ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

The Goods and Services Tax (GST) has completed its 5th year today since its inception on 1 July 2017. The move towards ‘one nation one tax’ was one of the most historic indirect tax reforms in India . After concerted efforts of consensus building for over a decade, GST replaced 17 Union and State taxes and 13 cesses. 5 years down the line, the GST regime has been successful in attaining many of the intended objectives however some key challenges still remain to be addressed.

What is GST and its key provisions?

Goods and Services Tax(GST) is a comprehensive indirect tax on the manufacture, sale, and consumption of goods and services throughout India.

It replaced the existing indirect taxes levied by the Union and State Governments. It is a single indirect tax for the whole nation, which aims to make India one unified common market.

It is a destination-based tax applied on goods and services at the place where final/actual consumption happens. GST is applied to all goods other than crude petroleum, motor spirit, diesel, aviation turbine fuel, natural gas and alcohol for human consumption.

There are four slabs for taxes for both goods and services: 5%, 12%, 18%, and 28%. Different tax slabs were introduced because daily necessities could not be subject to the same rate as luxury items.

Besides, a cess is levied on the highest tax slab of 28% on luxury, sin and demerit goods. The collection from the cess goes to a separate corpus called Compensation fund. It is used to make up for revenue loss suffered by the state due to GST rollout.

States were promised a compensation for five years if their GST collection falls short of the 14 percent compounded revenue growth.

About the GST Council

The GST Council is the most important part of India’s GST regime. The council is responsible for recommending rates of tax, period of levy of additional tax, principles of supply, the threshold for exemption, floor level and bands of taxation rate, special provisions to certain states, etc.

Article 279A of the constitution enables the formation of the GST Council by the President to administer & govern GST.

The Union Finance Minister of India is a Chairman of the GST Council. Ministers nominated by the state governments are members of the GST Council.

The council is devised in such a way that the Union Government has 1/3rd voting power and the States have 2/3rd. The decisions are taken by the 3/4th majority.

A mechanism for resolving disputes arising out of its recommendations is also decided by the Council itself.

What are the achievements of the GST regime in India?

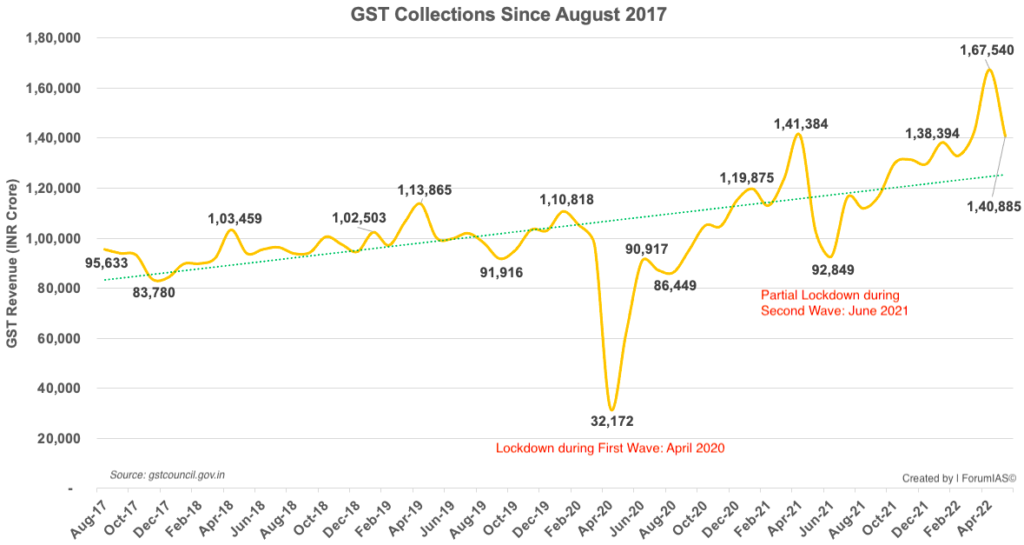

Revenue Collection: The GST council has met 47 times so far and have taken measures which made Rs 1 lakh crore GST collection per month ‘a new normal’. It is on the course to take the figure to Rs 1.4 lakh crore every month. The collections had touched a record Rs 1.68 lakh crore in April 2022. It had for the first time crossed Rs 1 lakh crore mark in collections in April, 2018.

The green trend-line indicates the upward trajectory of GST Revenues. During the initial 2 years, the revenues were lower because of implementation issues (system crashes, compliance problems, lower awareness). The external shock due to COVID-19 induced lockdown led to big dip in April 2020 (and to a lesser degree in June 2021). However, as the system stabilizes and compliance improves further, the collections are expected to settle at new normal upward of INR 1,40,000 Cr.

Faster Growth in State Revenues: In the five years (2017-18 to 2021-22) since the introduction of GST, the overall resource growth for States was 14.8% per annum, versus an annual average growth rate of 9% between 2012 and 2015. Thus, States appear to be better off. The Share of GST in States’ revenue has marginally increased in 2018-21 compared to 2014-17.

Source: Business Standard

Avoiding Cascading of Taxes: It subsumed 17 local levies like excise duty, service tax and VAT and 13 cesses. In the pre-GST era, the total of VAT, excise, CST and their cascading effect led to 31% as tax payable, on an average, for a consumer.

With regular adjustment of items in the various tax rate brackets, the effective GST rate had come down to 11.6% in 2019 from 14.4% at its inception.

