ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

Source: The post is based on the article “Over 7% Indians own digital currency; 7th highest in the world” published in Livemint on 12th August 2022.

What is the News?

UNCTAD has released three policy briefs focuses on the implications of cryptocurrencies for the stability and security of monetary systems, and financial stability.

What are the key highlights from these reports?

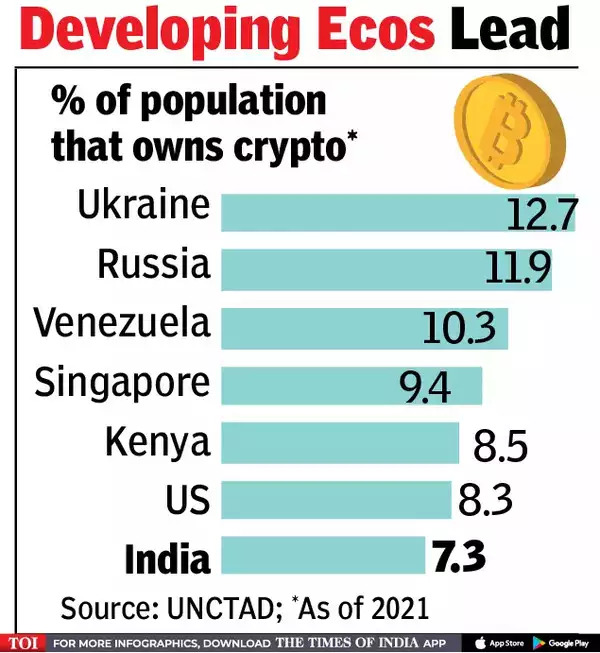

Globally: Ukraine topped the list of countries with cryptocurrencies at 12.7%. It was followed by Russia (11.9%), Venezuela (10.3%), Singapore (9.4%), Kenya (8.5%) and the US (8.3%).

– Global use of cryptocurrencies has increased exponentially during the COVID-19 pandemic, including in developing countries.

– In 2021, developing countries accounted for 15 of the top 20 economies when it comes to the share of the population that owns cryptocurrencies.

India: Over 7% of India’s population owns digital currency in 2021.

– India ranked seventh in the list of top 20 global economies for digital currency ownership as a share of the population.

What are the risks of cryptocurrencies?

Firstly, if cryptocurrencies become widespread means they can even replace domestic currencies unofficially (a process called cryptoization), and this could jeopardize the monetary sovereignty of countries.

Secondly, while cryptocurrencies can facilitate remittances, they may also enable tax evasion and avoidance through illicit flows of funds to a tax haven where ownership is not easily identifiable.

What are the measures suggested by the report?

1) Ensure comprehensive financial regulation of cryptocurrencies through regulating crypto exchanges, digital wallets and decentralized finance. 2) Restrict advertisements related to cryptocurrencies as for other high-risk financial assets. 3) Provide a safe, reliable and affordable public payment system adapted to the digital era. 4) Agree and implement global tax coordination regarding cryptocurrency tax treatments, regulation and information sharing. 5) Redesign capital controls to take account of the decentralized, borderless and pseudonymous features of cryptocurrencies.