9 PM Daily Current Affairs Brief – August 11th, 2022

Dear Friends,

We have initiated some changes in the 9 PM Brief and other postings related to current affairs. What we sought to do:

- Ensure that all relevant facts, data, and arguments from today’s newspaper are readily available to you.

- We have widened the sources to provide you with content that is more than enough and adds value not just for GS but also for essay writing. Hence, the 9 PM brief now covers the following newspapers:

- The Hindu

- Indian Express

- Livemint

- Business Standard

- Times of India

- Down To Earth

- PIB

- We have also introduced the relevance part to every article. This ensures that you know why a particular article is important.

- Since these changes are new, so initially the number of articles might increase, but they’ll go down over time.

- It is our endeavor to provide you with the best content and your feedback is essential for the same. We will be anticipating your feedback and ensure the blog serves as an optimal medium of learning for all the aspirants.

- For previous editions of 9 PM Brief – Click Here

- For individual articles of 9 PM Brief– Click Here

Mains Oriented Articles

GS Paper 2

- COVID-19, arguably, has become endemic in India

- A new global vision for G20

- Fair share

- Why higher GST on chit funds is a bad idea

- State-level OBC groups must be included in central list

GS Paper 3

- The uproar over the Electricity (Amendment) Bill, 2022

- Custom That Costs Us Dear

- The inequality challenge for India@75

Prelims Oriented Articles (Factly)

- Explained: What is Langya, a new zoonotic virus that has infected 35 people in China?

- Cabinet approves continuation of Pradhan Mantri Awas Yojana-Urban (PMAY-U) – “Housing for All” Mission up to 31st December 2024

- Action Plan for Introduction of Cheetah in India

- Reduction in EMF Emissions

- The grammar of VIP security

- Cabinet approves ratification of the eleventh Additional protocol to the Constitution of the Universal Postal Union

- Big relief for livestock, Agriculture Minister launches indigenous vaccine for Lumpy Skin disease

- Union Minister shares India’s roadmap for climate protection

- Union Minister for Social Justice & Empowerment launches “SMILE-75 Initiative”

- Audio Visual Co-production Treaty: India, Australia to sign film treaty

Mains Oriented Articles

GS Paper 2

COVID-19, arguably, has become endemic in India

Source: The post is based on the article “COVID-19, arguably, has become endemic in India” published in The Hindu on 11th August 2022.

Syllabus: GS 2 – Issues relating to development and management of Social Sector/Services relating to Health.

Relevance: About the endemic nature of Covid-19.

News: It has been 29 months since COVID-19 was declared a pandemic. However, new COVID-19 cases continue to be reported from different parts of the world, including India, regularly. This shows that Covid-19 has become an endemic state.

About the recent Covid-19 cases around the world

India: After the third wave in January 2022, India saw the lowest number of daily new COVID-19 cases in March and April. However, since then, daily cases have spiked to around 18,000 a day. India revives the discussion on whether COVID-19 continues to remain pandemic or has become endemic.

Other countries: The United States has returned to a ‘no mandatory COVID-19 test’ for inbound passengers. In Europe, many countries are back to full normalcy.

What are the terms epidemics, pandemics and endemics mean?

| Must read: Difference between epidemic, pandemic and endemic |

Pandemics are not merely health events but also encompass the social and economic implications of infections and diseases. For instance, HIV/AIDS was an epidemic in the mid-1990s. Now, HIV/AIDS cases are reported regularly but it is endemic because all societies/countries have agreed to it being an acceptable risk.

Why one should consider Covid-19 as endemic?

New diseases usually do not disappear completely. Chikungunya, dengue and many respiratory viruses usually stay within populations once they enter a population.

Twenty-nine months into the pandemic, there is consensus that SARS-CoV-2 will stay with humanity for long, possibly for years and even decades.

The risk of infection and disease under COVID-19, till early 2022, was unknown, and the outcome unpredictable. Two and half years into the pandemic, the risk of getting COVID-19 continues and will always be greater than zero.

But the risk of the social and economic impacts due to COVID-19 is minimal and close to zero. In such a backdrop, one can conclude that while the health challenges of SARS-CoV-2 remain, the socio-economic impact is blunted. Hence, one can conclude the COVID-19 pandemic in India has moved to its endemic stage.

| Read more: One billion Covid Vaccines and beyond – Explained, pointwise |

Is the Covid-19 pandemic over throughout the world?

No, in epidemiology and public health, context (local setting, infection rate and vaccine coverage) determines the disease spread. Every country would reach an endemic stage at different points of time.

Countries that had higher vaccination coverage and higher natural infection (such as India) are likely to reach that stage early. Countries with low natural infection and vaccination coverage (as in Africa) would reach an endemic stage a little later.

| Read more: Is Covid-19 now endemic in India? |

What should be done?

In June-July 2022, around 30 deaths are being reported every day on average in people who tested COVID-19. In India, an estimated 26,000 to 27,000 people die every day due to a variety of reasons. The government should take every effort to avoid any death that is preventable.

COVID-19 is one of the many challenges and cannot continue to be the top and the only health priority. So, it is time to deal with the COVID-19 just like any other health condition and integrate COVID-19 interventions into general health services.

People should undertake voluntary precautionary measures. COVID-19 vaccination should become part of the routine immunisation programme.

| Read more: Explained: When does a disease become endemic? |

A new global vision for G20

Source: The post is based on the article “A new global vision for G20” published in The Hindu on 11th August 2022.

Syllabus: GS 2 – Important International institutions, agencies and fora- their structure, mandate.

Relevance: About the necessary reforms for G20.

News: The role of the G20 themes and focus areas lacks vision.

About the role of G20

The primary role of the G20 accounts for 95% of the world’s patents, 85% of global GDP, 75% of international trade and 65% of the world population.

