ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

- 1 Introduction

- 2 What is the current status of State Finances?

- 3 What are the reasons for the fiscal deterioration in these States?

- 4 What are the risks highlighted by RBI to State Government Finances?

- 5 What are the implications of the poor state of State Finances?

- 6 What steps have already been taken for improving States’ Finances?

- 7 What recommendations have been given by RBI to improve State Finances?

- 8 What more can be done?

- 9 Conclusion

| For 7PM Editorial Archives click HERE → |

Introduction

A prudent fiscal position is necessary for overall development of a State and its people. However many recent studies have pointed out the deteriorating fiscal position of many States in India. This situation is a result of multiple factors like the impact of COVID-19 on State finances, high revenue expenditure and the rising freebie culture. Therefore a judicious expenditure mechanism needs to be created along with other steps so as to ensure that the States’ Fiscal Deficits do not reach unsustainable levels.

What is the current status of State Finances?

According to a recent RBI study, 10 states have a significantly high debt burden. These include Punjab, Rajasthan, Kerala, West Bengal, Bihar, Andhra Pradesh, Jharkhand, Madhya Pradesh, Uttar Pradesh and Haryana. These 10 states account for around half of the total expenditure by all State governments in India.

Among the 10 states, Andhra Pradesh, Bihar, Rajasthan and Punjab exceeded both debt and fiscal deficit targets for 2020-21 set by the 15th Finance Commission.

Further, Punjab’s debt-GSDP ratio is projected to exceed 45% in 2026-27. Rajasthan, Kerala and West Bengal are projected to exceed the debt-GSDP ratio of 35% by 2026-27.

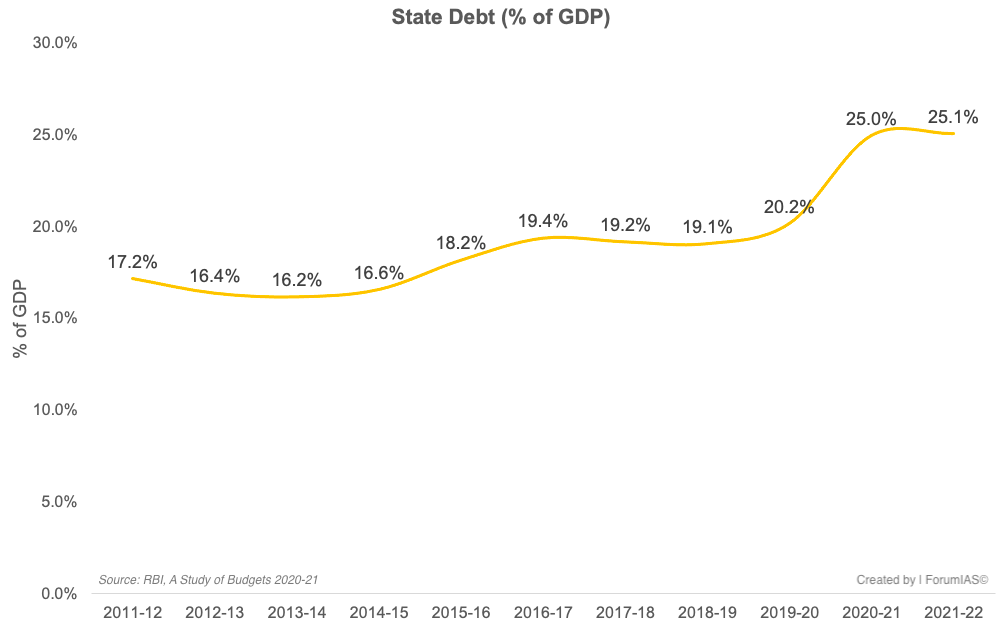

The cumulative debt of States has risen from 19.1% in 2018-19 to 25.1% in 2021-22.

Source: RBI. The cumulative State Debt Levels have seen a big jump from 2019-20 onward, with debt levels rising from ~20% of GDP to 25%. Many States have debt level >30%.

What are the reasons for the fiscal deterioration in these States?

