ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

- 1 Introduction

- 2 What is the meaning of Electoral Funding?

- 3 What are the findings of the ADR Report on Electoral Funding?

- 4 What are the issues with Electoral Funding in India?

- 5 What are the issues with Electoral Bonds?

- 6 What should be done going ahead?

- 7 What are the global best practices?

- 8 Conclusion

| For 7PM Editorial Archives click HERE → |

Introduction

The Association of Democratic Reforms (ADR) recently released an analysis report on Sources of Funding of National and Regional Political Parties. The report has provided some startling observations. The total income of national and regional parties from unknown sources for FY2020-21 stood at INR 690.67 crore. Between 2004-05 and 2020-21, the national political parties have collected more than INR 15,077 crore from unknown sources. Political experts rue that the opacity in electoral funding is the single biggest factor in political corruption in India. Money is central to the issue of political corruption and political parties are suspected to be the largest and most direct beneficiaries. Corruption in elections reduces accountability, distorts representation, and introduces asymmetry in policymaking and governance. Critics say that reforms in the electoral fundings are not forthcoming as all political parties, irrespective of their ideology, benefit from the current opaque set-up.

What is the meaning of Electoral Funding?

Money received by the political parties and the expenditure done by them in the process of election (directly or indirectly) come under the ambit of Electoral Funding/Financing. Laws governing these financial aspects are known as electoral funding/financing law. Electoral financing law can be studied under three broad sub-groups: (a) Limits on political contributions and party and candidate expenditure; (b) Disclosure norms and requirements; (c) State funding of elections.

Electoral funding in India is broadly governed by the provisions of the Representatives of People Act (RoPA), 1951; the Conduct of Election Rules, 1961; the Companies Act, 2013; and the Income Tax Act, 1961.

What are the findings of the ADR Report on Electoral Funding?

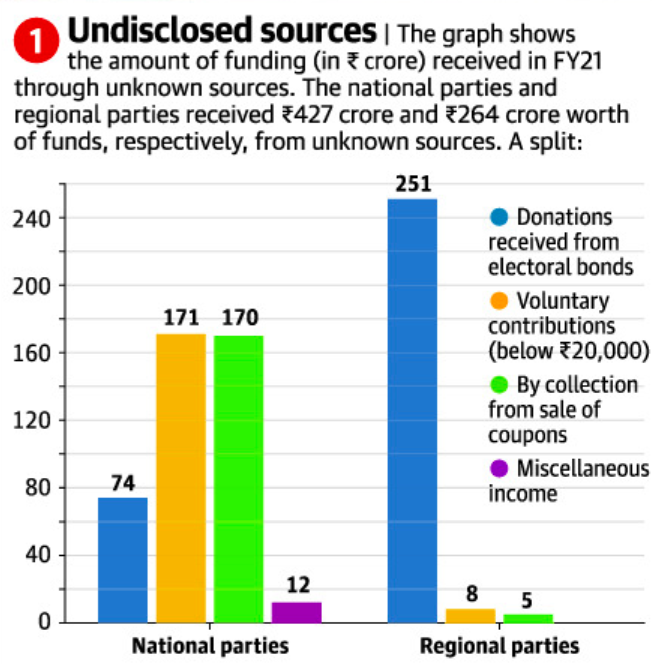

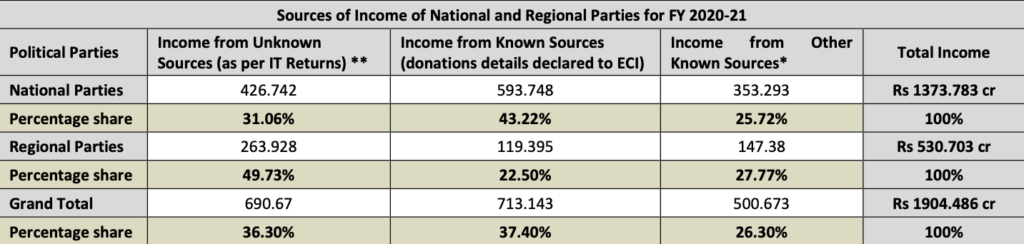

For the FY2020-21, 8 national political parties have declared INR 426.74 crore income from unknown sources. 27 regional parties received INR 263.928 crore income from unknown sources.

