9 PM Daily Current Affairs Brief – December 19th, 2022

Dear Friends,

We have initiated some changes in the 9 PM Brief and other postings related to current affairs. What we sought to do:

- Ensure that all relevant facts, data, and arguments from today’s newspaper are readily available to you.

- We have widened the sources to provide you with content that is more than enough and adds value not just for GS but also for essay writing. Hence, the 9 PM brief now covers the following newspapers:

- The Hindu

- Indian Express

- Livemint

- Business Standard

- Times of India

- Down To Earth

- PIB

- We have also introduced the relevance part to every article. This ensures that you know why a particular article is important.

- Since these changes are new, so initially the number of articles might increase, but they’ll go down over time.

- It is our endeavor to provide you with the best content and your feedback is essential for the same. We will be anticipating your feedback and ensure the blog serves as an optimal medium of learning for all the aspirants.

- For previous editions of 9 PM Brief – Click Here

- For individual articles of 9 PM Brief– Click Here

Mains Oriented Articles

GS Paper 2

- India’s crushing court backlogs, out-of-the box reform

- Good governance beyond motherhood and apple pie

- Decriminalisation of offences under GST

- Fumes of failure – Prohibition is damaging Bihar in multiple ways

- Maharashtra panel to track interfaith marriages threatens to limit personal freedoms, can be weaponised against minorities

GS Paper 3

- Why the Draft Data Bill needs stronger provisions for localisation of non-personal data

- Setting standards – New SEBI guidelines

- Passport To Justice: Can AI Help Cut Pendency Dramatically?

- A low-tariff regime can do India a world of good

- Creators Of Our Destroyers – INS Mormugao, commissioned yesterday, shows both the progress & weakness in indigenous warship building

Prelims Oriented Articles (Factly)

- Deepfake technology: how and why China is planning to regulate it

- Ladakh gets its first-ever GI Tag to its Raktsey Karpo Apricot

- What is the law on acid attacks in India?

- Missile destroyer INS Mormugao commissioned into Indian Navy

- Year End Review of The Ministry of Minority Affairs

- Kepler-138c and Kepler-138d: Scientists detect two water worlds 218 light years away

- India pushes for new biodiversity fund

- MINISTRY OF DEFENCE – YEAR END REVIEW 2022

- Govt plans to raise duty on non-essential goods

Mains Oriented Articles

GS Paper 2

India’s crushing court backlogs, out-of-the box reform

Source– The post is based on the article “India’s crushing court backlogs, out-of-the box reform” published in The Hindu on 19th December 2022.

Syllabus: GS2- Judiciary

Relevance– Reforms in judicial process

News– The article explains the steps needed to overcome the challenge of delays in justice delivery system

What is the way forward to overcome delays in the justice delivery system?

Empoy retired judges– A large number of experienced and fine judges are retiring from the High Courts because they have reached the age of 62. All that needs to be done is to continue them with pay and perquisites.

There is a need to bring back retired Supreme Court judges to hear admission of Special Leave Petitions. These are appeals filed in hundreds every week against all kinds of orders of lower courts and tribunals across. They take away half the time of the country’s senior most judges in just reading these mountainous files .

Working hours and schedules can be flexibly designed for retired judges to operate. This will enable the current judges to take up important cases in adequate Bench strength and composition. There can be a scheme by which experienced High Court senior advocates sit as judges once a week to hear matters from another State High Court.

Strengthen online justice– There is a need to cultivate online justice. The courts responded COVID-19 shutdown by harnessing online facilities. Judges and lawyers were quite well-versed in this new medium and welcomed its ease and flexibility. Unfortunately, we have gone back to the old days of only physical hearings in crowded courtrooms.

Enabling ad hoc judges to work online from home with minimum support staff is an excellent harness of human and technology resources. It will enable a vast number of cases to be disposed of.

Use of mediation– There is a need to employ mediation. As a method of dispute resolution, it is far superior to litigation. It covers a wide range, from personal and matrimonial to civil and commercial and property disputes.

India has a good track record in this process. In less than 20 years it has firmly established itself in the court annexed mediation schemes. Most mediation centres have a success rate of over 50%. It costs much less, takes a fraction of the time litigation does, brings about settlements which all sides can agree to. It eliminates appeals and is easy to enforce.

There is a need to make it a professionally attractive career option for mediators. An Indian Mediation Service can be created on the lines of the judicial service. Incentives and disincentives must be devised for existing and prospective litigants to try this consensual method in good faith.

Good governance beyond motherhood and apple pie

Source– The post is based on the article “Good governance beyond motherhood and apple pie” published in The Hindu on 19th December 2022.

Syllabus: GS2- Important aspects of governance

Relevance– Issues related to good governance

News– The article explains the steps taken by the current government at centre for good governance. It also exp[lains the steps that are needed to be taken by state governments to promote good governance

What are the steps taken by the current central government for good governance?

The current government has repealed an estimated 2,000 obsolete Acts, statutes and subordinate legislation which include dozens of Appropriation acts, the Excise Act 1863, Foreign Recruiting Act 1874 etc.

There existed a contentious provision in the Prevention of Corruption Act. Any pecuniary benefit to any private parties, without public interest, regardless of whether there was an intent to cause such gains or not, was construed as criminal misconduct by a public servant. Therefore, even honest officers had to face this cruel law. This government finally scrapped this provision.

Another step of this government towards good governance is the DigiLocker. It is an integral part of the India stack. It now has more than five billion documents and 100 million users.

What is the way forward for good governance?

Repeal of obsolete laws by state governments– They should repeal obsolete laws that are often tools for rent seeking. Take the example of Karnataka. It is one of India’s fastest growing States. However, Karnataka ranked 17th in the 2019 Business Reforms Action Plan national rankings.

Avantis RegTech has studied industries and compliance across Indian States and concludes that Karnataka features in the top five States in India in terms of compliance burden. Karnataka’s employers confront a total of 1,175 State-specific jail clauses and ranks among the top five in the country.

Digilocker by state government- State governments can set up enterprise DigiLockers to store all documents that any small or large business is expected to possess. Karnataka has implemented KUTUMBA (family beneficiary database), FRUITS (Farmer Registration and Unified beneficiary Information System), all leading to more good governance.

