ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 10th August. Click Here for more information.

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

The Union Ministry of Finance has announced that it would issue Sovereign Green Bonds worth INR 16,000 crore as part of its October-March (H2FY23) borrowing programme. With this issue, India will join a club of 25 nations which have issued bonds to exclusively fund climate sustainability and green infrastructure projects and initiatives. Despite the rapid progress over the last decade, the size of Global as well as domestic (Indian) Green Bond markets has not yet reached the scale to ensure sustainable green finance. Addressing the gaps hampering the growth of green bond markets will help in scaling up investments in sustainable infrastructure and economic development.

What are Green Bonds?

Green bonds are debt instrument (like normal bonds) to raise funds for climate and environmental projects. Governments, Companies and multilateral organisations issue these bonds. Like other bonds, these bonds provide investors fixed interest payments. Generally, Governments provide tax incentives like tax credits to make them attractive for investors. The World Bank issued the first official green bond in 2009.

Green Bonds differ from other bonds in one key aspect. The proceeds from Green Bonds are exclusively earmarked for green and environmentally sustainable projects like sustainable agriculture, prevention of pollution, fishery and forestry, clean water and transportation, environment-friendly water management projects etc. For regular bonds, the issuer can use the proceeds for various purposes at her discretion.

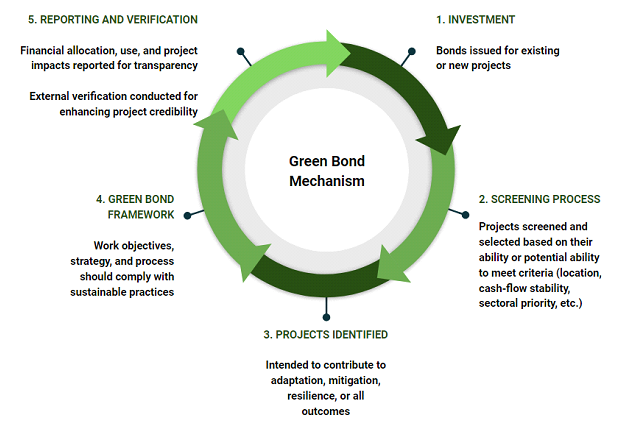

For bonds to qualify as green bonds, ICMA (International Capital Market Association) has come up with four components that help to ensure transparency and disclosure in the development of such bonds: (a) The proceeds must be used for green projects; (b) The issuer (of bonds) must indicate the process adopted for project evaluation and selection; (c) The issuer must maintain transparency in the management of proceeds; (d) They must also report the progress and impact about the use of proceeds.

Thus this information also helps investors with sustainability to their investments. Moreover, helping the issuer to develop a framework.

The Climate Bond Initiative has provided a Green Bond Taxonomy to indicate the types of works covered under Green Projects.

Source: OECD

What is the current status of Green Bonds?

Global

The United Nations’ Intergovernmental Panel on Climate Change estimates that limiting the temperature increase to 2oC, the goal of the Paris Agreement, will require about US$ 3 trillion of investment every year to 2050. Global green initiatives such as the Paris Agreement on Climate Change and the UN Sustainable Development Goals have helped the expansion of Green Bonds markets.

As of mid-June 2022, 25 nations have issued Sovereign Green Bonds worth US$ 227 billion, according to the research compiled by Climate Bonds Initiative. These include advanced economies like the United Kingdom, Spain, Ireland, Italy, Austria, Canada, and others, and emerging economies like Chile, Indonesia, Hungary, Poland, Fiji, Egypt etc.

Source: OECD

The market for green bonds is increasing rapidly. According to the Climate Bonds Initiative, annual issuance may reach US$ 1 trillion by 2023. The US is the largest source of green bonds, led by the government-backed mortgage giant Fannie Mae. Private Corporations from Apple to Pepsi and Verizon have followed suit. State and Local Governments have also turned to green bonds to pay for infrastructure projects.

India

The Union Ministry of Finance has announced that it would issue sovereign green bonds worth INR 16,000 crore as part of its October-March (H2FY23) borrowing programme. Budget 2022 had outlined the Union Government’s plan to issue Sovereign Green Bonds for achieving net carbon neutrality target by 2070.

According to the Reserve Bank of India report titled “Green Finance in India: Progress and Challenges” until February 12, 2020, India had an outstanding debt of US$ 16.3 billion in green bonds. Several Indian companies have issued such bonds. Most of them are listed on India INX, situated in Gandhinagar, Gujarat. The US$ 650 million bonds issued by SBI in 2018 were listed on INX Gujarat, Luxembourg Stock Exchange and also Singapore Stock Exchange (SGX).

Some issuers of green bonds with the maturity of 10 or more years include (issue year): (a) Yes Bank (2015); (b) Indian Renewable Energy Development Agency (2017, 2019); (c) Rural Electrification Corporation Limited or REC (2017); (d) Power Finance Corporation (2017); (e) Indian Railway Finance Corporation Ltd.(2017); (f) Adani Renewable Energy (2019) etc.

Around 76% of the such bonds issued in India since 2015 were denominated in US$. India’s first green bond was issued by Yes Bank in 2015 to raise INR 5 billion to enhance long-term resources for funding infrastructure projects in renewable and clean energy.

Source: Mint

The Green Bond issuance in India in 2021 exceeded US$ 6.5 billion. Yet they contributed only 0.7% to India’s Bond Market and 1.4% to the global green bond market.

What are the benefits of Green Bonds?

