ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

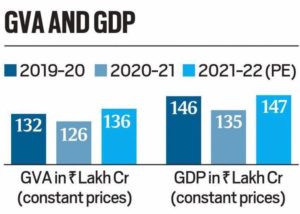

The Ministry of Statistics and Programme Implementation has released the provisional estimates regarding India’s GDP growth for the FY2021-22. According to the estimates, India’s economy grew by 8.7% compared to the previous fiscal. In contrast, the economy had contracted by 6.6% in FY2020-21 when the pandemic had caused massive disruptions and widespread lockdowns. The data released also showed that the Gross Value Added (or GVA) grew by 8.1% in FY2021-22, although it had contracted by 4.8% in FY2020-21.

About GDP and its Components

Gross Domestic Product (GDP) measures the value of all ‘final’ goods and services — those that are bought by the final user— produced in a country in a given period. It has four engines of growth in any economy.

In India’s case, the biggest engine is private consumption demand from individuals — the money spent by people in their private capacity. This demand typically accounts for 56% of all GDP and is technically called the ‘Private Final Consumption Expenditure‘ (PFCE).

The second-biggest engine is the money spent by companies and government towards making investments such as building a new office, buying a new computer or building a new road etc. This type of expenditure accounts for 32% of all GDP in India; and is technically called ‘Gross Fixed Capital Formation‘ (GFCF).

The third engine is the money spent by the Government towards its day-to-day expenses such as paying salaries. This accounts for 11% of India’s GDP, and is called ‘Government Final Consumption Expenditure‘ (GFCE).

The fourth engine is in demand from ‘Net Exports‘ (NX). This is the money spent by Indians on foreign goods (that is, imports) subtracted from the money spent by foreigners on Indian goods (exports). Since in most years India imports more than it exports, the NX is the smallest engine of GDP growth and is often negative.

So, GDP = PFCE + GFCF + GFCE + NX

What is the difference between GDP and GVA?

The GDP calculates national income by adding up all expenditures in the economy. The GVA (Gross Value Added) calculates the national income from the supply side by looking at the value added in each sector of the economy.

The two measures of national income are linked as follows:

GDP = GVA + Taxes earned by the Government — Subsidies provided by the Government

This shows if the government earned more from taxes than it spent on subsidies, GDP will be higher than GVA. If, on the other hand, the government provided subsidies in excess of its tax revenues, the GVA would be higher than the GDP. In simple words, GDP provides the demand side of the economy, and GVA the supply side.

What are the key observations regarding India’s GDP Growth?

At the aggregate level, in terms of GDP as well as GVA, the economy has gone past the pre-Covid level (FY2019-20). In other words, it has recovered all the lost ground due to the contraction in FY2020-21.

Source: Indian Express

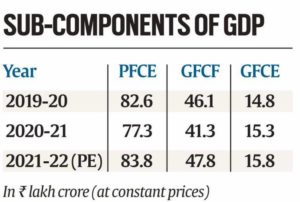

However, the sub-components of GDP and GVA reveal the true extent of this recovery.

GDP Sub components: While the government’s expenditures are more than 6% higher than FY19-20 levels, investments (with three times the weight) are up less than 4% and private demand (five times the weight) is just 1.4% above the FY19-20 level.

Source: Indian Express

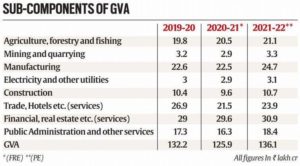

GVA sub components: While all sectors have shown an increase over FY20-21, different sectors of the economy tell a different story. Agriculture and allied sectors didn’t undergo any contraction and continued to grow through the last two years. At the end of FY22, it was 6.5% higher than the pre-Covid level.

Manufacturing is up over 9% from pre-Covid levels. But there are other sectors (such as mining and construction) that either show a moderate increase or a deficit. The contact-intensive services such as trade and hotel etc. are still more than 11% below pre-Covid levels.

