The launch of the Pradhan Mantri Jan Dhan Yojana on August 28, 2014 was a significant step by the government in its concerted attempt to bring the unbanked sections of the population into the ambit of the formal financial system. As the scheme completed 10 years recently, Prime Minister Narendra Modi hailed the ‘momentous‘ achievement of the scheme. The prime minister held that the scheme was paramount in boosting financial inclusion and giving dignity to crores of people, especially women, youth, and the marginalised communities.

In this article, we will look at the features of the scheme, the achievements of the scheme, the challenges it faces and the way forward for achieving better financial inclusion through this scheme.

What are the features of Pradhan Mantri Jan Dhan Yojana (PMJDY)?

PMJDY- Pradhan Mantri Jan Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, such as a basic savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner.

The Pradhan Mantri Jan Dhan Yojana was launched on August 28, 2014. On the day of the launch of the scheme, banks organised 77,892 camps around the country, and opened about 1.8 crore accounts.

Objective of the Scheme- The primary objective of this scheme is to provide accessible banking services to all citizens, particularly the underprivileged sections of society.

Key Features of the scheme

| Account Accessibility | Pradhan Mantri Jan Dhan Yojana (PMJDY) aims to ensure that every household has at least one bank account. |

| Zero Balance Accounts | The accounts under PMJDY can be opened without the need for a minimum balance. This makes it easier for low-income individuals to access banking services. These accounts earn interest on deposits like a regular account. |

| Overdraft Facility | The account holders are eligible for an overdraft facility of up to Rs.10,000. It is specifically aimed at women account holders. |

| Accident Insurance Cover | Accident Insurance Cover of Rs.1 lakh is available with Ru Pay card issued to the PMJDY account holders. It has been enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018. |

| Direct Benefit Transfers | PMJDY accounts are also eligible for Direct Benefit Transfers (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), and the Micro Units Development & Refinance Agency Bank (MUDRA) scheme. |

| Financial Literacy | The scheme focuses on promoting financial literacy among account holders. |

| Bank Mitras | The scheme employs Bank Mitras (bank representatives) to enhance accessibility of the scheme. These Bank Mitras provide branchless banking services across the country, especially in rural and remote areas. |

What has been the progress of the Pradhan Mantri Jan Dhan Yojana (PMJDY)?

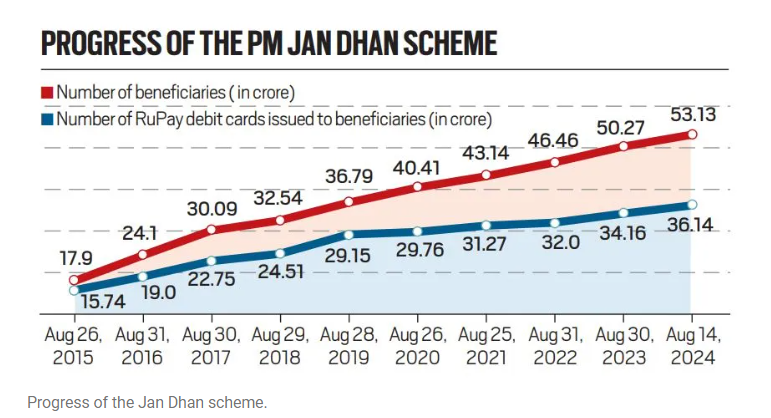

1. Large number of new bank accounts- As per the latest data, a staggering 53.1 crore accounts have been opened under the scheme. This includes 29.56 crore women beneficiaries account.

The number of bank accounts opened in the PMJDY is more than the population of the European Union, and almost the same as the population of the United States.

|  |

2. Bank accounts bank wise- The largest share of PMJDY accounts is with public sector banks.

Public Sector Banks- 41.42 crore accounts

Regional Rural Banks- 9.89 crore accounts

Private sector banks- 1.64 crore accounts

Rural Cooperative Banks- 0.19 crore accounts

3. State wise analysis of accounts under PMJDY-

a. Most of the accounts have been opened in Uttar Pradesh (9.45 crores) and the least has been opened in Lakshadweep (only 9,256 accounts).

b. 15 states apart from UP have more than 1 crore PMJDY bank accounts– Bihar, West Bengal, Madhya Pradesh, Rajasthan, Maharashtra, Assam, Odisha, Karnataka, Jharkhand, Gujarat, Chhattisgarh, Tamil Nadu, Andhra Pradesh, Telangana, and Haryana.

What is the impact and achievement of Pradhan Mantri Jan Dhan Yojana?

1. Banking to the unbanked- The opening of staggering 53.1 crore bank accounts has promoted financial inclusion in the country. As per the World Bank’s Findex database, 78% of Indian adults (population with 15 years or more of age) had a bank account in 2021 as compared to 53% in 2014.

2. Narrowing of the Rural-Urban Financial access Gap- Out of the total bank accounts opened under the PMJDY, 67% have been opened in rural/semi-urban areas. This has helped in narrowing the gap in access to the formal banking system between rural and urban areas.

3. Bridging the Gender Gap between financial access- Out of the new accounts opened, roughly 56% of the new account holders are women. This has helped bridge the gender gap in access to financial services.