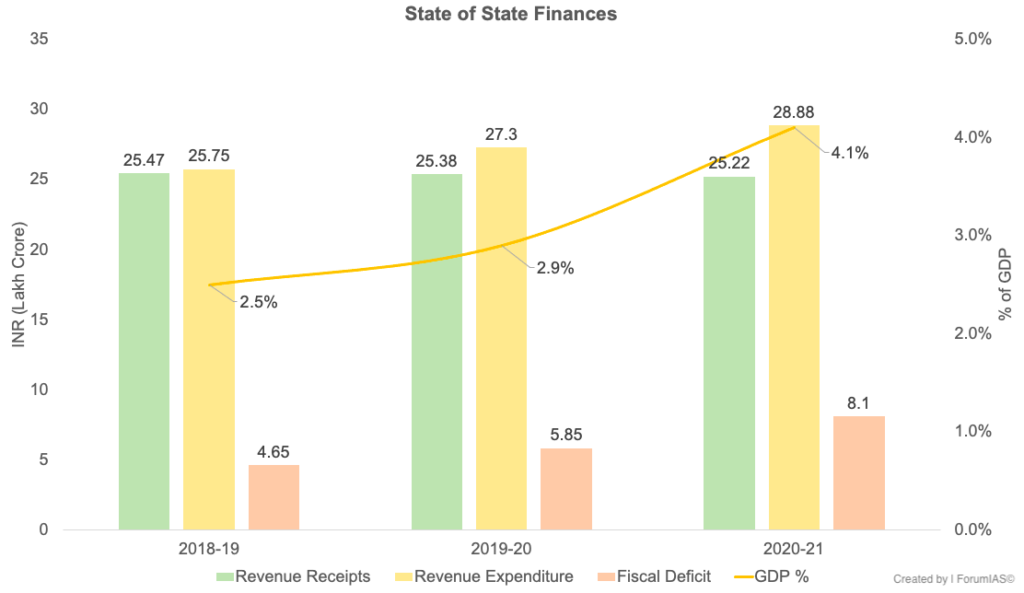

Impact of Pandemic: Before the pandemic, the average gross fiscal deficit (GFD) to gross domestic product (GDP) ratio was at 2.5%, though some States ran fiscal deficits above 3.5%. But the pandemic significantly affected government finances. During the pandemic State’s revenues were hit. Despite that, States continuously provided medical care and supported the vulnerable sections of the population.

Source: CAG. Due to negative impact of COVID-19, the cumulative revenue receipts of all State Governments fell from INR 25.47 Lakh Crore (2018-19) to INR 25.22 Lakh Crore (2020-21). The Revenue Expenditure rose from INR 25.75 Lakh Crore to INR 28.88 Lakh Crore in the same period. The Fiscal Deficit jumped from 2.5% of the GDP to 4.1% of the GDP.

Declining Tax Revenue: The own tax revenue of some of these states like Madhya Pradesh, Punjab and Kerala has been declining over time making them fiscally more vulnerable. Moreover, the revenue might fall sharply if the GST compensation is stopped from July 2022 e.g., significant part of Punjab’s guaranteed revenue was met using compensation (37% in 2018-19, 47% in 2019-20, and 56% in 2020-21).

Source: Mint

High Revenue Expenditure: The share of revenue expenditure in total expenditure of these states varies in the range of 80-90%. This results in poor expenditure quality, as reflected in their high revenue spending to capital outlay ratios.

Significant Committed Expenditure: Committed expenditure like interest payments (on debt), pensions and administrative expenses accounts for a significant portion (over 35%) of the total revenue expenditure in some of these states. For some States, the interest payments exceed 20% of the Revenue Receipts of the Government like Haryana (23%), Punjab (21%), Tamil Nadu (21%). This constraints State finances.

High DISCOMs Losses: The combined losses of DISCOMs in the five most indebted states, viz Bihar, Kerala, Punjab, Rajasthan and West Bengal, constituted 24.7% of the total DISCOMs losses in 2019-20. While their combined long-term debt was 22.9% of the total DISCOM debt in 2019-20. The sudden jump in cumulative debt (refer figure above) from 16% to 18% between 2014-15 to 2015-16 was due to the States assuming DISCOMs’ debts.

Freebie Culture: Political parties are outdoing each other promising free electricity and water, laptops, cycles etc. The freebies put a significant strain on the fiscal position of State governments and can’t be easily taken back by succeeding governments.

Legal Loopholes: The current FRBM provisions mandate that the Governments disclose their contingent liabilities, but that disclosure is restricted to liabilities for which they have extended an explicit guarantee. In reality, the State governments resort to extra-budgetary borrowings to finance their populist measures. This debt is concealed to circumvent the FRBM targets. Further, there is no comprehensive information in the public domain to assess the size of this off-budget debt.

What are the risks highlighted by RBI to State Government Finances?

The RBI study has also underlined several risks to State government finances. The RBI projections suggest that most States would have a debt-GSDP ratio of over 30% by 2026-27. These risks are: (a) Growing preference for distribution; (b) Some States reverting to the old pension scheme is also a cause for concern; (c) The guarantees extended to State-owned enterprises and the mounting debt of power distribution companies; (d) According to estimates, the off-budget borrowings of state governments have increased to about 4.5% of GDP; (e) The end of the compensation regime under the goods and services tax would further weaken the fiscal position of the states.

