ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

Contents

- 1 Introduction

- 2 About Mudra Scheme

- 3 What is the need for Mudra Scheme?

- 4 What is the performance of the Mudra Scheme?

- 5 What are the challenges associated with Mudra Scheme highlighted by experts?

- 6 What are the advantages associated with Mudra Scheme?

- 7 What should be done to take this scheme to new highs?

| For 7PM Editorial Archives click HERE → |

Introduction

The Pradhan Mantri Mudra Yojana (PMMY) was launched by the Indian government eight years ago to provide financial support and encourage self-employment among micro and small-sized enterprises. These businesses make up a significant part of India’s economy and the scheme has played a crucial role in empowering individuals and supporting their growth. However, despite its success, the PMMY still faces some challenges that need to be addressed.

About Mudra Scheme

| Read here: Cabinet approves 2% interest subvention for Shishu-Mudra loans |

What is the need for Mudra Scheme?

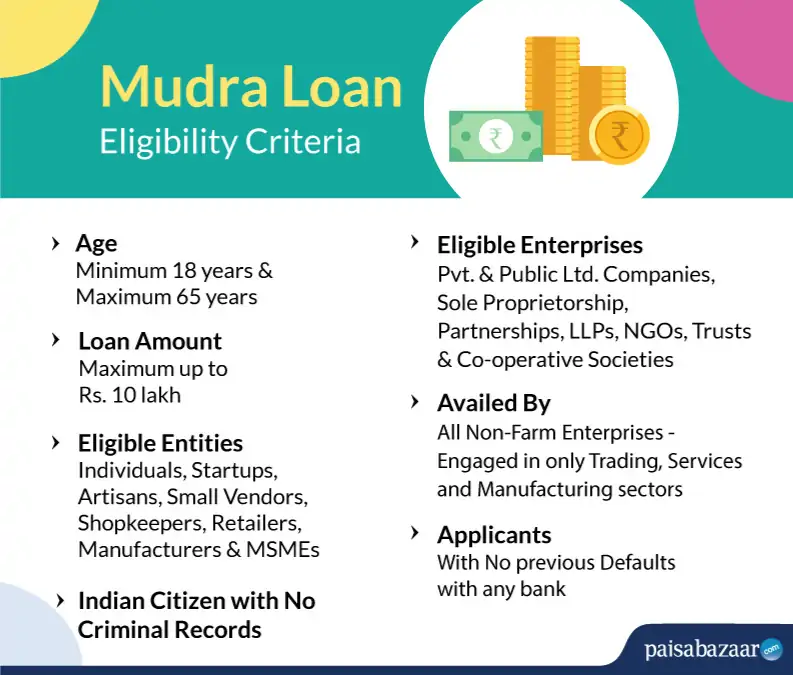

Lack of access to formal credit: Many small businesses and entrepreneurs in India face challenges in accessing credit from formal financial institutions due to factors such as lack of collateral or credit history. The Mudra Scheme aims to address this issue by providing collateral-free loans to small businesses and first-time borrowers.

Financial exclusion: Many individuals in India, particularly those in rural or underserved areas, lack access to formal financial institutions. The Mudra Scheme can help promote financial inclusion by providing loans to individuals and businesses who may not have access to traditional sources of credit.

Unemployment: Small businesses are a significant source of employment in India, but many struggle to grow and create jobs due to a lack of access to credit. The Mudra Scheme can potentially help address this issue by providing loans to small businesses, enabling them to invest in their businesses and create more jobs.

Gender inequality: Women entrepreneurs often face significant challenges in accessing credit in India due to factors such as lack of collateral or social norms. The Mudra Scheme has a special focus on supporting women entrepreneurs, providing collateral-free loans and promoting greater gender equality in the economy.

Lack of collateral: Many small businesses and entrepreneurs may not have sufficient collateral to secure loans, making it difficult for them to access loans. This issue can be addressed by mudra Scheme

Economic growth: Small businesses are a key driver of economic growth and innovation, but many struggle to access the capital they need to grow and expand. The Mudra Scheme aims to encourage entrepreneurship and innovation by providing loans to first-time borrowers and start-ups, enabling them to pursue their business ideas and contribute to the economy.

What is the performance of the Mudra Scheme?