Source: The Hindu

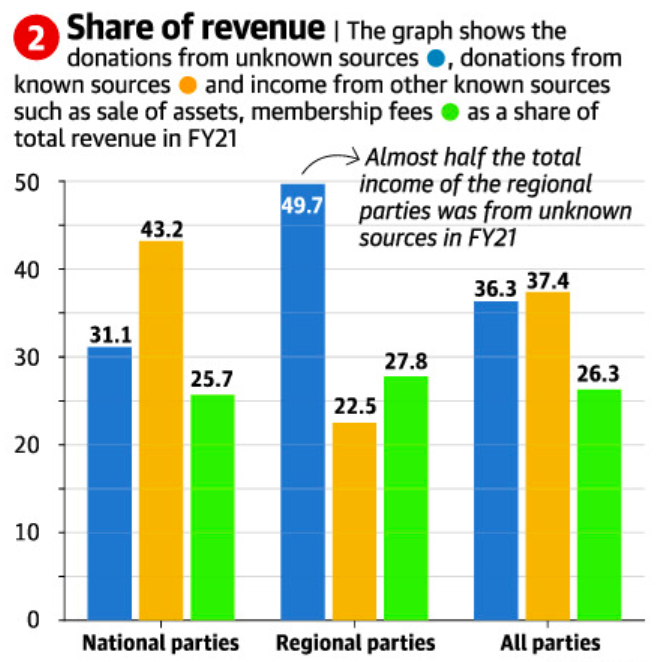

31% income of national parties and ~50% income of regional parties have come from ‘unknown resources’. The report has treated unknown income as the income declared in the IT returns without giving source of income for donations below INR 20,000.

Source: The Hindu

Overall, the combined income of national and regional political parties from unknown sources amount to 36%.

Source: ADR

ADR has also scrutinized the IT Returns of the political parties and found that between FY2004-05 and 2020-21, the National Parties have collected INR 15,077.97 Crore from unknown sources.

What are the issues with Electoral Funding in India?

Lack of Transparency: Large proportion of electoral funding comes from unknown sources. This is basic violation of transparency principles as electorate has a right to know whether the funds are being raised through legitimate means. The electoral bonds also suffer from this lacuna, and citizens are unaware about who is funding the political parties.

Corruption and ‘Regulatory Capture’: Activists argue that the unknown ‘donors’ include large corporate houses, or corrupt local businessmen who fund local political leaders. This makes the political leadership amenable to business interests. The current system tolerates lobbying and capture. The industry / private entities use money to ensure less stringent regulation, and the money used to finance elections eventually leads to favourable policies.

According to American political activist, Lawerence Lessig, even legal (but large) campaign donations, amount to ‘institutional corruption‘ which compromise the political morality norms of a republican democracy. Instead of direct exchange of money or favours, political candidates alter their views and convictions in a way that attracts the most funding. This change of perception leads to an erosion of public trust, which in turn affects the quality of democratic engagement.

No Limit on Funding: Earlier there was a cap on how much funds a corporate can donate to a political party out of the profits it earns. That upper limit has been removed. This has opened an avenue for corporates to increase funding to political parties and consequently increase their influence on the political system.

Lack of Fairness: Access to large financial resources translates into electoral advantage. Richer candidates and parties have a greater chance of winning elections. This distorts the level playing field. The Supreme Court has also supported this view in the Kanwar Lal Gupta v Amar Nath Chawla.

Contravention of Laws: Lack of disclosures contravenes various laws and ECI notifications. In spite of the Central Information Commission (CIC) ruling, all political parties have refused to submit themselves to the transparency that comes with Right to Information. There is widespread prevalence of black money, bribery, and quid pro quo corruption. The Supreme Court, affirmed the conclusions of the 2002 report of the National Commission to Review the Working of the Constitution, recognized this reality in PUCL v Union of India.

What are the issues with Electoral Bonds?

