ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

The devastating effects of climate change are becoming increasingly evident. The Monsoon rainfall is becoming increasingly erratic. There is wide variation in regional distribution of rainfall, the frequency of extreme rainfall events is rising followed by prolonged dry spells. This year, the regions of East Uttar Pradesh, Bihar and Jharkhand received very low rainfall during the paddy-sowing period. Abnormal rainfall in October has damaged the standing crop. These events will lead to lower production of rice for this year’s kharif season. Earlier, heat waves in March had destroyed the wheat crop. The wheat stock with Food Corporation of India has reached its lowest level in recent times. Thus the shortage will result in higher prices and inflation. Demand of energy will become volatile due to higher temperatures and extreme events, leading to more volatile prices of oil/gas in global markets. The uncertainty in prices will make it difficult for the Central Banks to intervene and control inflation. Thus, Climate Change will profoundly impact Monetary Policy.

What are the major impacts of Climate Change on various economic parameters?

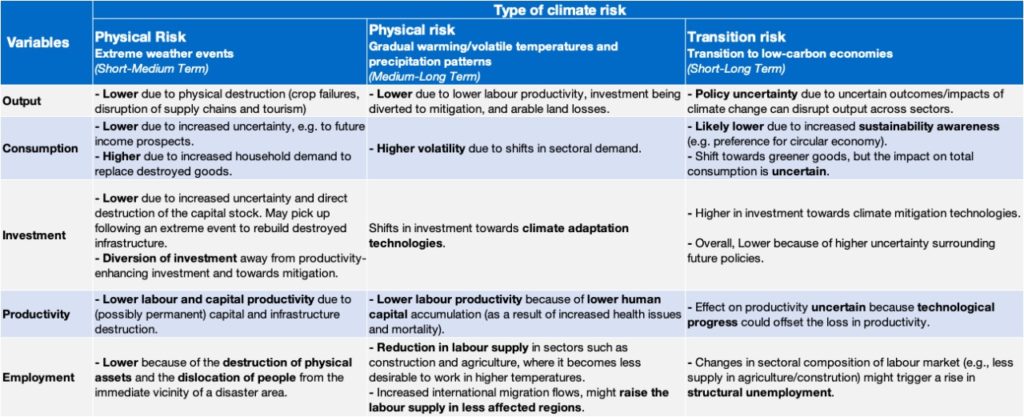

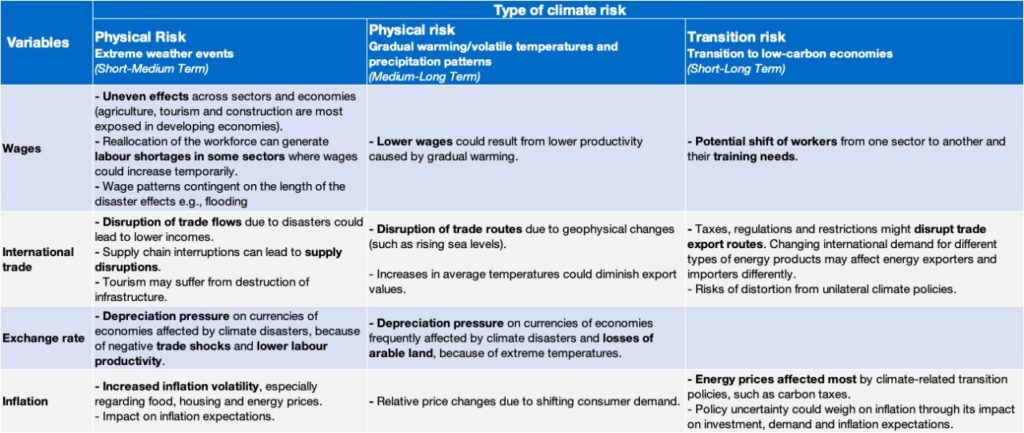

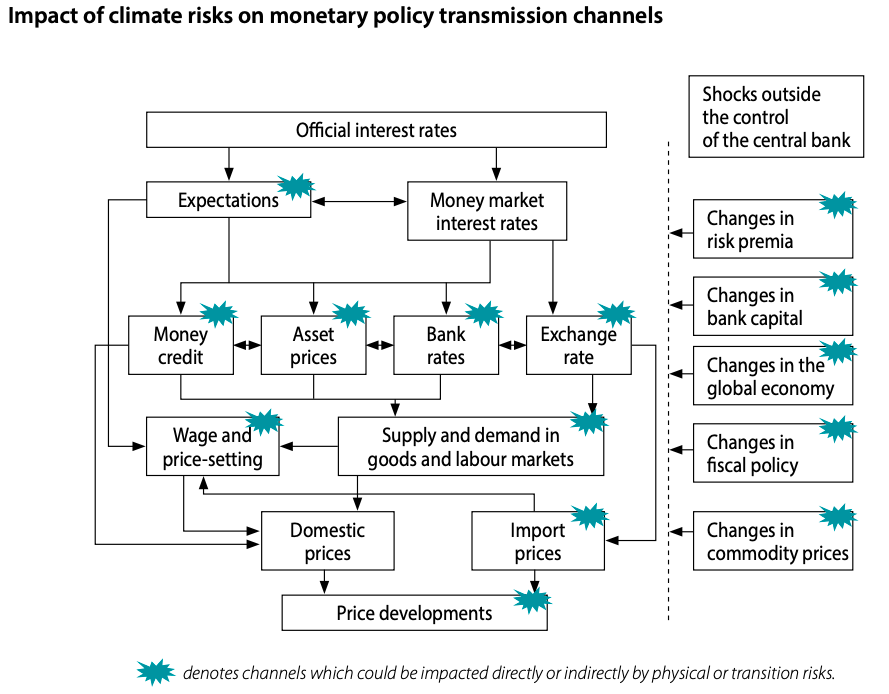

Climate Change has posed both physical and transitions risks for the economy. Physical risks include extreme weather events (like heavy rainfall, having short and medium term impacts) and gradual warming/slow onset events (like desertification, having medium and long term impacts). There are transition risks which include risks/uncertainties associated with transition to low-carbon economies based on green energy resources (like Green Hydrogen) and technologies based on new approaches (like Circular Economy).

These risks will have impact on economic parameters (macroeconomic variables) like output, consumption, investment, employment, wages and inflation among others.

Extreme weather events will destroy crops and infrastructure. Thus the output will decrease in the short term (e.g., rice output is expected to fall in Kharif season 2022). Similarly, in the medium/long term, arable land might reduce due to desertification, reducing the output. It is feared that in the medium-long term, the productivity levels will fall due to higher mortality and health issues due to altered climate patterns.

