ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

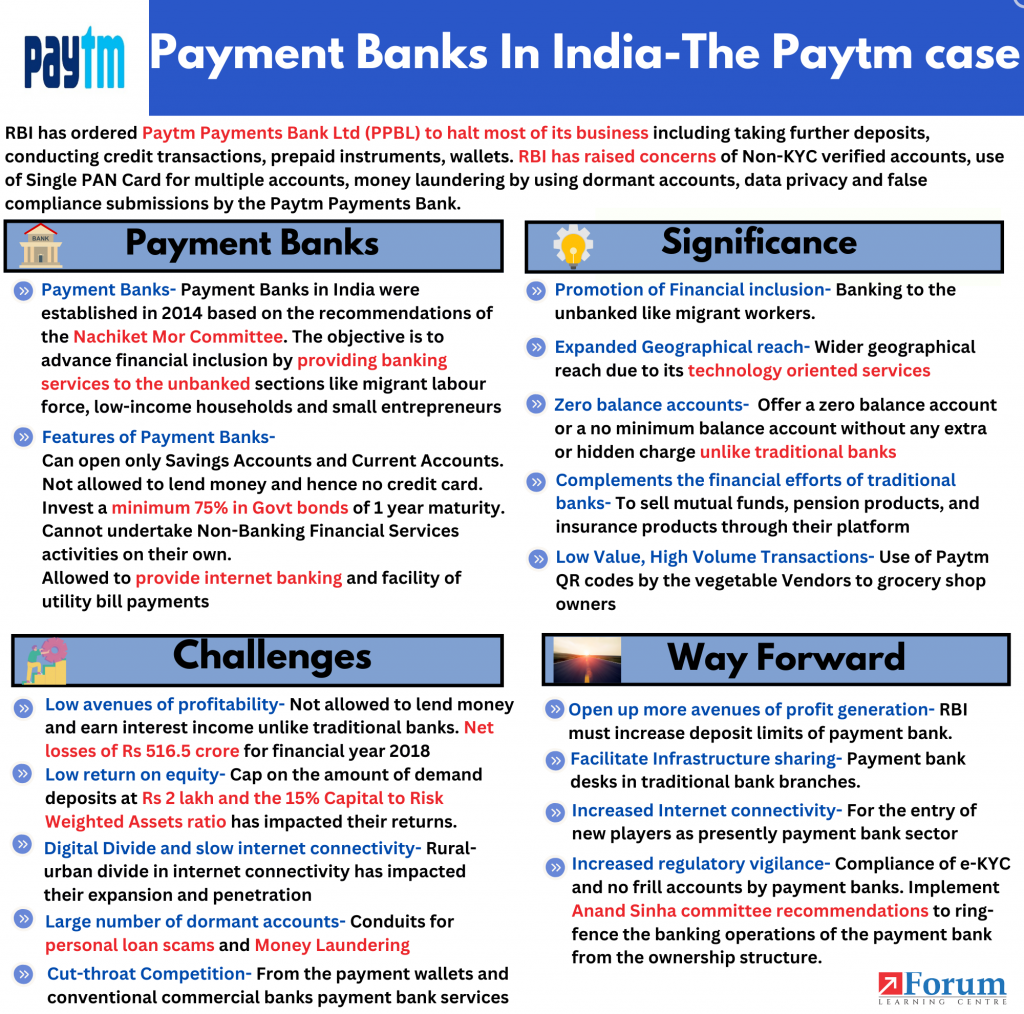

The recent case of RBI’s crackdown on Paytm has put the spotlight on the operations of Payment Banks In India. RBI has ordered Paytm Payments Bank Ltd (PPBL) to halt most of its business including taking further deposits, conducting credit transactions and carrying out top-ups on any customer accounts, prepaid instruments, wallets, and cards for paying road tolls after February 29, 2024.