The G20 plays an important role such as, a) Shaping and strengthening global architecture and governance on all major international economic issues, b) recognising that global prosperity is interdependent and economic opportunities and challenges are interlinked.

| Read more: Cabinet clears setting up of G20 Secretariat |

What does India want to change in G20?

According to the Ministry of External Affairs, India will strengthen international support for priorities of vital importance to developing countries in diverse social and economic sectors. This range from energy, agriculture, trade, digital economy, health and environment to employment, tourism, anti-corruption and women empowerment, including in focus areas that impact the most vulnerable and disadvantaged.

| Must read: G20 grouping and its relevance – Explained, pointwise |

What are the challenges faced by multilateral organisations?

1) Multilateral commitments on aid and trade are faltering, 2) The role of the United Nations and the World Trade Organization in securing cooperation between donor and recipient country groups is losing centrality. 3) There are now three socio-economic systems the G7, China-Russia, and India and others, 4) The Ukraine crisis is expanding the influence of the trade and value chains dominated by the U.S. and China.

What are the opportunities the G20 can utilise?

1) The G20 can harness the potential of the digital-information-technology revolution by redefining digital access as a “universal service.”

2) The world can build on the global consensus in the Vienna Declaration on Human Rights 1993. There is a growing recognition of economic and social rights. So, ensuring adequate food, housing, education, health, water and sanitation and work for all should guide international cooperation.

3) The global agenda has been tilted towards investment, whereas science and technology are the driving force for economic diversification. This can be corrected.

4) Space is the next frontier for finding solutions to problems of natural resource management. Open access to geospatial data, data products and services and lower costs of geospatial information technology facilities do not require huge financial resources.

| Read more: G20 summits have lost its significance |

What reforms are needed to make G20 fully functional?

Firstly, G20 needs a new conceptual model seeking agreement on an agenda limited to principles rather than long negotiated moderating text. For instance, the Rio Declaration of 1992 is an appropriate model which incorporated three major priorities as part of a global agenda.

Secondly, India should seek collaboration on limited focus areas around science and technology, building on resolutions of the United Nations General Assembly (UNGA) and other multilateral bodies.

Thirdly, the presumed equality, recognised in the case of climate change, needs to be expanded to other areas with a global impact redefining ‘common concerns’.

Fourthly, emerging economies are no longer to be considered the source of problems needing external solutions but the source of solutions to shared problems.

Lastly, a Global Financial Transaction Tax, considered by the G20 in 2011, needs to be revived to be paid to a Green Technology Fund for Least Developed Countries.

Fair share

Source: The post is based on an article “Fair Share” published in the Business Standard on 11th August 2022.

Syllabus: GS 2 Issues and Challenges Pertaining to the Federal Structure

Relevance: Fiscal Federalism

News: At a recent meeting of the governing council of the NITI Aayog, the state governments indicated that their resources to fund spending were dwindling.

What are the causes of these tensions between the Union government and many state governments?

Some of this has been caused by the transition to Goods and Services Tax (GST). It has reduced the space available to state governments to raise their own revenue.

The GST compensation payments to the states, which guaranteed increases in state revenues under the GST, have been ended.

The states argue that the Union government is taking too large a share of the tax revenues. As per some reports, the states’ share in taxes collected by the Union government has been between 29-32% since the pandemic hit in 2020-21. This is about 10 percentage points lower than the recommendations that were made by the Fifteenth Finance Commission (FFC).

Further, the Union government is excessively resorting to various kinds of cess and surcharge in the tax mix. For example, the proportion of revenue raised from cess and surcharges has risen from about 6% in 2014 to almost 25% of the tax collection now. Unlike regular taxes, these are not part of the divisible pool. Therefore, the Union government does not have to share these with the states.

What are the arguments in favor of providing more resources to the state governments?

The fact is that the state’s administrative machinery is on the front line of delivering growth and development.

It is the main touchpoint between the citizen and the government.

Underfunded states lead to poor public provision of services, with deleterious effects on both citizen welfare and the growth potential of the economy.

The centralization of the fiscal and spending power through various measures such as cess or centrally sponsored schemes could affect the delivery of quality services to citizens.

What are the arguments against providing more resources to the state governments?

The Centre also has spending commitments and needs resources to finance national security needs and to run welfare programs.

The State governments are often alleged of inefficient and ineffective utilization of funds. Further, the quality of spending is also debated.

What should be done?

In terms of spending, reforms are needed at both levels of the government. For Example, the division of resources should be done more transparently.

The Central government shouldn’t excessively resort to imposition of cess and surcharge, as it distorts the tax system and creates inefficiencies. This could increase resentment among states and lead to greater friction between the Centre and the states.

The Union and state governments work together to take the development process forward.

Why higher GST on chit funds is a bad idea

Source: The post is based on an article “Why higher GST on chit funds is a bad idea” published in the Live Mint on 11th August 2022.

Syllabus: GS 2 Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development, and Employment.

News: Recently, the Government of India has made an announcement of revised rates of GST on the chit funds. The tax has been raised from the earlier 12% to 18%.

About Chit Fund

It is an alternative source of credit, which is the earliest form of peer-to-peer lending.

In this, a piece of paper is used for writing a bid amount, known as a chit. Therefore, it is known as a ‘chit fund’.

It doesn’t fall under the jurisdiction of the Reserve Bank of India. These are the legal entities, registered with and regulated by, the state governments under the Chit Funds Act of 1982.

Functioning of the Chit Funds

A chit fund is a close-ended group lending scheme. In this, funding is involved in a cycle. The cycles end after each fund participant has received the pool of money once.

For Example, every month, each participant makes an identical contribution to the lump sum. And a lump-sum amount collected from the contribution of all participants is transferred to one of them who wins that month’s bid for the pool of money. The cost of borrowing and the return to savers depend on the bidding process.

The chit fund intermediary currently charges around 5% of the full lump-sum amount, divided by the number of participants.

