ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

Source: The post is based on the following articles

“SUMMARY OF THE UNION BUDGET 2023-24” and “HIGHLIGHTS OF THE UNION BUDGET 2023-24” published in the PIB on 1st February 2023.

“All that you need to know about this year’s budget” and “Agriculture to zero emissions: here’s the budget in 26 letters” published in the Livemint on 2nd February 2023.

“Union Budget 2023 big picture: Capex push, tax reform” published in the Indian Express on 2nd February 2023.

What is the News?

The Union Minister of Finance and Corporate Affairs presented the Union Budget 2023-24 in Parliament.

What are the major Union Budget 2023-24 highlights?

The government focused on two areas primarily. Such as 1) Incentivise the private sector in the economy to invest in the productive capacity and thereby create jobs and push growth, 2) Increasing capital expenditure and raising more government revenues via disinvestment and privatisation. This was done to ensure that the government maintains fiscal prudence.

What is the status of the economy mentioned in the Budget 2023-24?

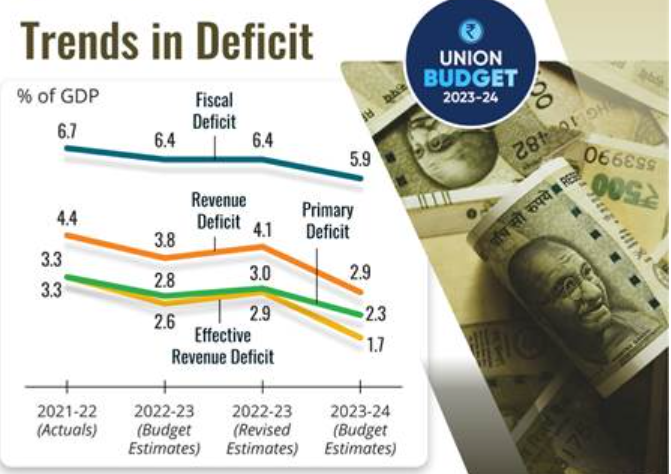

Fiscal deficit: According to the Revised Estimates 2022-23 the fiscal deficit is 6.4% of GDP. The fiscal deficit for 2023-24 is estimated to be 5.9% of GDP.

Income Tax: The rebate limit of Personal Income Tax is to be increased to Rs. 7 lahks from the current Rs. 5 lahks in the new tax regime.

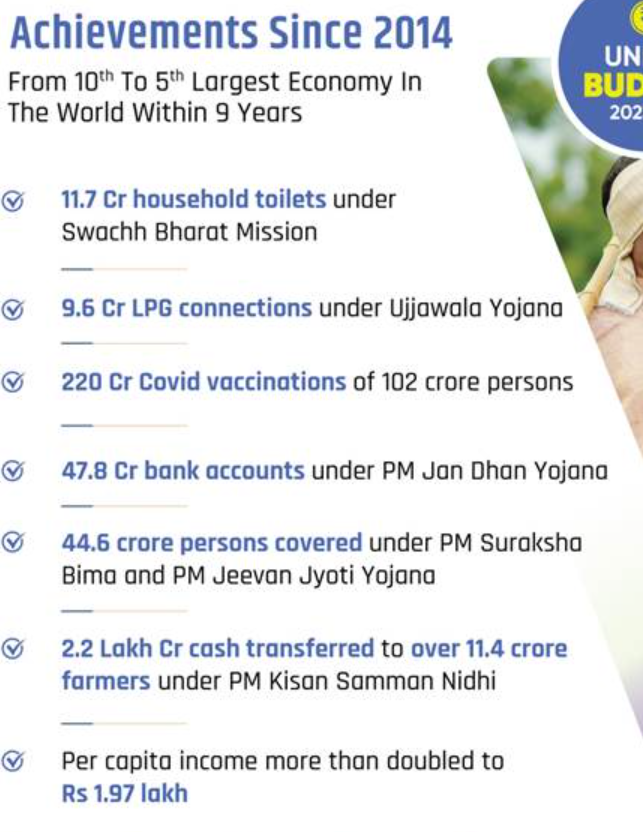

Per capita income has more than doubled to ₹1.97 lakh in around nine years.

What are the salient schemes and programs mentioned or launched in the Budget 2023-24?

Schemes for Agriculture

GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme: 500 new ‘waste to wealth’ plants under GOBARdhan scheme to be established for promoting circular economy

Atmanirbhar Clean Plant Program: The program will be launched to boost the availability of disease-free, quality planting material for high value horticultural crops.

Agriculture Accelerator Fund: It will be set-up to encourage agri-startups by young entrepreneurs in rural areas.

New sub-scheme under PM Matsya Sampada Yojana: It will be launched to further enable activities of fishermen, fish vendors, and micro & small enterprises, improve value chain efficiencies, and expand the market.

PM Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth” (PM-PRANAM): To incentivize States and Union Territories to promote alternative fertilizers and balanced use of chemical fertilizers.

