ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

The year 2023 has started on an optimistic note. The economy seems to be on the path of recovery post the challenges posed by the COVID-19 pandemic and the Russia-Ukraine War, although global uncertainties remain. The Industrial sector has received much attention especially the role of large businesses in economic recovery. However the Micro, Small and Medium Enterprises (MSME) sector is more crucial as MSMEs are the largest employers in India outside of agriculture. The Union Budget 2023-24 has introduced several enabling provisions for the growth of the MSMEs. However, MSMEs continue to face several challenges. Addressing these challenges can ensure not only faster overall economic growth, but also make the growth process more sustainable and inclusive.

What are the MSMEs?

MSME (Micro, Small, and Medium Enterprise) are regulated under the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006. MSMEs are managed under the Ministry of MSME. Earlier, MSMEs were categorised based on the amount invested in plant and machinery/equipment. With revised regulations effective from July 2020, annual turnover has also been added as a criteria. The classification criteria are: (a) Micro Enterprise: Investment in Plant and Machinery or Equipment is less than INR 1 crore and Annual Turnover is less than INR 5 crore; (b) Small Enterprise: Investment in Plant and Machinery or Equipment is less than INR 10 crore and Annual Turnover is less than INR 50 crore; (c) Medium Enterprise: Investment in Plant and Machinery or Equipment is less than INR 50 crore and Annual Turnover is less than INR 250 crore.

Statutory Bodies: The Ministry of MSME heads 5 statutory bodies

Khadi and Village Industries Commission (KVIC): It is a statutory organisation engaged in promoting and developing khadi and village industries for providing employment opportunities in rural areas, thereby strengthening the rural economy.

The Coir Board: It is a statutory body established for promoting overall development of the coir industry and improving living conditions of workers in the industry.

National Small Industries Corporation Limited (NSIC): It was established in 1955. It is responsible for promoting, aiding and fostering growth of micro and small enterprises in the country, generally on commercial basis.

National Institute for Micro, Small and Medium Enterprises, (NI-MSME): It was established in 1960. It is responsible for enterprise promotion and entrepreneurship development, enabling enterprise creation, performing diagnostic development studies for policy formulation, etc.

Mahatma Gandhi Institute for Rural Industrialisation (MGIRI): The objectives of the Mahatma Gandhi Institute for Rural Industrialisation (MGIRI) are to accelerate rural industrialisation for sustainable village economy, empower traditional artisans, encourage innovation through pilot study and R&D for alternative technology using local resources.

These bodies are responsible for aiding MSMEs with respect to Government schemes and policies.

What is the significance of MSMEs?

Contribution to GDP and Exports: In 2020-21, MSMEs accounted for 26.8% of Gross Value Added (GVA). The contribution of MSMEs in exports stood at 42.6% (April 2022-August 2022).The contribution of Manufacturing MSME Gross Value Added (GVA) contributed 38.4% of India’s total Manufacturing GVA (2020–21).

As Indian economy is poised to reach US$ 5 trillion status, the Ministry of MSME has set a goal of increasing its contribution to GDP to 50% by 2025.

Rural Development: 51% of MSMEs are located in rural areas. In contrast to large corporations, MSMEs have aided in the industrialization of rural areas at a low capital cost. The sector has made significant contributions to the rural socioeconomic growth while also supplementing major industries.

Creation of Employment: MSMEs are India’s largest employer outside of agriculture. They employ over 11.1 crore people, or 45% of all workers, and have low capital and technology requirements. MSMEs are key to the Make in India mission.

Simple Structure: Given India’s middle-class economy, MSMEs offers the flexibility of starting with limited resources under the owner’s control. As a result, making decisions becomes easier and more efficient . A large corporation, on the other hand, requires a specialist for every departmental function due to its complex organisational structure.

Innovation Promotion: They support local resource mobilisation, capacity building, industrial development in rural areas, and give aspiring entrepreneurs a chance to develop innovative products. It has enormous potential for connecting India’s MSME base with large corporations. Multinational corporations are increasingly purchasing semi-finished and auxiliary products from small businesses.

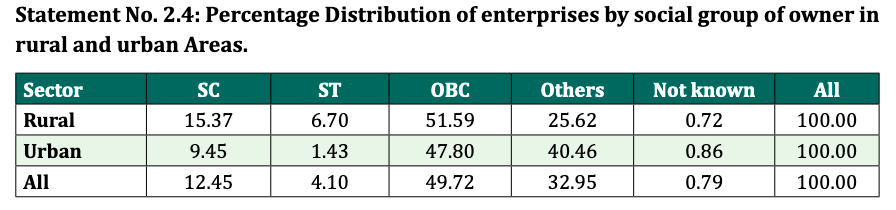

Social Inclusion: According to the Annual Report of The Ministry of MSMEs (2021-22), the socially backward groups owned almost 66.27% of MSMEs. In rural areas, almost 73.67% of MSMEs were owned by socially backward groups.

