ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Money and Banking Concepts Simplified

- The Barter system

- What is money?

- Functions of money

- Types of money

- What is Money Supply?

- Money Multiplier (m)

- Monetary system in India

- Credit Creation by a commercial bank

- What is a Digital Currency?

This Article is part of our Prelims Capsules 2021 Initiative, if you want to read more content – Click Here

Introduction

Money and banking are the cornerstones of a strong & effective economic & financial system.

But both money and banking have evolved over centuries to reach where they are today. For a very long time in the past, there was no concept of either of the two.

People simply exchanged commodities with each other i.e. barter system existed. The barter system provided people with a way of acquiring things that they didn’t have.

And until we began producing a surplus, we didn’t feel the need to change anything. Subsistence was enough. But once production attained reasonable levels and due to other inherent problems of the existing barter system people gradually shifted towards a more nuanced concept – money and in time banking system was also invented to further other complex functions.

In fact, the history of the development of money and banking is often interrelated.

In India also we find evidence of loans being given during the Vedic period. In the Mauryan period, an instrument called adesha was in use, which was an order on a banker desiring him to pay the money of the note to a third person, which corresponds to the definition of a bill of exchange as we understand it today.

So, we can see that while the modern money and banking system might seem too big & advanced now but it all began centuries ago with simple exchange of commodities between people.

Let us understand this topic from UPSC’s perspective.

It all begins with the barter system.

The Barter system

As per NCERT,

Exchange of commodities with the mediation of money is called Barter exchange

In earlier times, when there was no concept of money and banking, people used barter system of exchange. They exchanged commodities.

Let us illustrate this with a simple example:

Suppose I want to buy clothes and I have 1 kg apple with me. Now, all I have to do is to find a person who wants apples and has clothes to sell. I’ll approach the person and we both shall finalize a mutually agreeable deal wherein I get what I want (clothes) and the other person gets what he wants (apples). Both parties return home satisfied. This transaction has been successfully done under a barter system

But there are few obvious problems with this system.

Major problems of the Barter system

There are many issues with barter exchange, but here are few major ones:

- Double coincidence of wants: Everyone must find a person who is willing to buy what they are willing to sell and a person who is willing to sell what they want to buy. In the above example, I need to find someone who has surplus clothing to sell and not only this but a person who also wants apples in exchange for clothing.

- Difficult to carry forward wealth: In the above example, I cannot store apples for an indefinite amount of time. They cannot act as a store of wealth like gold or cash can.

- Absence of a standard unit of account: How many apples must I give in return for how much clothing would always be an issue in the above example. There is no standard unit of account.

As we can see above, to facilitate a transaction, a common medium of exchange acceptable to parties involved was necessary. Hence, the concept of money originated.

Now, a person was able to sell apples for money & buy clothes from the money earned. Similarly, the other person was able to sell clothing for money and then buy apples from that money.

Note: Barter system has its advantages too, like in cases of a monetary crisis or hyperinflation when the currency has lost its value, barter system works perfectly as an alternative.

Money and banking is an important topic for UPSC preparation but to understand it fully one must be thorough with underlying concepts, like money, money supply, monetary aggregates, etc.

What is money?

As per NCERT,

Money is the most commonly accepted medium of exchange

- Any object that is generally accepted as means of payment. Currency, in the form of notes or coins, is one type of money

- Do remember that money is not a necessity and our society can exist without it. It acts as a facilitator only.

Functions of money

- It acts as a medium of exchange: Any commodity can be bought through money

- A common measure of value: All commodities have their value that is expressed in terms of money

- Store of value

- Acts as a standard for deferred payments: Future monetary obligations can be settled using money. For example A loan which is taken today is settled in installments.

