ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Synopsis: The recently rolled out NMP project, though has the right intent, but is fraught with challenges. A look at some of them.

What are some issues with the National Monetization Pipeline (NMP) project?

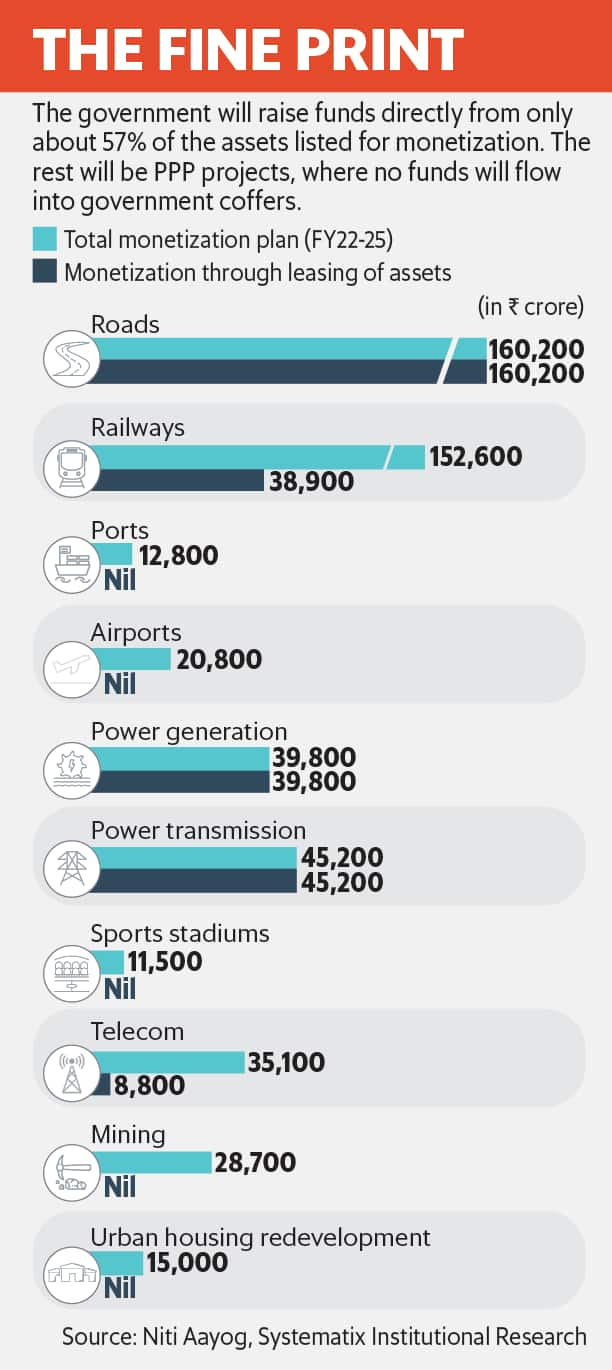

While the Niti Aayog has listed assets worth ₹6 trillion for the NMP, by its own estimate, it can only raise about ₹3.4 trillion in long-term asset leases.

ii). In the power transmission sector, the regulated tariff projects, part of the balance sheet of Power Grid Corporation of India Ltd, will have to be de-merged first before being privatized, and may pose associated transaction overheads such as the continuation of the tax holiday on assets.

iii). The clean energy assets on sale are 3.5 gigawatts of plants owned by public sector units. The challenge here will be to sell assets at book value at a time when newer plants are being built at ever-falling tariffs.

iv). Banks are not enthusiastic about NMP and understandably so. At the height of the bad loan crisis in 2017 that brought banks to their knees, the infrastructure sector accounted for a quarter of all non-performing assets.

v). As per reports, the NMP is “aggressive” and “over-ambitious” compared to the pace of privatization that India has so far been able to forge. For instance: In the past three years, a total of 1,408km of roads have been monetized. Against this, the NMP wants to monetize 26,700km of roads by FY22-25—a 20x jump over four years.

| Must Read: National Monetisation Pipeline (NMP) project |

Source: This post is based on the article “Inside India’s asset monetization gambit” published in Livemint on 29th Sep 21.