National Income depicts the health of the economy of the nation. It is the tool that provides the status of a country globally.

Updates on issues and concepts related to National Income of India for 2020/21:

Why Record FDI Inflow is Not a Cause for Celebration?

Synopsis: The record level of FDI inflows in India for the year 2020-21 does not match the development priorities of the government.

Background

- In a recent press release, the Ministry of Commerce and Industry announced that India has attracted the highest ever total FDI inflow (U.S.$81.72 billion) during the financial year 2020-21.

- This is 10 percent higher than the last financial year 2019-20.

- Also, given that there was a decline in global FDI inflows in 2020 by 42% compared to 2019, and inflows to developing countries had fallen by 12%, this is a significant development.

- Effective implementation of FDI policy reforms, investment facilitation, and ease of doing business were credited for the record level of FDI inflows.

- However, an analysis of FDI inflow data reveals that the reality of FDI in the Indian economy does not help India’s development priorities.

Why FDI inflows accounted for the year 2020-21 will not benefit India’s development priorities?

- First, the nature of the bulk of the investments involves just a mere transfer of shares without creating productive assets in the country. This is contrary to the expectation that FDI can contribute to the revival of the economy

- For instance, take the case of Reliance Group companies, the largest recipients of FDI for the year 2020-21. It accounted for 54.1% of the total equity inflows during the three quarters.

- In this case, FDI inflows were meant to facilitate Reliance Industries to withdraw its investments already made in the form of Optionally Convertible Preference Share.

- This, therefore, amounted to the indirect acquisition of shares held by Reliance Industries.

Optionally Convertible preference shares: This class of shares can be converted into equity shares either at the option of the holder or at the option of the company. The convertible portion can be in full or in part

- Second, according to RBI, though FDI inflows were stronger in 2020-21, their distribution was highly skewed.

- For instance, the manufacturing sector received just 17.4% of the total inflows during 2020-21.

- Whereas, the services sector attracted nearly 80% of the total inflows, with information technology-enabled services (ITeS) being the largest component.

- Further, according to the RBI, non-acquisition-related inflows into the manufacturing sector were the lowest in 2020-21.

- Third, the bulk of the investments in Reliance Group companies will not facilitate sharing of managerial experience and technical expertise. Because investors’ share is pegged at 9.9%. For instance, Facebook’s shareholding in Jio Platform was pegged at 9.9%.

- According to the International Monetary Fund and also the RBI, a foreign investor, holding 10% or more of voting shares in a company, can exercise a significant influence on its management.

- Finally, there are other issues related to FDI inflows in India for the year 2020-21. For example,

- According to RBI data, there was a 47.2% increase in repatriation/disinvestment in the year 2020-21.

- Further, RBI reports that there was a high increase in portfolio investment (FII) for the year 2020-21. This was the second-highest level of FIIs’ involvement in India.

- Surely, sustained sizeable repatriation of the long-term FDI, together with a large increase in speculative capital (FII’s) is not good for a country’s Economic Health.

Source: The Hindu

World Bank’s “Global Economic Prospects Report” predicts India’s growth as 8.3%

Contents

Contents

- 1 What is the News?

- 2 About the Global Economic Prospects Report:

- 3 Key Findings of Global Economic Prospects Report related to India:

- 4 Key Global Findings of Global Economic Prospects Report:

- 5 Key Findings of the Migration and Development Brief:

- 6 Other Key Findings:

- 7 About Migration and Development Brief Report:

- 8 About Remittances:

- 9 Why India’s Economic growth is not inclusive?

- 10 Suggestions for more inclusive growth

- 11 Demand related issues (PFCE)

- 12 Investment and supply related issues (GFCF)

- 13 Government expenditure related issues (GFCE)

- 14 What in the news-

- 15 Why GDP data should not be taken as sustainable recovery?

- 16 Why quarterly growth numbers are not robust?

- 17 Way forward-

- 18 What is government stance?

- 19 Why slowdown in contraction is no sign of recovery?

- 20 What government should do?

- 21 What are the impacts on States?

What is the News?

The World Bank has released the Global Economic Prospects Report.

About the Global Economic Prospects Report:

- Global Economic Prospects is a World Bank Group flagship report. It is issued twice a year, in January and June.

- Aim: To examine global economic developments and prospects with a special focus on emerging markets and developing economies.

- The World Bank has reduced its growth forecast for India for the 2021-’22 financial year to 8.3% from 10.1% estimated in April.

- Reason: It has attributed it to the devastating second wave of the coronavirus pandemic that slowed down the economic revival in early 2021.

- Moreover, the report has said that the economic activity in India would likely follow a similar but less pronounced ‘collapse and recovery’ trend seen during the first wave.

Key Global Findings of Global Economic Prospects Report:

- The global economy is expected to expand 5.6% in 2021. This is the fastest post-recession pace in 80 years, largely due to strong rebounds from a few major economies.

- However, many emerging markets and developing economies continue to struggle due to the following reasons,

- A resurgence of COVID-19 cases,

- Lagging vaccination progress

- The withdrawal of policy support in some instances.

- Among major economies, the growth of the US is projected to reach 6.8% this year. This is due to large-scale fiscal support and the easing of pandemic restrictions.

- Among emerging markets and developing economies, China is anticipated to rebound to 8.5% this year, reflecting an increase in demand.

Source: The Hindu

World Bank’s “Migration and Development Brief”: India is the top receiver of remittances

What is the News?

The World Bank has released a report titled “Migration and Development Brief, 2020”.

Contents

Key Findings of the Migration and Development Brief:

Findings Related to India:

- Firstly, India has received the highest amount of remittances in 2020. This was followed by China, Mexico, the Philippines, Egypt, Pakistan, France and Bangladesh.

- Secondly, India’s Remittances: India has received over USD83 billion in remittances in 2020. This was despite the pandemic that devastated the world economy.

- In 2019, India had received USD83.3 billion in remittances.

- Thirdly, India’s remittances fell by just 0.2% in 2020. This was due to a 17% fall in remittances from the United Arab Emirates. However, this was offset by the resilient flows from the United States and other host countries.

- Fourthly, Remittances outflow from India in 2020 was USD7 billion. In 2019, it was around USD7.5 billion.

Other Key Findings:

- China received $59.5 billion in remittances in 2020 against $68.3 billion in 2019.

- The remittance outflow was maximum from the United States. This is followed by the UAE, Saudi Arabia, Switzerland, Germany and China.

- Remittance inflows have increased in Latin America, South Asia, Middle East and North Africa.

- However, remittances have fallen for East Asia and the Pacific, Europe, Central Asia and Sub-Saharan Africa.

About Migration and Development Brief Report:

- Prepared by: The report is prepared by the Migration and Remittances Unit, Development Economics (DEC)- the premier research and data arm of the World Bank.

- Aim: The report aims to provide an update on key developments. Especially in the area of migration and remittance flows and related policies over the past six months.

- The report also provides medium-term projections of remittance flows to developing countries.

- The report is produced twice a year.

About Remittances:

- Remittance is money usually sent to a person in another country. The sender is typically an immigrant and the recipient a relative back home.

- Remittances represent one of the largest sources of income for people in low-income and developing nations.

Source: Indian Express

Suggestions for Inclusive growth in India

Synopsis: India lags behind many Human development indicators. India’s economic growth is not benefitting the poor. There is a need to create a new framework for measuring the inclusiveness of growth.

Why India’s Economic growth is not inclusive?

- One, Rising hunger: According to the Global Hunger Index 2020 India ranks 94th amongst 107 countries.

- Two, Indian citizens are amongst the least happy in the world. According to the World Happiness Report of the UN Sustainable Development Solutions Network, India ranks 144th amongst 153 countries.

- Three, the Pandemic has increased the inequality gap further by pushing many poor people into poverty. According to a World Bank report, during the pandemic the very rich became even richer. Whereas the number of poor people in India (with incomes of $2 or less a day) is estimated to have increased by 75 million.

