligibility for the scheme will be subject to;

- Achieving a minimum threshold of cumulative investment

- incremental sales of manufactured goods, with 2019-20 as the base year.

- Incentives: For the inclusion of MSMEs in the scheme, the minimum investment threshold has been kept at ₹10 crores while for others it is ₹100 crore. Further, for MSMEs, It proposes a 1% higher incentive in the first three years.

Significance of the scheme:

- The Government Schemes may lead to an incremental production of about ₹2.4 lakh crore with exports of about ₹2 lakh crore over five years. Moreover, it may bring in investments of more than ₹3,000 crores.

- With the inclusion of telecom equipment manufacturing under the ambit of PLI schemes, the total number of sectors under such programmes stands at 13.

Click here to Read about PLI Scheme

Source: The Hindu

“Samarth Scheme” for Capacity Building in Textile Sector

What is the News?

The Ministry of Textiles has informed Rajya Sabha about the Samarth Scheme.

Samarth Scheme:

- It was launched by the Ministry of Textiles.

- Aim: It will address the skill gap in the textile sector. It will supplement the efforts of the textile industry in providing gainful and sustainable employment to the youth.

- Objectives: Following are the objectives of Samarth Scheme:

- It will provide a program which demand-driven, placement oriented and National Skills Qualifications Framework(NSQF) compliant.

- It will supplement the efforts of the industry in creating jobs in the organized textile and related sectors, covering the entire value chain of textile. It excludes Spinning and Weaving.

- Likewise, it will provide for skilling and skill up-gradation in the traditional sectors of handlooms, handicrafts, sericulture, and jute.

- Target: The Scheme targets to train 10 lakh persons (9 lakhs in organised & 1 lakh in traditional sector).

- Implementing agencies: The programmes would be implemented through the Textile industry, government institutions and Reputed training institutions/ NGOs/ Societies active in the textile sector.

- Monitoring and Management Information System(MIS): It is a centralized web-based Information System that has been put in place for monitoring and implementation of the scheme.

Source: PIB

Mega Investment Textiles Parks (MITRA) scheme for textile sector

Why in News?

The Finance Minister has announced the launch of Mega Investment Textiles Parks (MITRA) Scheme.About Mega Investment Textiles Parks (MITRA) Scheme

- Aim: The scheme aims to enable the textile industry to become globally competitive and boost exports. The scheme also aims to boost employment generation within the textile sector and also attract large investment.

- Main Features of the Scheme:

- The scheme was launched in addition to the Production Linked Incentive(PLI) Scheme

- Under the scheme, there is a plan to establish Seven textile parks over three years.

- These textile parks will have a world-class infrastructure. They will also have plug-and-play facilities (business facilities will be available ready-made) to help create global champions in exports in the textile sector.

- Significance: The scheme will create a level-playing field for domestic manufacturers in the international textiles market. It will also pave the way for India to become a global champion of textiles exports across all segments.

Note:

- Indian textile sector is the sixth-largest exporter of textiles and apparel in the world.

- The industry is also among the top employers in the country providing direct employment to 45 million people and 60 million people in allied industries.

Source: PIB

“Vehicle Scrappage Policy” to phase out old and unfit vehicles

What is the news?

The Finance Minister has announced the voluntary vehicle scrappage policy. It aims at phasing out old and unfit vehicles.About vehicle scrappage policy

- Aim of the Policy: Scrappage policy will encourage fuel-efficient, environment-friendly vehicles on the road. Thereby It will reduce vehicular pollution and the oil import bill.

- Key Features :

- Under the policy, vehicles would undergo fitness tests after a certain period of time. In the case of personal vehicles, the duration is 20 years. In the case of commercial vehicles, this duration is 15 years.

- Each fitness test will cost approximately Rs 40,000. Other than that, old vehicles will have to pay green tax and road tax.

- If a vehicle fails a fitness test, it will not get a renewal certificate and won’t be able to run on the road.

- However, if it passes a fitness test, the vehicle will have to undergo a fitness test, after every 5 years.

- The aim of all these costs is to discourage consumers from keeping the older vehicle.

- The incentives for vehicle scrappage not announced yet. It is expected that the Government may announce some incentives and monetary benefits for the consumers scrapping their old vehicles.

