Contents

| For 7PM Editorial Archives click HERE → |

Introduction

Recently, the Supreme Court gave its ruling on the Insolvency and Bankruptcy Code. SC in its ruling affirmed key provisions of the Insolvency and Bankruptcy Code, (IBC) 2016 and held that the procedure contemplated under the law has been “carefully calibrated”. Various industrialists and promoters, including Anil Ambani, Venugopal Dhoot, Sanjay Singal and Kishore Biyani, were petitioners in the case

Brief snippet of the Case

| Arguments of Petitions against IBC 2016 | SC Judgement |

| (1) Sec 95 & Sec 96 of the IBC 2016 allows the lenders to initiate insolvency proceedings against personal guarantors and promoters, without giving them the opportunity to present their stand. (2) The petitioners argued that it was violative of the right to equality (Art 14) of the promoters/debtors and went against the principles of natural justice. | (1) SC in its judgement upheld the provisions of the Sec 95 & 96 of the IBC 2016. (2) SC held that the statute was not violative of Article 14 (equality and equal protection of law) of the Constitution. |

| (1) Sec 97, 99 & 100 of the IBC allowed for the appointment of a Resolution professional (RP). RPs submit the report to NCLT/DRT, which then decide to proceed for resolution/liquidation. The debtors are then called to submit their views. (2) The petitioners demaned that the procedure of the IBC must be changed. The Debtor must be given a chance to present his case before the appointment of RPs. | (1) SC held that the procedure contemplated under the IBC has been “carefully calibrated” by the parliament. (2) SC rejected the petitioner’s plea to amend the procedure of the IBC to grant the corporate debtor a hearing before the appointment and report of the resolution professional. |

What is Insolvency and Bankruptcy Code 2016?

The Insolvency and Bankruptcy Code was enacted in 2016, and it replaced all the existing laws with a uniform procedure to resolve insolvency and bankruptcy disputes. The code aimed to address the issue of Non-performing Assets (NPAs) and debt defaults.

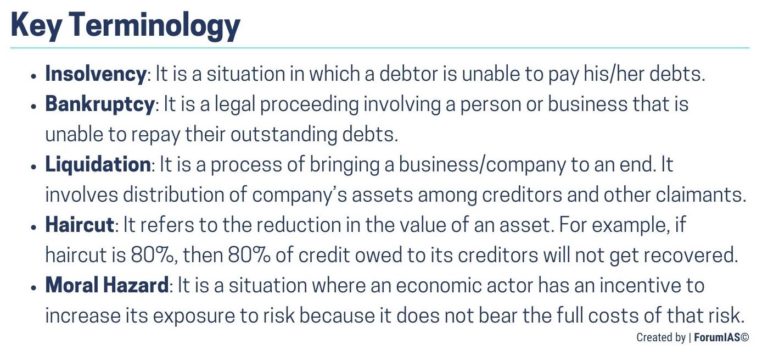

Terminologies related to the Insolvency and Bankruptcy Code 2016

Aims and objectives of the Insolvency and Bankruptcy code

(1) Consolidation and amendment of all existing insolvency laws in India.

(2) Simplification and expedition of the Insolvency and Bankruptcy proceedings in India

(3) Protection of the interests of creditors and stakeholders in the company

(4) Reviving the company in a time bound manner

Institutional framework followed by the Insolvency and Bankruptcy code

The Code creates a new institutional framework. This framework facilitated a formal and time-bound insolvency resolution process and liquidation. The framework includes:

| Insolvency Professionals | They will administer the resolution process. They also manage the assets of the debtor and provide information for creditors to assist them in decision-making. |

| Insolvency Professional Agencies | The insolvency professionals will be registered with insolvency professional agencies. The agencies would conduct examinations to certify the insolvency professionals and enforce a code of conduct for their performance. |

| Information utilities | They will keep a record of debts given by creditors along with details of repayments/ dishonour of debt. |

| Adjudicating authorities | They will give the approval to initiate the resolution process, appoint the insolvency professional, and approve the final decision of creditors. |

| National Company Law Tribunal(NCLT) | It is the adjudicating authority for companies and limited liability entities. |

| Debt Recovery Tribunal (DRT) | It is the adjudicating authority for individuals and partnership firms. |

| Insolvency and Bankruptcy Board of India (IBBI) | The Board will regulate insolvency professionals, insolvency professional agencies and information utilities set up under the Code. |

Time period for insolvency resolution as mentioned in the code

The code aims to resolve insolvencies in a strict time-bound manner. The Insolvency and Bankruptcy Code 2016, initially set a 180-day deadline for concluding the resolution process, allowing a potential extension of 90 days.

However, subsequent amendments to the IBC extended the overall timeline for completion to 330 days. This includes any extension or litigation period. But, in exceptional cases, the time limit can be extended even beyond 330 days.

Read More- On Insolvency and Bankruptcy Code of India – Keep Your Promise

What have been the positive outcomes of the IBC 2016?

(1) Increase in the rate of recovery of the lenders/creditors- Lok Adalat, Debt Recovery Tribunal and SARFAESI Act, which were the recovery mechanisms available to lenders before enactment of the IBC, had a low average recovery of 23%. However, under the new IBC regime, the recoveries have risen to 43%.