What are the benefits of the Chit Fund system?

In the case of a chit fund, any investor can bid to borrow from others against the promise of future contributions, while the credit risk devolves to the chit fund’s promoter.

A chit fund is a unique hybrid instrument that makes an individual a saver/lender instead of a borrower.

One can bid early in the cycle if one needs money for any planned purchase, working capital for business, or for a personal emergency. Alternatively, one can wait and take the lump sum in a later part of the cycle.

Professional chit funds have served a segment of the Indian population that do not have stable income streams, proof of regular income, or the collateral that banks need to sanction personal as well as small business loans.

Borrowers in chit funds pay interest lower than most other sources of credit.

For savers, the interest earned is a maximum of 4-6% or often even lower.

How will the GST hike impact the chit fund industry?

The chit fund intermediaries can raise their monthly commission from the current 5% to 7% (the most allowed by law). This will increase the cost of borrowings in the fund. Similarly, there would also be a decline in the already-low returns that chit-fund savers make.

The savers may switch to alternative saving instruments in an environment of rising interest rates. Therefore, it would make borrowing difficult as there would be inadequate savings.

If the chit fund industry shrinks, then borrowers would have to find a substitute source of unsecured financing.

State-level OBC groups must be included in central list

Source: The post is based on an article “State-level OBC groups must be included in the central list” published in the Indian Express on 11th August 2022.

Syllabus: GS 2 Important Provisions of the Constitution of India

News: The Justice Rohini Commission has been given the 10th extension in five years.

The commission was constituted to ensure equitable distribution of reservation benefits among the OBC castes through sub-categorization

Background

The issue of sub-categorization arises from the perception that a few dominant castes among the OBCs have cornered a disproportionate amount of the benefits from the reservation. It is leading to injustice.

About OBCs reservation

Articles 15(4) and 16(4) make special provisions for socially and educationally backward classes of citizens (SEBCs, popularly known as OBCs), the Scheduled Castes (SCs) and Scheduled Tribes (STs).

Currently, for each state, there are two OBC lists, i.e., one for the state and the Centre. So, a caste included in the OBC list of a state enjoys the reservation benefits in state government jobs and educational institutions, but not with respect to central government jobs or educational institutions.

Historical development of the OBCs reservation

In 1955, the 1st Backward Classes Commission recommended the inclusion of 2,399 castes as OBCs. But, the then central government did not implement the recommendations and implementation of the welfare programs. Therefore, OBC castes have an abysmal representation in central government jobs. But the Centre suggested that state governments may draw up their own lists.

The second Backward Classes Commission, known as the Mandal Commission, gave its report in 1980. However, the central governments did not implement the recommendation for almost a decade.

Finally, the V P Singh government decided to implement the recommendations of the Mandal Commission. Various OBC castes were included in the Central OBC lists. These were those castes and minorities which were common to both the State Lists and the Mandal Commission List.

The central government introduced a reservation of 27% for OBCs in government jobs on August 13, 1990. The constitutional validity of the reservation was upheld in the Indira Sawhney case. Pursuant to judgment, the National Commission for Backward Classes Act, 1993 was enacted.

In Ram Singh and Ors vs Union of India Case (2015), the Central government argued that the inclusion of classes or groups in state OBC lists is a strong and compelling reason for the inclusion of such classes in the central lists. Because, in our constitutional scheme, the Union and state governments need to work in tandem and not at cross purposes. The Supreme Court judgment validated this argument.

Issues related to OBCs reservation

OBCs are identified differently at the state and central levels. For example, the State OBC list and Central OBC list. But the SCs and STs are identified “with respect to any State or Union Territory” and have only one list and one status, both at the level of state and central government.

The “two-status” castes deny reservations in all these important avenues like IAS, IPS, IFS, IRS, and coveted educational institutions like the IITs, IIMs, AIIMS, and the Central universities.

Across all the states, there are hundreds of such OBC castes whose members are being denied reservation benefits in central government jobs.

The Way Forward

In order to establish the truth that few dominant castes enjoy the benefits of reservation, a caste census is required. The government should conduct an extensive caste census to give proportional representation to the OBCs.

GS Paper 3

The uproar over the Electricity (Amendment) Bill, 2022

Source: The post is based on the article “The uproar over the Electricity (Amendment) Bill, 2022” published in The Hindu on 11th August 2022.

Syllabus: GS 3 – Infrastructure: Energy, Ports, Roads, Airports, Railways etc.

Relevance: About the concerns associated with the Electricity (Amendment) Bill.

News: The Union Power Ministry introduced the Electricity (Amendment) Bill, 2022 in Lok Sabha.

What are the key provisions of the Electricity (Amendment) Bill?

| Read here: Explained: Electricity Bill – promise, problems |

What is the history of the Electricity Act?

The Electricity Bill was brought for the first time and passed in Parliament in 2003.

Aim:

-To consolidate the laws relating to generation, transmission, distribution, trading and use of electricity.

-To protect consumers’ interest and supply of electricity to all areas, rationalisation of electricity tariff, transparent policies regarding subsidies etc.

Outcome: The Act resulted in the privatisation of distributing companies.

Amendment: The 2007 amendment included provisions for “cross subsidy.” Thus ensured subsidy to poor households was added to the Bill.

Later many amendment Bills remained in their draft form but it wasn’t cleared.

| Read more: Explained: Electricity amendment bill 2021 —why are states such as WB opposing it? |

What are the concerns associated with the present Electricity bill?

a) Privatisation of distribution companies and generating units might result in job losses, b) The Bill might result in the privatisation of profits and the nationalisation of losses, c) The Bill is silent on subsidised power provided to poor farmers in States like Tamil Nadu.

The other concerns are,

Make Centre powerful: The Bill proposes Centre’s intervention in the area of power distribution. Further, the amendment empowers the Central Government to prescribe the criteria.