4. Expansion of Commercial Bank Infrastructure- The opening of more than half a billion bank accounts has fuelled demand for banking services. This has encouraged commercial banks to expand their infrastructure in recent years. For Ex-

| Financial Infrastructure | 2013 | 2023 | % increase |

| Scheduled commercial banks Branches | 1,05,992 | 1,54,983 | 46% |

| Number of ATMs | 1,66,894 | 2,16,914 | 30% |

| Number of Points of Sale (POS) machines | 10.88 lakh | 89.67 lakh | 82% |

5. Promotion of Direct Benefit Transfer (DBT)- The Jan Dhan Yojana as an integral component of the JAM trinity (Jan Dhan, Aadhaar and mobile), has enabled the government to shift to a more efficient system for transferring benefits directly to beneficiaries. As per government data, the JAM trinity has helped in total cumulative transfers of Rs 38.5 lakh crore.

6. Prevention of financial leakages- The direct benefit transfer through the Jan Dhan accounts, has helped in prevention of financial leakages by weeding out ineligible or fake beneficiaries. For ex- According to RBI report, the DBT through Jan Dhan account as resulted in a gain of Rs 3.48 lakh crore in the implementation of government schemes including MG-NREGS and PM-Kisan.

7. Support to citizens in times of distress- The JAM architecture has been used by the government to provide support to citizens during times of distress. For ex- The transfer of Rs 500 to 20 crore women Jan Dhan account holders during the initial days of the pandemic.

8. Promotion of Digital payments and Digital economy- JAM framework forms an integral part of the Unified Payments Interface (UPI), which has transformed the payment systems in the country. This has eased and increased banking transactions in the economy, leading to significant economic gains.

For ex- Large share of low value transactions as part of the UPI, shows the ease of the ability of low income households, to engage in formal financial transactions in their daily lives.

What are the Challenges with the scheme?

The Pradhan Mantri Jan Dhan Yojana (PMJDY) has made significant strides in promoting financial inclusion in India since its launch in 2014. However, several challenges continue to impede its effectiveness.

1. Account Dormancy and inactivity- Despite the high number of accounts opened (over 53 crore by 2023), many accounts remain dormant and inactive. For ex- According to a report, ~86.3% of PMJDY accounts are operational. This suggests that a significant portion of accounts opened remain dormant.

2. Use as mule accounts- There concerns regarding the use of PMJDY accounts as mule accounts in fraudulent activities, such as money laundering or storage of black money. For ex- Reports of large sums of money being deposited in dormant PMJDY accounts raised concerns about the misuse post-demonetisation in 2016.

3. Infrastructural Issues- According to KPMG report, the inadequacy of physical and digital infrastructure, particularly in rural areas, has hindered the ability of account holders to perform transactions. For ex- Lack of bank branches or functional ATM in villages of states like Bihar and Uttar Pradesh.

4. Technological Barriers- Poor internet connectivity and inadequate banking technology has affected the effective management of banking services for remote Jan Dhan account holders.

5. Lack of Financial literacy- The lack of financial literacy among beneficiaries is a critical barrier in the effective implementation of Pradhan Mantri Jan Dhan Yojana (PMJDY). For ex- Unawareness about overdraft facilities and insurance cover provided for beneficiaries under PMJDY.

6. Duplication of Accounts- The opening of multiple Jan Dhan accounts under different schemes complicates data management and skews the understanding of the actual number of beneficiaries.

7. Exclusion of Certain Populations- Certain marginalised groups, including tribal populations and people living in extremely remote areas, remain excluded from the scheme due to social and geographical barriers. For ex- Low Banking penetration in the tribal regions of Chhattisgarh and Jharkhand.

8. Gender Disparity- Women in some conservative rural areas are less likely to use PMJDY accounts independently due to social norms. This restricts their mobility and financial autonomy.

What Should be the Way Forward?

1. Enhancement of Financial Literacy- Implementation of widespread financial literacy campaigns, in partnership with local community leaders, NGOs, and educational institutions will promote financial literacy and better use of Jan Dhan Accounts.

2. Encouragement of active use of accounts- The active use of PMJDY accounts should be incentivized by linking them with various government schemes, subsidies, and benefits. For ex- Introduction of schemes where account holders receive benefits like interest on savings, overdraft facilities, or cashback for digital transactions.

3. Greater Integration of Financial Services- The integration of financial services like microcredit, pension, insurance products with the Jan Dhan accounts will help in encouraging the active use of Jan Dhan accounts.

4. Improvement of Banking Infrastructure- Expansion of the banking network, particularly in underserved rural and remote areas, by setting up more branches, ATMs, and digital banking touchpoints. Encouragement of the use of Business Correspondents (BCs) and mobile banking units to reach remote areas, will further deepen the process of financial inclusion.

5. Regular Monitoring and Feedback Mechanism- Establishment of a system for regular monitoring and evaluation of the PMJDY’s progress, and collection of feedback from beneficiaries to identify areas for improvement will ensure that the scheme adapts to changing needs.

| Source- The Indian Express UPSC Syllabus- GS 3- Indian Economy (Financial Inclusion) |

Discover more from Free UPSC IAS Preparation Syllabus and Materials For Aspirants

Subscribe to get the latest posts sent to your email.