(2) Shift of focus to ‘Resolution’ rather than ‘liquidation’- IBC process aims to put the financially ailing corporate entities on their feet through a rehabilitation process. The primary focus has shifted to ‘saving rather than selling’.

(3) Shift from ‘debtor-in-possession’ to ‘creditor-in-control’- The creditor-in-control model hands control of the debtor to its creditors and relies upon the managerial skills of a newly appointed management to take over an ailing company and ensure business continuance.

(4) Improvement in India’s global rankings in resolving insolvency- An IMF-World Bank study in January 2018 observed that India is moving towards a new state-of-the-art bankruptcy regime. Since enactment of the Insolvency and Bankruptcy Code, India significantly improved its ‘Resolving Insolvency’ ranking to 108 in 2019 from 134 in 2014 , where it remained stagnant for several years. India won the Global Restructuring Review award for the most improved jurisdiction in 2018.

(5) Stability of Indian financial systems- The SC in Swiss Ribbons Vs Union of India, has held that the core objective of the Insolvency and Bankruptcy Code, is to ensure revival and continuation of the corporate debtor. Insolvency and Bankruptcy Code is playing a larger role of public-welfare by ensuring the stability of Indian financial systems.

What are the Challenges associated with the Insolvency and Bankruptcy Code 2016?

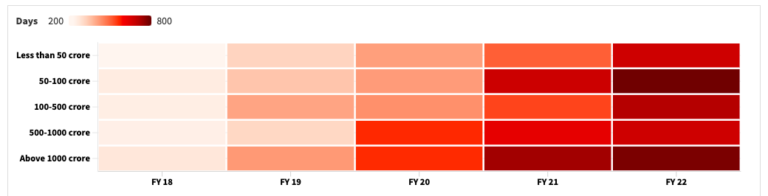

(1) Delays in the resolution process- Resolution and liquidation cases have been taking longer than the mandated time of 330 days. For example- In cases of over Rs 1,000 Crore, the average resolution time has risen to 772 days in FY2022 from 274 days in FY2018.

(2) Greater liquidation than resolution- The objective of Insolvency and Bankruptcy Code, was to promote resolution, but it has ironically resulted in more liquidation. This hinders the economic potential of the country. A/c to IBBI, the number of cases seeing liquidation are three times more than that of resolution.

(3) Big Haircuts- Longer delays in the IBC process, has resulted in larger haircuts, as the value of sick companies tends to diminish at an increasing pace over time. For instance- The lenders took a haircut of 83% in Alok Industries case, 90% Reliance Infratel case and 96% in the recent Videocon Group case.

(4) Infrastructural Issues and Resource Deficit- Out of the 25 NCLT benches establlished across the country, most of these NCLT benches remain non-operational or partly operational, on account of lack of proper infrastructure or adequate support staff.

(5) Fear of Vigilance inquires in case of govt lending institutions- The public sector banks fear risk-taking in a resolution process, as low rate of dues recovery in the short term, may subject them to vigilance inquiries and audits. Hence, these public lending institutions focus more on liquidation and safe exit.

(6) Exclusion of promoters from the resolution process- There are many cases, where a loan default occur for reasons beyond the control of the promoters. However, IBC has strictly excluded the promoters from the resolution and liquidation process, despite the promoters not being wilful defaulters.

(7) No focus on mediation, settlement and arbitration under IBC- Globally, a mechanism like the IBC’s corporate insolvency resolution process (CIRP) is used as a last-resort measure after all other alternatives like mediation, settlement and arbitration have been exhausted. However in India, there are no specific provisions for mediation under the IBC.

What should be the way forward to address the challenges under the IBC 2016?

(1) Address the resource and infrastructure deficit in NCLT- The NCLT benches must be filled with competent financial professionals, who must use the Insolvency and Bankruptcy Code’s platform as a resolution tool instead of recovery tool.

(2) Promotion of Alternative Dispute Redressal(ADR) Mechanism- The ADR mechanisms like mediation, arbitration and settlement must be explored first. The insolvency proceedings must be used as a last resort. The Mediation Act 2023 and the Arbitration Act 2021 are steps in the right direction.

(3) Protecting the public sector bankers in case of bona-fide resolution decision- ‘Business judgement’ rule that protects the board of directors in many countries for bona-fide decision making must be introduced for public sector banks officials in India.

(4) Allowing the defaulters who are not wilful ones to bid at NCLT- The defaulters who are not wilful defaulters and who have no hand in failure of their business should be allowed to take part in the resolution and the liquidation process. For ex- many businesses failed due to COVID.

(5) Proper use of National Asset Reconstruction comapny- The NARCL established by the government must be used in resolutions of companies which do not attract many strategic investors. Proper use of NARCL will help in increasing the resolutions and reduce the liquidations.

Above all on average IBC has promoted faster recoveries and resolutions as compared to the earlier timeline of five years, six years or more. However, there are some challenges that need to be addressed to resolve corporate distress. Some futher amendments like extending the pre-packaged insolvency resolution process that was introduced for MSMEs,need to be extended to other firms.

| Read More- Live mint UPSC Syllabus- GS2- polity- Government Policies and Interventions for Development in various sectors and Issues arising out of their Design and Implementation. GS 3- Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment. |

Discover more from Free UPSC IAS Preparation Syllabus and Materials For Aspirants

Subscribe to get the latest posts sent to your email.