ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

- 1 Introduction

- 2 What is the Digital Lending Landscape?

- 3 What is the status of Digital Lending in India?

- 4 What are the reasons for rapid popularity of Digital Lending?

- 5 What are the key benefits of Digital Lending?

- 6 What are the concerns associated with Digital Lending?

- 7 What are the new regulations by the RBI and how do they address the concerns?

- 8 What lies ahead?

- 9 Conclusion

| For 7PM Editorial Archives click HERE → |

Introduction

The lending business, in recent years, has been disrupted by digital technologies. The transformation of lending landscape has been driven by the need for superior customer experience, faster turn-around time, and adoption of modern technologies like Artificial Intelligence (AI) and Machine Learning (ML). However, the digital lending ecosystem has given rise to several concerns. In its effort to mitigate these concerns, the Reserve Bank of India (RBI) has come out with guidelines aimed at firming up the regulatory framework for such activities. The latest set of regulations are based on recommendations received from its Working Group on ‘Digital Lending including lending through online platforms and mobile apps’ (WGDL) which was constituted in January 2021.

What is the Digital Lending Landscape?

Digital Lending refers to lending through web platforms or mobile apps by use of technology. It utilizes automated technologies and algorithms for customer acquisition, credit evaluation, decision making, authentication, disbursements and recovery. Not only does it lower costs but also ensures speedy disbursal.

Lending Service Providers (LSPs) act in partnership with Non-Banking Financial Companies (NBFCs) who disburse credit (or a line of credit) to the customer using the former’s platform, making it a multi-sided platform.

What is the status of Digital Lending in India?

Digital lending is one of the fastest-growing fintech segments in India. It has grown exponentially from a volume of US$ 9 billion in 2012 to nearly US$ 110 billion in 2019. It is further expected that the digital lending market would reach a value of around US$ 350 billion by 2023.

This business is mainly covered by fintech startups, neo-banks and Non-Banking Finance Companies (NBFCs).

Its customers particularly include small borrowers without a documented credit history and thus, not served by traditional financial institutions. Their product mix primarily imbibes short-term loans, especially those which have shorter tenures of less than 30 days.

Commercial banks are also fast joining the genre of financial intermediaries either lending digitally on their own or joining with NBFCs to share the synergies.

What are the reasons for rapid popularity of Digital Lending?

First, rapid advancements in cloud computing, artificial intelligence, and blockchain, as well as faster and more affordable internet connectivity, have fuelled the rise of FinTech start-ups, and lending has also transformed and become “digital.”

Second, further, the synergy of the robust customer base created by banks in the last ten years, more importantly after the launch of Pradhan Mantri Jan Dhan Yojana (PMJDY) scheme in August 2015 is now available to lenders.

Third, the sector presents a huge opportunity which is attracting a lot of investment towards it. The digital lending platforms have witnessed a compound annual growth rate of 19.6% over the previous 7 years.

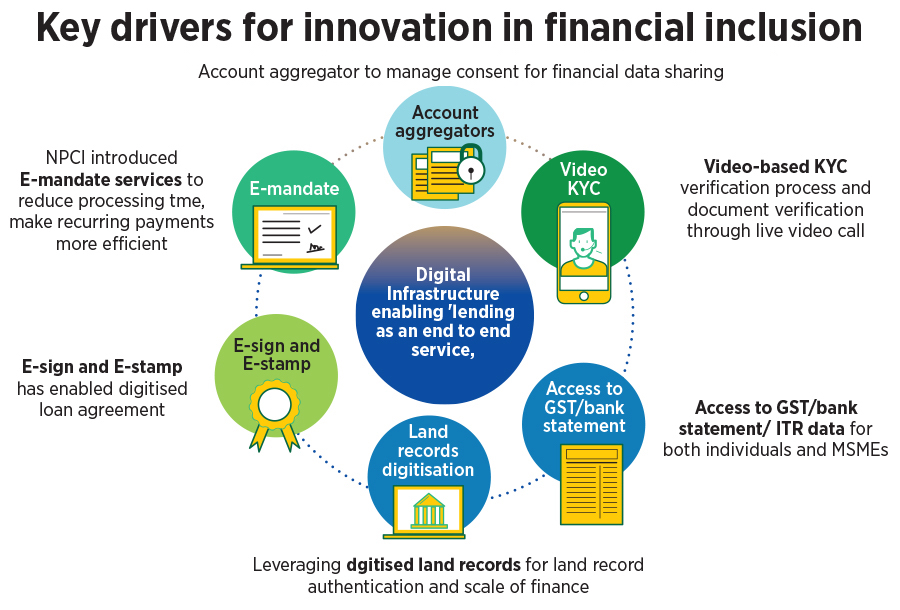

Fourth, according to KPMG, the rapid digitization of the economy and services has been a key driver in financial inclusion and digital lending.

Sources: KPMG

What are the key benefits of Digital Lending?

Easier loan disbursement: The digital lending platforms have minimized the geographical barriers allowing borrowers to quickly take up loan applications. They come with easy data entry, personalized user experience, and smooth loan application procedures.