Source: Annual Report, Ministry of MSMEs (2021-22)

MSMEs can play a significant role in creating an inclusive and sustainable society. They encourage balanced regional development, gender equity, and the use of banking services and products. In light of the information presented above, MSMEs can become the ‘growth engine of the nation‘.

What are the challenges faced by MSMEs?

Financial Constraints: This is a significant impediment for the MSME sector. Only 16% of SMEs have timely access to finance, forcing small and medium-sized businesses to rely on their own resources.

Lack of Formalisation: Almost 86% of the country’s manufacturing MSMEs are unregistered. Only about 1.1 crore of the 6.3 crore MSMEs are registered with the Goods and Services Tax (GST) regime, and the number of income tax filers is even lower. As a result of limited availability and access to data, as well as legacy underwriting methods, the credit requirement of Indian MSMEs’ have largely gone unmet.

Access to Technology: Majority of MSMEs use outdated technology that prevents them from keeping up with the modern world. Adoption of new technology and training employees is difficult and expensive, especially in manufacturing where both physical equipment and software are involved. Lack of access to IT education contributes to the technological gap. Another significant factor is a lack of awareness, which reduces willingness to invest in advanced technology solutions.

Skill Development: Skilled employees are critical for business growth. Multinational corporations (MNCs) recognise this and place on-the-job training at the heart of their operations. Unfortunately, small-scale businesses fail to upskill their workforce, causing them to suffer unknowingly.

Creativity: Businesses are becoming more knowledge-based, and their success and survival are inextricably linked to their creativity, and innovation. To remain competitive, MSMEs must learn and incorporate the process of innovation into their daily operations. However, they lack the resources and capacity to undertake innovations.

Competition: Because of increased competition, Indian MSMEs are finding it difficult to sell their products in both domestic and international markets. Small-scale enterprises face stiff competition from global counterparts as well as domestic giants due to their massive scale of operation (large corporations). While the government does provide protection for such small-scale businesses, competition remains largely one-sided.

Red-Tapism: MSMEs require various approvals and entrepreneurs are forced to navigate various government departments in order to obtain construction permits, enforce contracts, pay taxes, start a business, and trade across borders. In addition, regulatory risks and policy uncertainty limit scaling-up of MSMEs.

What steps have been taken to support MSMEs?

Credit and Financial

Prime Minister’s Employment Generation Programme: The scheme, implemented by the KVIC, aims to generate employment opportunities in rural and urban areas by setting up new self-employment ventures/projects/micro enterprises. The programme also aims to provide continuous sustainable employment to prospective artisans and unemployed youth and increase the wage-earning capacity of artisans and contribute to the growth of rural and urban employment.

Credit Linked Capital Subsidy Scheme: Its objective is to facilitate technology upgrade among MSEs (Micro and Small) by providing capital subsidy of 15% (on institutional finance of up-to Rs 1 crore availed by them) for induction of well-established and improved technology in the specified 51 sub-sectors/products.

Credit Guarantee Trust Fund for Micro and Small Enterprises (CGTMSE): It provides collateral-free credit to the micro and small enterprise sector.

Special Credit Linked Capital Subsidy Scheme (SCLCSS): This scheme will help enterprises in the services sector meet various technology requirements. It also has a provision to grant 25% capital subsidy for procurement of plant & machinery and service equipments through institutional credit to MSMEs owned by SC/ST entrepreneurs without any sector specific restrictions on technology upgradation.

Raising and Accelerating MSME Performance (RAMP): The scheme aims at strengthening institutions and governance at the Centre and State, improving Centre-State linkages and partnerships and improving access of MSMEs to market and credit, technology upgradation and addressing issues of delayed payments and greening of MSMEs..

Mudra Loan Scheme: It was launched in April, 2015 for providing loans up to INR 10 lakh to the non-corporate, non-farm small/micro enterprises. It encompasses 3 financing loans: Tarun (loans up to INR 10 Lakhs), Kishore (loan up to INR 5 Lakhs), Shishu (loan up to INR 50,000).

Skill Development and Training

A Scheme for Promotion of Innovation, Rural Industry & Entrepreneurship (ASPIRE): The objectives of this scheme are to create new jobs, promote entrepreneurship culture in the country, promote innovation in the MSME sector.

Entrepreneurship and Skill Development Programmes (ESDP): Under this, the Ministry of MSME has been organising several programmes focussing on the process of improving skills and knowledge of entrepreneur, and enhancing the capacity to develop, manage and organise a business venture.

