ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

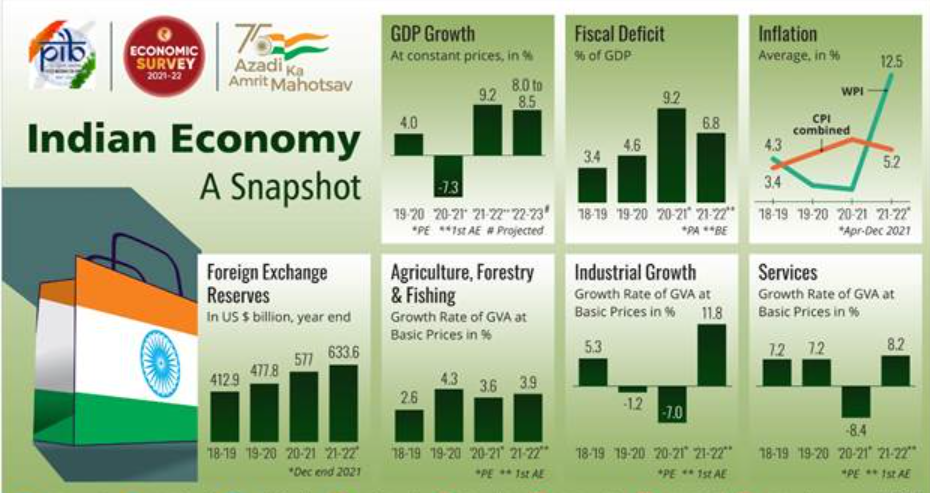

The Government tabled the Economic Survey 2021-22 in the Parliament on January 31. The survey focuses on the post-pandemic recovery and analyses a range of aspects including inflation, energy prices and global uncertainties.

The survey has also taken stock of growing revenues to indicate the availability of fiscal space for the Government. The Survey has noted that India will witness GDP growth of 8.0-8.5% in FY2022-23, supported by widespread vaccine coverage, gains from supply-side reforms and easing of regulations, robust export growth, and availability of fiscal space to ramp up capital spending. This growth (8.0-8.5%) would make India the fastest-growing major economy in the world.

[Download] Economic Survey 2021-22 pdf |

Status mentioned in Economic Survey 2021-22

GDP projections: GDP has climbed past pre-Covid levels with growth registering 9. 2% in 2021-22 after a contraction of 7. 3% in 2020-21. The Survey says, the GDP projection is comparable with the World Bank’s and Asian Development Bank’s latest forecasts of real GDP growth of 8.7% and 7.5% respectively for 2022-23.

| Note: The growth projection for 2022-23 is based on the assumption that there will be no further debilitating pandemic related economic disruption, monsoon will be normal, withdrawal of global liquidity by major central banks will be broadly orderly, oil prices will be in the range of US$70-$75/bbl, and global supply chain disruptions will steadily ease over the course of the year. |

Agriculture and allied sectors: This sector has been the least impacted by the pandemic and the sector is expected to grow by 3.9% in 2021-22 after growing by 3.6% in the previous year.

The area sown under Kharif and Rabi crops, and the production of wheat and rice, has been steadily increasing over the years. This is due to 1) Minimum support prices, 2) Timely supplies of seed and fertilizers, 3) Good monsoon rains as reflected in reservoir levels being higher than the 10-year average.

Industrial growth: The industrial sector went through a sharp rebound from a contraction of 7% in 2020-21 to an expansion of 11.8% in this financial year. The share of industry in the GVA is now estimated at 28.2%.

The survey mentioned that measures such as the PLI scheme for various sectors, along with policy initiatives such as the emergency credit line guarantee to micro, small, and medium enterprises will help aid the pace of recovery.

Services sector: The Survey states that the services sector has been the hardest hit by the pandemic, especially segments that involve human contact. This sector is estimated to grow by 8.2% this financial year, following last year’s contraction by 8.4%.

Sectors like Finance, Real Estate and the Public Administration segments are now well above pre-COVID levels. However, sectors like Travel, Trade and hotels are yet to fully recover. There has been a boom in software and IT-enabled services exports even as earnings from tourism have declined sharply.

Total consumption: It is estimated to have grown by 7.0% in 2021-22. Government consumption remains the biggest contributor.

Gross Fixed Capital Formation (GFCF): The investment to GDP ratio is about 29.6% in 2021-22, the highest in seven years. While private investment recovery is still at a nascent stage, there are many signals which indicate that India is poised for stronger investment.

Exports and Imports: Merchandise exports have been above US$30 billion for eight consecutive months in 2021-22. Net services exports have also risen sharply. India’s total exports are expected to grow by 16.5% in 2021-22 surpassing pre-pandemic levels. Imports are expected to grow by 29.4% in 2021-22.

| Read more: Increasing exports in India and challenges in exports- Explained, pointwise |

Balance of payments: India’s balance of payments remained in surplus throughout the last two years. This allowed the Reserve Bank of India to keep accumulating foreign exchange reserves, which stand at US$634 billion on 31st December 2021. This is equivalent to 13.2 months of imports and higher than the country’s external debt.