Climate induced migration will reduce supply of labor in regions impacted by extreme climate change events (like coastal cities at risk of submergence) and increase in regions considered safer. This will impact wages differently in different regions. Wages will have direct impact on demand and thus on consumption, production/output and inflation.

Disruption in supply chains will impact international trade. Sea level rise can impact trade routes as well. Change in energy consumption pattern (shift away from fossil fuels) will alter the trading pattern and trade balance of nations, consequently impacting exchange rates.

Source: Climate Change and Monetary Policy, Network for Greening the Financial System

Hence it is evident that Climate change will have a major impact on macroeconomic variables in future. The resulting changes in the economic systems will make it difficult for the Central Banks to ensure macroeconomic stability in general, and control inflation in particular. Even greater challenge is that it is very difficult to quantify these impacts. There is an expectation that a particular parameter (say wages) may increase or decrease (even that is not very certain), but it very difficult to estimate by how much (5%, 10%, 20% and so on). The lack of clarity will make it difficult to take decide the policy instrument to use (e.g., Repo Rate/CRR/MSF etc.) and the quantum of change (like 5/10/15 basis points or more).

What is the impact of Climate Change on Central Bank’s ability to manoeuvre Monetary Policy?

Climate change events will impact the ability of the Central Banks to carry their mandates of inflation control, ensuring employment and general macroeconomic stability.

First, the underlying reason of climate-induced inflation is supply-side disruptions (supply-side inflation) e.g., fall in production of crops and the resulting food inflation. Monetary policy has limited ability to control supply side inflation. Additionally, faulty policy prescriptions (like raising interest rates) can slow down growth rate of the economy.