Source: The Hindu

Vehicle Scrappage Policy and the associated challenges: Explained

Recently, The Finance Minister announced the “Vehicle Scrapping Policy” in her Budget speech. The policy will phase out older, inefficient and polluting vehicles. Apart from that, the policy will also promote the use of more environment-friendly vehicles and reduce the oil import bill. But it is not an easy task and has a few challenges associated with it.

What is the proposed Vehicle Scrappage Policy?

The Ministry of Road and Transport is yet to announce the proper guidelines. But according to the Budget speech, the important provisions of the scrappage policy will include the following features. Such as

- The private vehicles older than 20 years and commercial vehicles older than 15 years, can be scrapped voluntarily. To run these vehicles on the road, a fitness certificate (FC) will be mandatory.

- Automated vehicle fitness centres belong to the government will issue certificates after conducting fitness tests.

- Each fitness certificate is valid for five years. After that, the vehicle will undergo another fitness test. Those having this certificate will not need to pay any registration fee while buying a new vehicle. The certificate is tradable, which means it can be used by anyone and not necessarily by the owner of the scrapped vehicle.

- If a vehicle fails the fitness test, the government will not provide renewed Registration Certificates (RC) for those vehicles. As per the Motor Vehicle Act, 1988, driving a vehicle without an RC is illegal in India.

- Each vehicle is permitted to have three failures in the fitness test. After that, the vehicle might be forwarded to vehicle scrapping.

- The government is expected to provide monetary incentives to the owners scrapping the vehicles.

Each fitness test will approximately cost Rs 40,000. If the vehicle passed the fitness test, the owner of the vehicle has to pay road tax, and a possible “Green Tax” (Tax levied on goods that cause environmental pollution).

The total cost involved in pursuing a Fitness test and paying “Green tax” will act as a deterrent to have older vehicles. This will further facilitate voluntary Scrapping of the old vehicle and buying a newer one.

Read more about the proposed Green tax

Need for such Vehicle Scrappage Policy:

First, According to the Centre for Science and Environment (CSE), by 2025 India will have over two crore old vehicles nearing the end of their lives. Not only that, India adds 1,400 vehicles every day. The scrappage policy will reduce the congestion on the roads.

Second, A logical extension of NGT ruling for Delhi NCR and Scrappage policy of Government Vehicles.

- In 2015, National Green Tribunal barred diesel vehicles older than 10 years to commute on Delhi NCR roads. The scrappage policy is the next step to prevent them from further commuting on roads.

- Further, the government accepted the Scrappage policy for Central and State Government vehicles older than 15 years on January 25, 2020. The policy will come into effect on April 1st, 2022.

- Apart from that, the government also introduced a draft Vehicle Fleet Modernization Programme in 2016. But the project never got materialized.

Third, IIT Bombay’s conducted a multi-city study in 2014. The study estimated that pre-2005 vehicles were responsible for 70 per cent of the total pollution load from vehicles. The scrappage policy will be a shot in the arm for these polluting vehicles.

Benefits of the proposed policy:

First, The Scrappage policy will benefit the following sectors at one go.

- The policy will stimulate the domestic automobile and automotive industry. The automobile industry is projected to grow at an annual rate of 22% if this policy is implemented properly.

- Apart from that, it will provide a massive opportunity for players in the organised scrappage and recycling industry. The scrapping will provide recovery of steel, aluminium, plastic etc. and boost the industries associated with it.

Second, Curbing air pollution: Old vehicles are not compliant with Bharat Stage VI emission standards. This is leading to more air pollution. For example, one 15-year-old vehicle has emissions equivalent to 25 new-generation vehicles. The scrappage policy will reduce the pollution level by 25 percent as compared to old commuting vehicles.

Third, Increase in tax revenue for the government. The revival of the automobile and other sectors associated will boost the tax revenues. According to an estimate, taxes from the automobile sector will amount at Rs 10,000 Crores, if scrappage policy is implemented properly.

