ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

- 1 Introduction

- 2 What is the current status of the Jute Industry in India?

- 3 What is the significance of the Jute Sector?

- 4 What are the challenges faced by the Jute Industry?

- 5 How has Bangladesh improved its Jute Exports?

- 6 What steps have been taken to support the Jute Industry in India?

- 7 What steps are required to support the jute industry?

- 8 Conclusion

| For 7PM Editorial Archives click HERE → |

Introduction

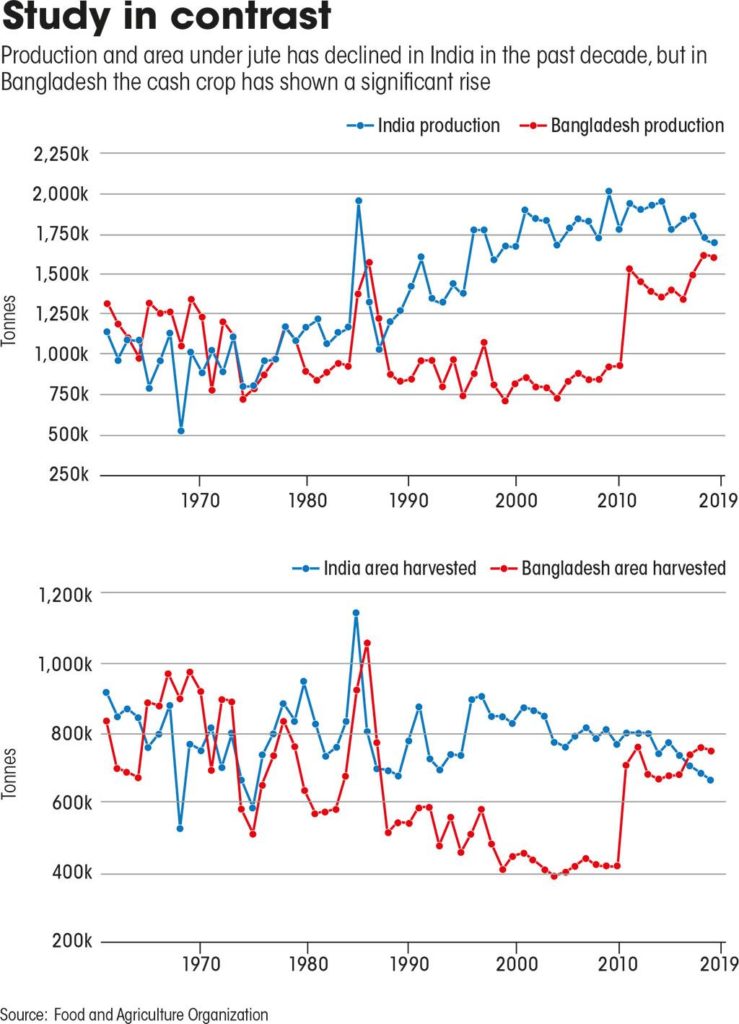

The Jute Industry in West Bengal is in a state of disarray. The area under jute cultivation has been falling and so is the price of jute. Several mills are on the verge of closure, putting the livelihood of thousands of people dependent on them in jeopardy. In contrast, the jute industry in Bangladesh is thriving, with Bangladesh accounting for 75% of global jute exports. The Member of Parliament from Barrackpore constituency recently met the Union Minister for Textiles to apprise him about the gravity of the crisis. The situation calls for a focused intervention by the Government to save the livelihoods of thousands of mill workers as well as farmers who are directly or indirectly dependent on the jute industry for their survival.

What is the current status of the Jute Industry in India?

