ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Full disclosure: on the credit rating industry

News:

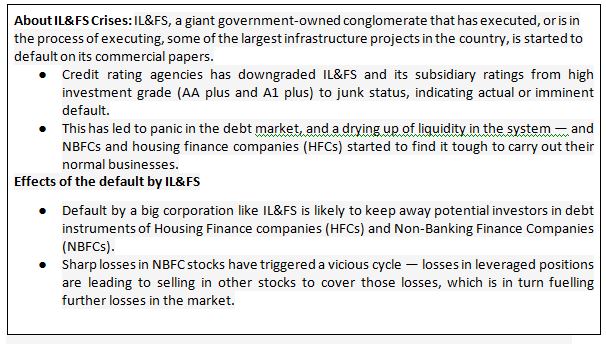

- SEBI has tightened disclosure norms for credit rating agencies after they failed to warn investors in time about the deteriorating credit profile of Infrastructure Leasing and Financial Services Ltd (IL&FS).

Important Facts:

- SEBI Guidelines:

- The credit rating agencies will have to inform investors about the liquidity situation of the companies they rate through parameters such as their cash balance, liquidity coverage ratio, access to emergency credit lines, asset-liability mismatch, etc.

- Further, rating agencies will have to disclose their own historical rating track record by informing clients about how often their rating of an entity has changed over a period of time.

- The regulator has also made it mandatory for rating agencies to disclose full list of subsidiaries or group companies if such entities form part of the consolidated ratings.

- A company’s liquidity position would include parameters such as liquid investments or cash balances, access to unutilized credit lines, liquidity coverage ratio, and adequacy of cash flows for servicing maturing debt obligation.

- SEBI also mandated CRAs to include a specific section on “liquidity” to highlight parameters like cash balances for servicing maturing debt obligation.

- Significance:

- Publishing details about the historical average rating transition rates across various rating categories will ensure investors have some way to analyse the performance of a rating agency.

- This will equip investors to make more informed decisions and be more discerning when comparing different ratings,

- Publishing transition statistics will help investors get a perspective on quality of ratings especially rating stability; an integral part of evaluating the performance on any CRA.

- This along with the default statistics will enable comparison of performance across CRAs.

- Critical Analysis:

- The latest regulations can only help to a certain extent as a lot of the problems with the credit rating industry have to do with structural issues rather than the lack of formal rules.

- The primary one is the flawed “issuer-pays” model where the entity that issues the instrument also pays the ratings agency for its services. This often leads to a situation of conflict of interest, with tremendous potential for rating biases.

- Second, the credit rating market in India has high barriers to entry, which prevent competition that is vital to protecting the interests of investors.

- Way Forward:

- Better disclosures can increase the amount of information available to investors, but without a sufficient number of alternative credit rating providers, quality standards in ratings will not improve.

- That’s why even after repeated ratings failures in their long history, credit rating agencies continue to remain and flourish in business.

- Structural reform should aim to solve another severe problem plaguing the industry, which has to do with rating shopping and the loyalty of credit rating agencies in general.

- Rating agencies will have to come up with lucrative business models that put the interests of investors above those of borrowers. Such a change requires a policy framework that allows easier entry and innovation in the credit rating industry.