Fourth, Containing oil imports: According to the BEE (Bureau of Energy Efficiency) estimates, India has to enforce Scrapping old vehicles and shifting towards higher fuel efficiency norms. If it is achieved, then as per the BEE estimates, “there will be a reduction of 22.97 million tons of fuel demand in India by 2025”. This will help in saving oil import and associated costs.

Fifth, Fulfilling India’s International commitments: India has committed to the Paris Agreement on Climate Change and provided national targets for reducing emissions. The Scrappage policy will reduce the pollution level and also fulfil India’s commitment to reduce CO2 levels to tackle Climate Change.

Overall the Scrappage Policy has the potential to revive the Indian Steel sector and also has the potential to promote India as a vehicle manufacturing hub in the world.

Challenges associated with the Vehicle Scrappage Policy:

First, Who will bear the cost of monetary incentive provided to owners? The scrappage industry may provide incentives for scrapping older vehicle (like recovery of scrap, steel etc.). The government is not a direct beneficiary except the environmental cost. Thus, providing incentives from public money might not be feasible.

Second, In rural areas, old vehicles are being used as the owners have very limited financial resources to purchase new vehicles.

Third, Scrapping capacity of India is in doubt. India so far has only one government-authorized scrappage workshop in Greater Noida. Also, the government do not have any standard operating procedures (SOP) for setting up of vehicle scrapping centres. Formulating a policy without having the capacity will lead to accumulation of old vehicles like solid wastes.

Fourth, Regulation of pollutants released during scrapping. The scrapping of Vehicle will release toxic metals like mercury, lead, cadmium or hexavalent chromium. If not properly regulated, it will pollute the environment and have long-lasting consequences.

Read more about the taxing older vehicles: a way forward

Suggestions:

First, In the Electric Vehicle Policy of the Delhi government, they linked scrappage incentives with buying of electric vehicles. Such a special linkage of policy is necessary at the national level to promote the electric vehicle.

Second, There must be an exception for Vintage and Classic cars. The government also have to introduce a provision for Modern Classics. These are an important part of automotive history and the history of humanity. Since most of these vehicles are used sparingly and in the well-maintained condition, they can be exempted.

Third, Centre for Science and Environment (CSE) released a report titled “What to do with old vehicles: Towards effective scrappage policy and infrastructure”. In that, the CSE gave a few important suggestions for vehicle scrapping policy in India. They are

- There should be a separate effort to include Extended Producer Responsibility (EPR) in collecting the car for scrapping. Apart from that, there should be legally binding rules for scrapping.

- The scrappage scheme should incentivise replacement of old vehicles with EVs. On the other hand, the government should also frame a policy to reduce the purchasing of traditional petroleum-powered vehicles.

The Scrappage policy has the potential to meet the government-set target of 30-40 percent electrification of the vehicle fleet by 2030. But it can be sustainable only when the government provide adequate support to Electric Vehicles such as by creating the necessary infrastructure for charging, manufacturing battery packs etc.

RERA 2016 protects the interest of Homebuyers

Synopsis: As compared to RERA 2013 act, the Real Estate (Regulation and Development) Act (RERA) 2016 was successful in empowering the home buyers. This has reduced the incidence of unfair trade practices in the real estate sector.

How RERA 2016 act was better than RERA 2013 act?

The RERA 2013 act had the following issues;

- It did not cover either “ongoing projects” or “commercial real estate”.

- Also, the minimum limit for registration of projects was so high that it excluded many projects from the coverage under law.

- These exclusions made the 2013 bill meaningless and harmful to the interests of home buyers.

However, the 2016 RERA act has fixed all the loopholes in the RERA act 2013,

- First, after a holistic review along with multiple stakeholder consultations both “ongoing projects” and “commercial projects” were included in the act.

- Second, the minimum limit for registration of projects was reduced to cover more projects. It reduced evasion under law.

How the Real Estate (Regulation and Development) Act (RERA) 2016 has contributed to the empowerment of consumers?

RERA act addressed the existing power gap in the real estate sector between buyers and promoters. It further empowered the consumers in the following ways.

- First, the real estate sector which was largely unregulated is now being regulated under RERA.

- Second, RERA along with demonetization and GST has reduced the use of black money in the real estate sector.

- Third, it has the mandatory rules of getting approval of competent authority for project plans.

