ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 27th May. Click Here for more information.

Contents

News: Indian policymakers have been gradually rolling back the Covid-19 pandemic stimulus, given since 2020. The ongoing Ukraine Crisis-2022 will have multiple economic implications for policymakers now.

Upcoming Challenges to due to Ukrainian Crisis

International Crude Oil Prices: Since Russian tanks rolled into Ukraine. International prices of crude oil have gone up sharply up to $140 a barrel.

Inadequate Forecasts in India: RBI’s inflation forecast as well as the budgetary calculations of the Union government have been made assuming crude prices at $75 a barrel.

Balance of Payment: The higher energy import bill will put pressure on the Balance of Payments. India is nowhere near unmanageable stress in its balance of payments, as a comparison with 2013 will show.

Headline Inflation: The prices of other industrial commodities have also gone up in tandem with energy prices. It will also influence headline inflation.

Government budget: The effect on budget will depend on the extent to which the government passes on higher oil prices to consumers and how much it absorbs through reductions in excise duty on petrol or higher fertilizer subsidies.

What should be the policy Reponses?

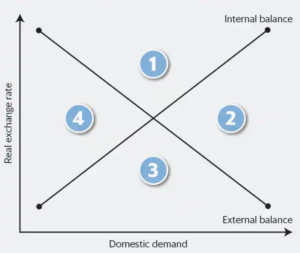

The Australian economist Trevor Swan gave a very good framework to understand how a country should respond to various combinations of internal and external imbalances in its economy. The Swan framework provides clues that are relevant even today, depending on where a country is in the macroeconomic space:

Fig: The Swan Diagram

Internal balance: When there is full employment or economic growth is at potential or when inflation is not accelerating.

External balance: When an economy has neither a large current account deficit nor surplus.

Interactions between Internal and External balance: study of the interaction between them is most closely identified with the work of international economists such as James Meade and Harry Johnson. J.P. Morgan.

Macroeconomic spaces:

Following are the 4 macroeconomic spaces that are depicted in the diagram above:

- A current account deficit with growth below potential.

- A current account deficit with rising inflation.

- A current account surplus with rising inflation.

- A current account surplus with growth below potential.

Combined Reponses for external and internal balance:

Any country that seeks to maintain an internal and external balance at the same time has to maintain a balance between the levels of real exchange rate and the domestic demand.

Changes in the real exchange rate (on the Y-axis) which affect the composition of demand between imported goods and domestically produced goods in an economy. It may include the depreciation of the real exchange rate to reduce the current account deficit or appreciation to bring down a current account surplus.

Changes in monetary and fiscal policies (on the X-axis in diagram) to affect the size of domestic demand, or expenditure control in the domestic economy. Meanwhile, interest rates and net government spending have to be calibrated to manage domestic demand.

India will thus have to adapt its mix of fiscal, monetary and exchange rate policies to maintain a balance in case global turbulence persists for an extended period of time. It will ensure that neither internal nor external imbalances get out of hand.

Source: The post is based on the article “The macroeconomic framework that can guide out policy choices” published in the Live mint on 09th March 2022.