Contents

| For 7PM Editorial Archives click HERE → |

In recent times the issue of Old Pension Scheme(OPS) vs National Pension System(NPS)(commonly known as new pension scheme) has been a hotly debated topic in the economic and political circles of the country. The demand for returning back to the old pension scheme (OPS) is gaining traction. Several states such as Rajasthan, Chhattisgarh, Jharkhand, Punjab and Himachal Pradesh have already announced a shift back to the OPS.

Due to the growing clamour for returning back to the Old Pension Scheme, the Union government has formed a committee headed by Finance Secretary TV Somanathan to look into the issue of Old Pension Scheme vs National Pension System debate. The committee will consider if any changes are needed to the National Pension System (NPS) framework to improve pensionary benefits while ensuring fiscal prudence.

What is Old Pension Scheme(OPS) and National Pension Scheme(NPS)?

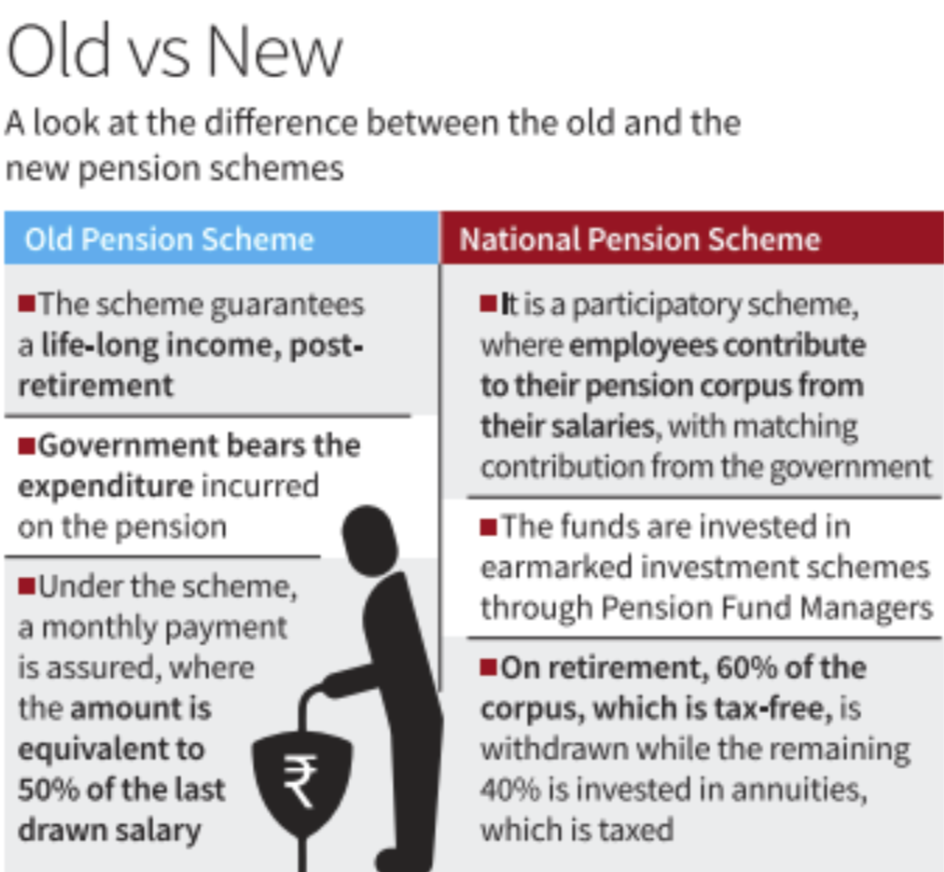

Old Pension Scheme (OPS)- The Old Pension Scheme(OPS) is applicable to all government employees appointed before January 1, 2004. The scheme is a “defined benefit scheme” as the government employees were paid 50% of their last drawn salary plus Dearness Allowance (DA) as pension after their retirement. Under this scheme, the entire pension amount was borne by the government while fixed returns were guaranteed for employee contribution to the General Provident Fund (GPF).

National Pension System (NPS)- The National Pension System (NPS) was introduced on January 1 2004. It was made mandatory for central government employees as well as staff of those state governments which adopted this scheme. However it remains voluntary for the workforce in the unorganized sector. The scheme is a “defined contribution scheme” as the government employees have to make defined contribution of 10% of basic pay and dearness allowance (DA). There is matching contribution by the government. There is no defined benefit. The pension benefit is determined by factors such as the amount of contribution made, the age of joining, the type of investment and the income drawn from that investment.

Read More- OPS and NPS Forum IAS

What is the status of NPS, the reasons for its introduction and the issues with the NPS?

Status of NPS today

With the introduction of NPS on January 1, 2004, all central government employees joining after this date were compulsorily enrolled in the National Pension Scheme(NPS). It was voluntary for the state governments to join the NPS. Almost all the states except for West Bengal and Tamil Nadu migrated to the NPS since adoption. However Rajasthan, Chhattisgarh, Jharkhand, Punjab and Himachal Pradesh have already announced a shift back to the OPS.

Reasons for the introduction of National Pension System (NPS)

Limited Coverage of the Old Pension Scheme(OPS)- The Old Pension Scheme(OPS) covered only the government employees which formed ~12% of the total workforce of the country. National Pension Scheme aim was to provide pension coverage to even the workers of the unorganised sector. Workers of the unorganised sector can also join the NPS voluntarily.

