Source – The Indian Express

Syllabus – GS 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Context – ‘Unlocking’ and ‘Revival package from the government’ are the two basic factors that will determine the course of India’s economy for the rest of the year.

Impact of COVID-19 on GDP

GDP contraction– India’s economy shrank nearly 25 percent in last quarter, the most drastic fall in decades. The following sectors reflects how deep the problem is-

- Public administration– Higher government spending was in the form of transfer payments rather than spending on goods and services, which resulted in a negative growth number.

- Manufacturing and Services– The sector has been in the negative zone across the board due to the national lockdown since end of March.

Factors that influence the growth prospects for the coming quarters

1st Factor – Unlocking economy activity-

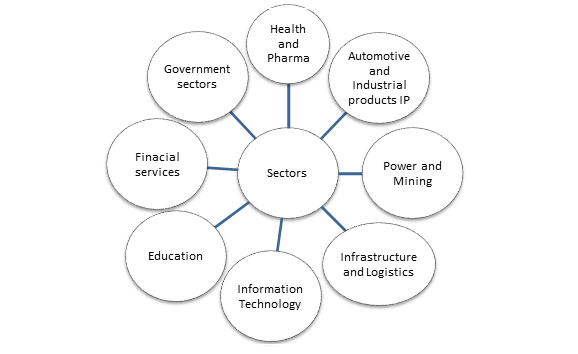

- Unlocking frictionsin nine core sectors and the MSME segment, which make up 75 per cent of the pre-pandemic GDP, can significantly uplift the economy.

The following sectors are-

Challenges

- Industries in which it is harder—

- Travel or Entertainment— It will still be in a gradual normalization process, and probably won’t rebound completely until a vaccine is available.

- Real estate– The present stress on home loans can hinder a revival in the residential real estate.

- Unchanged scenarios– Based on the first quarter performance, 25 per cent of the economy, which would be in the services category, would probably still be struggling in the fourth quarter.

2nd Factor – Revival package from the government

- Additional capital expenditure- By increasing capital expenditure [capex], the government can begin a virtuous cycle of creating assets as well as providing employment. This will create a dual impact on the economy.

- Transfer of Cash benefits– Money in the hands of people can provide an immediate sense of security and confidence, which is the cornerstone to restoring economic normalcy. This will raise the consumption and demand of the economy and can bring back the virtuous cycle in play.

- Banking system-COVID-19 assistance measures undertaken by the Reserve Bank of India (RBI) and the government such as interest rate reductions, credit guarantee and liquidity enhancement schemes are welcome steps.

Way forward

Government can certainly make a difference by altering its stance on fiscal policy, going in for some pump-priming. It is important to address and resolve ground level issues sector-wise and industry-wise in order to formulate the new policies.