- Also, according to the RERA act, the builder needs to register with a regulatory authority.

- This stringent regulation has ended the practice of selling real estate based on false advertisements.

- Fourth, to prevent fund diversion, Promoters are required to maintain funds of a specific project in separate bank accounts.

- Fifth, disclosure of unit sizes based on “carpet area” has been made mandatory. It has reduced the scope for unfair trade practices.

- Sixth, it promotes equity by making it mandatory for payment of “equal rate of interest” by the promoter or the buyer in case of default.

Federal issues in its implementation

RERA is a product of cooperative federalism. Though the Act was introduced by the Central government, state governments are empowered to notify the rules, appoint regulatory authorities and the appellate tribunals. Currently, RERA is notified in 34 states and Union territories.

However, the act is facing implementation-related issues in some states such as Maharashtra and West Bengal.

- First, in the case of Maharashtra, the state enacted its own law in 2013. The law was not consumer-friendly, and it has created a disadvantageous position for homebuyers in Maharashtra.

- However, the center repealed the state act and enforced the RERA act 2016 for the regulation of real estate sector.

- Second, in the case of West Bengal, the state government ignored RERA act 2016 and enacted its own state law (the West Bengal Housing Industry Regulation Act (WBHIRA)) in 2017.

- Even after multiple efforts by the Centre, West Bengal refused to implement RERA.

- Though there was a central law on the subject, Knowingly, the state government enacted WBHIRA in 2017.

- This act of WB government is a violation of constitutional principles and has been challenged in the court.

As SEBI is to securities market RERA will be to the real estate sector. RERA act 2016 will provide huge impetus to the growth of real estate sector while significantly contributing to the needs of Urban India.

‘MICE’ tourism policy of Gujarat

Why in News:

Gujarat CM has announced the tourism policy for 2021-25. It seeks to make Gujarat a hub of “MICE” tourism.

What is MICE Tourism?

- The “MICE” is an acronym that stands for “Meetings, Incentives, Conferences and Exhibitions”. It is a version of business tourism that draws domestic and international business tourists to a destination.

What are the salient features of MICE tourism policy?

- International Events: Policy has announced an assistance of Rs 5,000 to the event organiser per overnight stay of foreign participant. Incentives are subject to an upper limit of Rs 5 lakh.

- Domestic Events: For domestic events, the policy promises financial assistance of Rs 2 lakh per event, capped at three events per organiser per year.

- Big Convention Centres: The policy promises 15% capital subsidy on the eligible capital investment for building big convention centers. Centers are required to organize big national and international conferences.

- Land on Lease: The policy also promises land on lease, if required. A precondition to avail the incentive is that the convention centre should have at least one hall that can seat a minimum of 2,500 persons.

Which tourist attractions is the policy promoting?

Some of the tourist attractions are:

- Statue of Unity, the world’s tallest statue

- Gir, the only home of the Asiatic lion;

- Girnar ropeway, Asia’s longest;

- Ahmedabad, the first UNESCO World Heritage City in India;

- Lothal, the earliest known dock in the world, and India’s first port city;

- Dholavira, a showcase of the urban civilisation of the Indus Valley;

- Shivrajpur, one of India’s ‘Blue Flag’ beaches; and

- India’s first seaplane service from the Sabarmati Riverfront in Ahmedabad to the Statue of Unity in Kevadia.

What are spectrum auctions?

News: Department of Telecommunications (DoT) said on Wednesday (January 6) that auctions for 4G spectrum in the 700, 800, 900, 1,800, 2,100, 2,300, and 2,500 MHz bands will begin from March 1. Licence holders have until February 5 to submit their applications.

Facts:

What are Spectrum Auctions?

- Devices such as cellphones and wireline telephones require signals to connect from one end to another. These signals are carried on airwaves, which must be sent at designated frequencies to avoid any kind of interference.

- The Union government owns all the publicly available assets within the geographical boundaries of the country which also include airwaves. With the expansion in the number of cellphone, wireline telephone and internet users, the need to provide more space for the signals arises from time to time.

- To sell these assets to companies willing to set up the required infrastructure to transport these waves from one end to another, the central government through the DoT auctions these airwaves from time to time.

