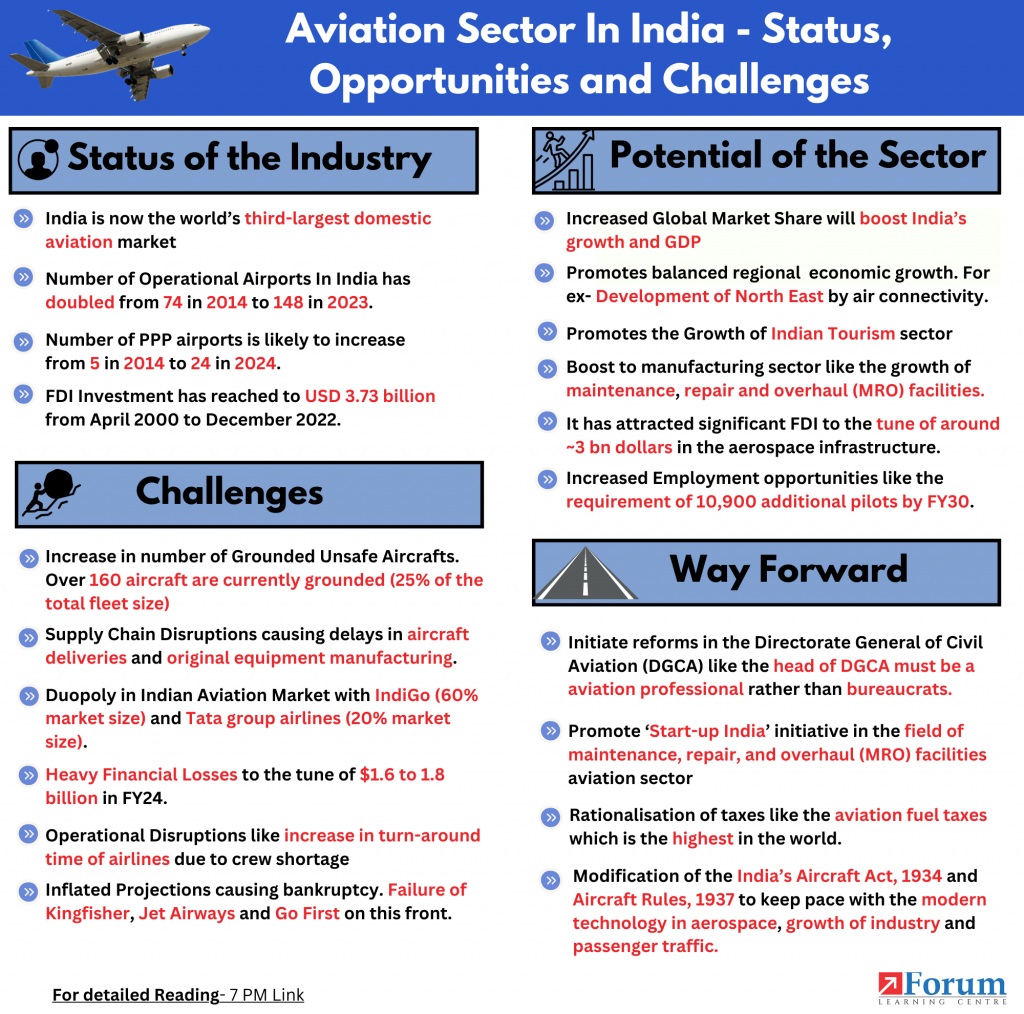

Aviation Sector in India has experienced significant growth in recent years. India has become the third-largest domestic aviation market in the world. According to the International Air Transport Association (IATA), by the year 2030, India is expected to overtake China and the United States as the world’s third-largest air passenger market. However, the aviation sector in India also faces numerous challenges, as highlighted by the recent insolvency of Go First Airlines and grounding of Spice jet aircrafts on account of safety concerns.

What is The Potential of Aviation Sector In India?

1. Increased Market Size of Indian Aviation Sector- According to IATA, India is expected to surpass the aviation sector of the United States and China by 2030. This will make India a lucrative market for airlines and related businesses.

2. Promotes Balanced Economic Growth- Passenger airlines and air cargo overcome geographic barriers by connecting remote areas which are alienated from the mainstream. For ex- Development of North-East due to enhanced airline connectivity.

3. Growth of Tourism sector- Aviation industry function as a growth pole by promoting spill-over & trickling-down of economic growth. For Ex- Aviation sector gives a boost to tourism sector which in turn drives the supporting infrastructure in a region, like roads, railways, hotels, markets. This helps in providing employment opportunities to the locals.

4. Boost to manufacturing sector- India’s expanding aviation sector offers potential for the growth of maintenance, repair, and overhaul (MRO) facilities, as well as the development of a domestic aerospace manufacturing industry. For ex- Enhanced employment opportunities in aerospace engine maintenance.

5. FDI in the Expansion of Infrastructure- Booming aviation sector has attracted significant FDI to the tune of around ~3 bn dollars in the development of aerospace infrastructure like airports, arrow bridges, airstrips. For ex- Greenfield airport development like Navi Mumbai, Noida (Jewar) airport and expansion of Bengaluru airport.