Infrastructure

Scheme of Fund for Regeneration of Traditional Industries (SFURTI): The objectives are to organise traditional industries and artisans into clusters to make them competitive and provide support for their long-term sustainability, enhance marketability of products of such clusters, build innovative products, improve technologies etc. The scheme cover three types of interventions, e.g., soft intervention wherein activities are held to build general awareness, counselling, skill development, etc.; hard intervention which includes creating common facility centers, raw material banks, etc.; and thematic intervention on brand building, new media marketing, e-commerce initiatives, research and development, etc.

Scheme for Micro & Small Enterprises Cluster Development Programme (MSE-CDP): The Ministry of MSME has adopted the cluster development approach as a key strategy for enhancing productivity and competitiveness as well as capacity building of Micro and Small Enterprises (MSEs). The programme includes activities such as support funding for setting up Common Facility Centres (CFC) and Infrastructure Development Projects (IDP).

Technology Upgrade and Competitiveness

Financial Support to MSMEs in ZED Certification: The scheme promotes Zero Defect and Zero Effect (ZED) manufacturing among MSMEs. It provides ZED Assessment for their certification to encourage MSMEs to constantly upgrade their quality standards in products and processes, promote adaptation of quality tools/systems and energy-efficient manufacturing, and drive manufacturing by adopting the Zero Defect production processes and without impacting the environment.

Support for Entrepreneurial and Managerial Development of SMEs through Incubators: The objective of the scheme is to promote and support the creativity of MSME enterprises and encourage adoption of the latest technologies in manufacturing as well as knowledge-based innovative MSMEs.