- These airwaves are called spectrum which is subdivided into bands which have varying frequencies. All these airwaves are sold for a certain period of time, after which their validity lapses, which is generally set at 20 years.

Why is spectrum being auctioned now?

- The last spectrum auctions were held in 2016.During that time, the government managed to sell only 40% of the spectrum that was put up for sale.

- However, the need for a new spectrum auction has arisen because the validity of the airwaves bought by companies is set to expire in 2021.

Who is likely to bid for the spectrum?

- All three private telecom players, Reliance Jio Infocomm, Bharti Airtel, and Vi are eligible contenders to buy additional spectrum to support the number of users on their network.

- Apart from these, new companies including foreign companies are also eligible to bid for the airwaves. Foreign companies, however, will have to either set up a branch in India and register as an Indian company or tie up with an Indian company to be able to retain the airwaves after winning them.

New norms for DTH television distribution sector

Synopsis: The reasons why a revised scheme for the Direct-to-Home (DTH) television distribution sector has been brought in.

Background

- Recently, the Union Cabinet has approved a revised scheme for the Direct-to-Home (DTH) television distribution sector which were in due for last 6 years after the TRAI gave its recommendation to reduce the license fee.

- Under the new norms,

- 100% FDI in Direct-to-Home (DTH) television distribution sector has been allowed.

- The licence period has been extended to 20 years from the present 10.

- The license fee has been reduced to 8% of Adjusted Gross Revenue, as opposed to 10% on Gross Revenue now.

What is the need for Direct-to-Home?

- Firstly, The Direct-to-Home (DTH) television distribution sector has been impacted by technological change like high bandwidth Internet and Over the Top (OTT) channels.

- Second, some DTH operators are under pressure as few big DTH players have made their presence on Internet service and OTT as well.

- Third, Fee reduction will address the concerns of petitioners filing the case in SC against high fees which is yet to get hearing.

- Fourth, as per the operators, the amended New Tariff Order (NTO) by TRAI has made them mere carriers of channels, with taking away the pricing power. Thus, high fee is not feasible.

What is the way forward?

- India with an estimated 200 million cable and satellite households serves as one of the biggest single markets for audiences. Any regulation should serve the consumer rather than the businesses.

- The broadcasters must realise that only authentic programming and entertainment along with best combination of technology and pricing can attract viewers.

100% FDI in DTH service

Source: The Hindu

News: Union Cabinet has approved revised guidelines for Direct-to-Home (DTH) broadcasting services.

Facts:

- Direct to Home(DTH): It enables a broadcasting company to directly beam the signal to your TV set through a receiver that is installed in the house.There is no need for a separate cable connection.

- Advantages of DTH:

- One can do away with the cable operator who will give you channels of his choice.

- The quality of signals in this case is expected to be superior since the signal is not split through a cable.

- There is a possibility of reducing your monthly cable bill.

- Disadvantages: Capital cost has to be borne initially. Since this involves setting up of a receiving apparatus at the subscribers end, the cost can be prohibitively high.

What are the revised guidelines for DTH Services?

- It allowed 100% Foreign direct Investment(FDI) in the direct-to-home (DTH) broadcasting services sector.Currently, FDI was limited to 49%.

- License for the DTH will be issued for a period of 20 years in place of present 10 years.Further the period of License may be renewed by 10 years at a time.

- License fee has been revised from 10% of GR (gross revenue) to 8% of AGR (adjusted gross revenue).License fee will be collected on a quarterly basis against the current annual basis.

- Sharing of Infrastructure between DTH operators. DTH operators, willing to share DTH platforms and transport streams of TV channels on a voluntary basis will be allowed.

INDIAN PHARMACEUTICAL SECTOR CHALLENGES AND REFORMS

Source: PIB, Indian Medicine Industry-RSTV , FDI data of Ministry, Mint,

Relevance:

- Recently PM follows up his 3 city visit by a virtual meeting with 3 more vaccine developers based in Pune and Hyderabad

- Ambassadors of 100 countries are scheduled to arrive in Pune on December 4, to visit Serum Institute of India and Gennova Biopharma.

Sweden has already acknowledged India’s role as the ‘pharmacy of the world’ and is focusing on expanding bilateral cooperation in the areas of health and life sciences in view of the Coronavirus pandemic.

