ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

| For 7PM Editorial Archives click HERE → |

Direct Tax remains one of the major sources of raising government revenues. Government raises revenues to finance public service programmes and to fulfil the social objectives of inclusive growth.

In Direct Tax the Government of India has undertaken substantial tax reforms in the last few years to ensure that tax collection increases in a non-adversarial manner through a stable and predictable tax regime.

What are Direct Tax and Direct Tax Reforms?

Direct Tax Definition- Direct tax is a tax which an individual or organisation pays taxes directly to the imposing body. The incidence and impact of the tax falls on the same entity. Its burden cannot be shifted to a different individual or entity. Direct Tax is progressive in nature which means the tax obligation increases in proportion to an individual’s or entity’s income.

Examples of Direct Tax in India-In India direct taxes are regulated by Central Board of Direct Taxes (CBDT). CBDT imposes various direct taxes in India like Income Tax, Corporate Tax, Capital Gains Tax, Securities Transaction Tax, Minimum Alternate Tax etc.

Direct Tax Reforms Definition- Direct Tax reform refers to bringing changes in taxation to maximize government’s revenue and reduce the burden of taxation on the people at the same time by ensuring equitable, transparent, and fair taxation system.

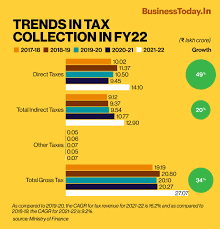

India has undertaken several Direct Tax reforms. A result of which the Direct Tax Collections have seen an increase. The direct tax collection in the financial year 2021-2022 grew by 49 per cent while the indirect tax collection 30 per cent. A comparison of direct tax and indirect tax is presented below-

Source-Business Today

What are the Direct Tax Reforms Initiated by the Indian Government?

Reduction of Direct tax rates and abolition of direct taxes

Reduction in the corporate tax rate for all existing domestic companies- Government has brought in a historic direct tax reform through the Taxation Laws (Amendment) Ordinance 2019 which reduced the corporate tax rate to 25.17% (including surcharge and cess) for existing domestic companies from the earlier 30% tax rate.

Direct tax incentive for new manufacturing domestic companies-A lower direct tax rate of 17.16% (including surcharge and cess) is applicable to new companies which are formed after Oct 1,2019 and which start production before 31st March 2024 through the Taxation Laws (Amendment) Ordinance 2019.

Personal Income tax rebate- Direct tax reforms have been carried out in personal income tax in 2020 by providing an option for taxpayers to shift to the new tax regime with lower tax rates but without exemption/deduction. The Finance Act 2023 has further reduced the direct tax rates in the new tax regime to make it more attractive.

Abolition of Dividend Distribution Tax (DDT)-The Finance Act, 2020 removed the Dividend Distribution Tax. The dividend income shall be taxed only in the hands of the recipients at their applicable rate. This was a major direct tax reform.

Maintenance of stable tax regime despite COVID-19- During COVID time while many countries imposed new taxes and changed the tax rates, the Government of India continued its resolve to provide a stable direct tax regime.

Widening of direct tax base

Introduction of New Tax Deduction at Source (TDS) and Tax Collection at Source (TCS) provisions- Many direct tax reforms like introduction of TDS on payment of rent by individuals/HUF, TDS on e-commerce, TDS on virtual digital assets,TDS on online games have been introduced by the government which has increased the direct tax base.

Measures taken for High-Net-Worth Individuals paying Direct Tax- Direct tax reforms have been undertaken for high Net Worth individuals to pay direct taxes like removing arbitrage on the sale of market-linked debentures and debt mutual funds, removing ambiguity on the taxation of return from business trusts classified as debt, putting a cap on saving long term capital gains tax by way of investment in residential property, a higher surcharge for high net worth taxpayers.

Laws against black money which has increased Direct tax base- Direct tax reforms have been undertaken by introducing stringent laws against black money which have led to increase in direct tax collections like Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 and Benami Transactions (Prohibition) (Amendment) Act 2016.

Use of Technology for increasing Direct Taxes

Faceless E-assessment Scheme-The faceless E-assessment Scheme, 2019 provides for a new scheme for making assessments by eliminating the interface between the Assessing Officer and the assessee, optimizing the use of resources through functional specialization, and introducing the team-based assessment.