Types of money

- Full-bodied money

- Token money (paper money/credit money)

- Paper money

- Representative full-bodied paper money

- Inconvertible paper money

- Fiat money

- Legal tender

- Non-legal tender/optional money

- Fiduciary money

- Near money

- Plastic money

- Deposit money

Full-bodied money

- Money whose face value is equivalent to its intrinsic value. Full value is embedded in the currency itself

- Money value = commodity value

- For example; gold currency

Token Money

- Its value as money is much more than its value as a commodity

- Money value > commodity value

As an example, consider the following two coins:

- One coin is of gold and its money value is 1000 Rs (meaning you can buy things worth this much from this coin)

- The second coin is of copper and its money value is 10 Rs

- Now, instead of buying something from the gold coin, if you decide to sell it as a commodity in the market, you’ll still get 1000 Rs because the coin has that much worth of gold inside it i.e., its intrinsic value is 1000 Rs.

- This type of currency is called Full-bodied money

- On the other hand, if you decide to sell Copper coin in the market as a commodity then you’ll not even get 10 Rs because the money value assigned to this copper coin is much more than its actual value in terms of Copper.

- This type of currency is called Token money

- Another example of this type of currency is a paper note. A 500 Rs note is worth very little if you decide to sell it as a commodity in the market (As a commodity it is just a piece of paper with 500 Rs written on it. That paper will be worth nothing)

Paper money

Money made out of paper is termed paper money. It is further divided into two parts:

- Representative full-bodied paper money/convertible money: It is a type of paper money that is issued against an equivalent amount of gold/silver (bullion) by the issuing authority.

- Anyone who holds this type of paper money can go to the central bank and get that converted to an equivalent amount of gold or silver i.e., paper money of this type can be converted to full-bodied money. Hence it is also termed convertible money

- Inconvertible money: This type of paper money cannot be converted to an equivalent amount of gold or silver.

- No obligation on the central bank to convert it

- India currently has token money. RBI has no such obligation to convert representative paper money to an equivalent amount of gold/silver.

Note: Token money is solely based on trust that people have in the government.

- Consider a time in medieval India.

- You live in a kingdom that has its own full-bodied coin system. Coins are made up of gold.

- After one year a new ruler comes who states that he is ending all the previous coins and issuing new coins in his name.

- This is similar to a sudden pan-economic demonetization where every coin is demonetized.

- What will happen to your wealth? You might have had 1000’s coins of the previous regime but now they are useless and you don’t have any means to get them exchanged. There are no banks yet 😀

- Suddenly you have become poor.

- So, foreseeing such circumstances people hoarded coins, melted them, and kept gold or silver instead because the utility of gold or silver was independent of any ruler.

- A lack of trust in the ruling dispensation meant people had no trust in the currency. They hoarded it.

- Slowly when kingdoms went away and democracy came, people developed trust and the countries shifted to a token money system.

Fiat system

- Fiat means order

- It serves as money on the order (fiat) of the government

- This type of money is issued without any backing of an equivalent amount of gold or silver

- There is no obligation on any person to accept this money as a medium of exchange. No legal action can be initiated in this case

Legal tender

It is compulsory to accept this type of money for the settlement of any monetary obligation.

- Legal tender is the money that is recognized by the law of the land, as valid for payment of debt. Similarly, It must be accepted for discharge of debt.

- The RBI Act of 1934, which gives the central bank the sole right to issue banknotes, states that “Every banknote shall be legal tender at any place in India in payment for the amount expressed therein”.

- Hence, the government can issue fiat money and can declare it to be a legal tender

- The coins issued by the Government of India under The Coinage Act, 2011 are legal tender

- The One Rupee notes issued by the Ministry of Finance (Government of India) under the Currency Ordinance, 1940 are legal tender

- Every banknote issued by Reserve Bank of India under RBI Act, 1934 (₹2, ₹5, ₹10, ₹20, ₹50, ₹100, ₹200, ₹500 and ₹2000), unless withdrawn from circulation, is a legal tender

- Did you notice that all coins and 1 Rs note are issued by the government of India while banknotes are issued by RBI!

- Also, coins are issued under Coinage Act while banknotes are issued under RBI Act 1934

Two types of legal tender: –

- Limited legal tender money: It is compulsory to accept this as a means of payment only up to a certain limit. For eg:

- 50 p paise coin cannot be used to make a payment beyond 10 Rs

- Coin >= 1Rs can be used to make a payment of only up to 1000 Rs.

