ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

In the recently released Financial Stability Report (FSR), the RBI has noted that the Gross Non-performing Assets (GNPA) ratio has declined to a 7-year low of 5% in September 2022. It is expected to further improve to 4.9% by September 2023. However, the Report also notes that NPA ratio may worsen to 5.8-7.8% if there are external macroeconomic shocks. Thus, although the NPA Crisis appears to have subsided, the banking sector is still vulnerable amidst geopolitical and economic uncertainties. The Government and the RBI had undertaken several initiatives that helped mitigate the challenge posed by NPAs. However, both need to be cautious in their approach and proactively take corrective steps should the NPAs rise in future.

What are Non-Performing Assets (NPAs)?

A Non-performing Asset (NPA) is a loan or advance for which the principal or interest payment has remained overdue for a period of 90 days.

Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

Substandard Assets: Assets which has remained NPA for a period less than or equal to 12 months.

Doubtful Assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

Loss Assets: According to the RBI, “Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.”

What is the current status of NPAs in India?

According to the Reserve Bank of India’s (RBI’s) Financial Stability Report the Gross non-performing assets (GNPA) ratio, has declined to 5% in September 2022. The ratio of Net non-performing assets (NPAs) to net advances ratio has fallen to 1.3% in September 2022 – the lowest in 10 years.

The NPAs had risen from 3.8% in 2014 to 11.4% in 2018. However, since then the NPAs have shown a declining trend. The decline has been achieved on the back of decrease in slippages, increase in write-offs, and pick up in credit growth.

In December 2022, the Government told the Rajya Sabha that loans written off by scheduled commercial banks (SCBs) during the last 5 financial years totalled INR 10.1 lakh crore. Of this, 1.32 lakh crore has been recovered. As a percentage of write-offs, this comes to be about 13%.

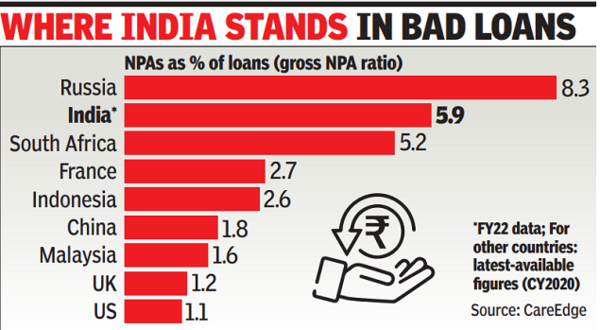

Despite the fall in the NPAs recently, the proportion is still high compared to other economies.

Source: The Times of India

What were the reasons for NPA Crisis?

Global Financial Crisis: The RBI Report on Trend and Progress of Banking in India (RTP) had noted that while the Indian banking system had largely withstood the pressures of the crisis, it remained vulnerable to the slowdown in global economic growth and the collapse of global trade following the crisis. The firms with exposure to global slowdown contributed to the NPAs.

Twin Balance Sheet Problems: In the aftermath of slowdown in the Indian economy beginning 2011 both the banking sector and the corporate sector come under severe financial stress. The proportion of non-performing loans (NPAs) in gross loans (GAs) went from about 2% in 2008 to over 11% in 2018.

Forbearance Policies: Between 2010-15, banks resorted to restructuring of loans in many cases to postpone recognition of non-performance, (’extend and pretend’ approach). As a result, until 2016 the restructured assets constituted more than 50% of the stressed assets of all scheduled commercial banks masking the actual extent of NPA crisis.

Stalled Judicial & Legislative Procedures: Many development projects were stalled due to prolonged judicial litigations. This had a particularly bad impact on sectors like mining, power, and steel. In addition, companies encountered difficulties in acquiring land, which resulted in the indefinite postponement of many projects and stalled investments

Other Factors: According to the RBI, aggressive lending practices, wilful defaults, loan frauds, diversion of funds and corruption also contributed to NPAs. Lack of information about creditworthiness about debtors also resulted in poor loan decisions. Poor recovery mechanisms also contributed to rise in NPAs.

What steps were taken to address the NPA Crisis?

RBI

The RBI undertook several measures to remedy the NPA, including the Prompt Corrective Action (PCA) framework in 2002 (which was reviewed in 2017 based on the recommendations of the working group of the Financial Stability and Development Council ), Schemes for debt restructuring (like the Scheme for Sustainable Structuring of Stressed Assets (S4A)), Asset Quality Review, etc. These efforts culminated in a 12 February 2018 circular by the RBI that granted banks the power to initiate insolvency proceedings and set a timeline of 180 days to formulate plans for a resolution.

Government

4R’s Strategy: Government has implemented a comprehensive 4R’s strategy, consisting of Recognition of NPAs transparently, Resolution and Recovery of value from stressed accounts, Recapitalising of PSBs, and Reforms in PSBs and the wider financial ecosystem for a responsible and clean system.

A National Asset Reconstruction Company (NARCL) was announced in the Union Budget for 2021-2022 to resolve stressed loans amounting to about INR 2 lakh crore in phases.

Indradhanush plan: The plan envisaged infusion of capital in PSBs by the Government. Capital infusion is aimed at supplementing the achievement of regulatory capital norms by PSBs through their own efforts and, in addition, based on performance and potential, augmenting their growth capital.

Insolvency and Bankruptcy Code, 2016: It is a step towards settling the legal position with respect to financial failures and insolvency. It provides an easy exit with a painless mechanism in cases of insolvency of individuals as well as companies.

| Read More: Issues in the IBC Resolution Process and Possible Solutions – Explained, pointwise |

Schemes for Settlement of NPAs

Lok Adalats: In order to address cases of non-performing assets (NPA) with balances of up to INR 20 lakhs of rupees, the Lok Adalats have been established. They take full responsibility for ensuring a speedy recovery . The Lok Adalats are typically not very harsh on those who have defaulted on their loans. Additionally, they are less expensive and more straightforward methods of resolving disputes related to loans.

NCLT and the National Company Law Appellate Tribunal (NCALT): NCLT has replaced the Board of Industrial and Finance Reconstruction (BIFR) and Appellate Authority for Industrial and Financial Reconstruction (AAIFR) that is under IBC. This had been done as the BIFR had failed to meet its stated objectives. Under the IBC, not only the financial creditors but also the operational creditor can file an application for the purpose to liquidate before the NCLT. The IBC also very well stipulates the complete procedure of resolution, including the litigation that is to be completed within a passage of 330 days.

What should be done going ahead?

First, The government needs to recognise how its decisions independent of the banking sector can adversely impact NPAs in certain sectors and address the impact of those decisions to check the crisis. For example, in the power sector, mandated renewable purchase obligations (RPOs) for state power utilities, forcing them to prioritise renewable sources, has affected the performance of non-renewable projects.

Second, Ensuring time-bound evaluation process to assess the viability of projects can help shield banks from ministry decisions that could give rise to NPAs as a secondary effect.

Third, The government also needs to ensure a rapid resolution of recognised NPAs. The passage of the Insolvency and Bankruptcy Code (IBC) in 2016 was a welcome first step, but the government must now ensure there are no delays in the timeframe outlined by the law.

Fourth, The government also needs to seriously consider the Nayak Committee’s recommendations reviewing the governance of boards of banks.

Fifth, While the government has created the Banks Board Bureau, deeper reforms such as setting up of a state-owned Bank Investment Company under the Companies Act for PSBs, or fully moving the selection of bank chairpersons to the Banks Board Bureau, have not yet been implemented. These should be undertaken on priority.

Syllabus: GS III, Indian Economy

Source: Indian Express, Business Standard, MoneyControl, The Hindu