- Four, unsustainable economic growth. According to global assessments, India ranks 120 out of 122 countries in water quality, and 179 out of 180 in air quality.

Suggestions for more inclusive growth

- First, India needs a new strategy for growth, founded on new pillars. Because the older economic growth strategy of relying on Foreign capital has made “ease of living” difficult, while the “ease of doing business” improved. The new economic strategy should be based on the following two pillars,

- One, Economic growth must no longer be at the cost of the environment.

- Two, the benefits of Economic growth should be made equitable. Thus creating more incomes for its billion-plus citizens

- Second, there is a need for local solutions to measure the wellbeing of people, rather than relying on universal, standard progress measure frameworks.

- While GDP does not account for vital environmental and social conditions that contribute to human well-being.

- Many countries are developing universally acceptable frameworks.

- They are trying to incorporate the health of the environment, public services, equal access to opportunities, etc. to make it universal, more scientific, and objective.

- However, experiences have shown that this ‘scientific’ approach does enable objective rankings of countries. For example, World Happiness Report misses the point that happiness and well-being are always ‘subjective’.

- Standard global solutions will neither make their conditions better nor make them happier. So, local communities need to find their own solutions within their countries, and in their villages and towns to measure their well-being.

- Third, we need to start recognizing the role of societal conditions that are responsible for the difficulties of the poor. For example, Caste system, Patriarchy, indifferent attitude towards the disabled, transgender, etc.,

- This way of looking at things also equally contributes to the increasing Inequality.

- Four, move away from the centralised Governance model towards a decentralized form of governance. Because Governance of the many by a few politically and economically powerful persons may work for a few.

- Whereas, decentralized system of governance will allow communities to find their own solutions to complex problems.

India’s growth should be measured on its sustainability and the improvements made in the lives of hundreds of millions of its citizens. It should be based on the size of GDP, the numbers of billionaires, the numbers of Indian multinationals.

Source: The Hindu

Impacts and importance of GDP revised estimates

Source – The Indian Express

Syllabus – GS 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development, and employment.

Synopsis – Revised estimates of GDP are released. It would impact the growth prediction and levels of the future National Income.

Introduction

- Last week all major financial publications were released i.e. economic survey, budget, and 1st bi-monthly monetary policy review.

- However, the first revised estimate of GDP growth in 2019-20 was not highlighted.

- This revision has not only revised the 2019-20 GDP growth rate, but also the GDP growth rate for 2017-18 and 2018-19.

- Accordingly, GDP estimates for 2019-20 have been revised from 4.2% to 4 percent. For 2017-18 revision is from 7% to 6.8% and for 2018-19 it is from 6.1% to 6.5%.

What are the key takeaways from GDP revision?

- First, There have been many revisions of GDP estimates. The growth rate is still not certain. For example, for 2016-17 the GDP growth rate went up from 7.1%, as per the First Advance Estimates, to 8.3% in the final analysis.

- Second, revision in 2019-20 figures is important for the base year effect. Due to COVID-19 disruptions in 2020-21, the GDP figures of 2019-20 becomes important for the comparison. Lower estimates in 2019-20, can result in higher figures of 2020-21 and 2021-22.

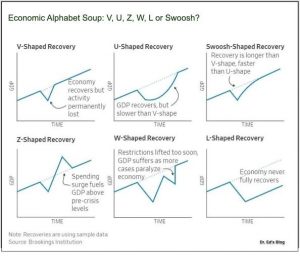

- Third, India’s GDP growth rate already going downwards from 2016 i.e. following an inverted-V shape. The COVID-19 pandemic brought that to a complete halt. Thus, a “V-shaped” recovery, which is being talked about by the expert is meaningless. For an actual recovery, the gains should first surpass the level of 2019-20.

Way forward-

The pandemic did not change the growth trajectory [it was already going down], it only made the decline even more precipitous.

Focus areas of Economic Survey 2020-21

Source- The Indian Express

Syllabus- GS 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development, and employment.

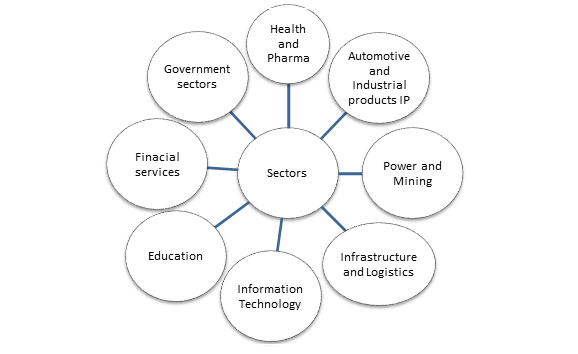

Synopsis – The Economic Survey 2020-21 outlines the status of various sectors of the economy.

Introduction-

- The government presented Economic survey 2020-21 of India in the Parliament.

- The Economic survey provides a summary of the annual economic development across the country during the previous financial year.

- The focus of this year’s economic survey is on the following basic tenets:

- Atmanirbhar Bharat in COVID times.

- Shifting from entitlement-based approaches to an entrepreneurship-based policy framework.

- Going beyond “nudging”.

Nudging is a method of changing people’s behavior by incentives and encouragement. It does not favour the use of force or penal actions for inducing behaviour change among people. It was used to discourage open defecation by communicating its advantages and financial incentives for toilet construction.

Key highlights of Economic Survey 2020-21

The Economic Survey 2020-21 examined the correlation of inequality and per-capita income with a range of socio-economic indicators, including health, education, etc.

- Economic recovery: The emphasis is mostly on the economic recovery routes after the damage due to COVID-19 pandemic. It is expected that the recovery will follow a V-shaped path. Now, the target of making India a $5-trillion economy by 2024 is also clear.

- Health expenditure: The survey recommends raising government spending on the healthcare sector [from the current 1 per cent to 2.5-3 per cent of GDP]. It will reduce out-of-pocket expenditures.

- Health outcomes- The health results of the states that have adopted Pradhan Mantri Jan Arogya Yojana (PM-JAY) have improved compared to those that have not adopted the scheme.

- Bare necessities- Access to the bare necessities such as water and sanitation, accommodation, micro-environment, and other facilities has improved across all States. The survey looks at how the bare necessities have changed.

- National Infrastructure Pipeline (NIP) will boost inclusive economic growth and employment opportunities during 2020-25. The NIP [introduced in 2020] has estimated cumulative investment of 111 lakh crore over five years in infrastructure projects.

- Government consumption and net exports cushioned the growth from diving further down.

- Strong services exports and weak demand leading to a sharper contraction in imports than exports.

- India remained a preferred investment destination in FY 2020-21 with FDI pouring.

- India’s forex reserves at an all-time high as to cover 18 months’ worth of imports in December 2020.

However, the survey should have focused more on the external trade aspect. India should try to establish value chains with South and Southeast Asia.

India should also reconsider the high cost of tariffs when 38% of our exports rely on imports.

Reviving consumption demand for economic growth

Synopsis- Expenditure side of National Income is showing signs of stress. The government should try to revive the consumption side to return to the growth path.

Introduction

- The first advance estimates of GDP growth for FY21 is more optimistic than the projections provided by many institutions, global and domestic.

- However, the figures still have a substantial chance of uncertainty as the source of data is not reliable [Very little up-to-date primary information is available for the estimation].

What are the areas of concern?

On the expenditure side, except for government final consumption expenditure, alternative drivers of demand are down sharply. Non-Public Consumption Expenditure is predicted to contract 9.5 per cent while capital formation has contracted by 14.5 per cent, with imports and exports also contracting.

The economic performance was dented by sharp de-growth in the following three sectors-

- A sector-wise breakup of data for FY21 shows the sharpest fall in trade, hotels, transport, communication, and broadcasting services at –21.4 per cent from 3.6 per cent growth last year.

- This is followed by 12.6 per cent contraction within the construction sector as against a growth of 1.3 per cent last year.

- Manufacturing is declining by 9.4 per cent in 2020-21 from 0.03 per cent growth last year.

The estimated losses in these three sectors account for 93.5 percent of the total loss for the whole year. Hence, fiscal policy needs to focus on priming demand to return to the trend growth path.

What policy interventions are needed to increase consumption?

- First, Government should focus on enhancing credit flows to the small and marginal farmers

- KCC (Kisan Credit Cards) constitute 60% of Major outstanding bank credit due to COVID and Agri stress.

- To encourage consumption among farmers, interest payment by farmers should be sufficient for their KCC loan renewal.

- It may result in a reduction of the NPA of the banks from KCC.

- Second, the government should try to mainstream the tenant farmers

- There are almost 3-4 crore tenant farmers, not receiving PM-KISAN benefits.

- The government should try to formalize the credit delivery to tenant farmers by issuing tenancy certificates on the line of Andhra Pradesh.

- Another way is the formation of SHGs to enable formal lending.

- Third, waive tax on Senior citizen saving scheme– The government should make SCSS interest income to be tax-free.

- Fourth, Launch Adopt-a-family scheme– The scheme is voluntary and taxpayers with income up to over Rs 10 lakh could be incentivized for supporting a BPL family for a year. The government can incentivize taxpayers with around Rs 50,000 tax deduction apart from exemption offered under-80C.

- Fifth, take the following steps to bring more FDI and increase Ease of Doing Business rankings;

- Withdraw all tax appeals.

- Accept all domestic arbitration decisions against government departments/agencies

- Clear above outstanding dues within a stipulated time.

- Sixth, the Government should increase investment in the health and education sectors;

- The government can introduce a medical savings account.

- Interest earned by the depositor can be deducted by government to provide the person with Mediclaim policy.

- Lastly, the government should bring down its stake in state-owned banks to less than 50 percent.

Way forward-

By fulfilling these criteria, India can improve its position on the Ease of Doing Business ranking.

Issue of K-shaped recovery: How government budget can deal with it?

Synopsis –The macro-implication of K-shaped recovery and labour market pressure. How the government budget will deal with it?

Introduction-

- COVID Vs Economic Mobility – India has broken the link between COVID virus proliferation and mobility earlier and more successfully.

- India’s GDP estimates for 2020-21 show that the economy is expected to perform much better than earlier projections.

- However, the present economic recovery is a hopeful development, but it is not accompanied by labour market growth.

What are the present economic developments in India?

- Industrial sector - The large firms have endured the crisis better and are gaining market share at the expense of smaller firms.

- Although it will increase medium-term productivity, but it will also increase the dominance/pricing power of big companies in the market.

- Employment – CMIE’s [Centre for Monitoring Indian Economy] labour market survey reveals 18 million fewer employed (about 5 per cent of the total employed) compared to pre-pandemic levels.

- These labor market projections not incompatible with a sharper near-term rebound, as this recovery is led by capital and profits, not labour and wages

- Household sector – Households at the top of the pyramid are seen their incomes largely protected, and savings rates forced up during the lockdown, increasing ‘fuel in the tank’ to drive future consumption.

- Meanwhile, households at the bottom are likely to have witnessed permanent hits to jobs and incomes.

What are the implications of a K-shaped recovery?

K-shaped recovery happens when, following a recession, different sections of an economy recover at starkly different rates or magnitudes. The macro-implication of K-shape recovery in India are-

- Firstly, issue of Income- Upper-income households have benefitted from higher savings for two quarters. Present recovery is led by these savings.

- But lower-income households are facing loss of income in the forms of jobs and wage cuts. This will be a recurring drag on demand, if the labour market does not heal faster.

- Second, the issue of Consumption– To the extent that COVID has triggered an effective income transfer from the poor to the rich, this will be demand-hindering because the poor have a higher marginal propensity to consume (i.e. they tend to spend (instead of saving) compared to higher marginal propensity to import among rich.

- Consumption pattern– Passenger vehicle registrations (proxying upper-end consumption) have grown about 4 per cent since October while two-wheelers have contracted 15 per cent.

- Third, increases the inequality– COVID-19 reduces competition or increases the inequality of incomes and opportunities between rich and poor.

- This could affect the trend growth in developing economies by hurting productivity and tightening political economy constraints.

How upcoming budget may help India to deal with K Shape recovery?

Policy needs to look beyond the next few quarters and anticipate the state of the macroeconomy post the sugar rush, for the wellbeing of poor citizens and increase its income level.

- First, Policy will look for the private sector to start re-investing and re-hiring, and thereby sets the economy onto a more virtuous path. Barring that, the labor-market hysteresis could sustain with the manufacturing and service sectors.

- Private investment revival policy may be implemented first for recovery of the private sector.

- Second, Ensure exports should benefit from increasing global growth as the world gets vaccinated steadily.

- Third, Government may invest in large physical and social (health and education) infrastructure push. It may provide employment for who lost job due to COVID. It may reduce inequalities.

- Fourth, a reliable medium-term fiscal plan will be key to anchoring the bond market and underscoring an adherence to macro stability.

- Lastly, the investment model for public investment must be balanced to push and financed by aggressive public asset sales.

Read Also :upsc syllabus pdf

World Bank’s Global Economic Prospects Report predicts contraction of Indian economy

News: The World Bank has released the Global Economic Prospects report.

Facts:

- Global Economic Prospects Report: It is a World Bank Group flagship report that examines global economic developments and prospects, with a special focus on emerging markets and developing economies. It is issued twice a year, in January and June.

Key Takeaways from the Report:

- India: It is expected to grow at 5.4% in fiscal year 2021-22 and 5.2% in fiscal 2022-23 after an expected contraction of 9.6% in fiscal 2020-21.

- Reason: India’s expected contraction in the is due to a sharp decline in household spending and private investment. There was severe income loss in the informal sector which accounts for 4/5ths of employment

- Globally: Global economic output is projected to grow by 4% in 2021 assuming widespread roll-out of a COVID-19 vaccine throughout the year. This projection is 5% below pre-pandemic levels.

- Emerging Market and developing economies (EMDEs): They are expected to grow at an average of 4.6% in 2021-22 reflecting the above average rebound in China (forecast at 7.9% and 5.2%, this year and next).

- Increase in Global Debt Levels: There has been a massive increase in global debt levels because of the pandemic with the South Asian region seeing the steepest increase. India’s government debt expected to increase by 17% of GDP while service output contracts over 9%.

- South Asia slowdown led by India: The South Asian region’s economy is expected to contract by 6.7 % in 2020 due to the pandemic. This was led by India’s deep recession where the economy was already weakened by the stress in non-bank financial corporations.

Recommendations:

- The key immediate policy priorities for countries should be limiting the spread of the virus, providing relief for vulnerable populations and overcoming vaccine-related challenges should be the key immediate policy priorities for countries.

- Countries should also foster resilience by safeguarding health and education, prioritising investments in digital technologies and green infrastructure, improving governance, and enhancing debt transparency.

Economic Impact of Internet shutdown in Indian and world economy

News: According to a report by the UK-based privacy and security research firm Top10VPN, India has suffered the longest internet shutdowns in 2020 globally.

Facts:

Key Takeaways from the report:

- Globally, internet shutdowns cost the world economy $4 billion. However, this represents a 50% decrease in impact compared to $8.05 billion in 2019.

- India has suffered the biggest economic impact in the world in 2020 due to Internet shutdowns adding up to 8,927 hours and $2.8 billion losses.

- Among 21 countries that curbed internet access last year, the economic impact seen in India was more than double the combined cost for the next 20 countries in the list.

- India continued to restrict Internet access more than any other country — over 75 times in 2020.The majority of these short blackouts were highly targeted, affecting groups of villages or individual city districts.

- The report made a separate mention of the extended curbs on Internet use in Jammu and Kashmir. It has called it as the longest Internet shutdown in a democracy.

GDP likely to contract by 7.7% in 2020-21, says Govt.