- Unlimited legal tender money: Currency notes are unlimited legal tender and can be offered as payment for dues of any size

Non-legal tender/optional money

- Money which has no legal obligation to being accepted by anyone, like Cheque, Demand Drafts, etc. They are generally used and accepted but no one is legally bound to accept them as a mode of payment.

- This type of money is accepted on the basis of the trust between the payee and the payer.

- For eg: Cheque. You are not bound to accept it legally but when there is trust between you and the person who is making the payment via cheque then you’ll readily accept it as a mode of repayment.

Near money/Quasi money

It refers to highly liquid assets that can be quickly converted into cash. These are generally non-cash assets that are very liquid but cannot be used directly for transactions.

- Near money takes some time to convert to money

- For example, Your fixed deposit account in any bank is a type of near money. It is liquid but still not liquid as cash because you’ll have to go to the bank first, fill in the paperwork to get the cash out from your FD before you can spend it. That’s why it’s near money.

Plastic money

It is used to refer to credit cards, debit cards, etc that we routinely use instead of actual cash.

Deposit money

Money deposited in banks & financial institutions. For example, your saving accounts, fixed deposits, recurring deposits, etc are all different types of deposit money

| Fun fact: The highest denomination note ever printed by the Reserve Bank of India was the ₹10000 note in 1938 which was demonetized in January 1946. The ₹10000 was again introduced in 1954. These notes were demonetized in 1978 |

What is Money Supply?

It is the total stock of all types of money held by the public at any point in time.

- ‘Public’ here signifies all economic entities except the government & banking system because these entities create money.

- Hence, money supply (MS) is,

| MS = Currency + Bank Deposits |

- MS shows the total purchasing power of an economy

There are various ways in which Money Supply is measured. These are called Monetary Aggregates. It is only once the money supply in the entire money and banking system is known that the central bank can take steps to regulate it.

Before explaining monetary aggregates, we should be fully aware of the banking concepts involved.

Types of deposits held by a bank

- Demand Deposits (DD)

- Time Deposits (TD)

- Other Deposits (OD)

Demand Deposits: This money can be withdrawn at any time (on-demand) from the bank. These deposits include:

- Current account

- The demand liability portion of a saving account

These deposits are 100% liquid

Time Deposits: Money can be withdrawn only after maturity or with a penalty before maturity. These include:

- Fixed Deposits

- Recurring Deposits

- Time liability of saving account

Other Deposits: Demand Deposits with RBI which includes demand deposits of public financial institutions, demand deposits of foreign central banks and international financial institutions like IMF, World Bank, etc.

Hence,

Net Bank Deposits = DD + TD

Note: Total bank deposits are different from Net bank deposits. Why? Because banks have other deposits too like the borrowings from RBI

Now, lets take a look at the monetary aggregates:

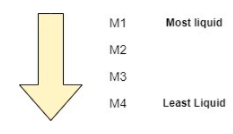

Monetary Aggregates

- M1 (Narrow Money)

- M2 (Narrow Money)

- M3 (Broad Money)

- M4 (Broad Money)

- M0 (Reserve/High-powered money)

M1 (Narrow Money)

- M1 = C + DD + OD

- C – Currency held by public

- DD – Net Demand Deposits with banks (Doesn’t include interbank deposits i.e., deposits which a commercial bank holds in other commercial banks)

- OD – These include Deposits with RBI held by certain individuals (former RBI governors can open an account with RBI) & institutions (IMF etc)

Note:

- For all practical purposes, OD is near about negligible

- Since the money included in M1 is most liquid so it is termed as narrow money

M2 (Narrow Money)

- M2 = M1 + Saving account deposits with Post office banks

- M2 is almost equal to M1 as deposits with Post office banks is not much

M3 (Broad Money)

- M3 = M1 + TD (time deposits with commercial banks like Fixed deposits, Recurring deposits)