Promoting Ease of Doing Business: The Government has been proactively issuing circulars and clarifications to clear doubts regarding taxation under GST and ensure ease of doing business. The GST Council, in its 47th meeting in Chandigarh, has decided to ease compliance for small taxpayers who supply through the e-commerce platform. Such suppliers, who make only intra-state supplies, need not seek GST registration. Provided their annual turnover is less than Rs 40 lakh in case of goods and Rs 20 lakh in case of supplies.

Improving Compliance: GST Network (GSTN) provides the technological backbone for the indirect tax regime. It has been using artificial intelligence and machine learning to dish out newer data and plug revenue leakages.

Compliance is also facilitated by: (a) Input credit availment linked to uploading of supply invoices; (b) Introduction of e-invoice for those with an annual turnover of more than Rs 20 lakh; (c) Filing of e-way bills by transporters for consignment worth more than Rs 50,000.

The GST-to-GDP ratio went up from 5.8% in 2020-21 to 6.4% in 2021-22, reflecting progressively improving compliance.

Center-State Relations: Since its inception, all but once decision of GST council have been through unanimous consensus. This shows an improvement in Co-operative Federalism in India.

What are the challenges associated with GST?

Multiple Tax Rates: Unlike many other economies which have implemented this tax regime, India has multiple tax rates. This hampers the progress of a single indirect tax rate for all the goods and services in the country. Most of the items fall in the high tax category of 18%. This acts as regressive, as it impacts the poorer section of the society.

Source: Mint

Further, current inflationary concerns have derailed the plans to tweak rates and GST slabs. The consumer price index-based inflation rate remained over 6% for the fifth month in a row and stood at 7.04% in May.

Inflation and Revenue Collections: Some economists argue that the current rise in GST collections is due to high inflation. The growth rate of GST collections in real terms (adjusted for inflation) is much lower e.g., the Year-on-Year growth rate in GST Collections in March 2022 was 14.7% in nominal terms, but only 3.7% in real terms (adjusted for inflation).

Source: Mint

Hardships for Taxpayers: There is unwarranted and excessive issuance of show cause notices for reconciliations of financial numbers, grant of registration, etc. that creates severe hardships for the taxpayers.

Lack of Coverage: With petrol, diesel, ATF outside GST, a large part of the economy is still not covered by the indirect tax regime.

Compensation to States: The GST (Compensation to States) Act guaranteed full compensation to States for the first 5 years of the GST if their revenues (after the implementation of GST) fall below 14% annual growth. A lot of States have been dependent upon the compensation. Since the clause is coming to an end, many States are demanding an extension. However, the Union Government appears to be reluctant. Moreover, the Union Government had delayed GST compensation to the States from 2019-20 when the economy started slowing down. It was paid in May 2022 after much delay.

Source: Mint

Conflicting orders by AAR: The state-level Authorities for Advance Rulings (AARs) have given conflicting rulings in various cases on the nature of goods, which determine the tax slab they fall under. These relate to food items such as ‘papad’, fryums and other areas such as setting up a solar power plant, intermediary services, and so on.

Source: Mint

Additionally, although the number of disputes have shown a falling trend, the absolute number of rulings by AAR continue to remain high.

Source: Mint

Bogus or No receipts: Despite coming out with e-way bills and e-invoicing, genuine receipts are not being given in every segment of the economy. For instance, retailers of fast moving consumer goods (FMCG), and chemists buy their stocks from super stockists who, in turn, buy from distributors appointed by the companies concerned. Though these distributors are tracked by e-invoicing and e-way bills, in many cases, the super stockists sell the products to stockists who do not keep records and do not give receipts.

Technical glitches: Frequent technical glitches have led to, first, the suspension of forms GSTR 2 (a purchase return) and GSTR 3 (an input-output return), and then, their scrapping altogether. Technical glitches were so rampant that the launch of the e-way bills had to be suspended in February 2018 because the system could not bear the load. Unfortunately, the glitches crop up even now.

National Anti-profiteering Authority (NAA): The NAA was set up in December, 2017 to ensure that GST rate reductions were passed on by firms to consumers and there was no profiteering. But right from the outset, the process of imposing penalties on companies was criticised for the alleged lack of a proper methodology to ascertain profiteering. As of May, there are close to 400 cases pending with it.

What lies ahead?

First, the Governments can consider bringing petroleum and electricity under GST ambit that will help prevent cascading and ensure further uniformity.

Second, Most states have sought an extension to the compensation mechanism and a final decision is likely to be taken at the next GST Council meeting in Madurai in the first week of August.

Third, with emerging technology, there is emergence of newer asset classes like the virtual digital assets (VDA) or cryptocurrency. Hence, there is a need for clarity on whether they would be classified as supply of ‘goods’ or ‘services’ and what would be the tax rate on them.

Fourth, the Government can consider setting up of Central authority to resolve conflicting AAR judgements across states. It can also consider doing away with anti-profiteering provisions freeing businesses to set prices. The Chief Economic Advisor has advised setting up a complaint-redressal mechanism (a GST Tribunal).

Fifth, some checks can also be incorporated on system generated GST notices, so as to avoid any unnecessary harassment of taxpayers.

Sixth, the GST system has a rich database. The data can be analysed to provide useful insights about the health of the economy. It can provide information about trends in economic activity like (consumption patterns) or the level of the formalization of the economy. It can also help understand which areas or districts are thriving or lagging behind. The data-driven insights can help prescribe appropriate policy interventions.

Conclusion

While the GST administration has moved forward with great efficiency, it is still a long way to go to achieve the full potential of GST and make it a true ‘good and simple tax’.

Source: Business Standard, Mint, Mint, Indian Express