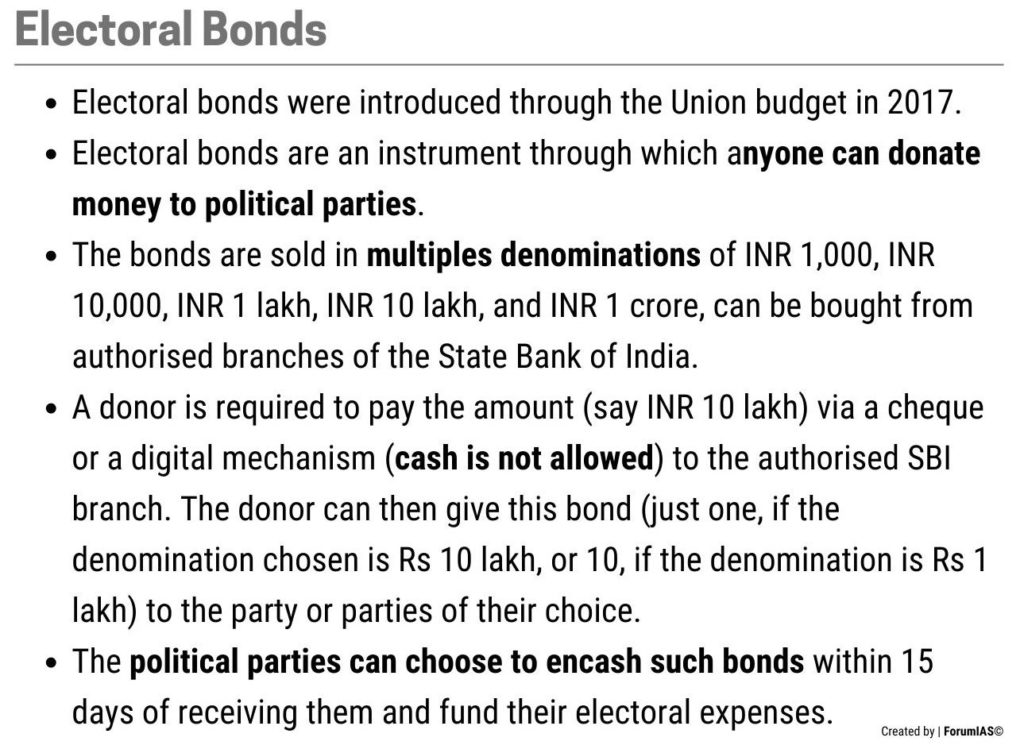

First, Before electoral bonds were introduced, it was mandatory for political parties to make public all donations above INR 20,000 and no corporate entity was allowed to make donations amounting to more than 7.5% of the average net profits of a company in the preceding 3 years. The introduction of electoral bonds not only increased the number of anonymous donors, but also the number of shell companies donating to political parties.

Second, Electoral bonds lead to information asymmetry; only the ruling government can access the information on who lends and to whom, leading to issues of moral hazard and adverse selection.

Third, Since the identity of the donor has been kept anonymous, it could lead to an influx of black money; and there is a threat to the spirit of democracy. The Election Commission in April 2019 told the Supreme Court that it did not approve of anonymous donations made to political parties, though it was not against the Electoral Bonds Scheme.

Fourth, one of the arguments for introducing electoral bonds was to allow common people to easily fund political parties of their choice, but more than 90% of the bonds have been of the highest denomination (Rs 1 crore).

What should be done going ahead?

There is a need to bring reforms in electoral funding

First, the funding process should be made completely transparent. Rules regarding funding and expenditure need to be tightened by placing an absolute cap on anonymous donations. The ADR Report has recommended that full details of all donors should be made available for public scrutiny under the RTI. Some countries where this is done include Bhutan, Nepal, Germany, France, Italy, Brazil, Bulgaria, the US and Japan.

Second, There should be an upper limit on the amount that can be donated to parties (like the limit of 7.5% of profits set under Companies Act, 2013). This will restrict influence of big corporate houses.