News: National Statistical Office(NSO), Ministry of Statistics and Programme Implementation(MoSPI) has released the First Advance Estimates (FAE) for 2020-21.

Facts:

- What are the First Advance Estimates(FAE)? For any financial year, the MoSPI provides regular estimates of GDP. The first such instance is through the FAE. The FAE for any particular financial year is typically presented on January 7th.

- Significance: FAE significance lies in the fact that they are the GDP estimates that the Union Finance Ministry uses to decide the next financial year’s Budget allocations.

- Based on: The FAE are based on the benchmark-indicator method. The sector-wise estimates are obtained by extrapolation of indicators like:

- Index of Industrial Production(IIP) of first seven months of the financial year

- Financial performance of listed companies in the private corporate sector available up to quarter ending September,2020

- First Advance Estimates of crop production

- Accounts of Central and state governments

- Information on indicators like deposits and credits, passenger and freight earnings of Railways, passengers and cargo handled by civil aviation, cargo handled at major sea ports, sales of commercial vehicles available for the first eight months of the financial year.

Key Takeaways:

- GDP: India’s real GDP (Gross Domestic Product) is estimated to contract by 7.7% in 2020-21, compared to a growth rate of 4.2% in 2019-20.India will witness a negative GDP growth rate for the first time after 1979-80.

- Reason: The reason for the contraction has been the disruption caused by Covid-induced lockdowns which saw the economy contract by almost 24% in the first quarter and by 15.7% during the first half of the year.

- Gross Value Added(GVA): It provides a picture of the economy from the supply side. It maps the value-added by different sectors of the economy such as agriculture, industry and services. The real GVA will also shrink by 7.2%.

- Positive Growth: Just two sectors are estimated to record positive growth in GVA this year with Agriculture continuing its strong run through the first half of year to the second half (3.4%) and Electricity, Gas, Water Supply & Other Utility services(2.7%).

- However, the sharpest decline in the pandemic-dented year is expected to be in the Services Sector.

- Private Final Consumption Expenditure (PFCE): The biggest demand for goods and services comes from private individuals trying to satisfy their consumption needs. This demand is called PFCE and it constitutes over 56% of the total GDP. It is expected to be almost what it was in 2017-18.

- Gross Fixed Capital Formation (GFCF): The second biggest component of GDP is called GFCF and it measures all the expenditures on goods and services that businesses and firms make as they invest in their productive capacity. This type of demand accounts for close to 28% of India’s GDP. It has fallen below the 2016-17 level.

- Government expenditure: It is expected to show a robust growth of 17% in the second half of the year, despite the challenges faced by the government on fiscal consolidation and the fact that government expenditure fell 3.9% in the first half of the year.

Current account surplus moderates to $15.5 bn in Q2

Source: The Indian Express

News: The current account surplus moderated to $15.5 billion (2.4% of GDP) in the quarter ended September of 2020-21 from $19.2 billion (3.8% of GDP) in the first quarter this fiscal.The current account saw a deficit of $7.6 billion(1.1%) in the year-ago quarter.

Facts:

- Why has current account surplus narrowed? The narrowing of the current account surplus in Q2 of FY21 was on account of a rise in the merchandise trade deficit to $14.8 billion from $10.8 billion in the preceding quarter.

Read Also : Current affairs for upsc

Current Account:

- What is the Current Account? Current account maintains a record of the country’s transactions with other nations, in terms of trade of goods and services, net earnings on overseas investments and net transfer of payments over a period of time, such as remittances.

- This account goes into a deficit when money sent outward exceeds that coming inward.

- What does Current account constitute? The current account constitutes net income, interest and dividends and transfers such as foreign aid, remittances, donations among others. It is measured as a percentage of GDP.

Current Account = Trade gap + Net current transfers + Net income. abroad

- Why does Current account matter? Current account balance measures the external strength or weakness of an economy.

- A current account surplus implies the country is a net lender to the rest of the world, while a deficit indicates it is a net borrower.

- A country with rising Current Account Deficit(CAD) shows that it has become uncompetitive, and investors are not willing to invest there. They may withdraw their investments.

Importance path How to increase economic recovery of India

Synopsis: Government should adopt a fiscal stimulus Path for the economic recovery of India, to make our economy grow at 9% GDP in the coming years.

Background

- The impact of the pandemic has pushed India to impose stringent lockdown measures to save millions of lives of Indian citizens but it’s after effect has caused massive economic disruption.

- This has resulted in fall of GDP by around 7.5 percent for this full year which has dented our aspiration to become a$5 trillion economy by 2024.

- Though nothing much can be done for what has happened, in the coming years India needs to get back to the trend line of growth (pre-COVID years) to sustain the aspiration of our young population.

How different sectors are performing currently?

- The sectors which have shown a positive sign of recovery are

- Pharmaceuticals and chemicals, the FMCG sector, the two-wheeler sector, Construction equipment’s driven by rural demand from sales to individuals, Capital goods.

- In contrast, Sectors that are still struggling for a full recovery are

- Mainly, the travel and tourism sector, real estate and construction sector, and retail which are significantly high employment sectors.

So, what steps must the government take?

Though the recovery underway is solid, but we need measures to sustain and deepen it. The government can do three things.

- First, the government should resort to fiscal stimulus by paying long-overdue government bills. Few examples are,

- Distribute the pending tax refunds, pay the bills of all companies (large and small), pay off the many arbitration award spending where the government has lost cases, and pay state governments their pending GST dues.

- Second, invest in public health infrastructure and centre should finance state government efforts to build an extensive public health network.

- While this will equip as to handle a possible second wave of the virus, on the other, it will spread confidence.

- Also, it is essential for the government to work in partnership with private sector hospitals.

- Third, invest massively in infrastructures such as roads, ports, logistics. Areas, where investment can be channelised, are,

- By Providing decent, accessible housing to improve the living conditions in slums across our cities by providing right public-private program.

- By providing cheap connectivity into our cities.

- Even, the 20 trillion infrastructure pipeline project that requires massive funding can be considered.

How the funds for the above will be sourced?

- To mobilize its resources that are needed to finance the above measures, the government can opt for a huge privatization programme (Disinvestment)

- Under this program, the government should intend to reduce its share-holding to 26 percent across public-sector banks, steel companies, oil companies, and every manufacturing company and hotel it currently owns.

- This announcement might trigger a big rally in the stock prices of PSUs, increasing return.

- To stem the protests due to big reforms,we are witnessing currently, the government should choose democratic methods for implementing them such as use of discussion papers for public comment, the debate in Parliament.

We need to act swiftly to regain from stunted recovery. We must use our economic crisis as an opportunity to set some bigger things right that we have ignored for too long.

Vital notes from the year 2020

Synopsis: As 2020 is coming to an end, we should ponder upon the issues the country faced this year and ensure that 2021 does not become another wasted year.

What are the issues India faced in the Vital notes year 2020?

- Pandemic: The COVID-19 pandemic had an impact on every segment of Indian society and infected approximately more than a crore of its citizens (1.5 lakh fatalities).

- Border stand-off: India is facing an unexpected border stand-off situation with China in eastern Ladakh. The tensions even led to martyrdom of Indian soldiers. This has had a serious impact on India-China relations.

- Internal Security issues: The bitterness caused by the altered status of J&K and the custody of political leaders and the Naxalite violence have resulted in serious internal problems.

- States: There lies a grave concern for violence in the upcoming elections of West Bengal.

- Economy: The economy is in recession. India has fallen down the scale in the Human Development Index and in the Global Economic Freedom Index.

- New bills on social issues, for instance:

- A law against forced conversion by marriage will intensify an already divisive society.

- The farmers’ agitation is another instance where official inflexibility has led to a situation in which the Supreme Court had to intervene.

What should India do in the upcoming year?

Series of electoral successes for the ruling party; the personal popularity of the Prime Minister; and the absence of any strong competitor on the national stage gives the current government an opportunity to bring solid changes.

