ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Source- This post on RBI draft rules for payment aggregators has been created based on the article “RBI’s draft rules for payment aggregators” published in “The Hindu” on 24 April 2024.

Why in the news?

The Reserve Bank of India is proposing new regulations for offline payment aggregators (PAs) to enhance safety.

About the payment aggregators:

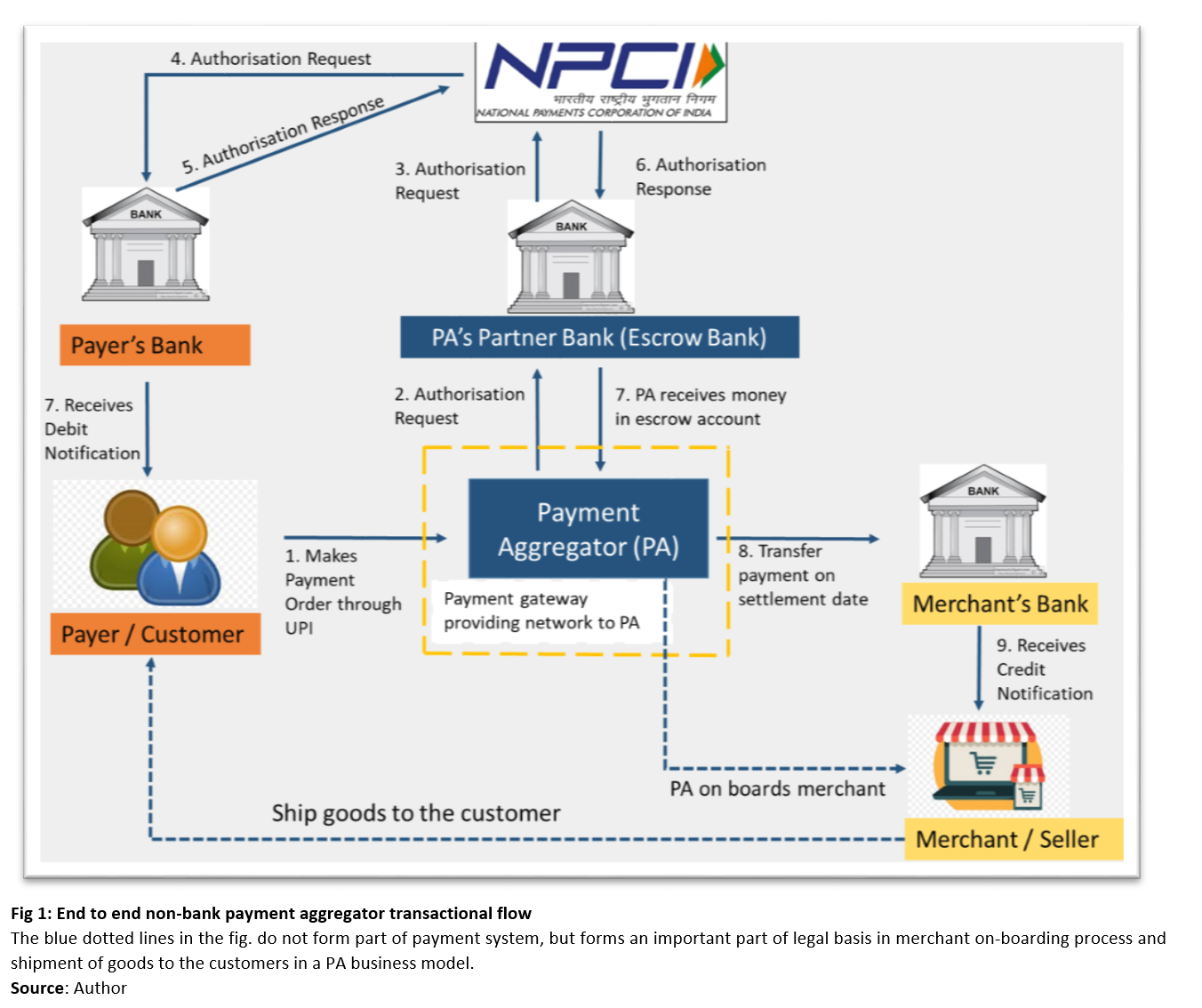

1. About Payment Aggregators (PAs): PAs are entities responsible for enlisting merchants and streamlining the process of collecting payments from customers for the purchase of goods and services. These aggregators unburden the merchants from creating a payment integration system of their own.

2. Methods employed by PAs to collect payments- PAs utilize various payment channels like online QR codes or physical point-of-sale (POS) machines to collect payments on behalf of the merchants. Subsequently, PAs settle the accumulated funds with the respective merchants.

3. Types of PAs: Two major types of PAs are a part of the payments ecosystem in the country: This includes PA-Online Point of Sale (PA-O) and PA – Physical Point of Sale (PA-P).

4. Inclusion of PA – Physical Point of Sale (PA-P) in the revised definition of payment aggregators- The revised definition of payment aggregators has been modified to include physical point-of-sale payment providers such as Innoviti Payments, Pine Labs, and MSwipe. Thus they have been subjected to regulatory oversight.

About new RBI guidelines for payment aggregators

1. Non-bank PoS providers must notify RBI within 60 days and submit authorization applications by May 31, 2025.

2. Banks must close accounts for non-bank payment aggregators by October 31, 2025, unless authorized.

3. Net-worth requirements for PAs facilitating face-to-face transactions have been changed. PAs net worth requirements will be increased to Rs 25 crore by March 2028.

4. Medium merchants, defined as physical or online merchants with annual business turnover of less than ₹40 lakhs who are not registered under the GST, would also have to undergo contact point verification.

5. PAs have to bolster risk management with KYC norms, tailored for small and medium-sized merchants.

6. PAs can now use escrow accounts for both PA-O and PA-P activities, including goods delivery. All PAs must join the FIU to report suspicious transactions.

7. Starting August 1, 2025, only card issuers and networks can store card data for face-to-face transactions.

Syllabus: Indian Economy