How big is Indian Pharma Sector?

- From 2000-2019 Pharma sector alone contributed for FDI inflows worth $16.2bn and it is expected to rise during COVID pandemic.

- Recent Economic Survey acclaimed Pharma sector as one of the top 5 sector which reduce trade deficit of India

- More than 80% worlds Anti Retro-viral drugs depend on India

- India is the largest producer of vaccines even before COVID pandemic and controlled more than 50% of global supplies.

- Bio-Pharma is the largest sector contributing to 62% of the total revenue

- It is estimated that medical tourism in the country can grow and become a 9 billion dollars industry this year

- 20% of global generic medicine has been controlled by India.

How Indian Pharma Sector is regulated?

- Under Drugs and Cosmetics Act 1940 (For Source click here) was the central legislation that regulates India’s drug and cosmetic import, manufacture, distribution and sale.

- The Act clearly defines the spurious drugs, adulterated drugs and mis branded drugs.

- This also established the Central Drugs Standard Control Organization (CDSCO)

- The Act establishes the regulatory control over the manufacture and sale of drugs

- State Health department has to regulate the manufacturing, sales and distribution of drugs

- Drug Inspectors will control the implementation at ground level.

Central Drugs Standard Control Organization (CDSCO) Source

- Central Drug Authority for discharging functions assigned under the Drugs and Cosmetics Act

- The CDSCO works in the Directorate General of Health services, is a division in Ministry of Health and Family welfare

- The CDSCO is headed by Drug Controller General of India (DCGI).

- It was advised by Drug Technical Advisory Board and Drug Consultative Committe

Potential lead for enormous growth of Pharma Sector:

- The growing population of over a billion along with diversity among people offers An excellent centre for clinical trials

- Focus on low cost, efficient drugs lead to growth of the sector in terms of Value and Volume

- Low cost of production and Low R&D costs in India

- A huge patient base from domestic and from foreign as a medical tourist

- Improving healthcare infrastructure in India

- An increase in lifestyle-related diseases such as diabetes, cardiovascular diseases, and central nervous system.

- Penetration of health insurance is increased

- Adoption of patented products by Indian Pharma Sector.

- Patent expiration and aging population in the US, Europe, and Japan.

Challenges in the Pharma Sector:

- From regulator side

- Doing a post-mortem kind of work by inspecting the drugs after getting into market

- Low data collection on drugs coupled with insufficient training to drug inspector leading to huge malpractice among drug sellers

- From Marketing side

- Medical representatives and drug sellers inefficient training to meet the man power along with prevalence of Quack(fake doctor) increases risk of life of patients

- Pharma companies unethical pratice of providing freebies and gifts to Doctors to promote their drugs

- Quality is getting compromised due to high demand for drugs among people. This is evident by wide scale recall of drugs in India.

- Low R&D investment: India only invests 0.7% of its GDP for research and investment. This is very low compare to the demand in the sector

- International Challenges

- Global Pharma companies accuse Indian pharma companies as an abuser of Patent laws and criticise India’s Compulsory Licensing Policies.

- India nearly 90% depend on China for its Active Pharmaceutical Ingredients

Solutions:

- Implementing the recommendation of Malshekar committee on drug regulation

- Recommend a new structure for the Drug Regulatory System in the country including the setting up of a National Drug Authority

- Recommended that the State Drug Control Organisations should be urgently strengthened. (for source)

- Creating a Digital Database for patients, drug usage and risk associated with the intake of drug

- Revise the ethical code for Pharma companies to discontinue freebies and gifts

- Government need to Upgrade the quality standards and qualities of Medical representatives and drug sellers.

- Promote country specific research for R&D and increasing the R&D spending

- Rework with the IPR policies to make Indian Pharma companies for encouraging more patents.

- Government need to frame a National Plan on self-sustaining in API’s and avoid over dependence on China.

- Government need to frame a policy to Utilise the traditional Knowledge in drug manufacturing

Though the sector is highly capital intensive, the sector developed into a global leader in Pharma products. Now It is time to implement better policies in regulation and encourage the sector to produce more API’s in India to avoid over dependence.