- Firstly, India should come up with a new model of ideas for foreign policy which can be implemented. This would enable India to be viewed as the only nation in Asia that can stand-up to the China challenge.

- Secondly, the idea that says India should look inward rather than outwards to enlarge its economy needs to be rejected, and India should enhance its export capacity.

- Thirdly, the government should take crucial steps to resolve the troubles in the labour market caused by the pandemic and other contributory factors.

- Creating new jobs in new industries should be a critical requirement.

- Stimulating demand would ensure growth in job opportunities.

Way forward

- Effective cooperation between the Centre and the States must be restored to impart confidence about India’s democratic future.

Economic Growth

Context: It is important that, only if the Indian economy grows at 8% in 2021-22 we will be able to compensate for the decline in 2020-21.

What needs to be done to make Indian economy to grow @ 8%?

- Accommodative Monetary policy: A reduction in interest rate through changes in policy rate, providing liquidity through various measures, and regulatory changes such as moratorium.

- Fiscal initiatives: A sharp increase in government capital expenditures which can act as a stimulus for growth. To increase government spending, government revenues should pick up with the rise in GDP and the fiscal deficit must be brought down.

- Growth and investment: The investment rate has been falling. In 2018-19, the rate fell to 32.2% of GDP from 38.9% in 2011-12. A detailed investment plan of the government and public sector enterprises must be drawn up and presented as part of the coming Budget.

- Exports: Closing borders may appear to be a good short-term policy to promote growth but it kills growth all around. A strong surge in our exports will greatly facilitate growth, in 2021-22.

What is the way forward?

- Strong effort must be made to improve the investment climate. The National Infrastructure Pipeline is a good initiative, but the government must come forward to invest more on its own.

- Reforms are important but the timing, sequencing and consensus building are equally important. For example, Labour reforms, are best introduced when the economy is on the upswing.

The Indian economy in 2019 was at around $2.7 trillion. To achieve the level of $5 trillion, we need to grow continuously at 9% for six years from now.

Why Indian Economy is slowing down?

What are the issues facing Indian Economy?

- COVID pandemic has pulled down the global economy and India’s economy is one of the worst affected among them.

- In the first quarter of the financial year (April-June), India’s economy had contracted by an unprecedented 23.9%. Whereas in the second quarter, after a bit improvement, economy contracted by 7.5%, less than the anticipation.

- With the result of 2nd quarter, India has slipped into the Technical recession, which requires economy to be negative or declining for two consecutive quarters or more.

- Although some economist argue that when growth rate is measured on quarterly basis, instead of year-on-year basis, India’s GDP plunged 25 per cent in 2Q20 and recovered by 21 per cent in 3Q20. Thus, India’s economy is not in the technical recession.

Before we move any further in this article to understand the causes behind slowing Indian Economy, first we need to understand the components of the GDP.

How to calculate GDP using Expenditure method?

Final goods and services produced in a country during a period of time are taken into account under expenditure method of calculating National Income or Gross Domestic Product. In this method final expenditure made by each stakeholder is taken into account.

Final expenditure is that part of expenditure which is undertaken not for intermediate purposes.

Following is the formula for calculating GDP by expenditure method;

GDP = C + I + G + (X − M)

- C (Consumption) represents the consumption expenditure by the households on Final goods and services, known as Private Final Consumption Expenditure (PFCE).

PFCE is the biggest component of the GDP and constitute around 55-57% of the GDP.

2. I (Investment) represents business investment on equipment. It includes Gross Fixed Capital Formation (GFCF) and Inventory.

- GFCF includes Investment made in the long-term assets by government and private sector and investment in residential units by business or households.

- Inventory investment includes investment for procuring raw materials and finished or unfinished goods.

Investment constitute around 30-32% of the GDP.

GFCF Includes investments from Government, Businesses and households. 25% of I is constituted by government investment (Centre, states and PSUs) and 35-40% each is that by the corporate (India Inc.) and non-corporate (MSMEs and household investment in real estate) private sector.

3. G (Government) represents sum of government expenditures on final goods and services including salaries, weapons, investments, etc., also known as Government Final Consumption Expenditure (GFCE).

It doesn’t include the investment in financial products.

GFCE constitute around 10-12% of India’s GDP.

4. X represents gross exports and M represents gross imports. Balance of both is called net exports.

What are the causes behind falling GDP growth?

- Consumer demand is falling in urban India. Sales of domestic cars and commercial vehicles are on decline even before COVID pandemic. More than 2.1 crore individuals have lost salaried jobs due to the pandemic since April, and economists estimate the number to increase in future as companies struggle to run smoothly.

- While many of those didn’t lose their jobs, saw their salaries drastically reduced.

- Wage growth rate in rural area has declined to a new low. 10 million more rural households are seeking MGNREGA employment per month since August compared to a year ago.

Effect on the GDP

- Fall in income of households is leading to drastic fall in aggregate demand for goods and services i.e. Private Final Consumption Expenditure (PFCE). PFCE remains in the negative territory, at -11.3% in Q2. Private consumption demand, is the mainstay of the economy as it contributes around 55-60% of GDP.

- Loans for households are although easily available after government stimulus package, but due to uncertainty of the future income and savings, people are apprehensive of taking loans at present.

- Growth rate in eight core sectors is sluggish. That means even if the demand is improving industries will not be in the position to meet those demands.

- As per All India Manufacturers Organization’s June survey, about one-third of small and medium-sized enterprises indicated that their businesses were beyond saving.

- Unorganised sector, which is specifically dependent upon daily cash flows and lacking organised fund sources like loans and finance from the institutions, has been badly affected. This sector was already badly affected by demonetisation and GST, COVID pandemic has reduced the possibility of revival of many firms working in this sector.

Impact on the GDP

- Gross Fixed Capital Formation (as % of GDP) had been on a constant decline (except in 2018) between 2014 and 2019, falling from 30.1% to 27.4%. In Financial year of 2020-21, GFCF was contracted by 7.3% in Q2, compared to 47.1% in Q1.

- The central government’s total expenditure (both revenue and capital) has been declining sharply since 2010-11. From a high of 15.4% of the GDP in 2010-11, the total expenditure has hit a low of 12.2% of the GDP in 2018-19.

- The capital expenditure component has dropped from 2% of the GDP in 2010-11 to 1.6% in 2018-19 and that of the revenue expenditure from 13.4% in 2010-11 to 10.6% in 2018-19.

- This decline in expenditure is driven by the government’s priority to contain fiscal deficit.

Impact on the GDP

- Most worrying part for economy is a fall in government spending. Although government has announced stimulus package for revival of economy, but actual fiscal support has not been commensurate as expected. Government-Fixed Capital Expenditure (GFCE) growth has declined by 22.2% in 2nd quarter after improvement of 16% in the first Quarter.

Why government is not able to provide direct fiscal support?

- Centre’s net revenue (tax and non-tax) collection for the first half of this fiscal is merely 27.3 per cent of the budget for the full fiscal year.

- Center’s capital expenditure has registered a decline of 11.6 per cent. Capital expenditure is defined as the money spent on the acquisition of assets as well as fresh investments

- Market borrowings of both the Centre’s as well as the states’ have increased by 50 per cent year-on-year basis. Due to that India’s public debt/GDP will likely reach around 85 per cent. High debt-servicing costs will further crowd out productive public expenditure.

- Central government fiscal deficit is also inflating.

Why there is a need of direct income support from the government?

Although government has announced stimulus package for revival of the economy that includes benefits for industries, poor people and MSMEs etc., however all these benefits may not be able to provide economy with the immediate boost required at this point of time;

- At times of slowdown in industrialised economies, there is idle productive capacity on the one hand and unemployed manpower on the other.

- Unemployment reduces the purchasing power capacity of the households, resulting in low aggregate demand.

- Increase in Government expenditure or investment on infrastructure lead to expansion of productive capacity and generate long-term economic growth.

