ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

- 1 Introduction

- 2 What are Global Value Chains (GVCs)?

- 3 What is the significance of Global Value Chains?

- 4 What are the Key Findings of the Report?

- 5 What factors favour India’s integration with the Global Value Chains?

- 6 What are the challenges in integrating India with the Global Value Chains?

- 7 What steps can be taken going ahead?

- 8 Conclusion

| For 7PM Editorial Archives click HERE → |

Introduction

A report titled ‘Building Resilient Global Value Chain Linkages in India: Findings from an Enterprise Survey‘ has been published by the Observer Research Foundation. It examines how India can better integrate into the Global Value Chains (GVCs) in the post-COVID world. The report draws on a survey of executives from 200 domestic and foreign companies in India across 6 sectors. The Report lists down constraints faced by global firms in scaling up operations in India. It also suggest possible measures to support GVC integration and how it can benefit India.

What are Global Value Chains (GVCs)?

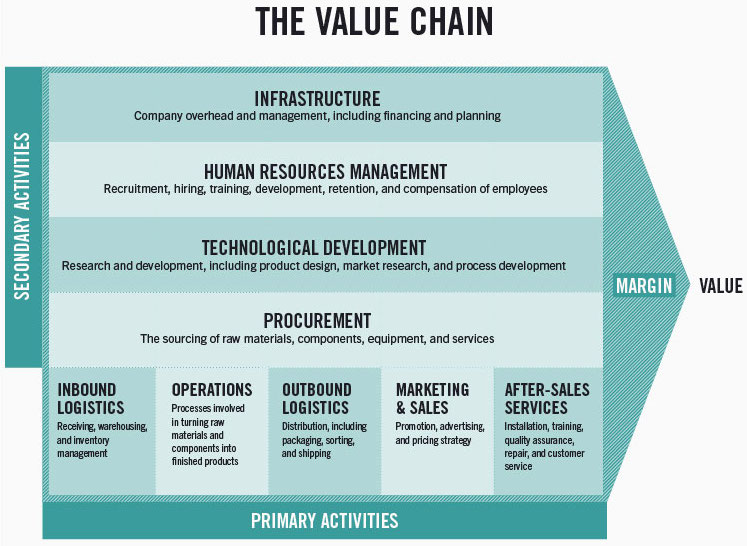

A value chain describes the full range of activities needed to create a product or service. This includes conception of a product, procurement of raw material, manufacturing, transportation (logistics), sales, marketing and distribution, and after-sale service.

Source: hbs.edu. Activities of a Value Chain. The activities include procurement, transportation/logistics, marketing, service, research and development, design, planning and human resource management etc.

Earlier, all the activities of a value chain (i.e. sourcing of raw material, transportation, manufacturing etc.) were limited to a single country. But the manufacturing model has changed now. Today, a single finished product often results from manufacturing and assembly in multiple countries, with each step in the process adding value to the end product. Through GVCs, countries trade more than products; they trade know-how (knowledge/information/manufacturing process), and make things together.

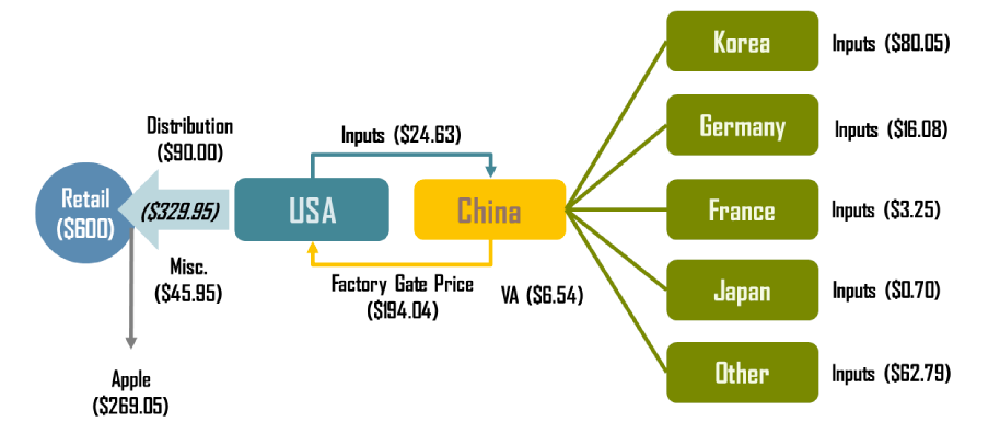

Source: ‘Global Value Chains and Smart Specialisation Strategy’ published by the Joint Research Centre, the European Commission. Apple’s iPhone is considered the most iconic example of Global Value Chains. The above image shows the input value addition (in terms of US$) in various countries for an iPhone.

