ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 27th May. Click Here for more information.

Falling crude puts OMC pricing under scanner

News:

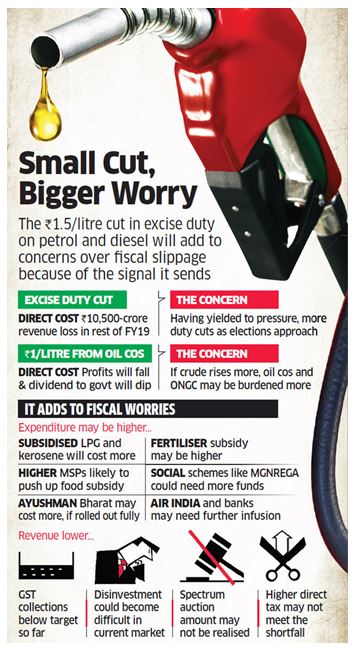

- Recently the Centre slashed excise duty on petrol and diesel to lower pump prices as global crude surged to a four-year record.

Important Facts:

- The article discusses whether the oil marketing companies have recovered after this price cut and absorbed into their financials.

- The OMCs had said that the total effect of price cut on their finances would amount to ₹4,000-₹5,000 crore in this financial year.

- Anomaly: The Indian basket of crude oil has seen prices fall almost 24% in one month after the price cut, whereas the price of petrol has fallen only 8.8% during that period.

- Reasons for disparity in oil prices: While there will be a reduction in fuel prices if oil prices reduce, it won’t be by the same percentage.

- The crude is a part of the supply chain of which consists of shipping, refining, supply and distribution, etc and are relatively fixed costs that do not vary with the price of oil.

- These various components in pricing add to the opacity behind how the final retail price is determined.

- For example, if the global price is $65 per barrel, then there are transportation costs, cross-subsidy losses, handling losses, export parity price, dealercommission, and then taxes added to this.

- Moreover, the international products, whose basket we use for pricing petrol products, do not move immediately and in tandem with the crude oil prices as there can be a lag.

- Arbitrages also change and the price stack up also includes in-land costs, over and above international products prices.

- The OMCs also bear costs including dealers’ commission.”