Common portal– No State government or the Government of India has any common portal, through which businesses even get to know fully the extent of the compliance burden.

There is a need to create a common portal where all the compliances for a particular industry are listed.

Responsible citizenry– Good governance is also the responsibility of enlightened citizens who should give some thought to complex trade-offs like compliance of tax laws in national interest.

Decriminalisation of offences under GST

Source: The post is based on the article “Decriminalisation of offences under GST” published in The Hindu on 19th December 2022.

Syllabus: GS 2 – Governance

News: The 48th GST council that was held recently recommended decriminalising certain offences under Section 132 of the Central Goods and Services Tax (CGST) Act, 2017.

What is the current problem with GST?

There have been multiple instances of increasing tax evasion with numerous cases of taxpayers using multiple strategies to avoid indirect tax.

For this, the GST law establishes penalties and guidelines that taxpayers must follow to ensure smooth intrastate or interstate trade of goods, prevent corruption and ensure an effective tax collection system.

What are the penalties provided under the GST Law?

The GST Law provides for two different types of penalties, i.e., concurrent and simultaneous.

Sections 122 to 131 of the CGST Act of 2017 contain provisions relating to penalties, while Sections 132 to 138 contains provisions relating to prosecution and compounding.

The department authorities have the authority to impose monetary fines and the seizure of goods as penalties for violating statutory provisions and the length of the prison sentence is determined by the amount of tax evaded, etc.

What are the offences under GST law which attract IPC and CrPC provisions?

Section 69 of the CGST Act provides the power to arrest a person by an order of a commissioner for any offence committed under Section 132.

Section 67 of the CGST Act defines that only an officer not below the rank of joint commissioner can authorize in writing an inspection or search.

Further, the CGST Act provides that if a group of two persons or more agree to commit an illegal act like tax evasion, fraud etc. they are held liable under the act of criminal conspiracy.

Why did the Parliament include punishments in the GST law?

This was debated in the Parliament whether arrests should be made for offenses or not and what is the rationale behind the arrest.

However, then Union Finance Minister Mr. Arun Jaitley cleared the point that arrests are only made for the offences involving a higher tax evasion and the Council is meant to follow a middle path. For example, there is no arrest for the fraud up to five crore rupees.

What has been the recent recommendation to decriminalize the GST offences?

- a) raising the minimum threshold of tax amount from one crore to two crore for prosecution under GST except for the offence of issuing invoices without supply of goods or services or both, b) reducing the compounding amount from the present range of 50 to 150% of the tax amount to the range of 25 to 100%, and c) decriminalising certain offences specified under Section 132 of the CGST Act, 2017, such as preventing any officer from doing his duties, deliberate tempering of material evidence, etc.

What will be the impact of decriminalisation?

The government has taken a good step towards decriminilising because GST is a law that is still under development and there are many provisions of the law that still require changes and proper enforcement.

In this scenario, criminalising every small offense would discourage investors and other businesses to carry forward their functions smoothly.

What are the other recommended measures to facilitate trade?

Refunding unregistered persons – There was no procedure for claim of refund of tax borne by unregistered buyers where the contract/agreement for supply of services like construction of flat/house and long-term insurance policy is cancelled. Therefore, the Council recommended amendment in CGST Rules, 2017 to prescribe the procedure for filing application of refund by the unregistered buyers in such cases.

Facilitating e-commerce for micro enterprises – The GST Council in its 47th meeting had granted in-principle approval for allowing unregistered suppliers and composition taxpayers to make intra-state supply of goods through E-Commerce Operators (ECOs), subject to certain conditions. The same has been allowed in the current GST meeting.

What is the way ahead?

The steps taken by GST to decriminalize certain offences is appreciable because it would encourage business activities and arrests would only be made in the rarest of rare cases.

Fumes of failure – Prohibition is damaging Bihar in multiple ways

Source: The post is based on the article “Fumes of failure – Prohibition is damaging Bihar in multiple ways” published in the Business Standard on 19th November 2022.

Syllabus: GS – 2 – Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Relevance: About prohibition movements in states.

News: The death of over 70 people in Bihar after consuming illicit liquor underlines the challenges associated with prohibition.

What are the challenges associated with prohibition?

a) There will be an emergence of an illicit liquor mafia that smuggles liquor across state and international borders.

b) Hooch-related deaths will increase as they deploy toxic chemicals to make hooch. This creates law and order problems in a state.

c) The revenue loss from prohibition is enormous. For example, 1) In a recent letter to Bihar CM, the Confederation of Indian Alcoholic Beverage Companies (CIABC) said the state lost about Rs 10,000 crore in revenues from prohibition annually. Given the development needs of a state like Bihar, additional revenue could have been useful, 2) Prohibition policy in Haryana in 1996 cost the state revenues and jobs. To compensate for the revenue forgone from liquor sales, the Haryana government raised tariffs on state-provided services — from bus fares to power and petrol.

| Must read: Prohibition of Liquor: Benefits and Challenges – Explained, pointwise |

Why there is an increase in prohibition movements in states throughout India?

1) To gain the support of women voters as they bear the brunt of men’s alcoholic inclinations as victims of domestic violence and wasted incomes.

2) In India social-drinking norms are near non-existent and daily life is tough enough to encourage alcoholic oblivion among working men.

What should be done instead of prohibition movements?

The government should move towards experimenting with alternative wage payment practices and gradually lifting prohibition in the states where it is implemented.

Manufacturing and mining units in states like Bihar can hand over the weekly wages of men to the womenfolk like in the UK.

| Read more: The effectiveness of prohibition of Alcohol in India and some alternative policy measures |

Maharashtra panel to track interfaith marriages threatens to limit personal freedoms, can be weaponised against minorities

Source: The post is based on the article “Maharashtra panel to track interfaith marriages threatens to limit personal freedoms, can be weaponised against minorities” published in the Indian Express on 19th November 2022.

Syllabus: GS – 2 – Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Relevance: About anti-conversion legislation.