Faceless appeals- Finance Act, 2020 empowered the Central Government to notify the Faceless Appeal Scheme in the appellate function of the department between the appellant and the Commissioner of Income-tax (Appeals).

Document Identification Number (DIN)- Every communication related to assessment, appeals, investigation, penalty, and rectification issued from 1st October 2019 onwards are mandatorily having a computer-generated unique document identification number (DIN).

Reduction of Litigation by Providing Direct Tax Certainty

Vivad se Vishwas- Direct Tax Vivad se Vishwas Act, 2020 was enacted on 17th March 2020 under which the declarations for settling disputes are currently being filed.This has brought down the litigation costs and has provided direct tax certainty.

Relaxation in the norms for Prosecution- The threshold for launching prosecution has been substantially increased. A system of the collegium of senior officers for sanction of prosecution has been introduced. The norms for compounding have also been relaxed.

Advance Pricing Agreements (APA)- Advance Pricing Agreement (APA) has been a success story in reducing litigation in transfer pricing. A record 95 APAs were signed in FY 2022.

What are the advantages of Direct Tax Reforms for the government?

Widening of tax base-Direct tax reforms widens the tax base and increases the government revenues. It helps deal with the problem of potential revenue loss due to complicated direct tax structures and higher rates of direct taxes.

Reducing of direct tax litigation- There protracted tax litigation in India has not only put a burden on Indian judiciary but has also cost the government exchequer. There will be reduction in tax terrorism due to direct tax reforms.

Provide level playing field between large businesses and start-ups & young companies- Due to Direct Tax reforms there is reduction of tax avoidance used by large businesses and this helps in providing a level playing field between large businesses and startups.

Increases Ease of Doing Business- Direct tax reforms increase the ease of doing business ranking of India as it provides the investors and the industrialists a clarity about the stable tax regime. Non-oppressive and progressive direct tax regime helps in increasing India’s ease of doing business potential.

Reduction of tax evasion- Direct tax reforms reduce the base erosion and profit shifting (BEPS) and indirect transfers from India which increases the revenues of the government and reduces international arbitrations.

Attracts Foreign Investments: Direct tax reforms help in attracting better Foreign Direct Investments (FDIs) and Foreign Portfolio Investments (FPIs) since India is much more integrated with the world globally in terms of business linkages and capital account convertibility.

Catalyst to Inclusive Growth-Direct tax reforms increase the taxes and revenues of the government which helps in better redistribution of resources in the society leading to inclusive growth.

What are the Challenges in the implementation of Direct Tax Reforms?

Structural Issues-Structural issues such as low financial literacy, a large share of the informal economy and large cash-based transactions hamper in the implementation of Direct Tax Reforms.

Large tax exemptions and incentives- According to G20 Development Working Group by the IMF, OECD, UN, and World Bank concluded that tax incentives are redundant in attracting investment in developing countries. Increased threshold provided in case of personal income taxes and exemptions, tax cuts, preferential tax rates, deferral of tax liabilities lead to a lower direct tax base.

Complex Taxation laws and procedures-The complex web of taxation laws of the Central and State Governments cause complexities and litigation and hamper effective implementation of Direct Tax Reforms.

Resistance from stakeholders- Initiative of tax reform likely to face resistance from various stakeholders like taxpayers, business community, tax professionals. It has resulted in the delay in implementation of direct tax reforms.

Large informal economy-A large population of India is engaged in unorganized or informal sector. This is main hurdle in creating a large direct tax base in country.

Tax Evasion and corruption-Tax evasion and corruption undermine the direct tax reform practices by the Indian Government.

Weak Tax Administration-Weakness of tax administration such as lack of technical expertise and financial resources, poorly drafted laws, and corruption.

What should be the way forward?

Simplification of Direct Tax on cross border transactions– Arbind Modi Panel on Income Tax Reforms has recommended simplification of rules of direct taxes on cross border transactions which will reduce Base erosion and profit shifting and Indirect Transfers. This will reduce International litigation cases like Cairn case.

Reintroduction of wealth tax-As Moderate rates of personal income tax are not sufficiently progressive to contain growing inequality, wealth tax can be reintroduced as part of Direct Tax Reforms.

Develop robust dispute resolution mechanism-Direct Tax reforms must focus on development of robust dispute settlement mechanism to reduce litigation and cost.

A robust Direct Tax Code is the need of the ‘new India’ aspiring to become third largest economy of the world by 2027.