ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

The middle income trap is a theoretical economic development situation, in which a country that attains a certain income (due to given advantages) gets stuck at that middle-income level and is unable to transition to high-income level.

The World Bank defines as the ‘middle-income range’ countries with gross national product per capita that has remained between US$ 1,000 to US$ 12,000 at constant (2011) prices.

Middle Income Trap: Current Status

- Typically, the economy of a country grows due to certain inherent factors like export competitiveness (e.g., due to low wages in a country), rich natural resource base etc.

- With growing economy, per capita income also rises. However, with time, the competitive advantage aiding growth gets eroded (e.g., wage levels rise).

- So, if the economy does not undergo structural changes, the growth may slowdown (or stop altogether or even reverse) and income levels may stagnate.

- Population stabilization is also a factor here, if population continues to grow, the per capita income may grow very slowly to make any significant impact on income level.

- Many countries in South East Asia (e.g. Thailand, Vietnam, and Malaysia etc.), Africa (e.g. South Africa) and Latin America (e.g. Brazil) currently face this phenomena. This has impeded their transition from middle income to high income.

- From 1960 to 2010, only 15 out of 101 middle-income economies escaped the middle income trap, including Japan, Singapore, and South Korea.

Middle Income Trap: Factors

Structural Transformation:

- At low per capita income levels, economic growth is driven by factors like low wage levels (cheap labour).

- However, at higher income levels, economic growth is driven by improvement in technology and productivity (especially in the tertiary sector).

- So if the economy doesn’t undergo structural transformation, it is susceptible to Middle Income Trap.

Lack of strong governance framework:

- Low income countries typically lack State capacity and have poor governance framework.

- At low income levels, even one or two sectors (like exports of garments) can drive economic growth.

- However, with an increase in income levels, factors like foreign investments and technology become critical factor in further economic growth.

- So the State must be able provide a stable economic policy framework, a corruption-free government, a robust institutional and judicial set-up to attract foreign investments and technology to ensure Ease of Doing Business.

- Lack of State capacity, say to protect investments or to enforce contracts can result in economic stagnation.

Income Inequality:

- Concentration of income within few sections of society limit potential of growth.

- A large and rapidly expanding middle class population is necessary for continuous demand-driven growth.

- Wealth/Income concentration limits upward mobility (poor continue to remain poor), prevents expansion and growth of middle class, lowers domestic demand and hence acts as drag on economic growth.

Economic Cycles:

- Frequent and severe recessions undo the expansion achieved in the growth years.

- Many Latin American countries have faced multiple economic crises which has limited their transition to high-income economies.

- In contrast, successful countries in East Asia—Japan, Hong Kong, Taiwan, Singapore, and South Korea that have been able to sustain high growth for over 50 years.

Population Explosion:

- Population growth must be stabilized to reap benefits of economic growth e.g., if both economy and population grow at an annual rate of 4%, the per capita income remains stagnant (0% growth).

Middle Income Trap: India’s susceptibility

- First, there is rising protectionism across the world. Due to this, India might not be able to reap the benefits of hyper globalization that benefited China, South Korea & Japan in the last few decades.

- Second, Structural transformation from primary to secondary and then tertiary sectors is crucial to become a high-income economy. In India, ~45-50% population is still dependent upon agriculture (primary sector).

- ‘Premature deindustrialization’, tendency for manufacturing to peak at lower levels of activity and earlier in the development process is a major concern in India.

- National Manufacturing Policy and Make in India initiatives have not been able to generate enough employment opportunities in the manufacturing sector. Failure to address this concern, will keep the population trapped in low income jobs in primary sector.

- Third, there is still a lot of State control in place. India has not matured into a market economy. Factors like retrospective taxation, lack of stable policies have curtailed growth of private sector and impacted investments in the economy.

- Fourth, the quality of human capital formation is also lacking in India. The quality of education in schools and colleges is not at par with international standards. Further, around 55% of graduates are not employable as per industry standards.

