ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Source: Live Mint

Relevance: IBC process is one of the most important aspects of industrial growth.

Synopsis: IBC Process has been a mixed bag of achievements and challenges. This article highlights issues and achievements of, and ways to improve the IBC process.

Recently, the chairperson of the standing committee on finance, Jayant Sinha informed parliament about the issues in the Insolvency and Bankruptcy Code (IBC).

Issues raised in IBC by committee

- Steep and unsustainable haircuts taken by financial creditors (as high as 95% in some cases).

- More than 71% of the cases remain pending for more than 180 days. It points to a deviation from the original objectives of the Code.

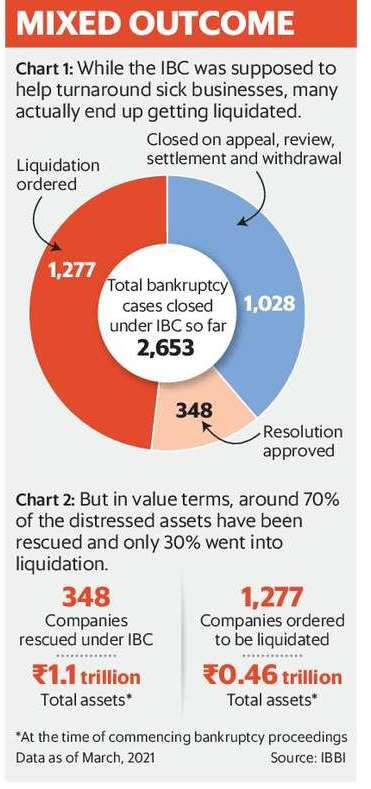

- Nearly half of the 2,653 companies, which have gone through the IBC process, received orders for liquidation, instead of resolution.

Read more – Insolvency and bankruptcy code

Positive impacts of IBC

Operational creditors: Under the earlier regimes, operational creditors, who are in the nature of unsecured creditors, could not initiate bankruptcy proceedings. Now, vendors whose payments are not paid and even workers whose dues have not been cleared can take a defaulting business to a bankruptcy tribunal. IBC has brought discipline and fear in the minds of borrowers. More than half of the bankruptcy cases so far have been initiated by operational creditors.

Average resolution time: The average resolution time has come down from 4.3 years in the earlier regime to 1.6 years under IBC, as per the World Bank’s 2020 ease of doing business report.

Recovery rate in India: The recovery rate in India (as a share of the claims made by creditors) stood at 71.6%, compared to 81% in the US. The recovery rate in Norway, the best performer in this parameter, is as high as 92.9%.

Causes Behind challenges facing IBC process

High liquidation: High liquidation is also due to the size of a business, e.g. a small business without physical assets, inactive for years will have to be liquidated for sure. Whereas big businesses are valuable. Thus, the majority of the high asset business got their resolution plans approved.

The size of the business also matters. For instance, a one million-plus tonne capacity steel plant is more likely to get a buyer than a 200,000-tonne plant.

Procedural hurdle: One such procedural hurdle is the share of vacant positions in the various benches of the National Company Law Tribunal (NCLT). According to official data, about half of the 63 NCLT positions are vacant.

Suggestions to reform IBC process

The vacancies in NCLT are creating hurdles to meeting the strict timelines mandated under the bankruptcy resolution process. Thus, steps to fill vacancies must be prioritized.

A key pending suggestion is the automatic admission of IBC cases in tribunals. Since a record of default is available when an insolvency case comes for admission, it could become an automatic process.

Dilution of section 29A of the IBC, if the failure of a well-governed insolvent firm can solely be attributed to economic conditions. The section currently disallows a promoter under whose watch the firm defaulted on repayment from bidding for the assets.