News: The Maharashtra government has decided to limit the mandate of the recently constituted Intercaste/Interfaith Marriage-Family Coordination Committee (state level) to gathering information on interfaith marriages.

About the Maharastra’s Intercaste/Interfaith Marriage-Family Coordination Committee

The renamed Interfaith Marriage-Family Coordination Committee was functioning under the state Women and Child Development Ministry. The committee will ostensibly track fraud committed in the name of “love jihad”. It will also provide support and rehabilitation when necessary.

Note: Already states such as Uttar Pradesh and Uttarakhand have brought in anti-conversion legislation.

| Read more: What are the existing laws on religious conversions? |

What are the concerns associated with the anti-conversion legislation?

a) It shows State’s disproportionately interest and demand for control over the lives of individual citizens, b) It is violative of one’s rights of freedom and equality, c) It denies a woman’s choice of partner as her own free will and acts as coercion, d) It limits the openness and possibility by casting communal aspersions on personal choice and e) Overall, these laws are designed to deter men and women from leading fuller, freer lives.

| Must read: What are the issues in anti-conversion law? |

India should uphold the cauldron of multi-ethnic, multilingual and multi-cultural aspirations of citizens. So, India should ensure openness and uphold personal choices.

GS Paper 3

Why the Draft Data Bill needs stronger provisions for localisation of non-personal data

Source– The post is based on the article “Why the Draft Data Bill needs stronger provisions for localisation of non-personal data” published in The Indian Express on 19th December 2022.

Syllabus: GS3- Awareness in the field of IT

Relevance– Issues related to data in emerging digital space

News– The article explains the issues related to the fresh draft of the Digital Personal Data Protection Bill, 2022.

What are the positive aspects of the draft bill?

It is crisp, to the point and easy to read. It is the first attempt to define who can possess data and what their legal obligations are.

It doesn’t get into issues such as critical and non-crucial data. There is a very simple definition of personal and non-personal data.

The new draft is neither a copy nor an adaptation of Anglo-Saxon laws, like the EU’s General Data Protection Regulations or the CLOUD Act. It is designed for India’s requirements.

What are the issues with the bill?

Lack of clarity– There is still no clarity on the role and structure of the data protection board. It is not clear if it will be a regulator or adjudicator or how it will function independently.

Issues related to sovereignty– People concerned about data sovereignty have long been advocating the housing of servers within India. The draft appears far too focused on individuals’ privacy issues.

There can’t be a handful of global corporations accumulating data through ethical and unethical means. In many cases, they can manipulate the minds of consumers.

India has resisted the attempt by developed countries at international fora to bring in the seamless flow of data to facilitate the competitiveness of their corporations.

The UNCTAD Trade and Development Report (2018) says, “it is important for the countries to control their data and be able to use or share their data and regulate its flow.

Issues related to data transfer– Chapter 4 of the draft Bill deals with the transfer of data outside the country. It says that the Central Government may notify such countries or territories outside India to which a Data Fiduciary may transfer personal data, in accordance with such terms and conditions as may be specified. These words may make the job of trade negotiators difficult when free trade agreements with the US, EU and the UK are yet to be concluded.

What are the updates that are required for the bill?

The draft requires fine-tuning, including determining the quantum of penalties. The upper ceiling has been fixed at Rs 500 crore. There are global examples, where the penalties are determined as a percentage of their global revenues.

There is no knowledge of how Big corporations use the data accumulated by them and what products are made out of it. To curb these tendencies, there is an urgent need for data nationalism and localisation.

India needs to assert its sovereign right over non-personal data emerging out of Indian citizens and make it obligatory to share products with Indian players.

India must continue to stand its ground on e-commerce at various WTO ministerials in the context of transfer of data outside our country.

It would have been much better if the law didn’t leave important matters, such as the obligations of data fiduciaries once the data moves to foreign shores open to interpretation.

The draft talks about consent, deemed consent, and has provisions for withdrawal of consent. But, this is largely for personal data.

As of now, there is little clarity about how personal data can be converted into non-personal data. One just has to remove the identification labels to make information non-personal.

Setting standards – New SEBI guidelines

Source– The post is based on the article “Setting standards” published in the Business Standard on 19th December 2022.

Syllabus: GS3- Mobilisation of resources

Relevance– Issues related to money and capital markets

News– The article explains the new guidelines by SEBI for performance benchmarking and investment approach for Portfolio Management Services segment.

What are the new guidelines by SEBI for the PMS segment?

Additional protection– The new guidelines would give investors a clearer picture of what strategy a PMS is targeting, and also a clearer idea of returns with detailed comparisons and timeliness.

The investment approach (IA) is the documented philosophy adopted by a given portfolio manager. Now this IA needs to provide more information by disclosure of an additional broad layer of strategy. This additional layer can be defined as “hybrid”, “equity”, “debt” and “multi-asset”.

Each IA can be tied to only one specific strategy, though a manager could adopt and declare several IAs. This tagging is based on the judgement of the manager concerned.

Change of strategy– The tagging of an IA to a strategy or a benchmark may be changed only after offering an option to subscribers to the IA, to exit without any exit load. The performance track record prior to the change would not be used by the portfolio manager for performance reporting after the tagging changes.

Any changes in strategy and benchmark would be recorded with the logic justifying the change, and this would be verified as part of the annual audit of the PMS.

Setting of benchmarks and standards– The Association of Portfolio Managers in India (APMI) could prescribe a maximum of three benchmarks to compare for each strategy. These benchmarks would then reflect the core philosophy of the strategy. Further, the board of the portfolio managers would hold responsibility for ensuring the appropriate selection of strategy and the benchmark for each IA.

The APMI must set standardised valuation norms for portfolio managers, similar to the corresponding benchmarks applicable to mutual funds. The valuation of debt and money market securities by portfolio managers would have to be in line with the valuation norms set by the APMI.

Evaluation of securities– The APMI would empanel valuation agencies for providing security-level prices to portfolio managers. The managers would have to mandatorily use services from empanelled agents for the valuation of debt and money-market securities in their portfolios.