The issue with multiple distribution licensees: Such a provision might create a situation similar to the telecom sector where monopoly companies will destroy the public sector and smaller networks.

| Read more: Government policies are successful in ensuring reliable electricity supply |

Custom That Costs Us Dear

Source: The post is based on an article “Custom That Costs Us Dear” published in the Times of India on 11th August 2022.

Syllabus: GS 3 Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.; Governing Budgeting

Relevance: External Sector; Ease of Doing Business

News: Since 2018-19, the government has switched from liberalism to protectionism on account of its import substitution.

History of tariff setting in India

(1) Since 1882, Britain had followed a policy of complete free trade in India. In 1894, it imposed 5% duty on imports meet revenue needs. However, it was simultaneously offset by an equivalent excise tax on domestically produced products in India. The custom duty was used with revenue roles instead of protective.

(2) The Indian Fiscal Commission of 1921-22 recommended that custom duty has a protective role to play, as initial protection is important to withstand foreign competition. A tariff board can be established to which industries could petition for grant of protective duties.

(3) First Tariff Board was appointed in 1923. Based on the board’s recommendation, the government granted protection to the iron and steel industry. Later on, more tariff boards were appointed between 1923 and 1939.

(4) With the advent of World War II, this practice of the grant of protection ended. Due to war, the government imposed strict and direct import controls through licensing.

(5) After the war, the government started liberalising controls. It ushered in an era of liberal trade policy ensuing. As a result, the Tariff Commission was created in 1951 in the prevailing liberal policy environment.

(6) In 1957-58, the balance of payments crisis ended this liberal era. In 1960s, strict import licensing regime was instituted. Later on, the Tariff Commission was disbanded in 1976.

(7) In the 1970s, the licence-permit raj era was ushered in. The Revenue Department had the authority to set customs duties in India.

(8) In 1991 reform, the government eliminated import licensing. Tariffs were used for protection once again. India also introduced anti-dumping and safeguard mechanisms. The GOI revived the Tariff Commission in 1997. However, but it failed to effectively challenge the authority of the revenue department to set customs duties.

Trends of customs-duty since 2014-15

In 2014-15, the duty rates were increased and applied to less than 1% of all tariff lines and later on. However, later on, it was increased to 3-4% of all tariff lines.

In 2018-19, the then finance minister in his budget speech said, “I am making a calibrated departure from the underlying policy in the last two decades, wherein the trend largely was to reduce the customs duty. There is substantial potential for domestic value addition in certain sectors . . . To further incentivise domestic value addition … I propose to increase customs duty on certain items”.

In 2018-19, increased custom duty rates were applied to 42. 3% of all tariff lines. Further, the average of all customs duties was also increased from 13. 7% to 17. 7%, and other measures were also taken in this regard.

What are the issues the trade policies have taken so far?

The Custom duties have been hiked without doing adequate analysis, discussion or debate while making decisions.

The government has used custom duties as a revenue-raising instrument. But, a central principle of public finance does not allow the customs duties to be used like a revenue instrument.

Institutional flaw: The revenue department shouldn’t be the authority to impose customs duties. The Tariff Commission lacks necessary expertise and authority to influence the decisions of the revenue department.

The Way Forward

Increases in customs duties should be strictly reserved for protection to new industries.

The government should constitute an expert body which should be mandated to review high customs duties prevailing in many existing industries.

The inequality challenge for India@75

Source: The post is based on an article “The inequality challenge for India@75” published in the Live Mint on 11th August 2022.

Syllabus: GS 3 Inclusive Growth; Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development, and Employment; etc.

Relevance: Inequalities in India

News: The article compares the present development with the national income at the time of independence. It highlights the lacunas in the growth patterns of India.

During the period 1900-01 to 1946-47, national income growth was 1% per annum and per capita income growth was 0.2% per annum.

(1) During the period 1950-51 to 2019-20, India has restored economic autonomy and enabled India to pursue its national development objectives. For Example, the GDP has multiplied by just over 29, which means it has doubled every 14 years and the GDP per capita has multiplied by almost 8, which means it has doubled every 24 years.

(2) India’s rapid economic growth since 1980 has led to a substantial reduction in absolute poverty.

What are the areas where India needs reflection as well as introspection in the coming period?

(1) During the same period, the East or Southeast Asia economies have performed better than the Indian Economy. For example, the per capita income as a proportion of that of the world economy rose from 12% to 18% for India, 13% to 87% for China, and 10% to 35% for Indonesia.

(2) Economic growth in India has been associated with unequal outcomes that have created divides between regions, sectors, and people.

(3) Western and Southern India have developed more than the east and north of India.

(4) There has been a widening gap between richer and poorer states.

(5) Over the period 1950-51 to 2019-20, the agricultural sector’s share in GDP fell from 58% to 15%.

(6) There is a massive rural-urban divide prevalent in India.

(7) The economic inequalities have risen in India since India took the path of rapid growth from 1980s. For example, For India, the World Inequality Report 2021, estimated that the top 1% held as much as 33% of total wealth in India and the top 10% held 65% of total wealth.

(8) However, the scale of absolute poverty in India is striking. Poverty reduction could have been much greater.

(9) Malnutrition, particularly among children and women—persists, hunger and destitution are common,

(10) The child labour is prevalent, access to educational opportunities is sparse, and healthcare is neither available nor affordable.

(11) There has been jobless growth in India. Economic growth has not led to commensurate employment creation in India.

What should be done?

Economic growth can be transformed into meaningful development only if it brings about an improvement in the living conditions of people.

It is essential to recognize that employment is not only a source of growth but also a means of mobilizing people, which is the most abundant resource for development in India.

Employment is the only sustainable means of eradicating poverty and mitigating inequality.