Reasons for RBI Clampdown on Paytm payments Bank

| 1. Non-KYC accounts- Existence of Lakhs of non-KYC (Know Your Customer) compliant accounts. 2. Use of Single PAN Card- A single PAN was used to open multiple accounts in thousand of cases. 3. Money Laundering concerns- The total value of transactions in some accounts ran into crores of rupees, which was beyond the regulatory limits in minimum KYC pre-paid instruments. 4. High number of Dormant Accounts- Out of the 35 crore Paytm wallet Accounts, 31 crore accounts were found to be dormant. These dormant accounts were used as mule accounts and for committing digital frauds. 5. Data Privacy Concerns- Paytm bank’s dependence on its parent entity one97 communications limited (OCL) for IT infrastructure raised data privacy concerns. 6. False Compliance Submissions- The compliances submitted by Paytm to the RBI were found to be incomplete and false on many occasions. |

| Table of Contents |

| What are Payment Banks? What are their features? What is the significance of these Banks for India? What are the Challenges with payment Banks in India? What should be the Way Forward? |

What are Payment Banks? What are their features?

Historical Background- Payment Banks in India were established in 2014 based on the recommendations of the Nachiket Mor Committee. It was set up to operate on a smaller scale with minimal credit risk.

Objective- The main objective is to advance financial inclusion by offering banking and financial services to the unbanked and under-banked areas. It also caters to the needs of uncovered masses in the banking sector like the migrant labour force, low-income households and small entrepreneurs.

Legal Provisions- The legal provisions governing the payment banking operations in India are mentioned below-

a. These banks have to register as a Public Limited Company under the Companies Act 2013 and obtain licence as per Banking Regulation Act 1949. They are also regulated by the RBI Act 1934, Foreign Exchange Management Act 1999 and Payment and Settlement Systems Act, 2007.

b. The minimum capital requirement is 100 crores. For the first five years, the stake of promoters should not be less than 40%. Foreign shareholdings will also be allowed as per FDI

rules for private banks in India.

c. The voting right of the shareholder is capped to 10% and which can be raised to 26% from the approval of Reserve Bank of India. The banks should be fully networked from the beginning.

Features- These Banks have several distinct features when compared to the conventional Banks. These are mentioned below-

| Type of Accounts | 1. The payment bank can open only Savings Bank Accounts and Current Accounts. 2. The maximum balance of deposit they can have in their account is only Rs 2,00,000 (Earlier it was only Rs 1,00,000). 3. However, these cannot accept deposits from Non-resident Indians. |

| Lack of lending power | 1. These are not allowed to lend money or lending services. 2. They are allowed to issue ATM or Debit cards to its customers. But these banks are not allowed to issue credit cards. |

| CRR requirements | Payments banks have to deposit Cash Reserve Ratio (CRR) with RBI, just like other commercial banks. |

| SLR Requirements | 1. They are required to invest a minimum 75% of its “demand deposit balances” in Statutory Liquidity Ratio (SLR) eligible Government securities/treasury bills with maturity up to one year. 2. Further, they can hold a maximum of 25% of their “demand deposit balances” in currents and fixed deposits with other commercial banks for operational purposes. |

| Lack of NBFC functions | 1. These banks are not allowed to open subsidiaries to undertake Non-Banking Financial Services activities. 2. However, with the approval from RBI, payment bank can work as a partner with other commercial banks to sell mutual funds, pension products, and insurance products. |

| Other Functions | 1. These banks are allowed to provide internet banking and mobile banking facility to their customers. 2. They can provide the facility of utility bill payments to its customers and the general public. 3. The payments banks can accept remittances to be sent to or receive remittances from multiple banks through payment mechanism approved by RBI, such as RTGS / NEFT / IMPS. |

Payment Banks operating in India- Currently only 6 banks are operating in the country- Airtel Payments Bank Limited, India Post Payments Bank Limited, Fino Payments Bank Limited, Paytm Payments Bank Limited, NSDL Payments Bank Limited and Jio Payments Bank Limited.

| Read More- Restrictions on Paytm Payments Bank |

What is The Significance of these Banks for India?