Tax collections: The tax collections have been buoyant for both direct and indirect taxes and the gross monthly GST collections have crossed Rs 1 lakh crore consistently since July 2021.

Fiscal deficit: According to the budget estimates, the FD for 2021-22 will be at 6.8%. This figure is a sharp increase from 4.6% in 2019-20.

Other details mentioned in the Economic Survey 2021-22

Fiscal space: Buoyant tax revenues and government policies have created “headroom for taking up additional fiscal policy interventions”.

The banking sector is well placed to support the economy, as it is now “well capitalised and the overhang of Non-Performing Assets seems to have structurally declined”. For instance, The gross NPA and net NPA ratios declined from 11. 2% and 6% respectively in 2017-18 to 6. 9% and 2. 2% at end-September 2021.

Vaccine economics: The Survey says the progress of vaccination should be seen not just as a health response indicator, but also as a buffer against economic disruptions, especially in the contact-intensive sectors, caused by repeated pandemic waves.

Over the course of a year, India delivered 157 crore doses that covered 91 crore people with at least one dose and 66 crore people with both doses.

India’s external sector: With the sizeable accretion of foreign exchange reserves India’s external sector is resilient for the withdrawal of liquidity measures.

Barbell Strategy: The Government of India opted for this strategy to overcome challenges in repeated waves of infection, supply-chain disruptions and global inflation. The strategy includes combined safety nets to support the vulnerable on one hand, and a flexible ‘Agile’ framework that used feedback loops and real-time responsiveness on the other.

a) Providing a bouquet of safety-nets to cushion the impact on vulnerable sections of society and the business sector, b) Significant increase in capital expenditure on infrastructure to build back medium-term demand, c) Aggressively implementing supply-side measures to prepare the economy for the sustained long-term expansion.

Supply-side reforms performed: One of the distinguishing features of India’s economic response to the pandemic has been an emphasis on supply-side reforms rather than a total reliance on demand management. These reforms include:

a) Factor market reforms: Deregulation of sectors like space, drones, geospatial mapping, trade finance factoring; process reforms like those in government procurement and in the telecommunications sector; removal of legacy issues like retrospective tax; privatization, etc.

b) Reforms aimed at improving the resilience: These include climate/environment-related policies; social infrastructure such as the public provision of tap water, toilets, basic housing, insurance for the poor, a strong emphasis on reciprocity in foreign trade agreements, and so on.

| Read more: 24th Financial Stability Report (FSR), December 2021 – Explained, pointwise |

What are the challenges highlighted by the Economic Survey 2021-22?

Inflation pressures: WPI inflation has been running in double digits, partly due to base effects. The Survey flags inflation as an issue as inflation is vulnerable to “imported inflation, especially from elevated global energy prices”.

The survey mentioned that elevated inflationary pressures could potentially lead to the unwinding of liquidity measures by systemically important central banks, including the US Federal Reserve.

Private consumption and formal sector jobs: The Government’s quarterly surveys on urban employment show that jobs have shifted to the informal sector. Similarly, private consumption in 2021-22 is not expected to reach the level that existed two years ago even though the overall GDP will be higher.

Challenges in global trade: Supply-side disruptions, exacerbated by the recovery in demand, pose significant risks for global trade. The biggest downside risk comes from the pandemic. The survey says that along with longer port delays, higher freight rates, and the shortage of shipping containers and inputs such as semiconductors.

Other challenges: Unexpected headwinds from geopolitical developments and spikes in energy prices remain a risk.

What are the suggestions mentioned in the Economic Survey 2021-22?

Change in the Energy sector: The report calls for a “diversified mix of sources of energy of which fossil fuels are an important part”, but simultaneously calls for focus on building storage for intermittent electricity generation from solar PV and wind farms to ensure on-demand energy supply.

The survey asks the Government to focus on the pace of the shift from conventional fossil fuel-based sources, and encourage R&D to ensure an effortless switch to renewable sources of energy.

Use the Government fiscal space: In addition to capital expenditure, the Government needs to use the fiscal space to help contact-intensive services sectors. This will improve the job market and increase private consumption.

Supply-side reforms: The survey calls for an emphasis on developing a supply-side strategy to deal with the long-term unpredictability of the post-Covid world, emanating mainly from factors such as changes in consumer behaviour, technological developments, geopolitics, climate change, and their potentially unpredictable interactions.

The Survey proposes the use of the Agile approach to policymaking with 80 high-frequency indicators in an environment of “extreme uncertainty”. The approach, used in project management and technology development, assesses outcomes in short iterations while constantly making incremental adjustments.

To conclude, the Indian economy is in a good place – macro-indicators are reasonably healthy and the growth engine looks primed to deliver the world’s highest growth rate. Overall macroeconomic stability indicators suggest that the Indian Economy is well-placed to take on the challenges of 2022-23, and one of the reasons that the Indian Economy is in a good position is its unique response strategy.

Source: PIB, Indian Express