Obligation of portfolio managers– The managers would also have to present the time-weighted rate of return (TWRR) of the IA alongside the return of the selected benchmark, and the returns of other PMS running under the same strategy. Such returns and comparisons must also be disclosed while advertising.

Further, portfolio managers would have to submit monthly reports to the APMI within seven working days of the end of each month. The APMI would then have to make available the monthly reports on its website.

What are the advantages of these nes guidelines on PMS?

This would clearly lead to improved transparency in the PMS segment. These multiple layers of additional disclosures and the detailed benchmarking of returns would allow investors to gauge relative performances better.

This information would also allow investors to make more informed choices in the selection of a new scheme.

Passport To Justice: Can AI Help Cut Pendency Dramatically?

Source: The post is based on the article “Passport To Justice: Can AI Help Cut Pendency Dramatically?” published in The Times of India on 19th December 2022.

Syllabus: GS 3 – Science and Technology

Relevance: use of AI in solving pendency of cases

News: India has a large pendency of cases and it takes a lot of time to hear them and provide judgment. Therefore, artificial intelligence techniques can be used to provide on time judgment.

How can Artificial Intelligence be helpful in solving cases?

Argentina has created Prometea software. It has been developed by the University of Buenos Aires in partnership with the public prosecutor and the constitutional court. It has three primary components –

First, a talkable user-friendly interface with a natural language processor for audio or text inputs so that it can be used by a clerk as well as by a judge. It can also be helpful in creating reports and graphs, providing solutions, sending notifications, doing deep internet search, etc.

Second, expert automation to draft judgments and provide recommendations. It uses No black box AI to provide transparent and clear assumptions, thereby preventing its misuse.

Third, machine learning for improving accuracy and reducing time in the future and to adapt to new types of cases. This is important to ensure that the software evolves as new judges and case law arise.

What are the advantages of this software?

- a) higher success rates, b)predict a judgment in 20 seconds with 96% accuracy, c) can create multiple versions of the judgment which the judge has to just sign, d) operates on the entire range of court process from filing cases, scheduling it and creation of the verdict.

How can this software be helpful for India?

India has currently digitised its passport system unlike before where people used to stand in queues and wait for long hours, today everything is done digitally.

Similarly, this software can also be helpful in digitising the Indian judiciary and help in resolving the problem of pendency of cases. Therefore, there is a need for the Indian judiciary to adopt software like Prometea in its working.

A low-tariff regime can do India a world of good

Source: The post is based on the article “A low-tariff regime can do India a world of good” published in the Livemint on 19th November 2022.

Syllabus: GS – 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Relevance: About challenges faced by the Indian economy.

News: The deputy managing director of the International Monetary Fund has said that a global need to diversify purchases had generated interest in India in other words “The world is looking at India as a destination for investment.”

What are some major remarks of the IMF deputy manager on the Indian economy?

There is a global demand weakness as imminent and tighter financial conditions as a potential trouble. The risks of supply over-reliance on China gain salience globally.

-Indian exports are showing signs of slowing down and dearer dollar debt has drawn capital out of the country and hit the rupee.

-Smartphone factories are improving in India due to production-linked incentives for manufacturers. Further, private funds have also started coming into other industries. However, their performance is too small for job generation and remains as a challenge in the trajectory of India’s economic growth.

–Retrospective taxation, rejections of foreign dispute settlements and a revenue-sharing clutter in telecom have created a bad reputation.

–Land acquisition has not eased and India’s labour market stands with great gender imbalance.

What should India do to boost its economy at the global level?

As global-scale manufacturing today tends to span multiple borders hence integration with supply chains is crucial.

Indian policymakers are keen to establish India as a factory for the world. But it is still a steep ambition, and achieving it will need well-rounded policy alignment.

The government has cut taxes for new ventures and sought to slash red-tape and eased tax remission for exporters. A lower-tariff regime will also push local producers to generally get more competitive.

Creators Of Our Destroyers – INS Mormugao, commissioned yesterday, shows both the progress & weakness in indigenous warship building

Source: The post is based on the article “Creators Of Our Destroyers – INS Mormugao, commissioned yesterday, shows both the progress & weakness in indigenous warship building” published in The Times of India on 19th November 2022.

Syllabus: GS – 3 – Various Security forces and agencies and their mandate.

Relevance: About India’s shipbuilding industry.

News: INS Mormugao, the Indian navy’s latest destroyer of the Project 15B class, has been commissioned recently.

About the Project-15 (P15) family of ships

The Project-15 (P15) class started with INS Delhi. It is India’s first home-built destroyer. It was commissioned in November 1997 and set a new benchmark.

Apart from three ships of the P15 class, there have been three of the P15A named the Kolkata class. Visakhapatnam was the lead ship of the P15B class followed by Mormugao.

These ships now complete most of their trials and even weapon firings before commissioning so that they are ready to go in harm’s way sooner.

What are the weaknesses associated with India’s shipbuilding industry?

1) INS Mormugao has taken the shortest build time of about seven years due to integrated shipbuilding, while the INS Delhi took over 10 years. But, a drop of build time from 10-plus years to about 6-7 years over a 35-year build period, is by itself not impressive.

2) There are some major commonalities between all three sub-classes of the P15, so efficiencies should have been better.

What are the improvements in India’s shipbuilding industry?

There have been generational improvements in each sub-class. Both in terms of combat capabilities, as well as indigenous content. “Indianisation” percentages have improved in the “float and fight” components when compared to the P15s.

For example, a) The steel for the hull and superstructure is now made in India; b) More of the electronic components for electronic warfare, communications and radars are now either Indian-origin or licence-built in larger numbers with knowledge accretion from Indian partner firms in the public and private sectors, c) Weapons and their launchers are collaborative like the accurate and lethal Brahmos, d) The main and secondary guns as well as anti-submarine ordnance which is now more “Indian” than any time earlier, e) There are other design improvements across evolutionary processes that benefit stability, damage control, sea-keeping and stealth through more automation and improved systems needing fewer operators.

WhCreators Of Our Destroyers – INS Mormugao, commissioned yesterday, shows both the progress & weakness in indigenous warship buildingeeds improvement in India’s shipbuilding industry?