- Fifth, climate change and weather extremities have become a recurrent phenomenon. This is a serious threat to India where agriculture is heavily dependent on monsoons. Moreover, climate related disasters (floods, landslides etc.) will consume considerable resources.

Middle Income Trap: Steps taken

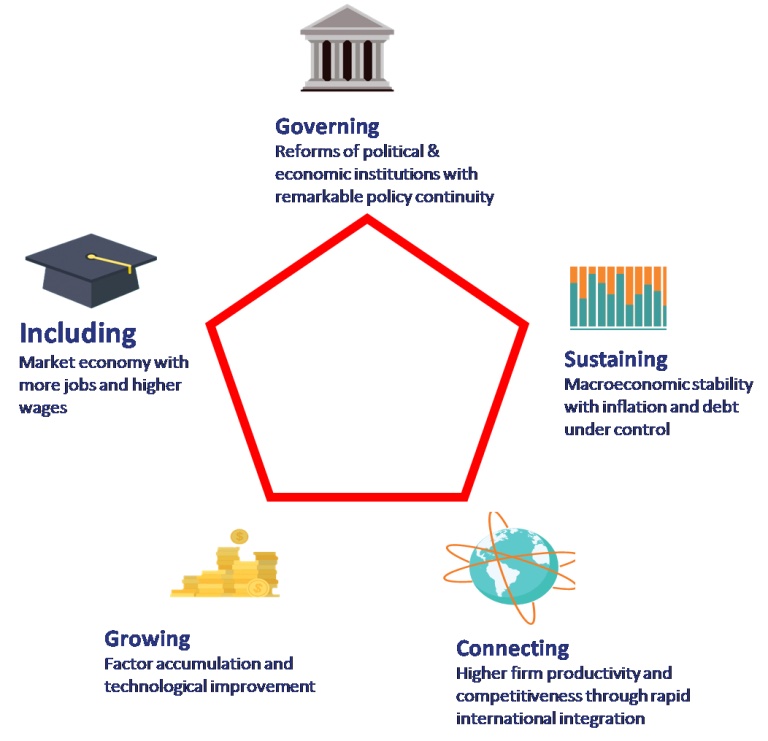

- First, It requires identifying strategies to introduce new processes and find new markets to maintain export growth.

- Second, it is also important to increase domestic demand, because an expanding middle class can use its increasing purchasing power to buy high-quality, innovative products and help drive economic growth.

- Third, the biggest challenge is to move from resource-driven growth based on cheap labor and cheap capital to growth based on high productivity and innovation.

- This requires investments in infrastructure and education—building a high-quality education system that encourages creativity and supports breakthroughs in science and technology.

- Fourth, Government must provide a stable policy environment. Additionally, there is need to enhance capacity of institutions to address the gaps.

- For instance, the Government must improve the resolution process (under IBC) to enable quick recovery of NPAs and improve the health of Banking sector.

- This will enable banks to lend more, improve investments and drive growth.

- Fifth, the focus should be shifted towards decentralized economic management.

- Greater powers should be vested in local governments to ensure speedier decision making. This will also ensure a more inclusive growth, and an increase in income levels in rural areas.

- Sixth, there should be transition from diversification to specialization in production. Specialization allowed the middle-income Asian countries to reap economies of scale and offset the cost of disadvantages associated with higher wages (E.g. Electronics industry in South Korea).

- High levels of investment in new technologies and innovation-conducive policies are two major requirements to ensure specialized production.

- Developing good social-safety nets and skill-retraining programs can ease the restructuring process that accompanies specialization.

Source: Brookings Institution. Five Key Policy Areas to avoid Middle Income Trap.

Making India a developed nation and transitioning to a high-income economy by 2047 is a big challenge. A lot of domestic and international factors make India vulnerable to falling into a Middle Income Trap.

The next 25 year period will be crucial in determining whether India becomes a high-income economy or becomes another basket case of Middle Income Trap.