ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 27th May. Click Here for more information.

Contents

What is the News?

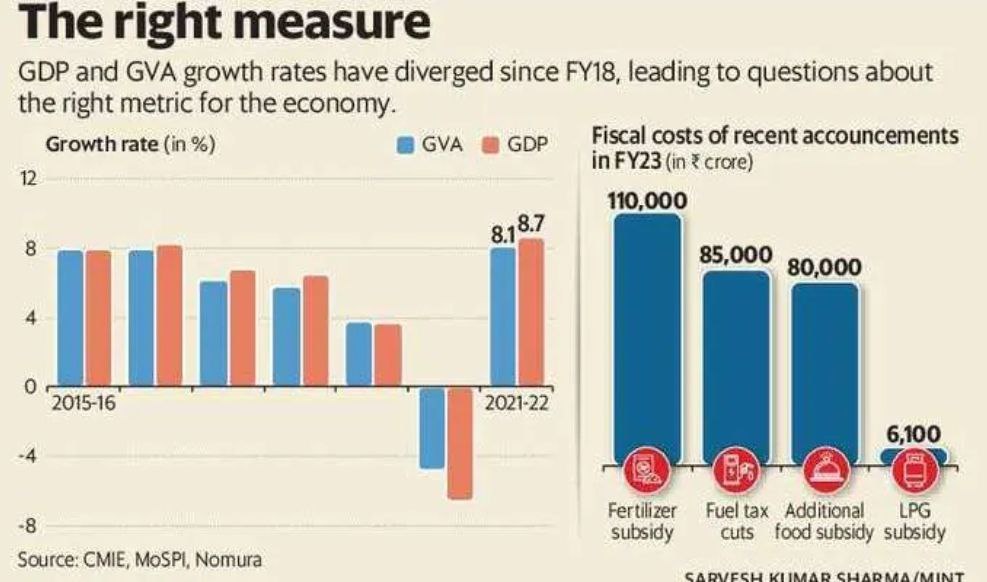

According to the data released by the government, the two measures of India’s economy— ‘gross value added’ and ‘gross domestic product’—have grown at widely different paces.

What is the difference between GVA & GDP?

GDP calculates national income by adding up all expenditures in the economy. On the other hand, GVA calculates the national income from the supply side by looking at the value-added in each sector of the economy.

The two measures of national income are linked as follows:

GDP = GVA + Taxes earned by the government — subsidies provided by the government

For instance, if the government earned more from taxes than it spent on subsidies, GDP will be higher than GVA.

But if the government provided subsidies in excess of its tax revenues, the absolute level of GVA would be higher than that of GDP.

Hence, simply put, GDP provides the demand side of the economy and GVA the supply side.

What explains the gap between GDP & GVA?

In FY21, GDP growth lagged GVA growth as the Centre brought onto the books several years of dues owed to the Food Corporation of India. Food subsidy costs ballooned in one go in a year when tax collections were severely hit due to the lockdown. This created a massive gap between the GDP and GVA.

In FY22, Tax Collections grew at a rapid pace(28%) due to a quick recovery in economic activity, while subsidies, despite remaining elevated, fell by over a third due to the base effect. This resulted in GDP growing 8.7%, while GVA rose just 8.1%.

Was the GDP & GVA gap there before FY21?

Yes. Overall, GDP tends to be higher than GVA as tax collections often remain bigger than subsidy payouts.

Will the GDP-GVA divergence continue?

Skyrocketing price pressures have forced the Center to announce a slew of measures from tax cuts to additional subsidies, both of which will weigh on GDP in FY23.

Moreover, additional subsidies worth ₹2.0 trillion would inflate GVA, while fuel tax cuts may pull GDP down unless tax revenue from other channels bridges the gap.

However, the real impact will not be known until the statistics ministry comes out with the second advanced estimate of the GDP next year.

Source: The post is based on the article “The story behind the GDP-GVA Gap” published in Livemint on 1st June 2022.