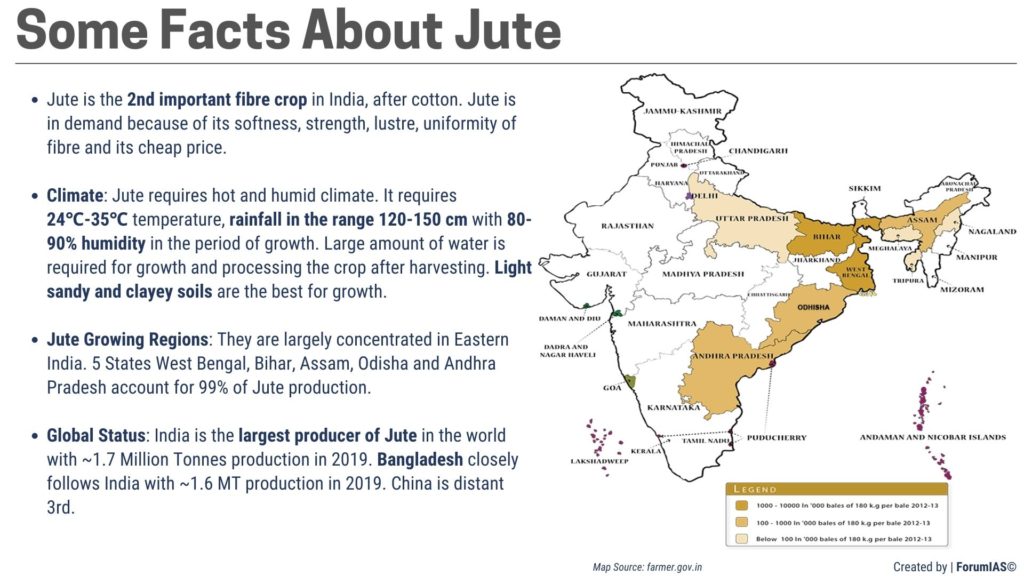

The Jute Industry in India is 150 years old. According to the Indian Jute Mills Association (IJMA), there are about 93 jute mills in India, of which 70 are in West Bengal. Of the 70, 54 are located in the three districts of North 24 Parganas (25), Howrah (15) and Hooghly (14).

The factors behind present localization of the jute industry in Eastern India especially West Bengal are: (a) Raw material: West Bengal is the largest producer of jute and most mill are located there; (b) Water supply: High rainfall and presence of rivers ensure abundant water for processing raw jute; (c) Easy Transportation: The region is well connected by a good network of railways, waterways, and roadways to facilitate the movement of raw materials to the mills. Inexpensive water transport is also provided by the Hugli river; (d) Labour: Availability of cheap labour from West Bengal and the adjoining States of Bihar, Orissa, and Uttar Pradesh; (e) Kolkata as a port and large urban centre, provides banking, insurance, and port facilities for the export of jute goods.

What is the significance of the Jute Sector?

Multiple Uses: It is used in insulation (replacing glass wool), packaging, geo-textiles, activated carbon powder, wall coverings, flooring, garments, rugs, ropes, gunny bags, handicrafts, curtains, carpet backings, paper, sandals and furniture. About 80% of the finished product – or B. Twill jute bag — is bought by the Government for packaging food grains and agricultural produce like sugar.

Employment Generation: Jute production is a labour-intensive industry. Jute sector provides direct employment to 3.7 lakh workers and support livelihood of more than 40 lakh farm families.

Environment Friendly: Jute provides a sustainable and environment-friendly alternative to single-use plastic. It is biodegradable and recyclable. Cultivation of just improves fertility of soil if grown in crop rotations. It does not produce toxic gases while burnt.

Agriculture Development: The sustenance of jute industry is crucial for jute cultivators. According to the Indian Jute Mills Association (IJMA), about 40 lakh farmers are associated with the production and trade of the golden fibre.

What are the challenges faced by the Jute Industry?

Stiff Competition: India lags behind Bangladesh in producing superior quality jute fibre. Bangladesh accounts for 75% of global jute exports while India’s share is only 7%. Even India imports jute products like yarn, floor coverings and jute hessian from Bangladesh.

Source: Down to Earth

Climate Change: Intensified cyclonic activity in the region as a result of climate change has impacted production of jute e.g., In May 2020, Cyclone Amphan caused considerable damage to the crop. A report by the Commission for Agricultural Costs and Prices (CACP) said that a lower quality of jute fibre was produced in 2020-21 due to the cyclone. Farmers had to harvest the crop prematurely due to water-logging.

Availability of Cheap Alternatives: Jute products costs higher than synthetic fibers and packing materials, particularly nylon and thus losing its market.

