ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

- 1 Introduction

- 2 What has been the growth of India’s Toy Industry?

- 3 What are the factors driving growth of India’s Toy Industry?

- 4 What steps have been taken by the Government to aid growth of Toy Industry?

- 5 What are the challenges facing India’s Toy Industry?

- 6 What steps can be taken going ahead?

- 7 Conclusion

| For 7PM Editorial Archives click HERE → |

Introduction

In August 2020, amid the COVID-19 pandemic, the Prime Minister had exhorted that India can become a global hub in Toy Industry manufacturing and exports. In July 2021, the PM had said that India imports 80% of toys. He called on people of India to be ‘vocal for local toys‘. By July 2022, India’s exports of toys had surged from INR 300-400 crore to INR 2,600 crore. Imports had fallen from INR 3,000 crore, making India a net exporter of toys. The turnaround in the toy industry showcases the success story of focused approach by Government in supporting domestic manufacturing. The learning from the success of toy industry can be implemented in other sectors to enhance India’s exports and reduce dependence on imports.

What has been the growth of India’s Toy Industry?

Indian Toys Industry is estimated to be US$ 1.5 billion making up 0.5% of global market share. The toy manufacturers in India are mostly located in the NCR, Maharashtra, Karnataka, Tamil Nadu and clusters across central Indian States. The sector is fragmented with 90% of the market being unorganized and 4,000 toy industry units from the MSME sector.

According to a joint report by industry body FICCI and KPMG, the India’s toy industry is expected to double from US$ 1 billion in 2019-20 to US$ 2 billion by 2024-25. A share of 0.5% of the global toy industry shows indicates large potential growth opportunity. The domestic toy demand is forecasted to grow at 10-15% against the global average of 5%.

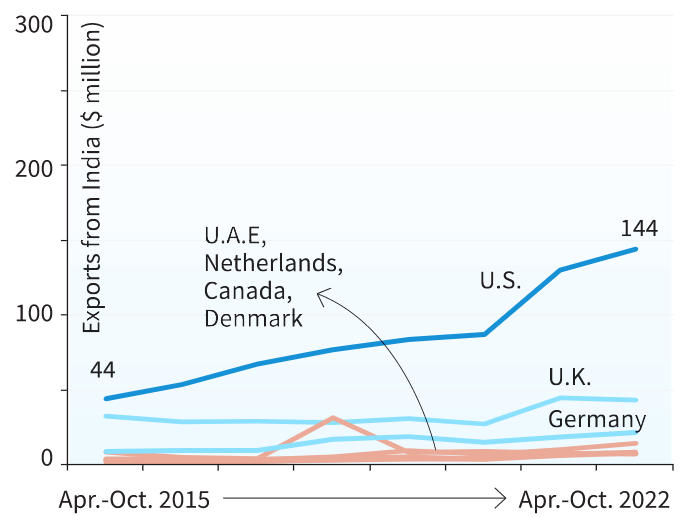

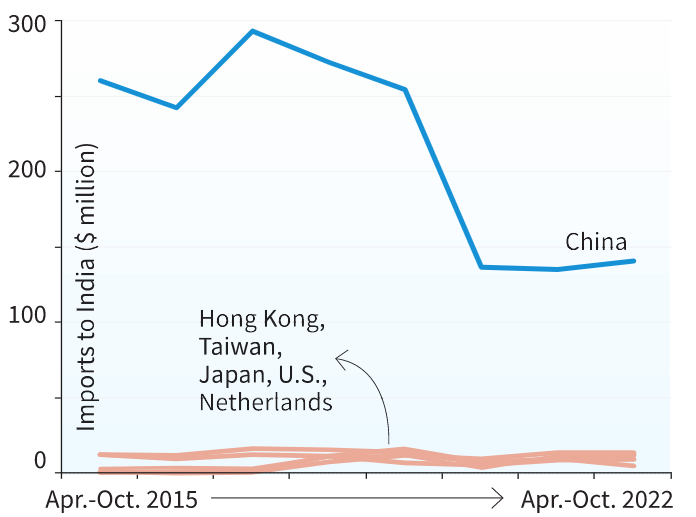

According to the Ministry of Commerce & Industry, the import of toys into India has declined sharply from US$ 304 million in 2018-19 to US$ 36 million in 2021-22. On the other hand, exports have increased from US$ 109 million in 2018-19 to US$ 177 million in 2021-22.