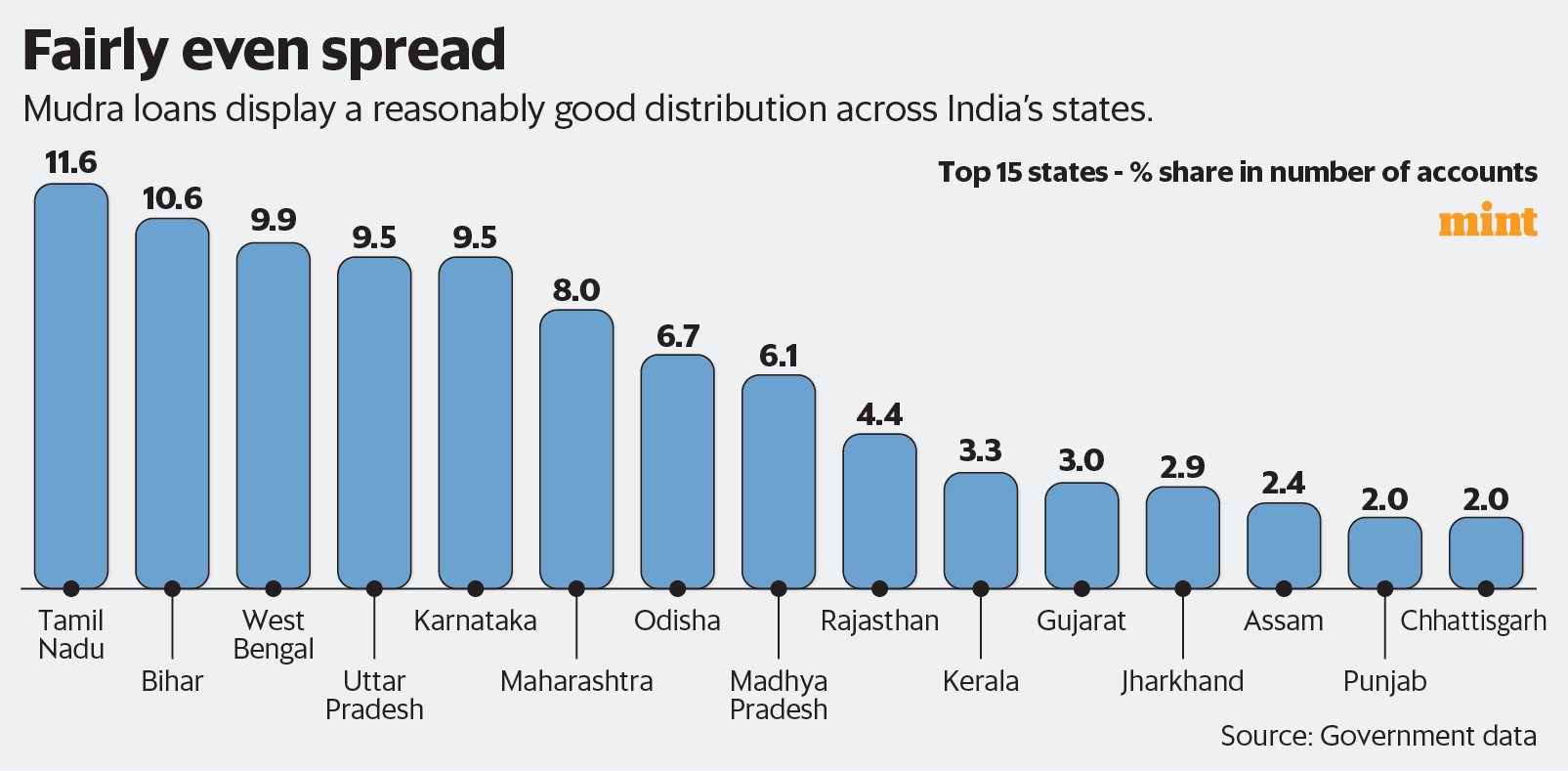

According to the government, approximately 40.82 crores in loans totalling $23.2 trillion have been sanctioned under the Pradhan Mantri Mudra Yojana (PMMY) since its start eight years ago.

About 68% of accounts under the scheme belong to women entrepreneurs and 51% of accounts belong to entrepreneurs of SC, ST and OBC categories.

The average ticket size for Mudra loans obtained by customers from banks and other financial institutions is less than Rs 50,000. The share of Shishu loans is the highest, at 40%, suggesting that the PMMY has largely supported first-time entrepreneurs.

| Must Read: Pradhan Mantri Mudra Yojana: Credit saturation for livelihoods |

What are the challenges associated with Mudra Scheme highlighted by experts?