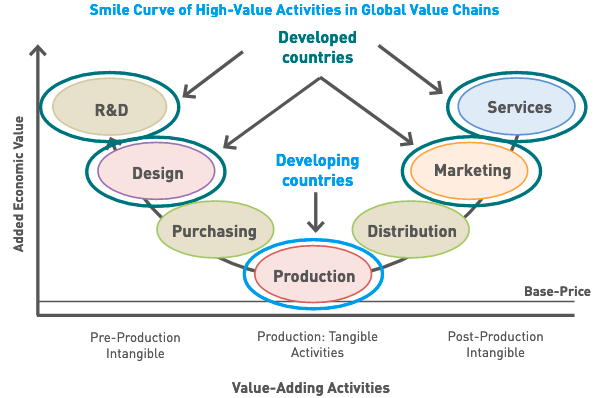

Typically, the upper end of GVCs, which involves research and development (R&D), design, services, and marketing are profit-intensive and mainly located in advanced economies. The lower parts of the GVCs, meanwhile, tend to be labour-intensive and have lower-value addition, and are typically located in developing countries (lower wage regions).

‘Smile Curve’ of GVC value addition

What is the significance of Global Value Chains?

First, GVCs are a powerful drivers of productivity growth, income boost, and increased living standards. Cross-country estimates suggest that a 1% increase in GVC participation can boost per-capita income by more than 1%, particularly when countries engage in limited and advanced manufacturing.

Second, Countries that embrace GVCs grow faster, import skills and technology, and boost domestic employment.

Third, with GVC-driven development, countries generate growth by moving to higher-value-added tasks and by embedding more technology and know-how in their agriculture, manufacturing, and services production. GVCs provide countries the opportunity to leap-frog their development process.

Fourth, the OECD’s METRO Model shows that localised manufacturing and value-addition models are more vulnerable to shocks, and result in a significantly lower level of economic activity and fall in national incomes as compared to the interconnected regimes. Thus GVCs ensure better absorption of shocks.

What are the Key Findings of the Report?

First, despite risks and uncertainties, enterprises consider further integration into GVCs as being critical for India. The current geopolitical climate, especially as companies search for alternatives to China, offers a window of opportunity for India to attract GVCs looking for new production homes.

Second, India’s attractiveness vis-à-vis other countries depends on its ability to improve the business climate. Investments in human capital development and infrastructure will be critical and will have co-benefits with other domestic priorities.

Third, Industry’s dependence on both imports and exports is high, but firms say relatively less attention has been paid to import challenges, which they view as crucial.

Fourth, Companies agree that India must re-evaluate its trade policies for improving GVC integration. India’s recent trade agreements with the United Arab Emirates (UAE) and Australia are a testament to the country’s willingness to enhance and deepen trade relationships.

Fifth, Companies have clear domestic policy priorities in India. They say that in the medium term, India should focus on enhancing its digital and physical infrastructure, strengthening financial and investment regulations, and ensuring clarity and certainty around trade policies and tariff rules.

| Read More: Bringing MSMEs into Global Value Chains |

What factors favour India’s integration with the Global Value Chains?

First, being a massive market with a young population makes India attractive. It is soon going to be the most populous country with the largest workforce in the world.

Second, India has also recently decided to pursue preferential trade agreements aggressively, which will support integration into GVCs.

Third, The US-China trade war has already created further opportunities for India to become part of major GVCs. MNCs headquartered in the US previously established bases in China to leverage China’s infrastructure, skills, and low factor cost to manufacture at globally competitive rates and export to the US. However, they are looking for alternative locations for manufacturing these goods and reducing their risks by diversifying their sources of supply.

Fourth, The COVID-19 pandemic has caused many bottlenecks in logistics networks, export restrictions on raw materials, intermediates, and supplies, playing havoc on the efficient functioning of GVCs. This has accentuated the need for both re-shoring and diversification of sources of supply to make GVCs function efficiently.

What are the challenges in integrating India with the Global Value Chains?

First, Enterprises continue to face domestic policy challenges. The most difficult obstacles to efforts in scaling up production in India include complex tax policies and procedures, the substandard quality of infrastructure, and uncertainty in trade policy.

| Read More: The Need for a New Foreign Trade Policy – Explained, pointwise |

Second, Indian Firms also face problems in meeting quality standards, lack institutional support, and inadequate information. All this impedes their integration into GVCs.

Third, Trade, one of the engines of growth, has not been fully leveraged in India in the last decade. Merchandise exports (that create jobs in manufacturing) have remained flat, at around US$ 300 billion annually. India’s trade as a percentage of GDP has plummeted from 56% in 2011 to 40% in 2019. Further, trade recovery is likely to slow down further as a result of the ongoing crisis in Ukraine.