- While the infrastructure spending and reforms are critical to sustain medium and long term growth, neither can boost near-term demand. A stimulus package focused on giving direct benefits to the middle-class could help alleviate the situation.

- Increase in direct benefit transfers to people lead to immediate increase in aggregate demand of household for goods and services. Increase in aggregate demand leads to fuller utilization of the existing productive capacity and employment generation.

- Thus, Fiscal spending (government expenditure), as against fiscal conservatism, is favoured because this can be mobilised quickly to deliver results in a shorter timespan while others need longer timeframes to get activated and deliver.

- Bank recapitalisation for increasing credit flow in the economy is another way to boost demand in the economy.

Way forward

Present time demands government to discontinue its fiscal conservatism approach centred on reducing its fiscal deficit. It is the time to boost the domestic demand by transferring direct benefits, as was done during the 2008 economic recession. Indian economy at that time proved to be resilient and performed far better compared to many developed countries at that time.

Private sector in India is not lacking funds as is the popular perception. It is the lack of confidence in the Indian economy and industries at present that investment in India are reducing. There are sufficient funds available for the government borrowings in the market.

India drops two ranks in Human Development Index 2020

News: United Nations Development Program (UNDP) has released the Human Development Index (HDI) 2020.

Facts:

● HDI Human Development Index measures the average achievements in a country in three basic dimensions of human development:

○ A long and healthy life- measured by Life expectancy at birth

○ Access to knowledge: measured by Mean years of schooling and Expected years of schooling

○ A decent standard of living- measured by Gross National Income (GNI) per capita (PPP US$).

What is PHDI ?

UNDP has introduced a new metric this year called Planetary Pressures-adjusted Human Development Index (PHDI).

PHDI reflects the impact caused by each country’s per-capita carbon emissions and its material footprint which measures the amount of fossil fuels, metals and other resources used to make the goods and services it consumes.

Key Takeaways of HDI Human Development Index 2020:

● Topped by: Norway has topped the index followed by Ireland, Switzerland, Hong Kong and Iceland.

● India in HDI 2020: India has dropped two ranks in the HDI index standing at 131 out of 189 countries. India’s HDI value for 2019 is 0.645— which put the country in the medium human development category

● BRICS: In the BRICS grouping, Russia was 52 in the human development index, Brazil 84, and China 85.

● Neighboring Countries HDI ranking: Bhutan (129), Bangladesh (133), Nepal (142), and Pakistan (154).

Other Takeaways from the index:

● Life expectancy of Indians at birth in 2019 was 69.7 years. This is worse than Bangladesh which has a life expectancy of 72.6 years. The life expectancy in Pakistan is 67.3 years.

● India’s gross national income per capita fell to $6,681 in 2019 from $6,829 in 2018 on purchasing power parity (PPP) basis.

○ Purchasing power parity or PPP is a measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries’ currencies.

● Solar capacity in India has increased from 2.6 gigawatts in March 2014 to 30 gigawatts in July 2019 achieving its target of 20 gigawatts four years ahead of schedule.In 2019, India ranked fifth for installed solar capacity.

For further reference: UNDP’s HDI and Other Indices

India’s retail inflation

Context- Retail inflation showed signs of easing in November, led by easing prices of some food items.

More in news-

Consumer Price Index inflation stood at 6.93% in November 2020 compared to 7.61% in October, according to data released by the Ministry of Statistics and Program Implementation, though it remained above the comfort level of the Reserve Bank.

What are the reasons for decline in CPI inflation?

- The movement in retail inflation is broadly driven by the movement in food and beverage inflation which has 46 per cent weight in the consumer price index.

- Within the food items, the inflation declined for vegetables to 15.63%, cereals and products 2.32%, meat and fish 16.67% and milk and products 4.98%.

- Inflation in the key transport and communication category that includes petrol and diesel eased by a marginal 10 basis points to 11.06%.

- The inflation for housing eased to 3.19%, while that for miscellaneous items was flat at 6.94% in November 2020.

- Within the miscellaneous items, personal care and effects 11.97%, recreation and amusement 4.57%.

What are the areas of concern for RBI?

- Inflation remained above the comfort level of the RBI-

- Out of the food basket of 12 items, inflation still remained in the double digits in the case of six.

- Key protein sources including pulses, eggs and meat and fish continued to register worryingly high levels of inflation.

- Worrying high transportation cost– With oil marketing companies continuing to raise pump prices of these crucial transportation fuels, it is hard to foresee any further appreciable softening in food prices in December.

- This put the RBI’s forecast for average fiscal third-quarter inflation of 6.8% in jeopardy.

Disrupted supply chain logistics, higher operational and labour costs, higher administrative fuel costs partly contribute to the upward inflation trajectory in recent months.

What is the way forward?

- Policymakers must guard against easing vigilance on prices while considering growth-supportive measures.

- Price stability must remain the monetary authority’s primary target.

- The decline in the CPI inflation print in Nov 2020 to 6.93 per cent from 7.61 per cent in Oct 2020 has definitely come as a relief to the bond markets.

Income support to mitigate income losses

Context- The government’s unusual reluctance in providing adequate support to the economy has purportedly been because of the lack of fiscal space.

Is India in a technical recession?

Technical recession– The National Bureau of Economic Research (NBER) in the US defines a technical recession to be in progress when real GDP has declined for at least two consecutive quarters.

- However, the growth rate is measured on a quarter-over-quarter, not year-ago, basis.

According to JP Morgan’s estimates – On quarterly basis, India’s GDP India’s GDP plunged 25 per cent in 2Q20 and recovered by 21 per cent in 3Q20.

- This implies that India did not suffer two consecutive quarters of negative growth.

- Therefore, India is not in a technical recession.

What is RBI’s survey suggests to real GDP growth?

RBI latest survey of professional forecasters (SPF) has forecast that real GDP is expected to recover in FY22 to 12 percent from -9 percent in FY21.

- This implies that six quarters from now it will still be about 7 per cent below the pre-pandemic path, or $300-billion-a-year of income losses across two years.

- Concern- This can cause great damage to household and SME balance sheets, to income inequality, to poverty, and to women’s employment

What are the issues with government policy?

- No income support– The income loss could have been mitigated by budgetary income support. However, the government chose not to provide this.

- Government consumption declined 22 per cent on a quarterly basis in 3Q.

- Limited support to the domestic economy – Despite the apparent lack of fiscal space at home, the RBI has been funding other countries’ fiscal deficits.

- RBI invested almost 3 per cent of GDP in foreign assets just in the first half of this fiscal year.

- India’s huge current account surplus is a bane– This reflected not economic strength but an economy imploding so much faster than others that India’s demand for imports fell faster than foreign demand for Indian exports.

- Ongoing recovery led by capital than wages – Indian companies reported a decline in sales. However, operating profits growth was in the double digits. Net profits grew even faster. Large firms achieved this by slashing costs.

- A recovery led by profits will not lead to higher investment demand as long as there is significant excess capacity in many parts of the Indian economy.

- As far as the labour market goes, unemployment has dropped below pre-covid levels, but that is partly because of a decrease in the labour participation rate.

What is the way forward?

Government needs to provide extensive income support to mitigate the income losses due to pandemic.

- Government needs to be ensured that the recovery is not hamstrung by damaged household and SME balance sheets because of the extended loss of wages and incomes.

- Infrastructure spending and reforms are critical to sustain medium-term growth, neither can boost near-term demand.

Overestimate GDP growth data

Context- The higher GDP growth rate of the economy actually masks the decline in the unorganized sector.

Contents

What in the news-

The second quarter GDP contracted at a slower pace of 7.5 per cent compared to a massive 23.9 per cent in the first quarter of the current fiscal.

- The economy’s performance between July and September when lockdown restrictions were eased is better than most rating agencies and analysts anticipated.

Why GDP data should not be taken as sustainable recovery?

- The source of information is not reliable– Very little up-to-date primary information from factories and offices is available for the estimation.