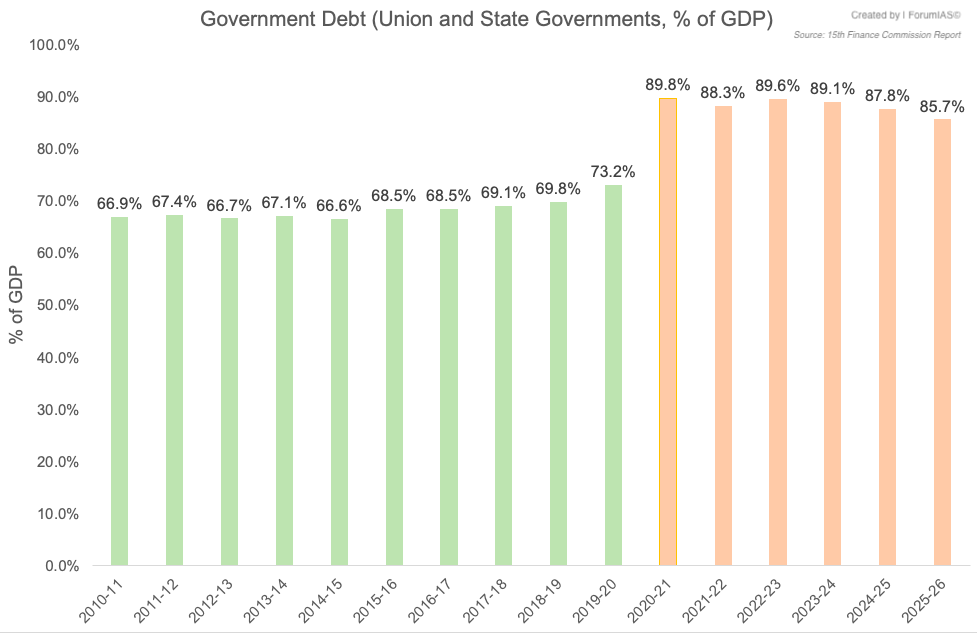

The 15th Finance Commission projects the combined Union and State Government Debt levels to hover around 86-89% till 2025-26. Of this, State Debts will be in the range of ~30-31% on an average.

What are the implications of the poor state of State Finances?

The costs of fiscal profligacy can be huge. It can have an adverse impact on India’s macroeconomic stability.

The more States spend on transfer payments, the less they have for spending on physical infrastructure and social infrastructure, which are vital to improve growth and generate jobs.

It will lead to the growth of debt burden which will eventually implode in future. There are discussions indicating that ‘some States might go down the Sri Lankan way’ by entangling themselves in a debt trap.

It may impair the fiscal position of the centre who may have to give concessionary credit to states and pay their external obligations.

What steps have already been taken for improving States’ Finances?

As a first step, a system of performance budgeting was introduced to assess performance against set goals/objectives. However, this was not able to establish a clear one-to-one relationship between financial budgets and performance.

Outcome budgeting was introduced in 2006-07, which also recognized that outlays do not necessarily mean outcomes.

A framework was suggested by the RBI study in 2009. This study proposes a “triple E framework” to assess expenditure quality, which has constituents of expenditure adequacy, effectiveness and efficiency: (a) Expenditure adequacy is in terms of focusing on the government’s primary role; (b) Effectiveness is about assessing performance; (c) Efficiency involves an assessment of the output-input ratio.

What recommendations have been given by RBI to improve State Finances?

In the near term, State governments must restrict their revenue expenses by cutting down expenditure on non-merit goods.

In the medium term, States need to put efforts towards stabilizing debt levels.

In the longer term, States need to increase the share of capital outlays in the total expenditure. This will help create long-term assets, generate revenue and boost operational efficiency.

Moreover, States also need to undertake large-scale reforms in the power distribution sector to reduce losses and make them financially sustainable and operationally efficient.

Alongside, State governments need to conduct fiscal risk analyses and stress test their debt profiles regularly to be able to put in place provisioning and other specific risk mitigation strategies.

What more can be done?

First, the FRBM Acts need to be amended. Its provisions should be expanded to cover all liabilities of the Government whether budget borrowing or off-budget borrowing, regardless of any guarantee.

Second, at present, the States are required to take the permission of Union Government when they borrow, under the Constitution. Therefore, the Union Government should not hesitate to impose conditionalities while giving permission. While doing so, the Government must act transparently and objectively.

Third, the Government should also focus on decreasing the magnitude of black economy. It erodes the fiscal pool of the Government and leads to suboptimal spending.

Fourth, in the longer run, eradication of unnecessary freebie culture requires an attitudinal change in the masses. Public should elect governments on the basis of performance and development outcomes, rather than doling out of freebies.

Conclusion

Given that the general government debt has increased sharply, India needs an overall medium-term consolidation road map. An unsustainable level of debt in some of the large States would not only affect growth prospects, but could also pose risks to macroeconomic stability.

Syllabus: GS III, Government Budgeting

Source: Mint, Business Standard, Indian Express, The Hindu, PRS