India’s Toy Exports to major Countries. Source: The Hindu

India’s Toy Imports from major Countries. Source: The Hindu

What are the factors driving growth of India’s Toy Industry?

Huge Consumer Base : India’s population today stands at ~1.4 billion or 17.7% of the global population. In 2019, ~26.62% of the Indian population fell into the 0-14 age category. Such a large young population is likely to offer potential for the toy industry’s growth.

Rising Disposable Income: India has exhibited strong GDP growth rates for the last several years and now, represents one of the world’s largest economies. Driven by this trend, the middle-class population has experienced strong growth. On an average, every Indian is earning 30% more than that six years ago. Consumers have more disposable incomes and their spending patterns have also changed. This has resulted in a major shift from traditional and medium- to low- end battery-operated toys to innovative electronic toys, intelligent toys, and upmarket plush toys.

Rise in Online Purchases: Online sales channels have also witnessed boom in India with the evolution of smartphones and other digital media. As quality and features of products can be discussed among shoppers and prices can be compared on various platforms, online sales channels have appeared to be one of the fastest-growing distribution channels for toys in India.

Shifting Preference: According to the Toy Association report in 2018, 67% parents believe in STEM-focussed toys as their primary way to encourage science and math development in young children. Shifting preference from conventional toys towards modern and hi-tech electronic toys is strengthening the market growth.

Going Global: Toy sector is also going global, as manufacturers are scouting new markets and increasing exports to the Middle East and African countries.

India’s Protectionist Strategy: In addition to increasing the basic customs duty on toys from 20% to 60%, stringent conditions have also imposed on the quality of toys that are imported. This has reduced availability of imported toys and enhanced demand for domestic toy industry.

What steps have been taken by the Government to aid growth of Toy Industry?

Call to the Start-ups: The Government has called upon start-up entrepreneurs to explore the toy sector. The Government has also urged industry players to support local toys and reduce reliance on foreign goods. Educational institutions have been asked to organise hackathons for students to innovate in toy technology and design, including online games, to reflect Indian ethos and values.

Increase in Custom Duty: The Government has increased basic customs duty from 20% to 60%. It is likely to result in toy importing brands to explore manufacturing in India, especially for the Indian market. It has also increased demand of toys manufactured by domestic toy industry.

Mandatory Quality Certification: The Government has made toy quality certification mandatory to revive the indigenous industry. The Government began enforcing quality control for imported toys from September 1, 2020, to ensure that only products conforming to standards enter the country.

Programmes Boosting the Toy Industry: The Government has chalked out a plan to promote traditional toys manufactured in the country by creating Toy Labs (a national toy fair for innovative Indian-themed toys). A plan to establish networks of toy labs such as Atal Tinkering Labs is also in the works to provide support for physical toys and for children to learn, play and innovate. Such labs will also be a way of specialised toy marking for quality certification and original design.

Involvement of Various Sectors: (a) The Government has invited the Ministries of Education, Textiles, I&B, Commerce, Women and Child Development, Culture, Tourism, Railways, Urban Development, Science and Technology and IT to give their inputs for betterment of the toy industry. The Department for Promotion of Industry and Industry Trade (DPIIT) has explained how various industries can contribute towards the toy sector; (b) The Ministry of Education has been asked to look at inclusion of indigenous toys as a major learning resource activity, as part of the recently announced National Education Policy. The plan also includes developing kits for Ek Bharat, Shreshta Bharat, a flagship scheme of the Ministry of Education; (c) IITs will be roped in to look at the technology aspect of toys. The National Institute for Design and the National Institute for Fashion Technology will study the concept of ‘Toys and National Values’. Using non-hazardous materials and creating toys that will help in mainstreaming children with learning disabilities will also be a top focus; (d) The Ministries of Science and Technology and IT will look at how ‘India’s indigenous games can be featured in the digital space and creating a digital repository archiving description of history’, while the Ministry of Culture could work on an ‘Indian Toy Museum’.