Issuers

The benefits to issuers include: (a) Improve investor diversification; (b) Enhance reputation of the issuer; (c) Provide an additional source of sustainable financing; (d) Increase alignment regarding the durability of instruments and the project lifecycle; (e) Attract strong investor demand, which can lead to high oversubscription and pricing benefits (as has been observed in relation to certain issuances).

These bonds have lower interest rates than the loans provided by commercial banks.

Investors

The benefits to investors include: (a) Comparable financial returns (in comparison to normal bonds) with the addition of environmental and/or social benefits; (b) Satisfy ESG requirements for sustainable investment mandates; (c) Enable direct investment in the ‘greening’ of brown sectors and social impact activities; (d) Increased transparency and accountability on the use and management of proceeds, becoming an additional risk management tool; (e) Green bonds can help mitigate climate change-related risks in the portfolio due to changing policies such as carbon taxation which could lead to stranded assets. Instead, a green bond invests in climate-friendly assets, such as green buildings, renewable energy, that over time bear a lower credit risk.

Other Benefits

In addition, Green Bonds have other benefits like: (a) Future improvements to the environment are ultimately made possible by these bonds’ contribution to green project funding; (b) The renewable energy industry is one of the priority sectors identified by RBI. Therefore, banks are required to allocate a particular portion of their loan book to the priority sector. This will help the credit flow in this sector; (c) Contribute to national climate adaptation, food security, public health, energy supply, amongst others;

Green bonds forms part of ESG (Environmental Social Governance) investing and since 2012, the Securities and Exchange Board of India (Sebi) has mandated the top 100 listed companies to disclose their business sustainability report to stock exchanges.

| Read More: ESG Framework In India – Explained, pointwise |

Source: Mint

What are the challenges associated with Green Bonds?

Greenwashing: Greenwashing refers to the practice of making false or misleading claims about the green credentials of a company or a project. Greenwashing remains a major challenge for the market in green bonds and other sustainable investments. This is because the funds generated through the bonds may be diverted to another product. Moreover, it is difficult to quantify the benefits of green projects. Similar concerns are faced in the functioning of the carbon markets as well.

| Read More: Carbon Markets: Benefits and Challenges – Explained, pointwise |

Legal Definition: With no single global standard or recognised legal definition, and the market criteria based on voluntary compliance, it is difficult to conclusively say if some bonds are green or not. It is also difficult to assess their level of ‘greenness’. Hence there is growing scepticism around the effectiveness of such bonds.

Lower Yield: Green bonds may be issued with a higher price, and thus have a lower yield compared to other bond instruments. This has been termed as “greenium”. Moreover, the coupon rates of a green bond are not easy to determine as there are constant debates on whether to price them higher or lower than regular bonds with equal arguments on both sides.

Credit Rating of Sovereign Bonds: If a government wants to go global to raise funds, it needs to improve its credit rating as all bonds issued globally are closely linked to the credit rating of the issuing country. This could mean close scrutiny of the domestic policies, which the government should be transparent and open to. Countries with poor credit ratings may find it difficult to raise funds.

What should be the approach going ahead?

Multiple Stakeholders: Creating green infrastructure would require investment and involvement of multiple stakeholders. Globally the green bond market should have adequate support from both the public and private sectors of all nations and from the multilateral institutions like World Bank for capacity building and expertise in green projects.

Market Development: For a strong green bond market to connect to the main capital markets and investors, it would also need common standards and rules. This will make it easier to put the money into sustainable development. According to the RBI, To strengthen the green bond market, it is necessary to: (a) Increased coordination between investment and environmental policies; (b) An implementable policy framework for both National and State levels in addressing the existing frictions; (c) Some of the policy measures such as deepening of corporate bond market, standardisation of green investment terminology, consistent corporate reporting, and removing information asymmetry between investors and recipients can make a significant contribution in addressing some of the shortcomings of the green finance market (RBI, 2019).

Source: Economic Times

Tax Incentivisation: There is need to provide clear tax incentives for green bond issuers and investors in order to improve fund flow to the green projects.

Recognition: Investor recognition and the reward of good green corporate citizens would strengthen green bonds as a dynamic capital markets product supporting genuine economic and societal needs.

RBI Recommendations: According to the Reserve Bank of India Annual Report (2015-16): (a) There is need for development of local green bond markets, facilitating cross- border investments in green bonds, knowledge sharing on environmental risks, and improving overall green finance activities; (b) There is also a need to address issues related to assessment of environmental risk by financial institutions, the definition and scope of “green activities”, and the protection of intellectual property rights during the creation and transfer of technology from developed countries.

Penalty: The monitoring of green projects needs to be stringent to ensure better completion rates. Recipients of such funds should be compliant, and a penalty component could be imposed in case of missing a deadline. This will check the tendency of greenwashing.

Information Management System: Developing a better information management system may help in efficient resource allocation . To overcome information gap, several countries including Australia, China, India and the United States have database related to green building projects in the country.

Conclusion

The Green Bond Market has grown rapidly during the last decade. However, it has not yet reached the scale necessary to address the challenges posed by the imminent climate change and the need for enhanced green finance. Addressing the concerns like greenwashing and making them more lucrative for investors, can attract private investments in green projects. Private Capital can supplement the green funding from developed economies, which has not been forthcoming despite the pledges in climate negotiations.

Syllabus: GS III, Indian Economy; Conservation, environment pollution and degradation.

Source: Mint, Business Standard, Business Standard, RBI, OECD, WEF, WEF