6. Increased Employment opportunities- The growth of aviation sector in India has created a need for skilled professionals, including pilots, cabin crew, and maintenance staff. For ex- Indian scheduled operators are likely to require 10,900 additional pilots by FY30 (IATA projection).

What are The Challenges With India’s Aviation Sector?

1. Increase in number of Grounded Unsafe Aircrafts – Airlines like Air India, Spice Jet, Go Air, and IndiGo face issues of poor financial performance due to grounded unsafe aircrafts. For ex– Over 160 aircraft are currently grounded which represents about a quarter of the total fleet size of Indian carriers.

2. Supply Chain Disruptions- Delays in aircraft deliveries and supply chain issues with original equipment manufacturers (OEMs) has hindered the industry’s capacity to meet growing demand.

3. Duopoly in Indian Aviation Market- India’s domestic aviation market is heading in the direction of a duopoly of market leader IndiGo (60% market size) and the Tata group airlines (20% market size).

4. Heavy Financial Losses- Indian airlines are projected to record a consolidated loss of $1.6 to 1.8 billion in FY24, due to heavy financial bleeding of Go first, Spice Jet and Jet Airways.

5. Operational Disruptions due to crew shortage- Lack of skilled pilots, maintenance engineers, and cabin crew members have led to operational disruptions like increase in turn-around time of airlines.

6. Low per-capita penetration of domestic air travel- India’s per capita penetration of domestic air travel (0.13 seats deployed per capita) remains significantly lower than countries like China (0.49) and Brazil (0.57). This indicates the failure of aviation industry in India to tap the maximum potential of domestic air market.

7. Inflated Projections- Airlines in India often announce ambitious growth plans without adequately analysing their financial security, infrastructural and personnel requirements. For Ex- Failure of Kingfisher, Jet Airways and Go First on account of inflated projections.

8. Regulations acting as barriers- Tough entry barriers for new entrants, high fuel prices on account of high taxes on ATF (Air Turbine Fuel) and monopoly of inefficient public sector airports have all acted as barriers in the rapid growth of the airlines sector.

9. Policy Lacunae- The Aircraft Act, 1934 and Aircraft Rules, 1937 have not kept pace with modern technology in aerospace. This has led to increased costs of the industry’s operation and ultimately affected passenger growth.

10. Poor rural connectivity- With mega airports controlling air and ground space, there has been challenge of enhancing the rural air connectivity. For ex- Less number of flights to tier 2 and tier 3 towns despite the UDAN scheme.

11. Environmental Concerns- The Indian aviation industry faces increasing pressure to reduce its carbon footprint and adopt sustainable practices (The Carbon Offsetting and Reduction Scheme for International Aviation or CORSIA). This has also posed a challenge for growth and expansion of the airline sector.

| Read More- CORSIA |

What are The Government Initiatives For Aviation Sector In India?

| National Civil Aviation Policy, 2016 | This aims to improve the international footprint of India-based airline services. Airlines can commence international operations, provided they deploy 20 aircrafts or 20% of their total capacity (whichever is higher) for domestic operations. |

| UDAN Scheme | This aims to expand access to air travel for Tier 2 and Tier 3 cities and shift the traffic pattern away from Metro routes. |

| Open sky policy | Aims to liberalise the aviation sector in India by opening the airport sector to private participation. Currently, 6 PPP airports are being developed and 60% of airport traffic is handled under PPP. |

| Open Sky Air Service Agreement | Open Sky Air Service Agreement allows for airlines from the two countries to have an unlimited number of flights as well as seats to each other’s jurisdictions. India has signed these agreements with multiple nations like the US, Greece, Jamaica, Japan, Finland, Sri Lanka. |

| FDI Policies, Tax and Duty cuts | 100% FDI is being allowed under the automatic route for greenfield projects, whereas 74% FDI is allowed under automatic route for brownfield projects. 100% tax exemption has been provided for airport projects for a period of 10 years. Indian aircraft Manufacture, Repair and Overhaul (MRO) service providers have been completely exempted from customs and countervailing duties. |

What Should be The Way Forward?

1. Initiate reforms in the Directorate General of Civil Aviation (DGCA)- DGCA should be modernized, well-staffed and incentivised. DGCA should be headed by aviation professionals rather than bureaucrats.

2. Promote ‘Start-up India’ initiative in the aviation sector- Entrepreneurship must be promoted in the maintenance, repair, and overhaul (MRO) facilities of the aviation industry.

3. Rationalisation of taxes- Tax rationalisation must be initiated in aviation fuel taxes (State and Central, which in India are among the highest in the world), air cargo and airport operations.

4. Modification of the India’s Aircraft Act, 1934 and Aircraft Rules, 1937- These acts must be updated to keep pace with modern technology in aerospace, growth of industry and passenger traffic.

By addressing these challenges and implementing the suggested reforms, India can pave the way for a thriving aircraft leasing industry, making the country a global leasing hub and bolstering the aviation sector.

| Read More- The Business Standard UPSC Syllabus- GS III, Infrastructure: Airports |

Discover more from Free UPSC IAS Preparation Syllabus and Materials For Aspirants

Subscribe to get the latest posts sent to your email.