Consolidating and Up-skilling the Unorganised Sector: The Government is also deliberating forming toy producer clusters and linking all such clusters with artisans. The Government is also looking at addressing skill upgrades and credit needs of the toy clusters and facilitating their engagement with foreign investors.

Educating Consumers: The Government is gradually introducing a new norm in the minds of consumers to purchase safe and good-quality ‘Made in India’ toys as against cheap and poor-quality imported toys. Adverts are also being gradually designed in a manner to target children and parents as influencers in building the Made in India brand loyalty.

What are the challenges facing India’s Toy Industry?

Highly Fragmented: The toy industry is still highly fragmented, dominated by local producers. 90% of the market is unorganized and 4000 toy industry units being from the MSME sector. They lack innovation, and resources to invest in equipment and technology. They do not have the capital to scale-up production. Supply chains are still highly fragmented.

Impact of Import Duties and Quality Certification: After the duty hike, customers started to cancel orders, some held their orders back in hope that the duties will be reduced. The 200% increase in duties led to price hikes, making toys more expensive. Quality Certification has increased challenges for traditional craftsmen. They cannot afford to get these certifications. It is better for the Government to step in and club units or allow distributors to get the certification.

Labour Laws: Toy making is labour intensive. The life of a toy is limited. For instance, a ‘Transformers’ Toy sells well when the movie releases and the off-take dies down soon after. Therefore, the demand for a product changes rapidly and each toy requires a different skillset. These factors not only rule out mechanisation, but also call for flexible staffing. Indian laws do not permit recruitment or retrenchment based on demand if the organisation grows beyond a certain size in terms of employee strength. Hence, most units in the toy sector are very small and no major corporates have forayed into the industry despite the low capital investment needs.

Foreign Dependence for Sourcing Raw Materials: Indian manufacturers specialise in board games, soft and plastic toys and puzzles etc. Companies have to import materials from South Korea and Japan to manufacture these toys.

Fall in Free Trade amidst Geopolitical Uncertainties: Many economies are imposing restrictions on free trade to boost their local economies. The US government is taking a more protectionist stance and renegotiating many trade agreements, including NAFTA (North America Free Trade Agreement) and increasing tariffs on Chinese manufactured goods. These changes could set off a wider trade war, reversing the recent trend towards greater global free trade. For example, according to a report by the International Monetary Fund, rise in trade barriers could increase import prices by 10% and decrease exports by 15% during the forecast period, affecting growth of the toy manufacturing market, which relies on easy and cheap movement of goods between countries.

What steps can be taken going ahead?

First, In order to stimulate growth in the domestic toy industry, it is necessary to devise a specific manufacturing policy for toys.

Second, To become a major player in the global toy manufacturing industry, reducing the amount of imported toys may not be the best way to move forward. Instead, the Government should focus on enhancing India’s reputation as a reliable location for the production of high-quality toys.

Third, To foster an environment that is more conducive to healthy competition, the Government should: (a) Assist the industry in the formation of additional clusters; (b) Offer export subsidies and production-linked incentives for the manufacture of their products; (c) Ensure that toys are included in India’s Free Trade Agreements (FTAs). Support from the Central Government in the form of Incentives, as well as Inputs on the Upgrading of Technology, can go a long way towards assisting in the rapid growth of the domestic toy industry.

Fourth, Re-skilling the 7 million artisans in the country to help them meet the evolving demands of the industry while framing labour laws and regulations that protect workers’ rights can also help reap rich dividends.

Fifth, there is a shift towards intelligent toys and video games, away from traditional wooden/plastic toys. Domestic toy manufacturers should tap into India’s expertise in information technology to offer games that capture the imagination of the children. The Prime Minister has also asked the start-ups to help achieve this transformation.

Conclusion

The success of India’s toy industry in the last few years shows that focused interventions by the Government can help a great deal in creating conducive manufacturing ecosystem. Measures facilitating exports help in reducing dependence on imports and save valuable foreign exchange. This can help in achieving the vision of Atmanirbhar Bharat. The Government should adopt this approach to achieve self-sufficiency in critical sectors like EVs, batteries, Semiconductor Manufacturing etc.

Syllabus: GS III, Indian Economy and issues related to growth and development.

Source: The Hindu, IBEF, MoneyControl, Economic Times, PIB