The government should resolve to ensure that poverty and illiteracy do not exist 25 years from now when we celebrate the first centenaries (100 years) of our independence.

Prelims Oriented Articles (Factly)

Explained: What is Langya, a new zoonotic virus that has infected 35 people in China?

Source: The post is based on the article “Explained: What is Langya, a new zoonotic virus that has infected 35 people in China?” published in Indian Express on 11th August 2022.

What is the News?

A new zoonotic virus named Langya Henipavirus or the LayV has been discovered in China with 35 infections identified so far.

What is Langya Virus?

Langya is a part of a genus of viruses called henipaviruses.

Note: Henipaviruses belong to the family of paramyxoviruses. They can cause severe illness in animals and humans and are classified as biosafety level 4 (BSL4) pathogens with case fatality rates between 40-75%.

– The types of Henipaviruses that had been identified till now include Hendra, Nipah, Cedar, Mojiang and the Ghanaian bat virus.

– According to US CDS, the Cedar virus, Ghanaian bat virus and Mojiang virus are not known to cause human disease. But Hendra and Nipah infect humans and can cause fatal illness.

– As of now there are no licensed drugs or vaccines meant for humans.

Where was Langya Virus discovered?

Langya was discovered in eastern China during surveillance testing of patients who had fever along with a recent history of animal exposure.

Where has Langya virus come from?

In all likelihood, the new virus has jumped from an animal to humans. The LayV virus RNA has been predominantly found in shrews, which may be its natural hosts.

Note: It is not known yet whether this virus is capable of human-to-human transmission.

What are the symptoms of the Langya virus?

Fever, Fatigue, cough, muscle aches and pains, nausea, headache and vomiting were the common symptoms.

More than half of the patients also had leukopenia defined as an insufficient number of pathogen-fighting white blood cells. More than a third had thrombocytopenia, a low number of blood-clotting cells called platelets. An impaired liver or kidney function was also detected in a few patients.

Cabinet approves continuation of Pradhan Mantri Awas Yojana-Urban (PMAY-U) – “Housing for All” Mission up to 31st December 2024

Source: The post is based on the article “Cabinet approves continuation of Pradhan Mantri Awas Yojana-Urban (PMAY-U) – “Housing for All” Mission up to 31st December 2024” published in PIB on 10th August 2022.

What is the News?

The Union Cabinet has approved the proposal of the Ministry of Housing and Urban Affairs (MoHUA) for the continuation of Pradhan Mantri Awas Yojana-Urban (PMAY-U) up to 31stDecember 2024.

What is Pradhan Mantri Awas Yojana-Urban(PMAY-U)?

Nodal Ministry: Ministry of Housing and Urban Affairs (MoHUA)

Aim: To provide all-weather pucca houses to all eligible beneficiaries in the urban areas of the country through States/UTs/Central Nodal Agencies.

Coverage: The scheme covers the entire urban area of the country, i.e., all statutory towns as per Census 2011 and towns notified subsequently, including Notified Planning/ Development Areas.

Verticals: The scheme is being implemented through four verticals:

– Beneficiary Linked Construction (BLC): Subsidy for beneficiary-led individual house construction /enhancement.

– Credit Linked Subsidy Scheme (CLSS): Promotion of affordable housing for weaker sections through credit subsidy.

– Affordable Housing in Partnership (AHP): Creation of houses by both public and private sectors.

– In-Situ Slum Redevelopment (ISSR): Rehabilitation of slum dwellers with the participation of private developers using land as a resource.

Features of the Scheme

– Type: It is a Centrally Sponsored Scheme (CSS), except for Credit Linked Subsidy Scheme (CLSS), which is a Central Sector Scheme.

– The Mission promotes women’s empowerment by providing the ownership of houses in the name of a female member or in a joint name.

Action Plan for Introduction of Cheetah in India

Source: The post is based on the article “Action Plan for Introduction of Cheetah in India” published in PIB on 10th August 2022.

What is the News?

The Government of India has released an “Action Plan for Introduction of Cheetah in India”.The aim of the plan is to restore the only large carnivore, the Cheetah, that has become extinct in independent India.

What is the “Action Plan for Introduction of Cheetah in India”?

Released by: Ministry for Environment, Forests and Climate Change at the 19th meeting of the National Tiger Conservation Authority(NTCA)

Goal: Establish a viable cheetah metapopulation in India that allows the cheetah to perform its functional role as a top predator and provide space for the expansion of the cheetah within its historical range thereby contributing to its global conservation efforts.

What are the objectives of the Plan?

1. To establish breeding cheetah populations in safe habitats across its historical range and manage them as a metapopulation.

2. To use the cheetah as a charismatic flagship and umbrella species to garner resources for restoring open forest and savanna systems that will benefit biodiversity and ecosystem services from these ecosystems.

3. To enhance India’s capacity to sequester carbon through ecosystem restoration activities in cheetah conservation areas and thereby contribute toward the global climate change mitigation goals.

4. To use the ensuing opportunity for eco-development and ecotourism to enhance local community livelihoods.

5. To manage any conflict by cheetah or other wildlife with local communities within cheetah conservation areas expediently through compensation, awareness, and management actions to win community support.

About Cheetah Reintroduction in India

Reduction in EMF Emissions

Source: The post is based on the article “Reduction in EMF Emissions” published in PIB on 5th August 2022.

What is the News?

The Minister of State for Communications has informed Rajya Sabha about the steps taken by the government to reduce Electromagnetic Field(EMF) Emissions.

What are Electromagnetic Field(EMF) Emissions?

Electromagnetic fields are a combination of invisible electric and magnetic fields of force.

Electromagnetic fields are present everywhere in the environment but are invisible to the human eye.

Natural Sources: Electric fields are produced by the local build-up of electric charges in the atmosphere associated with thunderstorms. The earth’s magnetic field causes a compass needle to orient in a North-South direction and is used by birds and fish for navigation.