- The data usually used to project quarterly growth rates were not available and so “some other data sources” were used.

- The method of calculation of quarterly growth rates is inaccurate.It was implicit in the method of estimation that this component could be proxied by the data from the organized sectors of the economy.

- Pent up demand- The healthy recovery in the second quarter represents meeting the pent-up demand after the ‘Unlock’ phase started in June.

How the proportionality between the unorganized and organized sectors disrupted?

- Due to demonetization– The cash shortage impacted unorganized sectors far more than the organized sector.

- The non-agriculture unorganized sector was disproportionately impacted by demonetization, as this sector consists of tiny units that work with cash.

- Implementation of the GST-The GST system favoured the organized sector, and demand shifted from the unorganized sector to the organized sector.

Why quarterly growth numbers are not robust?

- Collected data limited to organized sector only.

- The growth of the economy has been much less than that what is implied by the official GDP numbers.

- While trade has declined, data will indicate growth since it is available only from e-commerce and big stores [organized sector].

- If the data are taken only from the larger units, the decline of 20% to 30% will not be captured.

- Not all data are collected– The organized sector was able to restart business but not the unorganized sector due to low demand for the produce of unorganized sectors

Way forward-

- The quarterly growth numbers are not robust.

- It is difficult to predict that weather the economy is recovering or not, as the collected data was non comparable.

Dangers of misplaced optimism in economy

Context: The government’s economic recovery hype is no rights and this is not a time for fiscal conservatism.

What is current economic scenario?

- India’s economy contracted by 7.5% in the second quarter of financial year 2020-21 was, both good and bad.

- It is far lower than the 23.9% contraction registered in the first quarter of this financial year.

- second-quarter contraction is high with most similarly placed countries.

- Relaxation of lockdown restrictions during that quarter has not ensured automatic recovery.

Contents

What is government stance?

- Based on the evidence, the Finance Ministry’s Monthly Economic Report, for November, speaks of a V-shaped recovery reflective of “the resilience and robustness of the Indian economy”.

Why slowdown in contraction is no sign of recovery?

- Lockdown has affected employment, income and demand:

- Now since lockdown are relaxed, production must rise, not just to meet demands backed by the available purchasing power but also to restore inventories to normal levels across the distribution chain.

- Demand must return to and rise above pre-crisis levels for production to recover and grow.

- Burden on economy: The lockdown increased indebtedness and the bankruptcies. Lockdown induced affects are to be felt well after restrictions are relaxed.

- Decline in consumption: the decline in private final consumption expenditure at constant prices, which accounts for 56% of GDP, has come down but still remains high.

- Lack of consumer confidence: net incomes and consumer confidence are not at levels that can even restore last year’s levels.

- Less recovery in investment: the decline in fixed capital formation has fallen from a high minus 47% in the first quarter to minus 7% in the second, however, investment is still falling year-on-year.

- Half-hearted stimulus: Government Final Consumption Expenditure, which rose by 10% in the first half of 2019-20, relative to the corresponding period of the previous year, declined by 4% in the first half of 2020-21.

What government should do?

- Shun fiscal conservatism: Lockdowns limit production and result in a rundown of inventories.

- Government’s responsibility: the tasks of providing safety nets, reviving employment and spurring demand become crucial. The market cannot deliver on those fronts that is why state action facilitated by substantially enhanced expenditure is crucial.

- Increase borrowing: since government revenues shrink during a recession expenditure need to be funded by borrowing.

- GDP movements: need to understand the dynamic of the post-COVID-19 economy.

- Increase allocations for welfare expenditures: for example, subsidised food to minimal guaranteed employment.

What are the impacts on States?

- Squeezing expenditure at the State level: As per Office of the Controller General of Accounts, the total expenditure of the central government stood at 55% of what was provided for in the Budget for 2020-21, which was woefully inadequate even for normal times.

- Shortfall in spending: The shortfall in spending was sharper in the case of capital expenditure, with 48% of that budgeted being spent over April to October. The corresponding figure for 2019-20 was 60%.

- Fall in GST revenues: the government has decided not to compensate for the shortfall, as promised under the GST regime.

Indian economy witnessing V-shaped recovery: Finance Ministry report

Source: Click here

Finance Ministry’s Monthly Economic Review report has stated that the Indian Economy is witnessing a V-shaped recovery as the decline in the GDP has narrowed to 7.5% in the second quarter of 2020-21 from 23.9% in April-June quarter.

Facts:

- V-shaped recovery: It is characterized by a quick and sustained recovery in measures of economic performance after a sharp economic decline.

- Significance: Because of the speed of economic adjustment and recovery in macroeconomic performance, a V-shaped recovery is a best case scenario given the recession.

- Example: The recoveries that followed the recessions of 1920-21 and 1953 in the U.S. are examples of V-shaped recoveries.

Read Also : current affairs for upsc

Economic recovery

Context: A recovery led by profits, at the expense of wages, has implications for demand, inequality and policy.

- GDP is typically reported in two ways: The sectoral, production side (agriculture, manufacturing, services) and the functional, expenditure side (consumption, investment, net exports).

- Third way: On the income side, GDP is calculated as the sum of profits, wages and indirect taxes.

Discuss the role of factors of production in economic recovery.

- Capital: The economic recovery in many parts of the world is too twisted for comfort, driven excessively by capital than labour.

- If listed company profits are growing at 25 per cent, and yet GDP contracted 7.5 per cent, it reveals significant pressure on profits of unlisted SMEs, wages and employment.

- Labour market pressures around the world: US hiring slowed sharply in November and the unemployment rate is still forecasted to remain close to 6 per cent i.e. almost twice pre-COVID levels even at the end of 2021.

- Household demand for MGNREGA remains very elevated, suggesting significant labour market slack.

- The employment rate: Some labour market surveys still reveal about 14 million fewer employed compared to February.

- Nominal wage growth across a universe of 4,000 listed firms has slowed from about 10 per cent to 3 per cent over the last six quarters.

Why does this matter?

- Weak demand: It disincentivises re-hiring, reinforcing the risks of settling into a sub-optimal equilibrium.

- Worry for future demand: It may be normal for any one firm to boost profits by cutting employee reward. But if every firm pursued that strategy, It simply dismantles future combined demand and profitability for all firms.

- Acceleration of technological adoption: Differential productivity impacts on capital, skilled and unskilled labour, will likely have more deep impacts on the future capital-labour mix, possibly stressing existing inequities.

- Job-market pressures: If job-market pressures convince households into observing this shock as a quasi-permanent hit on incomes, households will be incentivised to save, not spend in the future.

- Global recovery: If labour market pressures dent private consumption, and an incomplete global recovery in 2021 dents export prospects.

- There will be no authoritative for entrepreneurs to invest, especially with manufacturing utilisation levels below 70 per cent heading into COVID-19 outbreak.

- Fiscal policy: US policymakers are negotiating yet another fiscal package, and only a small fraction of the large discretionary stimulus that the Euro Area and Japan injected will be reversed next year.

- India’s fiscal response has been controlled so far. It’s therefore important for the Centre to step up spending in the remaining months.

What is the way forward?

- Public investment and a large infrastructure push: Must be the theme of the next budget. This will be crucial to boost demand, create jobs, crowd-in private investment and improve the economy’s external competitiveness.

- Monetary to fiscal: In 2021, the stick must pass from monetary to fiscal, especially since the latter is a more surgical instrument to target SMEs and the labour market.

- GDP is typically reported in two ways: The sectoral, production side (agriculture, manufacturing, services) and the functional, expenditure side (consumption, investment, net exports).

GDP recovery- questionable data

Context- The Q-2 sharp recovery is very tactical because of pent-up demand, because of lockdown and the Data used for quarterly growth rates are weak and questionable.

What in the news-

The second quarter GDP contracted at a slower pace of 7.5 percent compared to a massive 23.9 percent in the first quarter of the current fiscal.