Fourth, India has not been part of significant trade blocs and is thus a latecomer to the GVC space. GVCs thrive across geographies that liberalize trade with each other by reducing tariff and non-tariff barriers, actively implementing trade facilitation measures, and protecting investments. Latin American countries, the European Union, ASEAN, Japan, and even China have many plurilateral and mega regional trade arrangements that facilitate GVCs.

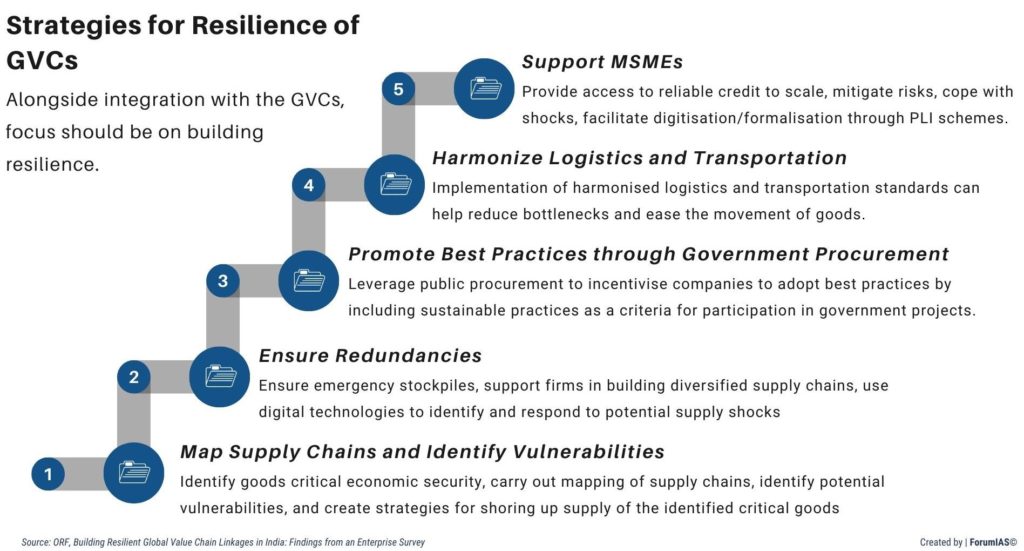

What steps can be taken going ahead?

India should prioritize the following policy domains: (1) Upgrading infrastructure; (2) Improving the business environment; (3) Facilitating trade.

(1) Upgrading Infrastructure

(a) Digital infrastructure

- Enhance ICT, broadband, and 5G connectivity.

- Ensure clarity on data protection rules that may impact investment decisions for digital infrastructure.

- Implement cross-border paperless trading.

(b) Physical infrastructure

- Implement the National Logistics Policy.

- Enhance both road and non-road inland transportation networks.

- Address gaps in power supply and distribution.

(2) Improving the business environment

(a) Investment and financial regulations

- Ensure clarity on dispute settlement in the post-Bilateral Investment Treaty system.

- Regularise GST rates with import tariffs to equalise domestic costs and import costs.

- Promote financial access by improving creditworthiness assessments (especially for SMEs).

(b) Institutional support

- Set up a supportive contracting environment.

- Implement legislation to protect Intellectual Property.

- Provide support for regulation compliance.

- Increase investments in research and development (R&D).

- Update and implementation of Labour Rules.

- Giving more momentum to initiatives like Skill India

(c) Addressing information gaps

- Develop a GVC integration action plan with an inclusiveness framework.

- Improve access to digital technologies and establish secure feedback loops and information sharing for technology-enabled sectors.

(d) Tax policies

- Simplify and streamline tax procedures and policies.

- Remove barriers and disincentives for firm formalisation.

(3) Facilitating Trade

(a) Trade policy

- Establish stable tariff rules.

- Pursue further FTAs with partners.

- Review the link between BITs and trade, i.e., trade policy and investment policy.

- Simplify and streamline border procedures.

(b) Improving quality

- Implement the Indian National Strategy on Standardization to increase firms’ capacity to meet international standards.

Conclusion

GVCs give manufacturing a fillip, bring in infrastructure, develop skills, and increase exports, thereby serving as catalysts for increasing local incomes and economic growth. However, GVC integration does not automatically result in direct economic benefits such as job creation and improved living standards, and therefore policy has an important role to play in ensuring the best possible outcomes. The Government must take all possible steps to enhance India’s role in the GVCs. Integration with the Global Value Chains can be the most significant lever in the next stage of India’s economic growth.

Syllabus: GS III, Indian Economy and issues related to growth, development; Changes in industrial policy and their effects on industrial growth.

Source: The Week, ORF, ORF, World Bank