1. Promotion of Financial inclusion- These banks have promoted financial inclusion by catering to financial services to the unbanked sections of the society like migrant workers, low-income households and small scale entrepreneurs.

2. Expanded Geographical reach- These banks have a wider geographical reach due to its technology oriented services, unlike traditional banks whose geographical outreach is constrained by the requirements of physical infrastructure.

3. Zero balance accounts and No minimum balance accounts- These banks offer a zero balance account or a no minimum balance account without any extra or hidden charge, unlike a commercial bank who levy charges if the customer doesn’t hold a minimum balance in their account.

4. Complements the financial efforts of traditional banks- Payments banks complement the financial efforts of traditional banks by partnering to sell mutual funds, pension products, and insurance products through their platform. For ex- SBI Life Insurance product through Paytm.

5. Low Value, High Volume Transactions- They have provided effective infrastructure to deal with low value, high volume transactions. For Ex- Use of Paytm QR codes by the vegetable Vendors to grocery shop owners.

6. Higher rates of Interest- The rates of interest being offered by these banks is higher in comparison to the traditional banks. For Ex- ROI of Payment Bank is generally around 7% whereas as ROI of commercial bank ~3.5 and 6 per cent.

What are The Challenges with Payment Banks in India?

1. Low avenues of profitability- These banks are not allowed to lend money and earn interest income unlike traditional banks. Further, the stringent SLR requirements of 75% demand liabilities to be invested in G-secs have impinged on the avenues of profitability of these banks. For ex- The operational payments banks showed net losses of Rs 516.5crore for financial year 2018.

2. Low return on equity- The cap on the amount of demand deposits at Rs 2,00,000 and the 15% capital to Risk Weighted Assets ratio, has severely impacted the returns on equities of payment bank in India. Their return on equity is less than 5%.

3. Digital Divide and slow internet connectivity- These banks have no physical presence and their banking operations are solely reliant on internet connectivity. However, the rural-urban divide in internet connectivity has impacted their expansion and penetration.

4. Large number of dormant accounts- The large number of dormant zero balance accounts have impacted the operations of payment bank in India. They have also been used as conduits for personal loan scams and Money Laundering. For ex- Out of the 35 crore Paytm payment bank accounts, 31 cr remained dormant and were misused.

5. Cut-throat Competition- These banks are facing cut-throat competition from the payment wallets like Phone pe, Bharat Pe and conventional commercial banks payment bank services like SBI yono, ICICI i mobile pay.

6. Increasing number of Defunct Payment Bank- The over-regulated functioning and huge losses, have led to increase in the number of banks surrendering their licences and halting their operations. For ex- Cholamandalam Distribution Services, Sun Pharmaceuticals, Tech Mahindra and Aditya Birla Payment Bank have surrendered their licences.

Read More UPSC Topics-

What Should be The Way Forward?

1. Open up more avenues of profit generation- RBI must increase deposit limits of payment bank. Also, a mechanism must be worked out to let these banks transfer the surplus money in the demand deposit accounts to the universal banks.

2. Facilitate Infrastructure sharing- RBI should take measure to facilitate infrastructure sharing among the traditional banks and Payment Bank. For ex- Payment bank desks in traditional bank branches.

3. Increased Internet connectivity- The internet connectivity in rural areas must be increased for the entry of new players in the payment bank market as payment bank sector is dominated by telecom giants like Airtel and Jio which have their own network.

4. Increase the scope of operations- The payment bank should be allowed to offer their own mutual fund and insurance products to enhance their source of revenue generation and profitability.

5. Increase regulatory vigilance- The compliance of e-KYC and no frill accounts must be regularly undertaken by the RBI to prevent future crisis like the Paytm crisis. The recommendations of the Anand Sinha committee must be implemented to ring-fence the banking operations of the payment bank from the ownership structure.

| Read More- Livemint UPSC Syllabus- GS 3- Indian Economy (Banking Sector Challenges) |