- The economy’s performance between July and September when lockdown restrictions were eased is better than most rating agencies and analysts anticipated.

Critic’s view– India had introduced one of the strictest lockdowns in the world which has resulted in the sharpest output contractions and massive losses in terms of jobs and livelihoods.

Why GDP data should not be taken as sustainable recovery?

- The source of information is not reliable– Very little up-to-date primary information from farms, factories and offices is available for the estimation.

- Pent up demand- The healthy recovery in the second quarter represents meeting the pent-up demand after the ‘Unlock’ phase started in June.

However, the quarterly figures do indicate the broad direction of change.

- GDP in the manufacturing sector– It rose 0.6 percent in the September quarter, in a big sign of recovery compared with a crash of 39.3 percent in the April-June period.

What are the challenges for sustainable recovery?

- Weak aggregate demand-

- Revenue shortfalls- The government’s debt-GDP ratio has gone up though.

- Bank credit growth in the economy continues to decelerate.

- The cumulative growth of the index from April to October this year stood at negative 13% when compared to the same period last year.

- Balance of payment surplus– the shortfall is on account of a sharp decline in investment demand, denting potential output.

- Both exports and imports have shrunk but imports have shrunk relatively more than exports, such a sharp fall in import demand does not augur well for a growing economy such as India.

- Rising foreign exchange reserves- India’s flourishing foreign exchange reserves are made up of short-term debt flows; they are not our net export earnings.

- Sudden booming stock market– This entirely driven by short-term foreign capital inflows.

- Such inflows are highly fickle, representing hot money, which can quit the financial markets in a jiffy if perceptions change for any exogenous reason.

Way forward-

- As an additional expenditure on government consumption or investment or credit growth remain muted, recovery is likely to remain modest.

- Economic recovery could still prove to be premature and illusory – Economists have reservations about reading too much into the September-October data as a sustainable trend.

Present State of economy

Context: The pandemic has delivered a “scissor cut” to the government finances.

What is the current scenario?

- Economic output and government revenues are shrinking.

- The government has to spend more to safeguard lives and livelihoods.

- Widening deficit.

- Most of state’s revenue come from center which changes their debt servicing ability for the worse.

What are the recent issues?

- Revenue side:

- In the first half of fiscal the center’s net revenue (tax and non-tax) collection stood at 27.3% of budget for the full fiscal year compared to 41.6% of previous fiscal year.

- Revenue collections in the first half of the year were down to 32.5% as compared to an average 15% growth over the same period.

- State’s fiscal issue:

- Fiscal data for the year is available only for the eleven non special category states.

- Revenue of these states is down by 21.5%.

- Adding center’s transfer to the states then the decline in revenue reduces to 16.5%.

- Shortfall in states’ revenue is much steep than that of center.

- For the eleven states total expenditure and capital spending have contracted by 1.5% and 23.4 % respectively.

- Allocation for pension and subsidies down by 10% and 20%.

- Since health is State subject, state will have to shoulder major part of health expenditure burden on account of the pandemic.

- Cutting capital expenditure:

- Both center and state have cut their capital expenditure.

- This is worrying as states undertake more as they have more than 60% of the overall general government capital expenditure.

- For instance, in 2019-20, capital expenditure by states stood at rs 4.97 lakh crore down by 20%.

- Low capacity utilization: for instance, it was 71.9 % in the previous year which is down to 58.6 %.

What are the consequences?

- Reduces Center’s and states’ ability to invest and lift the economy.

- Need of more borrowing.

- Centre’s total expenditure has been declined by 0.6 % which led to 11.6% decline in capital expenditure with revenue expenditure by 1 %.

- To maintain states ‘spending government has forced them to increase borrowing which has led to increase in market borrowing by 50%.

- Rising debt level of states. For instance, overall government general debt stood at nine year high.

- Centre’s debt to GDP is declining.

- Ratio of interest payment to revenue receipts is also declining which raises question on sustainability of debt.

- The private sector will remain wary of investing as demand uncertainty continues.

Cut in rate on small saving schemes withdrawn by Finance Minister

Export: A key to economic growth

Context: Arvind Panagariya’s new book, India Unlimited: Reclaiming the Lost Glory, discuss systematically how to reconstructs a path to higher growth.

What is the present scenario?

- Public sectors confronting a mountain of debt, the fiscal will need to be reined in post-COVID across several emerging markets.

- COVID-19 will accentuate the prevailing export pessimism, as global potential growth is damaged and protectionist instincts are stoked.

- The choice and sequencing of reforms will depend critically on the growth philosophy India embraces.

What are the possible strategies?

- India’s size provides fertile ground for import substitution. However, this approach was not successful in the past.

- The most significant is to underscore the necessity of export-led growth to India’s prospects.

- No emerging market has been able to sustain 7-8 per cent growth for any length of time without relying on the Siamese twins of exports and investment.

- Dismantle the underpinnings of export pessimism.

Why there is need to focus on exports?

- Prospects in exports: Global merchandise exports stood at almost $18 trillion in 2017 (more than six times India’s GDP) with India commanding an export share of just 1.7 per cent (versus China’s 12.8 per cent).

- Doubling exports: Even if the global market shrinks to $15 trillion, India could double its exports by raising its global market share to just 4 per cent. India’s 2002-2010 growth boom was underpinned by exports, which grew 18 per cent a year for eight years.

- Labour-intensive manufacturing: For many labour-intensive tasks, automation is still infeasible. Adidas, for example, produces only 1 million of its 360 million pairs of shoes in automated factories.

- Geopolitical reasons: Chinese real wages are rising; the workforce is shrinking and the embattled relationship with the US.

- Integration: integrate into the Asian supply chain by attracting multinational companies seeking a China hedge in the region.

- Create jobs: exports can create manufacturing jobs which will serve as a powerful magnet to attract labour away from agriculture. By 2030, agriculture will constitute less than 10 per cent of GDP while still employing 35-45 per cent of the workforce.

What are the challenges that lie in front of India?

- India’s fragmented industrial structure: It’s estimated almost 60 per cent of India’s manufacturing workforce is employed in firms with five or less workers, and 75 per cent in firms with 50 or less workers.

- Low productivity and low wages: For example, 92 per cent of workers in the apparel sector worked in firms with less than 50 workers. In contrast, 57 per cent of China’s apparel workforce were employed in firms with more than 200 employees.

What needs to be done?

- Avoiding the import-substitution trap.

- Reduce Import tariff which are equivalent to an export tax.

- Ensuring the rupee remains competitive.

- Boosting free trade agreements and trade facilitation.

- Creating autonomous employment zones (AEZs) where factors of production are less distorted.

- Reduce the gulf in per-capita incomes between agriculture, industry and services.

- Create higher-wage jobs in industry and services for agricultural workers to migrate to.

Base year of CPI-IW changed

The Labour and Employment Ministry on Thursday revised the base year of the Consumer Price Index for Industrial Workers (CPI-IW) from 2001 to 2016.

Why the base year for the Consumer Price Index for Industrial Workers(CPI-IW) has been changed?

Due to the changing consumption pattern, more weightage has been given to spending on health, education, recreation and other miscellaneous expenses while the weight of food and beverages has been reduced.

Consumer Price Index (CPI) for Industrial Workers

It measures changes in the price level of a market basket of consumer goods and services purchased by households.

CPI data is released monthly by the Central Statistics Office (CSO) which functions under the Ministry of Statistics and Programme Implementation.

There are four types of CPI: a) CPI-IW (Industrial Worker), b) CPI-UNME (Urban Non-Manual Employees), c) CPI-AL (Agricultural Labourers) and d) CPI-RL (Rural Labourers)

RBI has adopted CPI as the key measure for determining the inflation situation of the Indian economy on the recommendation of the Urjit Patel Committee.

Usage of CPI-IW

CPI-IW is used:

- To regulate the dearness allowance (DA) of government staff and industrial workers.

- Apart from measuring inflation in retail prices.

- To revise minimum wages in scheduled employments.