Source: Indian Express

What is the significance of GDP Growth Data?

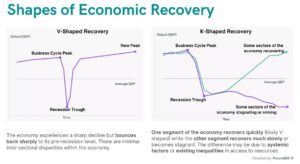

First, India’s GDP growth rate has been impressive. The economy has shown a trend of sharp recovery. At the aggregate level, the economy has recovered to the pre-pandemic level. However, this recovery is neither uniform nor broad-based, Some sectors have performed well, but many other sectors continue to suffer from the after-effects of the pandemic. The recovery is being called a K shaped recovery.

Second, the current growth can be classified as a ‘recovery‘ only when compared to the pre-Covid level. The current aggregate level of economy is much below the level of the pre-Covid growth trajectory. According to the RBI, if India’s economy grows consistently at 7.5% (annually), the losses suffered due to pandemic can be recovered only by 2034-35.

Third, according to some experts, even the modest recovery (1.4% above pre-pandemic level) in aggregate private consumption is misleading. If the population growth over the 2-years is accounted for, the private consumption has actually fallen by 0.6% (adjusted for population growth).

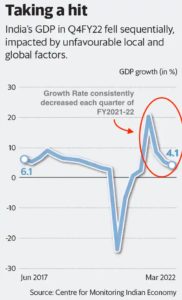

Fourth, while India’s GDP growth has been 8.7% on annual basis, there is considerable volatility at quarterly level. The quarterly growth trend has been 20.1% (April-June 2021), 8.4% (July-September 2021), 5.4% (October-December 2021) and 4.1% (January-Marcy 2022). Thus the recovery rate is actually slowing down.

Source: Mint

What are the challenges restricting India’s GDP growth in future?

Continuation of Pandemic: There are no clear signs that COVID-19 has been controlled across the world. Countries are still forced to impose lockdowns if the situation worsens as happened in China. This may impact sectors like travel, hospitality, airlines etc. industries, consequently impacting the economic recovery.

Russia Ukraine Conflict: It has sent global commodity prices soaring. Russia is a big exporter of commodities like crude oil, natural gas, fertilizers, sunflower oil and coal while India imports a huge amount of these commodities. The shortage could further push inflation and reduce private consumption expenditure.

Inflation and Monetary Tightening: The RBI recently hiked the repo rate by 40 basis points to 4.40% in order to control inflation. This has enhanced the cost of raising loans. The rate hike will disincentivize investment and creation of new ventures to propel the growth. Similarly, most central banks have already started aggressively tightening monetary policy. These actions have increased financial market volatility, which has had spillover effects on emerging economies, including India.

High Unemployment Rate: The reduced demand for products and rising input cost is resulting in huge layoffs in the private sector. The unemployment rate in the country grew to 7.83% in April from 7.60% in March, according to the Centre for Monitoring Indian Economy (CMIE) data.

What lies ahead?

First, inflation will continue to negatively impact consumption and is feared to drive down economic growth in the current financial year, at least as long as the war in Ukraine continues.

Second, the government should focus on implementation of schemes like MGNREGA, NFSA 2013, MUDRA, PM Kisan etc. in order to support the masses in tough times. This will help in reviving private consumption expenditure.

Third, the tax compliance should be enhanced by devolving more staff and resources to tax enforcement agencies. This will enhance government revenue thereby allowing them to spend more and raise government consumption expenditure.

Fourth, the RBI should consider rate relaxation once inflation levels are down. Similarly, there should be better enforcement of commercial contracts in order to attract private investment and enhance gross fixed capital formation.

Conclusion

While economic activity is recovering at a modest pace, many sectors and segments still seem to be constrained by a weakness in demand and will require continued policy support. A coordinated policy response — fiscal, monetary, trade, industry — will be required for balancing the multiple macroeconomic policy objectives.

Source: Indian Express, Indian Express, The Hindu, Mint