Huge Fiscal burden on the Central and State Governments due to OPS- With every new pay commission awards, the basic salaries of the Government servants were increasing. This was increasing the burden on the Union and state exchequers in making pension payments under OPS scheme. According to the India Pension Research Foundation, the expenditure on Union civil service pensions was around be 2.31% of the GDP in 2004-05 and the implicit pension debt of the Government of India was around 56% of the GDP.

Burden on the future Generation due to OPS- Under the OPS Scheme contributions of the current generation of workers were explicitly used to pay the pensions of pensioners. Hence OPS scheme involved direct transfer of resources from the current generation of tax payers to fund the pensioners.

Disincentivised Early Retirement- The OPS scheme used to disincentivise early retirement as the pension was fixed at 50% of the last drawn salary. Hence even the disinterested govt employees used to linger around to reach till their retirement age to avail maximum pension. This resulted in massive under utilisation of human resources.

Flexibililty- NPS allows the subscriber to choose the fund manager and the preferred investment option including a 100% government bond option. A guaranteed return option could also be considered to provide an assured annuity.

Simplicity and portability- Opening of account with NPS provides a Permanent Retirement Account Number (PRAN) which remains valid through out the lifetime of the subscriber. The NPS is also portable across jobs as PRAN account remains the same.

Well Regulated Scheme- An NPS Trust has also been constituted to regularly oversee performance of fund managers with a trustee bank to efficiently manage fund flows. A custodian has also been appointed to hold the securities with subscribers being beneficial owners of the assets.

Issues with National Pension System(NPS)

Market Volatility/Uncertainty- Contributions under the NPS scheme is invested in the markets through the fund managers. There is an apprehension that the new NPS will not deliver the same benefits as the old scheme. The returns will be impacted by the market volatility and uncertainity. As per SBI report, NPS asset growth has been affected by the Ukraine-Russia conflict and may fall short of the declared target of Rs 7.5 lakh crore by March 2022.

Increased burden on Employees- Under the old pension scheme all the burden of pension was borne by the government. There was no requirement of monthly contribution from employees in the pension fund. Hence the employees used to get greater disposable monthly income in their hands along with an assurity of pension. NPS has decreased the disposable monthly income in the employees hands as 10% of their basic pay and DA is deducted every month.

No General Provident Fund (GPF) benefits- Under the Old Pension Scheme (OPS), fixed returns were guaranteed for employee contribution to the General Provident Fund (GPF). However NPS has no General Provident Fund (GPF) provisions.

Why were states shifting back to the Old Pension Scheme (OPS) and what are the concerns?

Some states are shifting back to the Old Pension Scheme due to the following reasons.

Reasons for Shifting to OPS

Political Gains- OPS scheme has been politicised for gaining vote bank by the political parties. Government employees are a very vocal and an important pressure group and Vote Bank.

Deferment of matching Govt contribution- The Government when they switch to OPS defer the payment of matching 10% contribution towards NPS by a few years. This however is a very short respite for the government as they have to end up paying much more after few years when the employees under NPS start retiring.

Concerns raised against the re implementation of OPS

RBI, NITI aayog and Finance Commissions have highlighted the grave concerns that re- implementation of OPS poses. These are as follows

Lack of proper funding mechanism for OPS- There is no separate corpus for funding the pension liability. Also there were no clear mechanisms through which money could be raised and given to the pensioner.

Unsustainable- OPS is unsustainable because the liability of pension will keep on increasing every year due to the increase in dearness allowances (DA) and increase in life expectancy rates.

Increase in the burden of states- According to RBI report “State Finances- A study of budgets 2022-23”, the central bank has highlighted that OPS poses to the entire fiscal structure of the state governments. State governments are spending 1/4th of their revenues only on pensions. It will further increase the debts of the states.

Will further burden the taxpayers- The current generation of taxpayers is already facing the burden of paying for the pensions of OPS employees and the government contributions newer employees under NPS. Returning back to OPS will further increase the burden on the taxpayers.

What Should be the way ahead?

Various economists have suggested several way out which are being scrutinised by the TV Somanathan committee. Some of the ways ahead can be as follows-

Designing an “Assured pension Scheme”- Some states have suggested designing an “assured pension scheme” by linking it to minimum level of pay and not the last drawn salary as provided under OPS.

Combining the OPS and NPS scheme- New pension framework can be designed by taking “defined contribution” by employees element of NPS and “defined benefits” of the OPS.

Role of future pay commissions- The future pay commissions should move towards the concept of “cost to company” (C-to-C) and include the cost of assured pension while determining pay revisions.

Restructuring the civil services- The government should also revisit the structure of the civil services to ensure that the organizations don’t become ‘top heavy’ as it would increase the pension burden liabilities.

Implementing the CAG recommendations on NPS reform- The following CAG recommendations on the NPS reforms must be implemented in the meantime.

(a)A foolproof system needs to be put in place to ensure all nodal offices and eligible employees are registered under NPS

(b) Delays need to be penalized and compensation affected to avoid loss to the subscriber

(c) Government to ensure that rules on the service matters are in place for the government NPS subscribers.

The experience so far has been that NPS has given good returns and many experts believe that the annuity is likely to be as attractive as in the old pension scheme, if not better. However, another set of experts criticize NPS due to its uncertainty. There is no doubt that old pension system will prove to be fiscally unsustainable. Thus current scenario warrants reforming NPS and providing a greater degree of assurance to the subscribers.

Read More- Indian Express

Discover more from Free UPSC IAS Preparation Syllabus and Materials For Aspirants

Subscribe to get the latest posts sent to your email.