Human-made sources: It includes medical equipment using static fields (e.g. MRI), electric appliances using low frequency electric and magnetic fields (50/60 Hz), and various wireless, telecommunications and broadcasting equipment using high radio frequency electromagnetic fields.

Impact: When properly used, electromagnetic fields greatly improve quality of life, health and well-being. However, above certain levels, these fields can be harmful to health and affect the human body in different ways depending on their frequency.

What are the steps taken by the Government to monitor Electromagnetic Field(EMF) Emissions?

EMF emissions from mobile towers: According to the Government, EMF emissions from Mobile towers are non-ionizing Radio frequencies having very minuscule power and are incapable of causing any adverse environmental impact.

Effect of EMF emissions on Animals: The International EMF Project of the WHO published an information sheet in 2005 on the effect of EMF emissions on animals, insects, vegetation, and aquatic life and has concluded that the exposure limits in the Non-Ionizing Radiation Protection (ICNIRP) guidelines for the protection of human health are also protective of the environment.

– Note: The present norms for Electromagnetic Field (EMF) emissions from mobile towers in India are already ten times more stringent (even lower) than the safe limits prescribed by ICNIRP and recommended by WHO.

Monitoring of EMF emissions: Government has put in place a well-structured process and mechanism for monitoring any violation so that Telecom Service Providers(TSPs) adhere to the prescribed norms including the submission of a self-certificate before the commercial start of the Base Transceiver Station (BTS) site.

– The field units of the Department of Telecommunications (DoT) regularly carry out the EMF audit of up to 10% of BTS Sites annually on a random basis.DoT also imposes a financial penalty on TSPs whose BTSs are found to exceed the prescribed EMF emission limits.

– In addition, if emission levels of such non-compliant BTSs are not brought within prescribed limits within 30 days, the same is liable to be shut down as per the prescribed procedure.

The grammar of VIP security

Source: The post is based on the article “The grammar of VIP security” published in The Hindu on 11th August 2022.

What is the News?

There are huge similarities between the assassinations of Former Japanese PM Shinzo Abe and Rajiv Gandhi such as both were killed during an election campaign.

However, if enough checks are carried out before the arrival of the VIP and access control is ensured after, assassinations are largely preventable.

In this context, let us understand a few basic principles of VIP security which is also called the grammar of VIP security.

What is the Grammar of VIP Security?

It can be subsumed under two broad principles:

Anti-sabotage: The checks are done before the arrival of the protectee and are intended to ensure the sterility of the place. This principle is strictly adhered to at the protector’s place of stay and at the place of function.

Access control: It is a process put in place after the protectee’s arrival. Access control ensures that no unidentified, unchecked or unauthorized person is allowed within the vicinity of the protected. By unidentified, it means that no person should be permitted to be within the proximity of the protectee unless they are known and their antecedents screened.

What are the other details that need to be followed?

First, security forces need to be sensitized before every visit as every visit is unique. As the protectees frequently visit capitals and pilgrimage spots, security forces tend to become complacent.

Second, every visit is dynamic, even if it is to a secure place and a regularly visited one such as a Raj Bhavan.

Third, security arrangements are like a chain and a chain is as strong as its weakest link.

Fourth, security considerations are more important than the elegance of the place of function or stay or approach path of the VIP. If the security principles are consolidated into a science, attacks and assassinations are largely preventable.

Cabinet approves ratification of the eleventh Additional protocol to the Constitution of the Universal Postal Union

Source: The post is based on the article “Cabinet approves ratification of the eleventh Additional protocol to the Constitution of the Universal Postal Union” published in PIB on 10th August 2022.

What is the News?

The Union Cabinet chaired by the Prime Minister has approved the ratification of amendments to the Constitution of the Universal Postal Union(UPU).

What is the Universal Postal Union(UPU)?

Established by: Treaty of Bern in 1874

Purpose: It is the primary forum for cooperation between postal sector players. It helps to ensure a truly universal network of up-to-date products and services.

Significance: It is a United Nations specialized agency. It is also the second-oldest international organization worldwide.

Headquarters: Bern, Switzerland

Members: Any member country of the United Nations may become a member of the UPU.

– Any non-member country of the United Nations may become a UPU member provided that its request is approved by at least two-thirds of the member countries of the UPU.

– The UPU now has 192 member countries. India has been a member of the UPU since 1876.

What are the amendments approved by the Government of India?

The 27th UPU Congress held at Abidjan (Cote d’Ivoire) adopted several amendments to the constitution of UPU.

These amendments ensure further legal clarity and stability to the Acts of the Union, resolve many long-standing discrepancies in the text and accommodate provisions for ‘acceptance or approval’ of the Acts in consistency with Vienna Conventions on Law of Treaties, 1969.