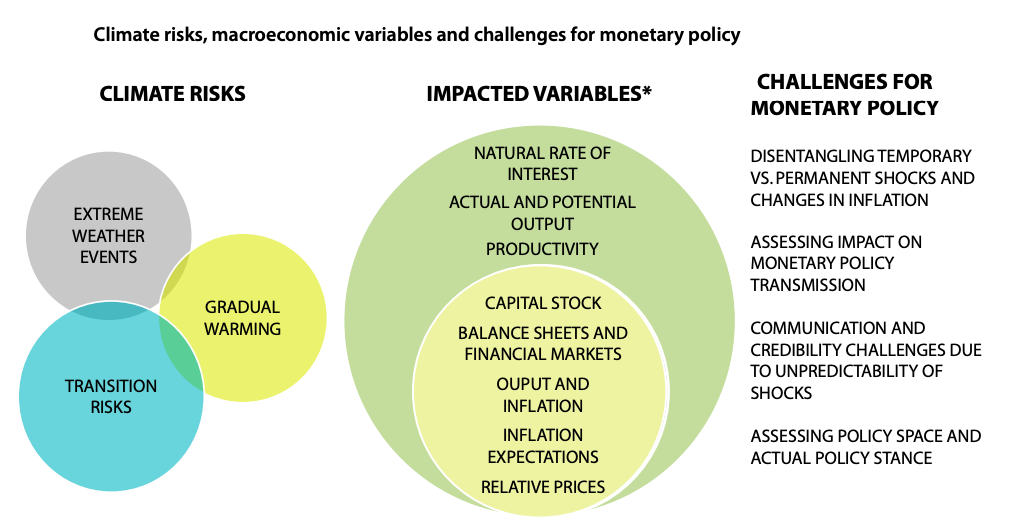

Second, climate change will impact monetary policy transmission. Climate change will affect the balance sheets of financial intermediaries (like Banks) and asset valuations e.g., climate related disasters (and resulting destruction of infrastructure) may force some corporates to go bankrupt thus increasing Non-performing Assets (NPAs). This will negatively impact Banks’ capacity to lend leading to discontinuity in monetary policy transmission. Additionally, some long-term investments (e.g., in coal-based thermal power plants/oil wells/coal mines etc.) may be rendered useless (‘Stranded Assets’) due to transition of economy towards low carbon technologies. This asset revaluation will also constrain Banks’ ability to provide credit to the economy.

Source: Climate Change and Monetary Policy, Network for Greening the Financial System

Third, the effects of climate change could make it harder for monetary policy decisions made by central banks to affect how households and businesses can get money to spend and invest e.g., losses from physical risks may reduce the ability of corporates to invest despite lowering of interest rates by the Central Bank.

Fourth, some economists argue that climate change could lower the natural or equilibrium rate of interest which balances savings and investment. This could further diminish the space for conventional monetary policy e.g., higher temperatures might impair labor productivity or increase rates of morbidity and mortality. Productive resources might be reallocated to support adaptation measures. Climate-related uncertainty may increase precautionary savings and reduce incentives to invest. Collectively, these factors can reduce the real equilibrium interest rate and therefore increase the likelihood that a central bank’s policy rate will be constrained.

| Natural/Equilibrium Rate of Interest The natural rate of interest is also called the neutral interest rate, neutral rate, and the long-run equilibrium interest rate. This interest rate is the theoretical short-term interest rate that would support the economy at maximum output or full employment GDP while keeping inflation constant. The neutral rate is often referred to by Central Banks when making decisions about the Bank Rate. This neutral rate is essentially the dividing line between expansionary and contractionary monetary policy. |

What should be the approach going ahead?

First, There is needs to develop a better understanding of the impact of climate change on the macro economy, like productivity, output, inflation, risks to the financial system and the implications for monetary policy.

Second, the RBI and other Central Banks should update their economic models factoring in climate change. The update models should account for energy transition, and the impact of climate change policies of the Governments. Moreover, since there are inherent uncertainties associated with Climate Change, models must develop scenario analysis for various possibilities.

Third, Central Banks (RBI) should work closely with Market Regulators (SEBI) to develop new framework for enhanced disclosure mechanisms related to climate-related information (e.g., proportion of assets (say factories) located in climate vulnerable regions). This will increase general awareness and understanding of climate risk.

Fourth, Central Banks and Market Regulators should also develop and strengthen in-house risk assessment capabilities of climate-related risk and explore how to incorporate climate change risk in economic models and credit ratings. This would ensure that they reflect all relevant risks arising from climate change.

Fifth, Central Banks should clearly articulate the changes in their monetary policy in context of climate change with the corporate sector, financial markets and the general public. Clear communication is a basic requirement for the success of the Monetary Policy.

Conclusion

There is ample evidence to establish that climate change is a certainty. However, the impact of climate change on macroeconomic parameters in the short to long term are still uncertain and difficult to quantify. This has posed a new challenge to the Central Banks in exercising the monetary policy. Central Banks must step up efforts, undertake further research to understand climate risks and incorporate them into their economic models. A proactive approach will help in better forecasting of risks and consequently a more effective policy response to mitigate the impacts of climate change on the economy.

Syllabus: GS III, Indian Economy; GS III, Environmental Pollution and Degradation.

Source: Indian Express, IMF, European Central Bank, Network for Greening the Financial System