In the “move” area or propulsion, Indian ships reflect big lacunae. For example, frigates and destroyers still require imported gas turbines. India does not have any indigenous options even under imported transfer of technology neither in aero nor in marine gas turbines. This has to be improved.

Given the turmoil in Russia and Ukraine, ships that depend on hardware from these two countries could face problems that need to be addressed with ‘atmanirbharta’.

Prelims Oriented Articles (Factly)

Deepfake technology: how and why China is planning to regulate it

Source: The post is based on the article “Deepfake technology: how and why China is planning to regulate it” published in The Hindu on 19th December 2022

What is the News?

The Cyberspace Administration of China is rolling out new regulations to restrict the use of deep synthesis technology and curb disinformation.

What is Deep Synthesis Technology?

Deep synthesis is defined as the use of technologies, including deep learning and augmented reality, to generate text, images, audio and video to create virtual scenes.

One of the most notorious applications of technology is deepfakes.

What is Deepfake?

Deepfakes are a compilation of artificial images and audio put together with machine-learning algorithms to spread misinformation and replace a real person’s appearance, voice, or both with similar artificial likenesses or voices.

It can create people who do not exist and it can fake real people saying and doing things they did not say or do.

What is China’s new policy to curb deepfakes?

The policy requires deep synthesis service providers and users to ensure that any doctored content using the technology is explicitly labelled and can be traced back to its source.

The regulation also mandates people using the technology to edit someone’s image or voice, to notify and take the consent of the person in question. When reposting news made by the technology, the source can only be from the government-approved list of news outlets.

Deep synthesis service providers must also abide by local laws, respect ethics and maintain the correct political direction and correct public opinion orientation.

What are other countries doing to combat deepfakes?

The European Union has an updated Code of Practice to stop the spread of disinformation through deepfakes. The revised Code requires tech companies including Google, Meta and Twitter to take measures in countering deepfakes and fake accounts on their platforms.

They have six months to implement their measures once they have signed up for the Code. If found non-compliant, these companies can face fines of as much as 6% of their annual global turnover.

Ladakh gets its first-ever GI Tag to its Raktsey Karpo Apricot

Source: The post is based on the article “Ladakh gets its first-ever GI Tag to its Raktsey Karpo Apricot” published in AIR on 19th December 2022

What is the News?

Ladakh got its first ever Geographical Indication (GI) Tag to its Raktsey Karpo Apricot.

Apricot Production in Ladakh

Ladakh is the biggest apricot producer in the country.

Ladakh Apricot is classified into two broad categories based on kernel taste and stone color. Fruits with bitter kernels are called khante meaning bitter, while those with sweet kernels are called nyarmo meaning sweet.

They are further divided into two sub-groups based on seed stone color. Fruit with white seed stones is called Raktsey Karpo while those with brown seed stones are called Raktsey Nakpo or Nyarmo (black seeded).

Ladakh Apricot is also being promoted under One District One Product for Kargil.

What is special about Raktsey Karpo Apricot?

Firstly, it is packed with vitamins, is low on calories and is rich in sorbitol – a natural glucose substitute that can be consumed by diabetics.

Secondly, the oil from its seed is known to relieve back aches and joint pain.

Thirdly, it is grown organically as an individual on trees or in clusters without using any chemical fertilizers.

What is the law on acid attacks in India?

Source: The post is based on the article “What is the law on acid attacks in India?” published in Indian Express on 19th December 2022

What is the News?

A 17-year-old girl was attacked with an acid-like substance in Delhi by three assailants while she was on her way to school.

How prevalent are acid attacks in India?

Acid attacks on women are not as prevalent a crime as others against women.

According to data compiled by the National Crime Records Bureau (NCRB), there were 150 such cases recorded in 2019, 105 in 2020 and 102 in 2021.

West Bengal and UP consistently record the highest number of such cases generally accounting for nearly 50% of all cases in the country year on year.

The chargesheeting rate of acid attacks stood at 83% and the conviction rate at 54% in 2019. In 2021, the figures were recorded to be 89% and 20% respectively.

What is the law on acid attacks?

Until 2013, acid attacks were not treated as separate crimes. However, following amendments carried out in the IPC, acid attacks were put under a separate section (326A) of the IPC and made punishable with a minimum imprisonment of 10 years which is extendable to life along with a fine.

The law also has provisions for punishment for denial of treatment to victims or police officers refusing to register an FIR or record any piece of evidence.

Denial of treatment (by both public and private hospitals) can lead to imprisonment of up to one year and dereliction of duty by a police officer is punishable by imprisonment of up to two years.

What is the law on the regulation of acid sales?

In 2013, the Supreme Court took cognizance of acid attacks and passed an order on the regulation of sales of corrosive substances.

Based on the order, the Ministry of Home Affairs(MHA) issued an advisory to all states on how to regulate acid sales and framed the Model Poisons Possession and Sale Rules, 2013 under The Poisons Act,1919. It asked states to frame their own rules based on model rules, as the matter fell under the purview of states.

Key provisions of the model rules

Over-the-counter sale of acid was not allowed unless the seller maintains a logbook/register recording the sale of acid. The sale is also to be made only when the buyer produces a photo ID containing his address issued by the government. The buyer must also prove he/she is above 18 years of age.

Sellers are required to declare all stocks of acid with the concerned Sub-Divisional Magistrate (SDM) within 15 days and in case of undeclared stock of acid. The SDM can confiscate the stock and suitably impose a fine of up to Rs 50,000 for a breach of any of the directions.

Educational institutions, research laboratories, hospitals, government departments and the departments of Public Sector Undertakings which are required to keep and store acid should maintain a register of usage of acid and file the same with the concerned SDM.

Is there any compensation and care given to acid attack victims?

Based on Supreme Court directions, the MHA asked states to make sure acid attack victims are paid compensation of at least Rs. 3 lakhs by the concerned State Government/Union Territory as the aftercare and rehabilitation cost.

Apart from this, MHA suggested states should extend social integration programs to the victims for which NGOs could be funded to exclusively look after their rehabilitative requirements.

Missile destroyer INS Mormugao commissioned into Indian Navy

Source: The post is based on the article “Missile destroyer INS Mormugao commissioned into Indian Navy” published in The Hindu on 18th December 2022

What is the News?

INS Mormugao (Pennant D67) has been commissioned into the Indian Navy.

What is INS Mormugao?

INS Mormugao is the second ship of the Visakhapatnam-class destroyers (also classed as Project -15B stealth, guided-missile destroyers).

Built by: Mazagon Dock Shipbuilders Limited(MDSL).

Named after: Mormugao is named after the historic port city of Goa on India’s west coast.

Features: The ship is propelled by four powerful gas turbines and is capable of achieving speeds of over 30 knots.

It is equipped with surface-to-surface and surface-to-air missiles.

It is also fitted with a modern surveillance radar that provides target data to the gunnery weapon systems.

The ship is able to fight under nuclear, biological, and chemical (NBC) warfare conditions.

Year End Review of The Ministry of Minority Affairs

Source: The post is based on the article “Year End Review of The Ministry of Minority Affairs” published in PIB on 18th December 2022

What is the News?

The Ministry of Minority Affairs has launched several initiatives and schemes in 2022.

What are the schemes and initiatives launched by the Ministry of Minority Affairs in 2022?

Scholarship Schemes: Ministry of Minority Affairs is implementing three scholarship schemes for the educational empowerment of students belonging to the notified minority communities: (i) pre-matric scholarship; (ii) post-matric scholarship; and (iii) merit–cum–means based scholarship.

To improve transparency in scholarship schemes, a new and revamped version of National scholarship Portal 2.0 was launched for various ministries of the Central Government including the Ministry of Minority Affairs for extending scholarships during 2016-17.

Pradhan Mantri Virasat Ka Samvardhan(PM VIKAS) Scheme

Seekho Aur Kamao(Learn and Earn): It is a placement-linked skill development scheme for minorities that was launched by the Ministry of Minority Affairs in 2013. It aims to upgrade the skills of minority youth (in the age group of 14-45 years) in various modern/ traditional skills.

– The scheme has now been converged as a component of the integrated PM VIKAS scheme.

USTTAD (Upgrading the Skills and Training in Traditional Arts/ Crafts for Development) Scheme

Pradhan Mantri Jan Vikas Karyakram(PMJVK): It is a Centrally Sponsored Scheme. It is being implemented by the Ministry of Minority Affairs with the objective to develop infrastructure projects, which are community assets, in the identified areas with development deficits for socio-economic development of the said areas.

National Commission for Minorities

Commissioner for Linguistic Minorities: The Office of the Commissioner for Linguistic Minorities(CLM) was established in 1957 in pursuance of the provision of Article 350-B of the Constitution. It envisages investigation by CLM of all matters relating to the safeguards provided for the linguistic minorities in the country under the Constitution and reporting to the President upon these matters at such intervals as the President may direct.

– The President may want that all such reports to be laid before each House of Parliament and sent to the government administration of states/UTs concerned.

– Headquarters: Delhi with Zonal offices at Chennai and Kolkata.

Central Waqf Council: It is a statutory body under the administrative control of the Ministry of Minority Affairs. It was set up in 1964 under the Waqf Act, 1954.

– Mandate: It is an advisory body to the Central Government on matters concerning the working of the Waqf Boards and the due administration of Auqaf in the country.

The council can issue directives to the Boards to furnish information to the Council on the performance of the board, particularly on their financial performance, survey revenue records encroachment of Waqf properties and Annual and Audit report etc.

– Chairman: Union Minister of Minority Affairs is the ex-officio Chairperson.

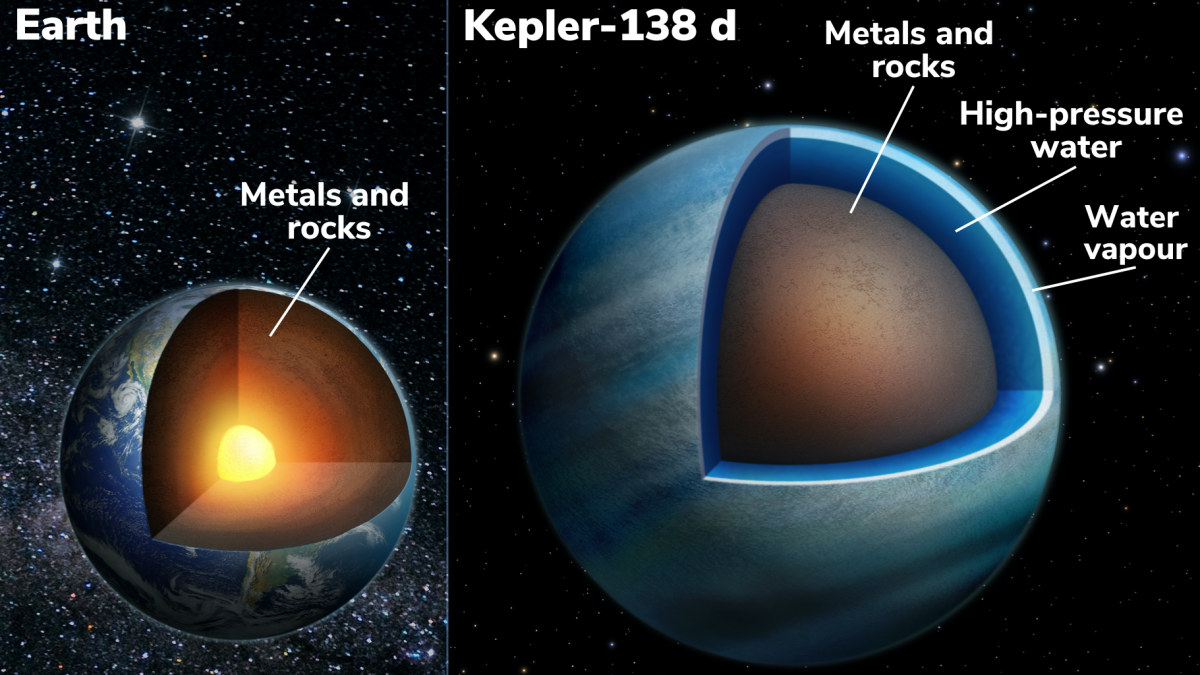

Kepler-138c and Kepler-138d: Scientists detect two water worlds 218 light years away

Source: The post is based on the article “Scientists detect two water worlds 218 light years away” published in Down To Earth on 18th December 2022

What is the News?

A team of researchers has announced that two previously discovered exoplanets Kepler-138c and Kepler-138d are Water Worlds which means they are primarily made of water.

Background

In 2014, astronomers discovered three exoplanets orbiting Kepler-138, a star 218 light years from Earth.

They observed two of these exoplanets Kepler-138c and Kepler-138d with Hubble and the retired Spitzer space telescopes.

What were the key findings of the researchers?

The unique factor of the two exoplanets was that watery liquid makes up a large part of their composition.

Notably, water on these exoplanets wasn’t detected directly. Researchers compared the sizes and masses of the planets to conclude that a significant fraction of their volume — up to half of it — should be made of materials that are lighter than rock but heavier than hydrogen or helium — and water is the most common material that fits that criteria.

The closest comparisons to these water worlds are Europa and Enceladus — icy moons orbiting Jupiter and Saturn, respectively — but because Kepler-138 c and Kepler-138 d are so much closer to their star, their water would not be frozen.

India pushes for new biodiversity fund

Source: The post is based on the article “India pushes for new biodiversity fund” published in The Hindu on 19th December 2022

What is the News?

At the U.N biodiversity conference in Canada, India called for the setting up of a New Biodiversity Fund to help developing countries successfully implement a post-2020 Global Biodiversity Framework(GBF).

What is the Global biodiversity framework(GBF)?

A new post-2020 Global biodiversity framework(GBF) is being negotiated under the United Nations Convention on Biological Diversity (CBD).

This framework will replace the Aichi Biodiversity Target. It will define targets and pathways for the conservation and sustainable use of biodiversity for the next decade and beyond.

Some of the targets under GBF include reducing pollution, pesticides, subsidies harmful to nature and the rate of introduction of invasive alien species among others.

What were the demands put forth by India and other developing countries?

Biodiversity Fund: India has called for the setting up of a New Biodiversity Fund to help developing countries successfully implement a post-2020 GBF.

– This fund is required because developing countries bear most of the burden of implementing the targets for the conservation of biodiversity and therefore, require adequate funds and technology transfer for this purpose.

– Currently, Global Environment Facility, which caters to multiple conventions, including the UNFCCC and UN Convention to Combat Desertification, remains the only source of funding for biodiversity conservation.

Goals of GBP should be realistic: The goals and targets set in the GBF should not only be ambitious but also realistic and practical.

– For instance, the conservation of biodiversity must be based on ‘Common but Differentiated Responsibilities and Respective Capabilities’(CBDR) as climate change also impacts nature.

Note: CBDR is defined as states that have common but differentiated responsibilities in view of the different contributions to global environmental degradation.

On Agriculture related subsidy: At CBD COP15, the countries are trying to achieve a consensus on eliminating subsidies that are harmful to the environment such as subsidies for fossil fuel production, agriculture, forestry and fisheries by at least $500 billion (one billion = 100 crore) annually and using this money for biodiversity conservation.

However, India has said that it does not agree on reducing the agriculture-related subsidy and redirecting the savings to biodiversity conservation as there are many other national priorities.

This is because for developing nations, agriculture is a paramount economic driver for rural communities, and the critical support provided to these sectors cannot be redirected.

MINISTRY OF DEFENCE – YEAR END REVIEW 2022

Source: The post is based on the article “MINISTRY OF DEFENCE – YEAR END REVIEW 2022” published in PIB on 18th December 2022

What is the News?

The Ministry of Defence has launched several initiatives and schemes in 2022.

What are the schemes and initiatives launched by the Ministry of Defence in 2022?

Indian Naval Air Squadron(INAS) 325 operating the indigenously built Advanced Light Helicopter (ALH) Mk-III, was commissioned into the Indian Navy. The unit was the second ALH MK III Squadron commissioned into the Indian Navy.

– ALH MK II is the state-of-the-art multi role helicopter developed and manufactured by HAL.

Two frontline warships of the Indian Navy – ‘Surat’ and ‘Udaygiri’

Diving Support/Survey vessels: Two Diving Support Vessels(DSVs) – Nistar and Nipun – built by Hindustan Shipyard Ltd were launched.

– DSVs equipped with an array of complex Diving Support systems and Deep Submergence Rescue Vessels are being deployed for deep sea diving and submarine rescue operations. The ships are capable of conducting Search and Rescue operations and carrying out Helicopter Operations at sea.

Offshore Patrol Vessel: Indigenously built Offshore Patrol Vessel for Indian Coast Guard, Saksham was inducted. The ship has been designed and built by Goa Shipyard Ltd and is fitted with advanced technology navigation and communication equipment, sensors and machinery.

C-295 transport aircraft manufacturing facility

Major successful missile tests: Brahmos Extended Range Version, Prithvi-II, Agni, Helina Laser-Guided Anti-Tank Guided Missile, Quick Reaction Surface to Air Missile, Phase-II Ballistic Missile Defence interceptor, Man Portable Anti-Tank Guided Missile

Operational Deployments by Indian Navy: Operation SANKALP and Mission SAGAR

Indian Navy Foreign Exercises: MILAN – 22, Exercise Sea Dragon, Bongosagar, Exercise KAKADU, Exercise Malabar, RIMPAC

Indian Air Force Foreign Exercises: Exercise Eastern Bridge, Ex Udara Shakti, Exercise Garuda

Green Mobility Initiative: In order to achieve a reduction of carbon footprint and in keeping with the Government’s initiative towards the introduction of Green mobility, the Indian Air Force(IAF) has introduced Tata Nexon Electric vehicles. The IAF plans to enhance the usage of electric vehicles in a progressive manner by procuring e-vehicles against downgraded vehicles.

Missiles launched by DRDO: New Generation Akash Missile (Akash-NG), Advanced Chaff Technology, ABHYAS, Smart Anti-Airfield Weapon, Pralay, Stand-Off Anti-Tank Missile, Solid Fuel Ducted Ramjet Technology

3D Printed Buildings: A dedicated museum is being constructed at Leh to recognise the efforts of the BRO personnel and to showcase their achievements.

Use of Steel Slag in Road Construction: The BRO is constructing a pilot road stretch in Arunachal Pradesh using steel slag which can withstand heavy rains and adverse climatic conditions.

Govt plans to raise duty on non-essential goods

SoGovt plans to raise duty on non-essential goods: The post is based on the article “Govt plans to raise duty on non-essential goods” published in Indian Express on 19th December 2022

What is the News?

The Government of India is planning to regulate imports of “non-essential items” through hikes in import duties.

Trade Deficit of India

Trade deficit for April-October 2022 has widened to USD 173.46 billion as against USD 94.16 billion in April-October 2021.

To reduce this trade deficit, the government’s policy options are to push exports or disincentive imports. But a poor outlook on global growth means India’s exports will suffer just like most other countries.

The other way is to hike duties on imports, particularly those that are not critical and are produced in India. This will keep the deficit down.

What is the government doing to address this trade deficit?

The government is planning to hike the duties on imports of “non-essential items” to address this widening trade deficit.

Non-essential items include those commodities for which there is “enough manufacturing capacity” in the country.

To impose these import duties, the Government is looking for ways to separate commodities that come under the same Harmonized System of Nomenclature (HSN) code.

An HSN code subsumes a broad sweep of items. All the items under one HSN code are, however, taxed at the same rate.

But under the current deliberations, the Centre is likely to impose duty only on a few items under a code and not all.

For instance, in the case of LED lights, the government may want to levy a higher duty only on the single-wire LED light but not on the LED bulbs. This would require them to segregate the two products. Currently, they come under the same HSN code.

Supreme Court Gives Verdict — EVMs are safe

Source-This post on Supreme Court Gives Verdict — EVMs are safe has been created based on the article “Express View: Message from Supreme Court — EVMs are safe” published in “The Indian Express” on 27 April 2024. UPSC Syllabus-GS Paper-2– Salient Features of the Representation of People’s Act. News-The Supreme court in Association of Democratic… Continue reading Supreme Court Gives Verdict — EVMs are safe

ISRO’s findings on the growth of glacial lakes in the Indian Himalayas

Source: The post ISRO’s findings on the growth of glacial lakes in the Indian Himalayas has been created, based on the article “How ISRO used satellite remote-sensing to analyse glacial lakes in Himalayas” published in “Indian express” on 27th April 2024. UPSC Syllabus Topic: GS Paper 1-geography-changes in critical geographical features (including water-bodies and ice-caps)… Continue reading ISRO’s findings on the growth of glacial lakes in the Indian Himalayas

Protests at U.S. universities against the war in Gaza a sign of the crisis

Source: The post protests at U.S. universities against the war in Gaza a sign of the crisis has been created, based on the article “Pratap Bhanu Mehta writes: Behind student anger in US, three crises — democracy, university, protest” published in “Indian express” on 27th April 2024. UPSC Syllabus Topic: GS Paper 2-international relations- Effect… Continue reading Protests at U.S. universities against the war in Gaza a sign of the crisis

Curative Jurisdiction: Sounding the gavel on curative jurisdiction

Source: The post Curative Jurisdiction has been created, based on the article “Sounding the gavel on curative jurisdiction” published in “The Hindu” on 27th April 2024. UPSC Syllabus Topic: GS Paper 2 – Polity – Supreme Court News: The article discusses the Supreme Court of India’s use of “Curative Jurisdiction” to overturn a previous decision… Continue reading Curative Jurisdiction: Sounding the gavel on curative jurisdiction

Supreme Court VVPAT judgement- Explained Pointwise

Recently, the Supreme Court VVPAT judgement reposed the faith in the integrity of the current electoral process involving the use of VVPAT and EVM. The Supreme Court has rejected a plea for 100% verification of Voter Verifiable Paper Audit Trail (VVPAT) slips with the Electronic Voting Machine (EVM) count. Table of Content What is the… Continue reading Supreme Court VVPAT judgement- Explained Pointwise

Antihistamines

Source-This post on Antihistamines is based on the article “What are antihistamines?” published in “The Hindu” on 26th March 2024. Why in the News? There has been an increase in the intake of antihistamines to treat health concerns. About Antihistamines 1. About Antihistamines: They are common drugs that can be purchased without a prescription. They are… Continue reading Antihistamines

Nephrotic Syndrome

Source- This post on Nephrotic Syndrome is based on the article “In search of skin lightening creams, kidneys take a hit” published in “The Hindu” on 26th March 2024. Why in the News? Researchers from Kerala have reported a series of cases from Malappuram district where the regular use of fairness creams has been linked to… Continue reading Nephrotic Syndrome

Phi-3-mini

Source- This post on Phi-3-mini is based on the article ” Microsoft unveils Phi-3-mini, its smallest AI model yet: How it compares to bigger models” published in “Indian Express” on 27th March 2024. Why in the News? Recently, Microsoft unveiled the latest version of its ‘lightweight’ AI model that is the Phi-3-Mini. About Phi-3-mini 1.… Continue reading Phi-3-mini

Decreasing trend in solar radiation for electricity in India

Source- This post on the Decreasing trend in solar radiation for electricity in India is based on the article “Study says solar radiation available for producing power falling in India” published in “The Hindu” on 27th March 2024. Why in the News? A recent study conducted by the India Meteorological Department (IMD) in Pune has warned… Continue reading Decreasing trend in solar radiation for electricity in India

Symbol Loading Unit (SLU)

Source- This post on Symbol Loading Unit (SLU) and how it works is based on the article “SLU, ‘matchbox’ that feeds EVM candidate info” published in “The Indian Express” on 26th March 2024. Why in the News? Recently, the Supreme Court dismissed a request to verify 100% of Voter Verifiable Paper Audit Trail (VVPAT) slips… Continue reading Symbol Loading Unit (SLU)