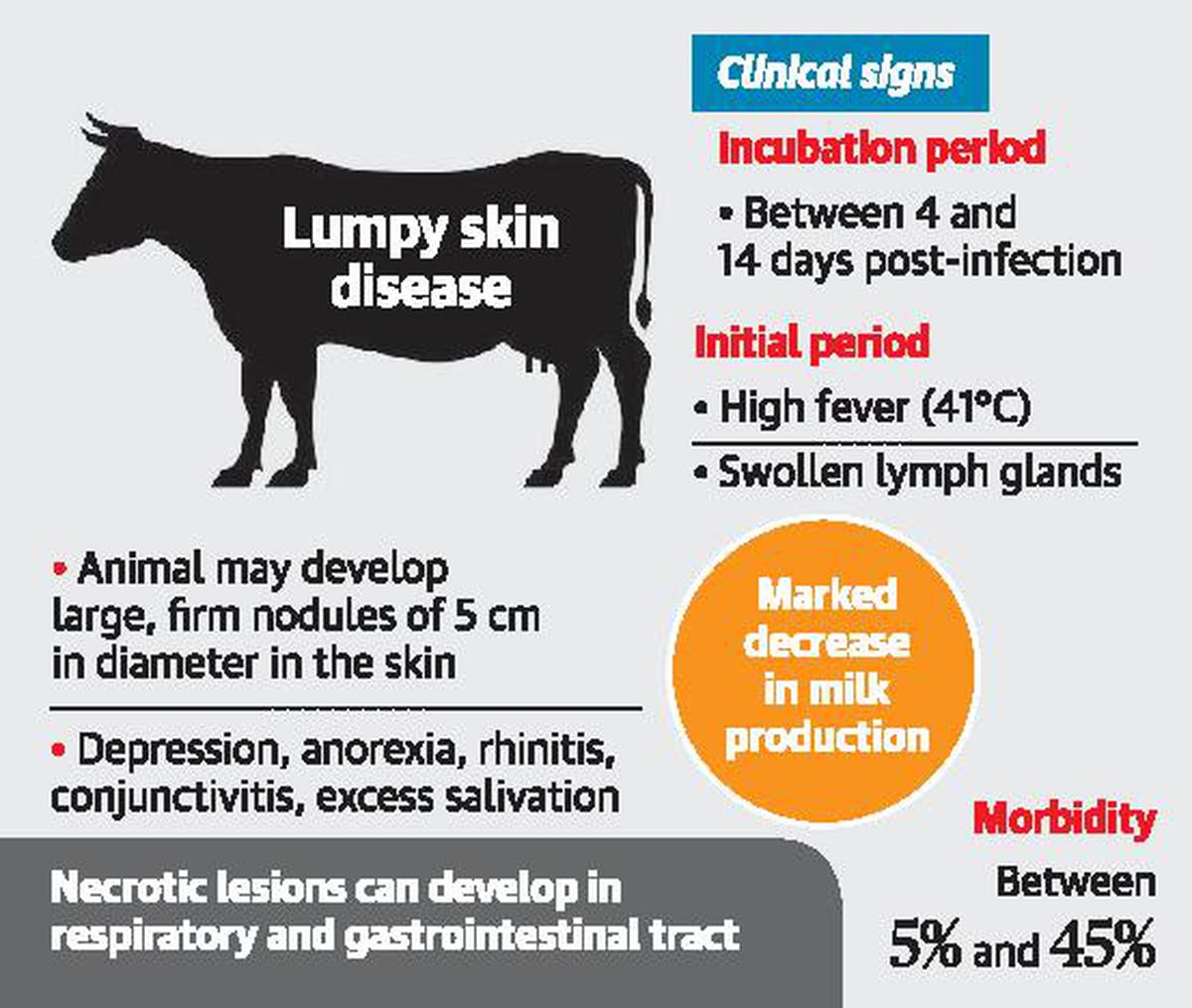

Big relief for livestock, Agriculture Minister launches indigenous vaccine for Lumpy Skin disease

Source: The post is based on the article “Big relief for livestock, Agriculture Minister launches indigenous vaccine for Lumpy Skin disease” published in PIB on 10th August 2022.

What is the News?

The Union Minister for Agriculture and Farmers Welfare has launched the indigenous vaccine Lumpi-ProVac to protect livestock from Lumpy Skin disease.

What is Lumpi-ProVac Vaccine?

Developed by: ICAR-National Research Centre on Equines (ICAR-NRCE), Hisar (Haryana), in collaboration with ICAR-Indian Veterinary Research Institute (IVRI),Uttar Pradesh.

Purpose: It is a vaccine to protect livestock from Lumpy Skin disease.

Cost: The cost per dose is ₹1-2.

Immunity: The immunity induced by this vaccine usually persists for a minimum period of one year.

What is Lumpy Skin Disease(LSD)?

LSD is primarily a disease in cattle. It was reported for the first time in India in 2019 from Odisha.

In the initial years, the disease was mainly restricted to the eastern part of our country. Later on, it rapidly spread to almost all the states in the country.

Union Minister shares India’s roadmap for climate protection

Source: The post is based on the article “Union Minister shares India’s roadmap for climate protection” published in PIB on 10th August 2022.

What is the News?

The Union Minister has inaugurated the International Conference on “Systems Analysis for Enabling Integrated Policy Making”.

About Conference on “Systems Analysis for Enabling Integrated Policy Making”

Organized by: Technology Information, Forecasting & Assessment Council(TIFAC), an Autonomous Body under the Department of Science and Technology(DST) in collaboration with the International Institute for Applied Systems Analysis(IIASA).

Aim: To formulate ideas and identify complex issues of climate change, pollution, clean energy, livelihood, and digitalization widely shared by countries across Asia.

Note: International Institute for Applied Systems Analysis is an independent international research institute located in Laxenburg, near Vienna, Austria.

What are the key highlights from the Minister’s address at the conference?

Since the turn of the 20th century, the global average temperature has risen, sea levels have increased, the oceans have warmed and become more acidic, land and sea ice has melted and the atmospheric carbon dioxide level has increased. It is widely felt that human activities are largely the cause of this climate change.

To combat this, India has presented a roadmap to the world about the mitigation measures by building upon the principle of Common but Differentiated Responsibility (CBDR).

However, the battle against this cannot be fought alone and the scientific communities need to talk in harmony toward a shared goal of mitigating climate change and achieving Sustainable Development Goals (SDGs).

Hence, there is a need to build up strong regional collaboration for systems research and design policy directives with collective efforts to deal with climate Change.

Union Minister for Social Justice & Empowerment launches “SMILE-75 Initiative”

Source: The post is based on the article “Union Minister for Social Justice & Empowerment launches SMILE-75 Initiative” published in PIB on 10th August 2022.

What is the News?

The Ministry of Social Justice & Empowerment has launched the “SMILE-75 Initiative”.