Governance

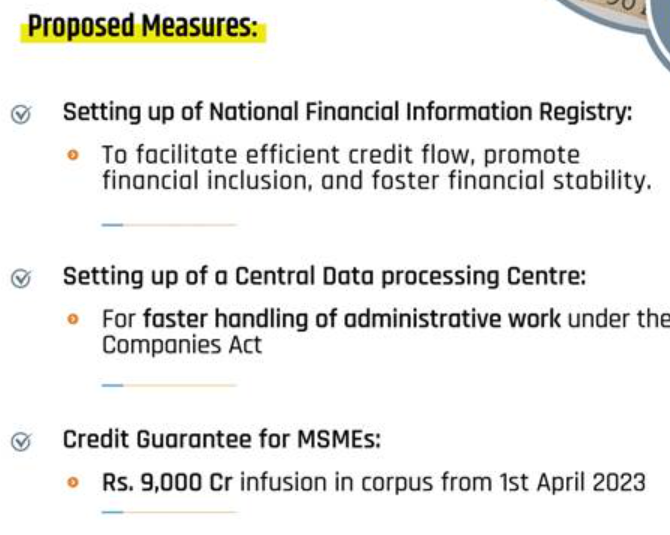

National Data Governance Policy: To unleash innovation and research by start-ups and academia.

Environment

Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI): For mangrove plantation along the coastline and on salt pan lands, through convergence between MGNREGS, CAMPA Fund and other sources.

Green Credit Programme: It will be notified under the Environment (Protection) Act to incentivize and mobilize additional resources for environmentally sustainable and responsive actions.

Amrit Dharohar scheme: To encourage optimal use of wetlands, enhance bio-diversity, carbon stock, eco-tourism opportunities and income generation for local communities.

Infrastructure

Urban Infrastructure Development Fund (UIDF): It will be established through the use of Priority Sector Lending shortfall. It will be managed by the National Housing Bank and will be used by public agencies to create urban infrastructure in Tier 2 and Tier 3 cities.

Skill Training

Pradhan Mantri Kaushal Vikas Yojana 4.0: It will be launched to skill lakhs of youth within the next three years covering new age courses for Industry 4.0 like coding, AI, robotics, mechatronics, IOT, 3D printing, drones, and soft skills.

Unified Skill India Digital platform: For enabling demand-based formal skilling, linking with employers including MSMEs, and facilitating access to entrepreneurship schemes.

Industries

Unity Mall: States will be encouraged for setting up such malls for the promotion and sale of their own and also all other states’ ODOPs (One District, One Product), GI products and handicrafts.

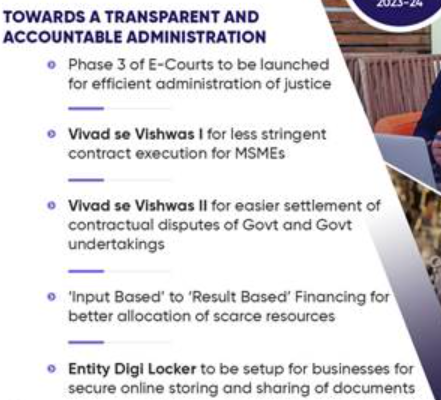

Entity DigiLocker: It will be setup for use by MSMEs, large businesses and charitable trusts to store and share documents online securely.

Health

The government will soon launch a Sickle Cell Anaemia elimination mission.

The new Programme to promote research in Pharmaceuticals will also be launched.

Education

National Digital Library for Children and Adolescents: To facilitate the availability of quality books across geographies, languages, genres and levels, and device-agnostic accessibility.

Bharat Shared Repository of Inscriptions: It will be set up in a digital epigraphy museum, with the digitization of one lakh ancient inscriptions in the first stage.

Tribal development

Pradhan Mantri PVTG Development Mission: The government allocated funds for the implementation of the mission under the Development Action Plan for the Scheduled Tribes.

Women

Mahila Samman Savings Certificate: It is a new small savings scheme for women. It will offer a deposit facility upto Rs 2 lakh in the name of women or girls for the tenure of 2 years (up to March 2025) at a fixed interest rate of 7.5 per cent with a partial withdrawal option.

How Budget 2023-24 will promote various sectors?

Promote EVs: This is done by a) A capacity of 4,000 MWh of battery energy storage systems is being supported with viability gap funding, b) The import duty on goods and machinery used in the manufacture of lithium-ion cells has been waived.

Increase Capital Expenditure: One of the major highlights of this year’s budget. There is a sharp 33% increase in capital investment.

Defence: The allocation for defence has seen an increase of 1.5%, which is an all-time high. This is allocated for purchasing new weapons, aircraft, warships and other hardware.

Benefits for High net worth individuals: The highest effective income tax rate currently stands at 42.74%. In 2023-24, this will be reduced to 39%.

Overall, the projects mentioned in Budget have a low gestation period and can create jobs quickly.