Less Errors: With digital lending, the chances of human errors are minimal as it is easier to capture an applicant’s details. The validity of documents can be scanned digitally making the process quicker and error-free.

Increases efficiency: A digital lending platform can cut down overheads by half and increase efficiency at the same time. Digital lending saves time, boosts revenue, growth and improves lender borrower relationships.

Better customer experience: Digital lending has a quick turnaround time, is transparent, and relieves applicants from the long waiting period for a credit decision. For banks, it also reduces the cost of managing loans, reduces time spent on underwriting loans. Banks can process more loans and products and offer a better experience to borrowers with quick loan approval and funds.

What are the concerns associated with Digital Lending?

First, In order to cement their presence in a space with multiple peers, LSPs often resort to reckless lending practices by endowing credit beyond a borrower’s repayment capacity. The risk is mitigated by spreading it to all users by charging higher interest rates.

Second, The absence of standardized disclosure and regulatory norms made it cumbersome to assess a participant’s operational legitimacy. Between January-February 2021, there were about 1,100 lending apps available for Indian android users of which about 600 were illegal. They were either unregulated by the RBI or had NBFC partners with an asset size of less than INR 1,000 crore.

Apart from this, mis-selling, breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices are some of the other concerns associated with digital lending.

What are the new regulations by the RBI and how do they address the concerns?

The RBI has divided the digital lenders into 3 groups: (a) Entities regulated by the RBI and permitted to carry out lending business; (b) Entities authorized to carry out lending according to other statutory/regulatory provisions but not regulated by the RBI; (c) Entities lending outside the purview of any statutory/regulatory provision.

These guidelines are for the first category i.e., entities regulated by the RBI. For other entities under the second and the third categories, the RBI has asked the respective regulator/controlling authority/ the Union Government to formulate guidelines.

The central premise of the new guidelines is transparency.

Lending only by Regulated Entities: Lending must be carried out by entities that are either regulated by the RBI or possess permission to operate under a relevant law. Considering the large-scale outsourcing in the industry, this would also help address regulatory arbitrage.

The RBI has mandated that all loan disbursals and repayments are to be executed directly between the bank accounts of the borrower and the entity, eliminating the involvement of LSP’s nodal pass-through account.

Transparency about Cost of borrowing: The lenders would have to inform the borrower in a standardised format about all fees, charges and the all-inclusive cost of digital loans in the form of annual percentage rate (APR). (The Annual Percentage Rate (APR) is the cost to borrow money, including fees, expressed as a percentage).

Key Fact Statement: they have to provide a key fact statement (KFS) to the borrower before the execution of the contract in standardized format for all digital lending products. This would also help borrowers make better comparisons with industry peers.

Automatic Increase of Credit Limit: The RBI has specified that there cannot be automatic increase in credit limits without the borrower’s on-record explicit consent. These regulated entities also have to publish the list of LSPs and DLAs (Digital Lending Apps) engaged by them, besides details of the activities for which they have been engaged, on their website.

Due Diligence: They also need to conduct an enhanced due diligence process before entering into a partnership with an LSP for digital lending. They should take into account its technical abilities, data privacy policies and storage systems, among other things.

Grievance Redressal: To address the need for a dedicated resolution framework, entities would have to appoint a grievance redressal officer. The ecosystem would also fall under the purview of the RBI’s Integrated Ombudsman Scheme (RB-IOS) should the complaint not be resolved within 30 days of receipt.

Data Collection and Sharing: All data collected by the apps should be ‘need-based‘ and must be with prior and explicit consent of the borrower. Users can also revoke previously granted consent. The information to be collected must be stated in the privacy policy during enrolment. The RBI has put forth that user consent would be mandatory for sharing any personal information with a third-party.

The guidelines also state that the regulated entities are required to ensure that any lending done through DLAs has to be reported to Credit Information Companies (CICs), irrespective of its nature or tenor. Lending through the Buy Now Pay Later (BNPL) mode also needs to be reported to CICs.

What lies ahead?

First, the RBI has said that some of the recommendations of the working group need wider consultation with the government like framing legislation for banning unregulated lending activities. The Government must take this up on priority.

Second, India still has the 2nd-largest number of people who don’t have a bank account. Over 190 million Indian adults don’t have any kind of bank account thereby representing a huge opportunity. In this regard, banking correspondents under Jan Dhan Yojana need to be incentivized to augment financial inclusion.

Conclusion

The share of digital lending may be small at present, but given their scalability they may soon become significant players. It is yet to be seen what kind of changes the digital lenders make to their operating models in light of the new regulations. The regulations have done well to protest consumer (borrowers) interests without putting any undue pressure on lending entities or the platforms. The digital lending ecosystem has a great potential to further the financial inclusion goal of the Government. Hence the ecosystem should be carefully nurtured and supported.

Syllabus: GS III, Indian Economy and issues related to growth, development.

Sources: The Hindu, Business Standard, The Times of India, KPMG