ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 27th May. Click Here for more information.

Source– This post is based on the article “India’s heft in MSCIEM index: what it means” published in “Live mint” on 17th November 2023.

Why in the News?

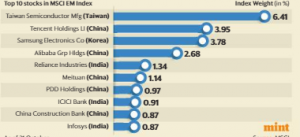

India’s weightage on the MSCI Emerging Markets(EM) index will rise after inclusion of nine Indian stocks.

What is MSCI Emerging Markets Index?

| Aspect | Details |

| What is it? | It is a NYSE(New York Stock Exchange) listed global index that is designed to track the financial performance of key companies in fast-growing nations. |

| Launched by | MSCI Inc., formerly Morgan Stanley Capital International in 1988. |

| Significance | 1. Its stock indices widely tracked by global asset managers, banks, insurance companies, corporates and various other entities to allocate funds across global markets. 2. The MSCI Emerging Markets Index reflects the performance of large-cap and medium-cap companies in 25 nations. 3. It is also used by emerging market Exchange Traded Funds and mutual funds as a benchmark to measure their own performance. |

| How stocks are included? | 1. The stock weight on EM index are based on free float market capitalization(capital available for trade in the stock market). 2. The higher the market capitalization, the higher the weight and the allocation by investors. |

How India performed in the Index?

1. India included in the index in 1994.

2. After inclusion of nine Indian stocks, India’s current representation in MSCI EM index will reached to 131 stocks.

3. India, has the second-highest weightage in the index after China’s.

UPSC Syllabus- Reports & Indices