- M3 denotes currency and total bank deposits. Therefore, it signifies purchasing power of an economy. In the case of M2 and M4 deposits with Post Office banks are also included. These banks cannot give out loans and purchasing power is equal to the currency held by the public plus loans given out by the banks. So, instead of M2 or M4, we use M3 to show the purchasing power

- M3 is the most commonly used measure of the money supply. It is also known as aggregate monetary resources

M4 (Broad Money)

- M4 = M3 + Total Deposits with Post Office banks (excludes deposits under National Savings Certificate, Kisan Vikas Patra)

Note: For practical purposes, total deposits with Post office banks is very less so M4 is taken almost equal to M3

Rank monetary aggregates in terms of increasing liquidity

- M1

- M2

- M3

- M4

M0 (High-powered money/ Primary money)

- M0 or H

- It is the total stock of all types of currency (notes, coins) held by money held by all types of economic entities (public & banks) at any point of time except the government

- M0 = C + R + OD

- C – Currency in circulation: It is the total value of the currency (coins and paper currency) that has ever been issued by the Reserve Bank of India minus the amount that has been withdrawn by it.

- R – Cash Reserves of banks

- OD – Other Deposits

Note:

- Vault cash is also not a part of the money supply

- Also, M3 > M0 (because M3 includes deposits held by banks while M0 includes cash reserve of the banks and deposits held by a bank is always greater than its cash reserve)

- It is the ratio of money supply (MS) to the reserve money (M0)

- m = MS/M0

Monetary system in India

- India follows the ‘Minimum Reserve System (MRS). This system was adopted in place of proportional Reserve System

- Under MRS, RBI has to maintain reserves of at least 200 Crore in the form of gold & foreign securities.

- Out of these, at least 115 Crore should be maintained in terms of gold

- On the maintenance of these reserves, RBI can print unlimited currency against the backing of gold, foreign securities and securities of GOI

Things against which RBI can print money

- Gold

- Foreign securities

- Securities of GoI (G-sec)

Credit Creation by a commercial bank

So far, we have understood few basic concepts of money and banking. Now, let us understand in the simplest of terms the entire process of credit creation. First of all, let us see what is an asset and what is a liability for a bank.

- Assets: Loans and advances given to anyone are assets for a bank because they generate interest

- The asset is something that generates a cash flow in the future

- Liabilities: Deposits made in the bank are liabilities for the bank because they have to be paid back to the customer

Note: Banks are allowed to engage in fractional reserve banking meaning a fraction of the deposits made in the bank have to be kept as a reserve and the rest can be given out as a loan. This is done to prevent problems to the general public.

- This reserve requirement is done under Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR)

- SRR & CRR together is known as Legal Reserve Ratio (LRR)

Process of credit creation:

With your money and banking fundamentals clear, let’s see how credit creation is actually done by commercial banks.

Here we shall assume that the LRR requirement is 10%

- Consider a person A who has 100 Rs with him. He has not deposited it in the bank yet.

- Thinking that he is not going to spend that money and that his neighbor might try to steal it from him, he decides to deposit that money in a bank.

- He goes to an SBI branch and deposits Rs 100 in a savings account. Satisfied that his money is safe he comes back home happily.

- Step 1: At this point, SBI has a Demand Deposit of 100 Rs with it. It is a liability at this moment.

- It also keeps a reserve of 10 Rs as per the LRR requirement

- So, the loanable amount at this point is 90 Rs, not 100 Rs.

- One day, Mr. B enters the bank and asks for a loan.

- SBI is more than happy to lend money to him. It gives him a loan of 90 Rs but this loan is not given in cash, for the obvious reasons.

- Mr. B has an account in ICICI. SBI transfer this amount to his ICICI account.

- Step 2: Now, ICICI receives 90 Rs as a deposit.

- It keeps 10% i.e., 9 Rs as a reserve and it can now loan 81 Rs further to another customer.

- Step 3: Similarly, ICICI shall loan this amount to Mr C. He deposits 81 Rs in Axis bank.