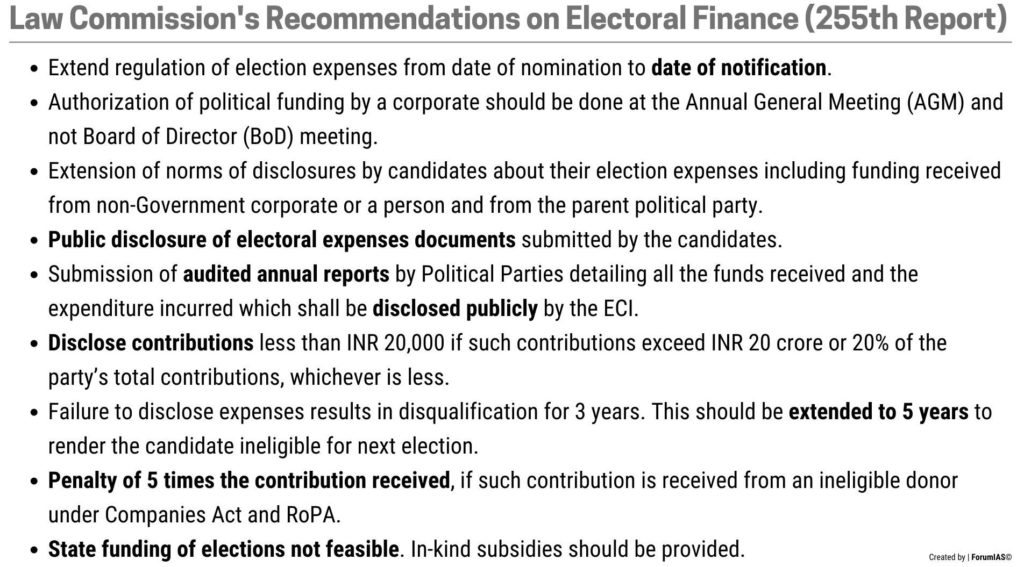

Third, electoral rules should be amended to regulate political advertisements, outline permissible categories of expenditure, prevent foreign sources of donations and lay down a limited base for public funding. The Law Commission of India in its 255th Report has recommended to cap the entire donation received through anonymous sources at Rs. 20 crores or 20% of the total funding of a political party.

Fourth, the ADR Report has recommended that scrutiny of financial documents submitted by the political parties should be conducted annually by a body approved by CAG and ECI so as to enhance transparency and accountability of political parties with respect to their funding.

Fifth, the ECI has recommended that tax exemption be awarded only to those political parties which contest and win seats in Lok Sabha/Assembly elections. The Commission has also recommended that details of all donors who donate above INR 2,000 be declared in public domain.

Sixth, violation of rules and transparency provisions should be stringently penalized. The Election Commission must be provided with greater powers in this regard.

Seventh, some provisions of the Electoral Bond scheme has been questioned in the Supreme Court. The Court must adjudicate on the issue quickly and bring more clarity.

What are the global best practices?

European countries such as France and Belgium have curtailed private spending on elections through a series of legislations since the 1990s, thereby successfully negating the influence of rich corporates in elections. France banned all forms of corporate funding in 1995 and capped individual donations at 6,000 Euros.

Brazil and Chile have banned corporate donations after a series of corruption scandals emerged related to corporate funding.

| Some Important Reports/Commission related to Electoral Reforms Law Commission 170th Report (1999) ‘Reform of the Electoral Laws’. Law Commission 255th Report (2015) ‘Electoral Reforms’. Election Commission of India (2004) ‘Proposed Electoral Reforms’. The Goswami Committee on Electoral Reforms (1990). The Vohra Committee Report (1993). The Indrajit Gupta Committee on State Funding of Elections (1998). The National Commission to Review the Working of the Constitution (2001). |

Conclusion

Former Judge of the US Supreme Court Justice Louis Brandeis once wrote, “We can have democracy in this country, or we can have great wealth concentrated in the hands of a few, but we cannot have both“. A clean, transparent electoral funding process is vital to ensure a fair electoral democracy. Most developed countries in the West have robust mechanisms to ensure transparency in their political systems. As India aspires to emulate the West by setting the ambition of achieving developed country status by 2047, it must aspire for similar standards of transparency in the political sphere. Cleaning up electoral finance can be the first step in this regard.

Syllabus: GS II, Salient features of the Representation of People’s Act