What is the SMILE-75 Initiative?

Launched by: Ministry of Social Justice & Empowerment under the SMILE: Support for Marginalized Individuals for Livelihood and Enterprise Scheme.

Aim: To make cities/towns and municipal areas begging-free and make a strategy for comprehensive rehabilitation of the persons engaged in the act of begging through the coordinated action of various stakeholders.

Under the initiative, seventy-five (75) Municipal Corporations in collaboration with NGOs and other stakeholders will cover several comprehensive welfare measures for persons who are engaged in the act of begging.

These measures will focus extensively on rehabilitation, provision of medical facilities, counselling, awareness, education, skill development, economic linkages and convergence with other Government welfare programmes etc.

Audio Visual Co-production Treaty: India, Australia to sign film treaty

Source: The post is based on the article “India, Australia to sign film treaty” published in The Hindu on 10th August 2022.

What is the News?

The Union Cabinet has approved the signing of an Audio Visual Co-production Treaty between India and Australia which is aimed at facilitating joint production of films between the two countries.

What is Audio Visual Co-production Treaty?

Audio visual co-production treaties are enabling documents which facilitate the co-production of films between both countries.

Under such umbrella agreements, private, quasi-government or governmental agencies enter into contracts to produce films together.

India has so far signed 15 audio-visual co-production treaties with other countries.

What is the significance of this treaty with Australia?

The treaty will boost ties with Australia, lead to an exchange of art and culture and showcase the soft power of our country.

This will also generate employment among artistic, technical as well as non-technical personnel engaged in audio-visual co-production, including production and post-production work.

Moreover, the use of Indian locations would increase the prospects of the country becoming a preferred film-shooting destination and also lead to an inflow of foreign exchange.

UPSC Mains Answer Writing 27th April 2024 I Mains Marathon

Good Morning Friends, Following are today’s UPSC Mains Marathon Questions. About Mains Marathon – This is an initiative of ForumIAS to help/aid aspirants in their mains answer writing skills, which is crucial to conquering mains examination. UPSC Mains Answer writing 27th April 2024 Every morning, we post 2–3 questions based on current affairs. The questions framed are… Continue reading UPSC Mains Answer Writing 27th April 2024 I Mains Marathon

Must Read Daily Current Affairs Articles 27th April 2024

About Must Read News Articles is an initiative by Team ForumIAS to provide links to the most important news articles of the day. It covers The Hindu newspaper. This saves the time and effort of students in identifying useful and important articles. With newspaper websites requiring a paid subscription beyond a certain number of fixed articles,… Continue reading Must Read Daily Current Affairs Articles 27th April 2024

Changes in India’s job market before and after the COVID-19 pandemic

Source: The post changes in India’s job market before and after the COVID-19 pandemic has been created, based on the article “India’s employment paradox of the 21st century: An explanation” published in “Live mints” on 26th April 2024. UPSC Syllabus Topic: GS Paper 3 – Indian Economy – Employment News: The article discusses changes in… Continue reading Changes in India’s job market before and after the COVID-19 pandemic

Claims that solar and wind energy are the cheapest forms of electricity are misleading

Source: The post claims that solar and wind energy are the cheapest forms of electricity are misleading has been created, based on the article “Why solar and wind energy are still far from winning” published in “Live mints” on 26th April 2024. UPSC Syllabus Topic: GS Paper 3- Economy-Infrastructure (renewable energy) News: The article discusses… Continue reading Claims that solar and wind energy are the cheapest forms of electricity are misleading

Supreme Court’s view on false advertisement

Source: The post Supreme Court’s view on false advertisement has been created, based on the article “Courting action: Courts should deal firmly with violators of existing food safety regulations” published in “The Hindu” on 26th April 2024. UPSC Syllabus Topic: GS Paper 2-Polity-Judiciary News: The article discusses a Supreme Court case in India where Patanjali… Continue reading Supreme Court’s view on false advertisement

The issue of Winning an Election with Contest

Source: The post the issue of Winning an Election with Contest has been created, based on the article “Questioning the polls ‘rain washes out play’ moments” published in “The Hindu” on 26th April 2024. UPSC Syllabus Topic: GS Paper 2 – Indian Constitution, and Salient features of the Representation of People’s Act. News: The article… Continue reading The issue of Winning an Election with Contest

A week food chain

Source-This post on a week food chain has been created based on the article “A weak food chain:Recent controversy points to poor regulation” published in “Business Standard” on 26 April 2024. UPSC Syllabus-GS Paper-2– Issues Relating to Development and Management of Social Sector/Services relating to Health, Education Context– Hong Kong and Singapore have recently banned… Continue reading A week food chain

Health on a hot planet

Source-This post on Health on a hot planet has been created based on the article “All the way a hotter planet makes us sicker” published in “The Indian Express” on 26 April 2024. UPSC Syllabus-GS Paper 2- Issues Relating to Development and Management of Social Sector/Services relating to Health, Education and GS Paper 3-Disaster Management… Continue reading Health on a hot planet

Green credits-Significance & Challenges

Source-This post on Green credits-Significance & Challenges has been created based on the article “Can green credits benefit India’s forests?” published in “The Hindu” on 26 April 2024. UPSC Syllabus–GS Paper-3– Conservation, Environmental Pollution and Degradation, Environmental Impact Assessment. Context-The article presents a critical analysis of Green Credit Programme.This is a is a market-based initiative… Continue reading Green credits-Significance & Challenges

SC verdict on childcare leave- Explained Pointwise

Recently, a Supreme Court (SC) bench headed by Chief Justice of India D Y Chandrachud has delivered its verdict on a case of childcare leaves. The court was hearing a plea by an assistant professor in the Government College, Nalagarh, who was denied childcare leave (CCL) to attend to her child suffering from a genetic… Continue reading SC verdict on childcare leave- Explained Pointwise