While the scheme has been successful in providing loans to a large number of beneficiaries, there have been some challenges associated with it. Some of the challenges highlighted by experts include:

Targeting beneficiaries: One of the key challenges of the Mudra Scheme is the targeting of beneficiaries. There is a concern that the benefits of the scheme are not reaching the intended target group, which are small and micro enterprises, especially those run by women, SC/ST, and other marginalized communities.

Non-performing assets (NPAs): There is a concern that the Mudra Scheme may lead to a rise in non-performing assets (NPAs) in the banking system as the scheme offers collateral-free loans to small and micro enterprises. This can lead to a high default rate and NPAs.

For example, In July 2019, the RBI blamed the poor credit appraisal system of banks for rising bad debts. The biggest bad loans (12.39 per cent) were in the smallest loan category (under ₹50,000).

Lack of financial literacy: Many of the beneficiaries of the Mudra Scheme are first-time borrowers, and they may not have the necessary financial literacy to manage their loans effectively. This can lead to defaults and NPAs.

Inadequate monitoring: Experts have pointed out that there is inadequate monitoring of the implementation of the Mudra Scheme. This can lead to leakages and misuse of funds, which can undermine the effectiveness of the scheme.

Lack of credit guarantee: The Mudra Scheme does not provide credit guarantee to the banks that lend under the scheme. This can lead to a reluctance among banks to lend to small and micro enterprises.

| Read More: Reserve Bank flags rising bad assets from Mudra loans |

What are the advantages associated with Mudra Scheme?

The advantages associated with the Mudra Scheme, including:

Access to credit: The Mudra Scheme provides collateral-free loans to small businesses and first-time borrowers, enabling them to access credit that they may not have been able to obtain from traditional financial institutions. This can help spur entrepreneurship and innovation, and create more jobs in the economy.

Financial inclusion: The Scheme promotes financial inclusion by providing loans to individuals and businesses who may not have had access to formal financial institutions. This can help in reducing inequality and promote economic growth.

Special focus on marginalized groups: The Mudra Scheme has a special focus on supporting borrowers from marginalized communities such as SC/ST and OBC, as well as women entrepreneurs. By providing loans to these underserved populations, the scheme promotes greater inclusion and reduces inequality.

Promoting entrepreneurship: By providing loans to first-time borrowers and start-ups, the Mudra Scheme encourages entrepreneurship and innovation, which can create new jobs, boost economic growth, and improve the overall business environment in the country.

Low-interest rates: The Mudra Scheme offers loans at relatively low interest rates, making credit more affordable for small businesses and first-time borrowers.

Flexible loan options: The Mudra Scheme offers a range of loan products to suit the needs of different types of borrowers, including micro-enterprises, small businesses, and start-ups. This can ensure that borrowers are able to access the financing they need to pursue their business goals.

What should be done to take this scheme to new highs?

Increase awareness: Many small businesses and entrepreneurs in India may not be aware of the Mudra Scheme or how to access it. Increasing awareness through targeted marketing campaigns and outreach programs can help more people benefit from the scheme.

Simplify the application process: The application process for the scheme can be complex and time-consuming. Simplifying the process and reducing the documentation requirements can make it easier for small businesses to apply for loans and access the funds they need.

Strengthen monitoring and evaluation: Monitoring and evaluation are critical to ensuring that the Mudra Scheme is achieving its goals and reaching the target beneficiaries. Strengthening these processes can identify any issues or challenges and address them in a timely manner.

Expand the network of lending institutions: Currently, the scheme is primarily implemented through public sector banks. Expanding the network of lending institutions, including private banks and microfinance institutions, can increase access to credit and promote competition in the market.

Provide additional support services: In addition to providing loans, the Mudra Scheme could provide additional support services such as business training and mentorship programs to help small businesses succeed and grow.

Increase loan amount: The scheme can consider increasing the loan amount for borrowers, especially those who have a good track record of repayment. This can help businesses access larger amounts of credit and invest in their growth and expansion.

Harnessing the power of technology: By doing so, the Mudra Scheme can improve its efficiency, reduce the risk of fraud, and reach a wider audience of potential borrowers. For example, better utilisation of 5G technology and e-commerce would be helpful in this regard.

Sources: The Hindu (Article 1 and Article 2), Livemint (Article 1 and Article 2), Business Standard, Economic Times and AIR

Syllabus: GS 2: Social Justice – Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes