ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

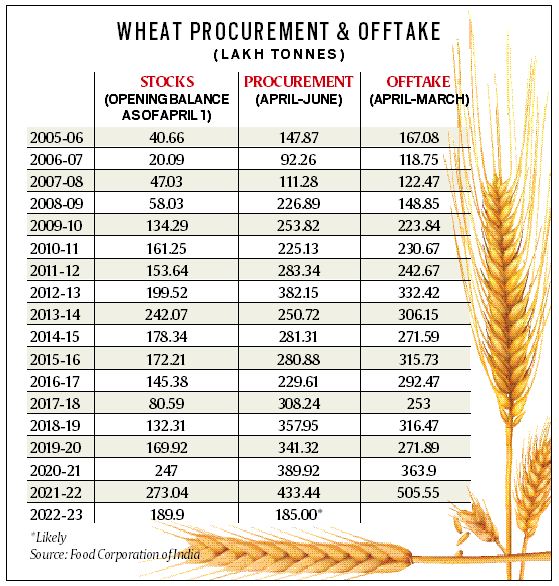

The procurement of wheat by the government agencies is set to dip to a 15-year low in the current marketing season. Wheat procurement in this year is expected to be 18.5 million tonnes (MT). This will be the lowest since the 11.1 MT bought in 2007-08. This would be the first time that wheat procured from the new crop (18.5 MT) is less than the public stocks at the start of the marketing season (19 MT). The below table shows, fresh procurement has always exceeded the opening balance stocks. It was so even during the previous two low procurement years of 2006-07 and 2007-08. The year 2021-22 had unprecedented levels of both opening stocks (27.3 MT) and procurement (43.3 MT). This has made the current fall even more dramatic.

Source: Indian Express

Some Key Facts about Wheat

Wheat is the second most important staple food after rice. It is consumed by 65% of the population in India. It is the main food crop, in the north and north-western part of the country. It is mostly consumed in the form of ‘chapati’ in our country for which bread wheat is cultivated in nearly 95% of the cropped area. Durum wheat, which is most suitable for making macaroni, noodles, semolina and pasta products, occupies about 4 to 5% of the area, and is predominantly grown in Central and Peninsular parts of India.

Climate: Wheat is a rabi crop. It requires a cool growing season and bright sunshine at the time of ripening. It requires 50 to 75 cm of annual rainfall evenly- distributed over the growing season.

Wheat Growing Regions: There are two important wheat-growing zones in the country – the Ganga-Satluj plains in the northwest and the black soil region of the Deccan. The major wheat-producing states are Punjab, Haryana, Uttar Pradesh, Bihar, Rajasthan and parts of Madhya Pradesh.

India is the second-largest producer of wheat in the world, with China being the top producer and Russia the third-largest. US and Canada complete the list of the top 5. Ukraine is the world’s eighth-largest producer of wheat.

How is the procurement of wheat undertaken in India?

The Food Corporation of India (FCI) along with State Government Agencies(SGAs) procures wheat. The FCI’s wheat procurement system can be decentralized or centralized.

Under the centralized system, the procurement of foodgrains in Central Pool are undertaken either by FCI directly or State Government agencies procure the foodgrains and handover the stocks to FCI.

Under the decentralized procurement system, State governments or their agencies procure, store, and distribute — against the Government of India’s allocation for the targeted public distribution system and other welfare schemes (OWS).

What are the reasons behind the fall in wheat procurement?

Rising Export Demand: In 2021-22, India exported a record 7.8 MT of wheat. Supply disruptions from the Russia-Ukraine war (the two countries account for over 28% of global wheat exports) have led to drastic rise in price of wheat in global market. It has led to an increase in the demand for Indian wheat.

The Indian wheat is getting exported at about US$ 350 or INR 27,000 per tonne. This is well above the minimum support price (MSP) of INR 20,150 per tonne at which the government is procuring.

Amid the Russia-Ukraine crisis, new markets in countries like Israel, Egypt, Tanzania and Mozambique have opened up for India.

Lower Production: The sudden spike in temperatures from the second half of March has taken a toll on yields. In most wheat-growing areas where the crop is harvest-ready by mid-March, farmers have reported a 15-20% decline in per-acre yields. On May 4, the government lowered its wheat production estimates by 5.7% to 105 MT from the projected 111.32 MT for the crop year ending June.

Hoarding by Traders: The price of wheat is expected to rise further as the Russia-Ukraine conflict is getting prolonged. Traders and flour millers are already paying the farmers premium over the MSP. Traders are stocking up wheat in anticipation of price rise. There are reports that some enterprising farmers are also holding back their crop to realize greater gains when prices rise further. This has made it difficult for the government to procure wheat at MSP.

The end-result of a heatwave-affected crop and open market prices rising closer to export parity levels has been that procurement by government agencies has plummeted.

It has reduced to 9.6 MT in Punjab (from 13.2 MT last year), and even more in MP (12.8 MT to 4 MT), Haryana (8.5 MT to 4.1 MT) and other states (8.8 MT to not more than 0.8 MT). With opening stocks of 19 MT and expected procurement of 18.5 MT, government agencies would have 37.5 MT of wheat available for 2022-23.

What are the possible impacts of lower wheat procurement?

First, the expected procurement would be able to meet the requirements of the public distribution system, midday meals and other regular welfare schemes, whose annual wheat requirement is around 26 MT. However, it will fall short in meeting the commitments of special schemes like the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) scheme.

Second, the government will not be able to supply wheat to flour millers and other bulk consumers to moderate open market prices during the lean months after October.

Third, the price of wheat may rise further due to lower production and huge export demand. This may enhance food inflation in the country and also increase the food subsidy bill of the government that is likely to cross INR 2.8 lakh crore this fiscal.

What lies ahead?

First, the relatively tight supplies in wheat can be compensated by the comfortable public stocks of rice. At over 55 MT as on April 1, these were more than four times the required buffer of 13.6 MT.

Further, a good monsoon should further augment availability from the ensuing kharif crop and tide over the shortages in wheat.

In this regard, the government has revised the grain allocation under PMGKAY for May to September 2022. According to the new guidelines, the FCI will fill the gap left by wheat with an increased allocation of rice.

Second, with every 1oC rise in temperatures, wheat yields are likely to suffer by about 5 Million Metric Tonnes (MMT), as per earlier IPCC reports. This calls for massive investments in agri-R&D to find heat-resistant varieties of wheat and also create models for ‘climate-smart’ agriculture.

Third, there should be a check on wheat exports. Indian wheat is highly competitive in the global market today, but the government should let these exports happen through the private trade in the natural course. It mustn’t push beyond a point, leave alone exporting from its stocks.

Conclusion

As government wheat procurement has dipped, concerns are being raised about the stability of prices in the country and the availability of grain for internal consumption. India has duly grabbed the export opportunity arising out of the Russia-Ukraine crisis however the Government must not disregard domestic commitments (Welfare measures, Food Security etc.) for meeting the demands of foreign customers.

Source: Indian Express, Indian Express, The Hindu