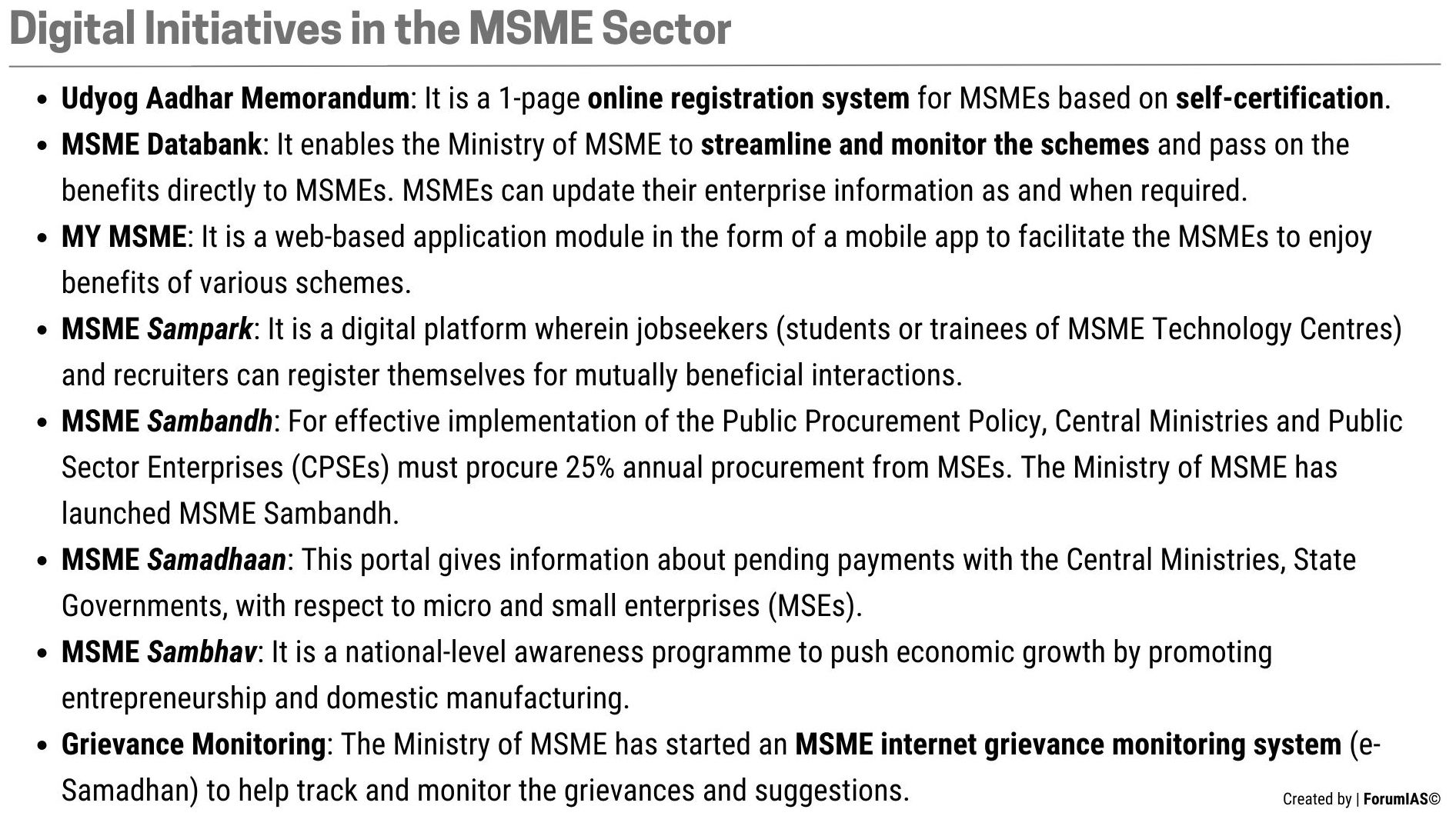

Digitalisation: Government initiatives such as the Digital Saksham and the interlinking of the Udyam, e-Shram, National Career Service (NCS), and Atmanirbhar Skilled Employee-Employer Mapping (ASEEM) portals show the promise of targeted digitalisation schemes.

Services

Building Awareness on Intellectual Property Rights (IPR) for MSMEs: It has been launched to promote awareness about IPRs among MSMEs by assisting them in technology upgrade and enhancing competitiveness and effective utilisation of IPR tools.

Trade, Import and Export for MSMEs: MSME support and development organisation, National Small Industries Corporation (NSIC), will assist MSMEs working with the Agricultural and Processed Food Products Export Development Authority (APEDA) across multiple areas. APEDA members will get access to NSIC schemes, which would help them address issues pertaining to technology adoption, skills, product quality and market access.

Miscellaneous

In June 2022, the Union Government announced a new initiative called ‘Promotion of MSMEs in North Eastern Region and Sikkim‘. Its main purpose is to stimulate MSMEs in the North East by establishing mini-technological centres, developing new and existing industrial estates, and promoting tourism.

In November 2021, NITI Aayog released a discussion paper to introduce new financial entities called ‘Digital Banks‘ that would fundamentally aim to bridge the current credit gap among India’s MSMEs and get them into the formal financial fold.

Support by Private Sector

The Small Industries Development Bank of India (SIDBI) has inked a pact with Google to pilot social impact lending with financial assistance up to INR 1 crore at subsidised interest rates to micro enterprises. To reinvigorate the Indian MSME sector, Google India Pvt. Ltd. GIPL, will bring a corpus of US$ 15 million for micro enterprises as a crisis response related to COVID-19.

Digital freight forwarder Freightwalla, launched a shipment tracking service for MSME exporters and importers based on predictive analytics to help businesses tackle risks associated with shipment delays and improve supply chain efficiency.

Bombay Stock Exchange (BSE) announced that it has collaborated with the All-India MSME Association (AIMA MSME) to encourage and promote the listing of MSMEs and start-ups.

Meta India has announced the launch of online resource centre ‘Grow Your Business Hub‘, to help MSMEs find relevant information, tools and solutions curated to cater to their business goals.

What more should be done to support MSMEs?

First, There is a need to push for for Digitisation of MSMEs. Owing to problems like the dearth of proper infrastructure, finance, and limited knowledge, the MSME sector has been slow in going digital. Digitising the sector could help in enhancing efficiency and reliability, cutting costs, and keeping up with latest technological trends.

Second, The National Logistics Policy can also be used to boost the competitiveness of MSMEs. The NLP aims to reduce logistics costs as a percentage of GDP from 13-14 percent to 8%, putting the country on par with developed nations. While lower costs will encourage more MSMEs to use logistics services powered by technology.

Third, with the advent of online e-commerce platforms, MSMEs have got access to a channel to expand their markets. However, to meet the growing demand for e-commerce in suburban and rural areas, they will require assistance. To that end, the Government could enlist India Post as a technologically advanced last-mile delivery partner capable of facilitating cash-on-delivery transactions at competitive rates.

Fourth, similarly, the unparalleled reach of Indian Railways can be leveraged to quickly and cost-effectively ship goods to the most remote parts of the country. This can expand the reach of products manufactured by MSMEs.

Conclusion

MSMEs can play a vital role in growth of the economy as India enters the Amrit Kaal phase. They can help in inclusive and balanced development and make India a global manufacturing hub. The Government has been supporting the MSMEs through various initiatives, the need is to focus on the implementation and realizing the outcomes.

Syllabus: GS III, Indian Economy; GS III, Changes in Industrial Policy and their effects on industrial growth.

Source: Indian Express, The Hindu, IBEF, PIB