High procurement cost: The mills procure raw jute at higher prices than what they sell them at after processing. Mills do not acquire their raw material directly from the farmers, but instead through intermediaries due to cumbersome procurement process (many farmers are far-off from location of mills). The middlemen charge mills for their services which involve procuring jute from farmers, grading, bailing and then bringing the bales to the mills.

The government has a fixed Minimum Support Price(MSP) for raw jute procurement from farmers which is INR 4,750 per quintal for the 2022-23 season. However, jute reaches mill at INR 7,200 per quintal.

Policy Issues: The recent crisis began with the recent notification of Office of Jute Commissioner which capped the price of raw jute at INR 6,500 per quintal. However, mills are procuring material at INR 7,200; INR 700 more than the price cap on the final product. A mill owner in West Bengal estimated INR 12 Lakh loss per day forcing him to shutdown his mill. 10 mills have already closed down, and more mills are feared to follow suit.

Another issue is the non-implementation of the Tariff Commission’s report for fair price of B. Twill jute bags (bought by the Government). At present, the bags are priced on the basis of provisional rates of 2016. The price was meant to last for only 6 months till Tariff Commission recommended new price. The Commission submitted report in March 2021 but it has not been implemented. This has led to a loss of INR 1,500 crore to the industry, according to jute mill owners.

The losses have hampered to ability of mill owners to invest in new machines/technology or undertake innovation to diversify the products.

Raw material supply: India is not self-sufficient in the supply of raw material. To meet the growing need of the industry, raw material is imported from Bangladesh, Brazil, and Philippines.

How has Bangladesh improved its Jute Exports?

First, Jute produced in Bangladesh is of superior quality. This is because Bangladesh has favourable conditions that allow better retting of the crop. Under retting, jute bundles are kept under water at a depth of about 30 cm. This process gives the fibre its shine, colour, and strength. It should ideally be done in slow moving, clean waterbodies like rivers. But Indian farmers do not have access to such resources.

Second, Bangladesh provided 3-4 different kinds of subsidies to the jute industry. For instance, it gives 9-10% export subsidy for food-grade packing bags, which is much higher than India’s 1.5-3% subsidy.

Third, Bangladesh has been successful in capturing the diversified jute products market, for which there is a huge international demand. India’s major jute exports, in contrast, are sacking and hessian bags.

Fourth, jute production in Bangladesh is more cost competitive than India. This is because of lower procurement cost, lower wages and lower power tariffs etc. compared to India.

These factors provide a comparative advantage to Bangladesh vis-a-vis India in the export of jute products

What steps have been taken to support the Jute Industry in India?

Jute-ICARE: It was launched by National Jute Board (NJB) in technical collaboration with ICAR-Central Research Institute for Jute and Allied Fibers (ICAR- CRIJAF). The objective of the scheme is to support the small and marginal jute growers with adequate pre- and post-harvesting operations so that they can grow good quality jute & receive higher prices for their produce.

Jute Packaging Material (Compulsory use in Packing Commodities) Act, 1987: It mandates that 100% production of foodgrains and 20% sugar production must be packaged in jute bags.

What steps are required to support the jute industry?

First, the recommendations of the Tariff Commission’s report should be implemented in order to cut the losses of mill owners and prevent their closure.

Second, focus can be placed on innovative products like the Jute Geo-Textiles (JGT). It can be made through the special treatment and weaving processes. JGT can be applied to many fields including soil erosion control, civil engineering, protection of river banks and road pavement construction.

Third, Diversification is key if India wants to make the jute market successful. Demand for diversified products has to be created even domestically. This can be a big boost for a plastic-free India as well. At present, 92% of the total domestic jute produced is used for packaging purposes and just 8% is for other products.

Conclusion

Bio-degradable, eco-friendly jute products have a very big international market. But there is an urgent need for the domestic jute market to diversify. The need of the hour is to upgrade and adopt new technology, new manufacturing standards and evolve with time. The Government must support the jute industry and enhance its competitiveness through appropriate policy interventions.

Syllabus: GS I: Factors responsible for the location of the primary, secondary and tertiary sector industries, GS III: Major crops, cropping patterns in various parts of the country.

Source: Down to Earth, The Hindu, The Hindu