- Now, Axis bank keeps 10% (8.1 Rs) and can now loan 72.9 Rs as a loan

Did you notice how an initial deposit with SBI went on to create credit in the economy! That’s how credit is created and money gets multiplied in the process. This process of credit creation will go on until the initial deposit of 100 Rs is exhausted.

There is a formula to calculate this.

Money Multiplier = 1 /LRR (For this example: Money Multiplier = 1/0.1 = 10)

Credit Creation = Initial deposit*money multiplier = 100 * 10 = Rs 1000

So, in the above example, the initial deposit was 100 Rs which means credit creation will be equal to 100*1/10% = Rs 1000

Hence, in this case, 100 Rs will generate a credit flow of 1000 Rs in the economy.

PS: No need to remember the formula for credit creation. Given just for your better understanding.

Note: Please remember that here we have assumed that all people will not turn up on the same day to ask for their deposit money. This is termed as a bank run and it happens rarely but if it happens then obviously a bank will not be able to extended loans to anyone.

We hope you are now clear with the basics of money and banking and have a better idea of how the entire system works to benefit society by encouraging transactions and increased credit flow in an economy.

This is an age of rapid technological innovation and adaptation. As a result, the world economic and financial system has grown tremendously and so has the concept of money along with it. Everything is being digitized. It has led us to a point where we now have a digital form of money i.e., a digital currency.

Let us know more about it.

What is a Digital Currency?

Digital currency is any currency that’s available exclusively in electronic form.

- Cryptocurrency is a type of digital currency.

- The majority of currencies in this world are digital. As per an estimate, around 92% of the world’s currency is already in digital form. Only 8% is in cash.

What is a Central Bank Digital Currency (CBDC)?

Following the success of decentralized digital currencies like Bitcoin, Ethereum, etc countries the world over are thinking to introduce their own digital currencies known as Central Bank Digital Currency (CBDC), or national digital currency, in India.

- CBDC is simply the digital form of a country’s fiat currency. Instead of printing paper currency or minting coins, the central bank issues electronic tokens.

- This token value is backed by the full faith and credit of the government.

Note: Please keep in mind that Cryptocurrency (like Bitcoin, Dogecoin etc) is a type of digital currency. They are not same. There are major differences between them.

Cryptocurrency vs Digital currency

Here are some key differences –

- Decentralization: Digital Currencies are centralized meaning they are regulated and issued by a single entity like a central bank.

- Openness: In Cryptocurrencies, one can see all the transactions as the directory (ledger) is kept open. This functionality is an integral feature of blockchain where every block contains information about the previous transaction. In Digital Currencies one would not be able to visualize the entire chain of transactions.

- Legal framework: Most Cryptocurrencies have no legal frameworks while a digital currency is backed by an appropriate legal framework

National Digital Currencies around the world

- According to the Bank for International Settlements, more than 60 countries are currently experimenting with the CBDC. There are few countries that already rolled out their national digital currency. Such as,

- Sweden is conducting real-world trials of its digital currency (krona)

- The Bahamas already issued their digital currency “Sand Dollar” to all citizens.

- China started a trial run of their digital currency e- RMB amid pandemic. They plan to implement pan-china in 2022. This is the first national digital currency operated by a major economy. The e-RMB has no anonymity and requires users to download and register to an app on their smartphone. This centralisation means that the Chinese government would be able to shut down and seize accounts, something that is nearly impossible with the more democratic cryptocurrencies.

National Digital Currency in India

With the growth of digital currencies worldwide, various start-ups dealing with cryptocurrency have come up in India, such as Unocoin in 2013 and Zebpay in 2014. Further, their volatility is a cause of concern for India.

So, the government-appointed SC Garg Committee for suggestions. The committee recommended banning cryptocurrencies and allow an official digital currency. Further, the committee also drafted a bill Banning of Cryptocurrency & Regulation of Official Digital Currency Bill.

PS: Read more about the National Digital Currency issue in this article