ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

- 1 Introduction

- 2 About the evolution of Digital Transactions in India

- 3 About UPI

- 4 What is the current status of UPI and Digital Transactions?

- 5 Why are the reasons for wide adoption of UPI?

- 6 What recent innovations have been done in UPI?

- 7 What are the benefits associated with UPI?

- 8 What are the challenges in further scaling-up UPI?

- 9 What steps can be taken going ahead?

- 10 Conclusion

| For 7PM Editorial Archives click HERE → |

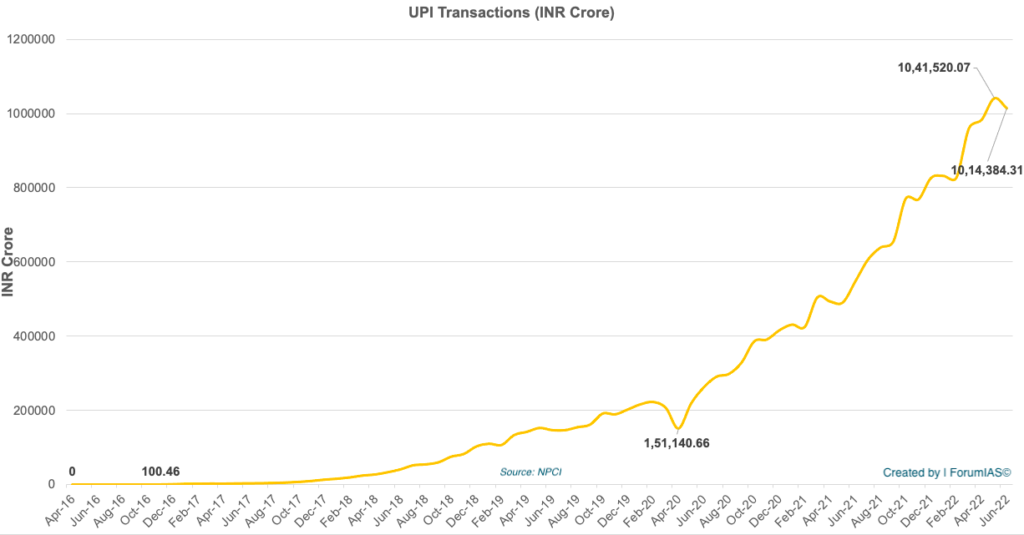

Introduction

The Unified Payments Interface (UPI) is a convenient way of transferring funds from one bank account to another. It has gained huge popularity since its launch in 2016. The popularity is testified by its adoption from tiny roadside shops to large consumer brands. In May 2022, the UPI processed payments worth INR 10,41,520 Crore and crossed INR 10 Lakh Crore threshold in monthly transactions for the first time since its launch. More than 40% of all retail digital payments (non-cash and non-paper payments) in India happen through UPI now.

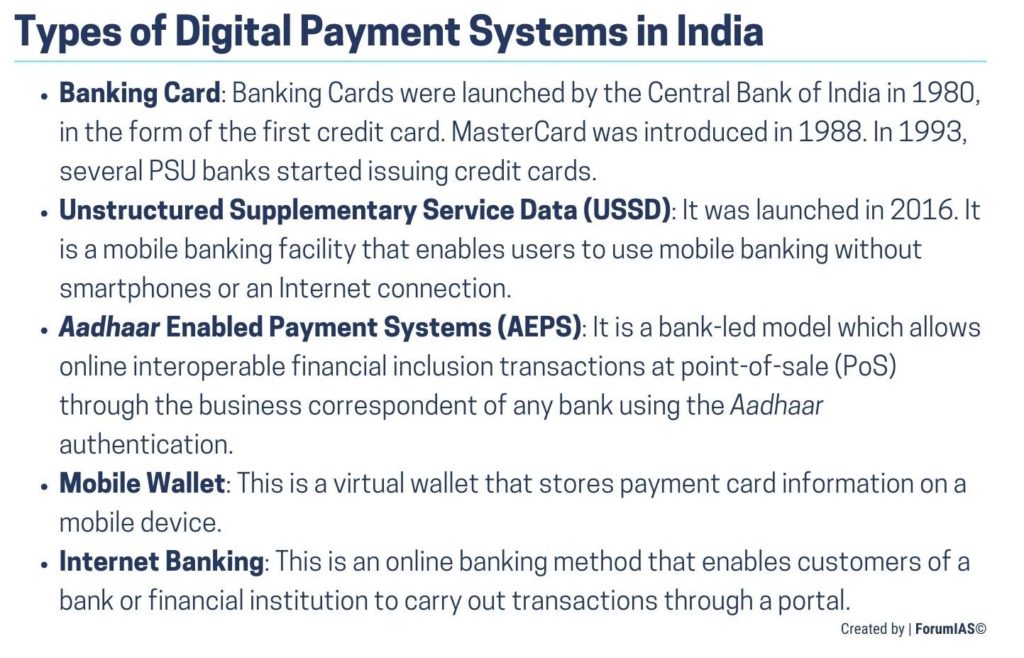

About the evolution of Digital Transactions in India

In 1996, Industrial Credit and Investment Corporation of India (ICICI) introduced online banking services in India, by using electronic banking at its branches. Later in 1999, banks such as HDFC, IndusInd, and Ci launched online banking facilities. The trend continued to grow with increasingly more banks launching net banking services in India. This marked the beginning of the digital transactions era in India – several new banks started offering services to users.

About UPI

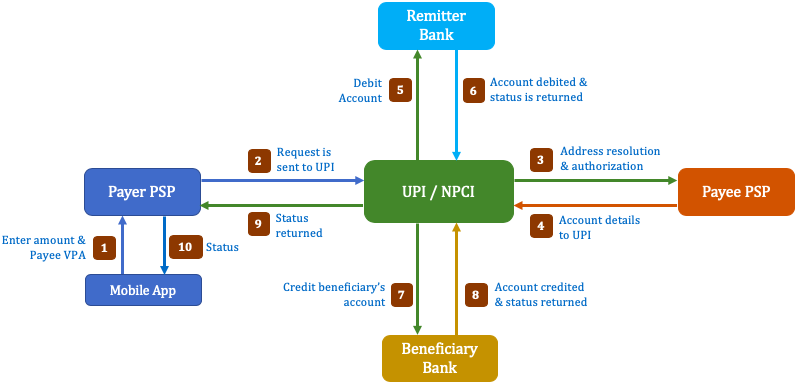

The UPI was launched in 2016 and is operated by the National Payments Corporation of India (NPCI). It is a system that powers multiple bank accounts into a single mobile application. The NPCI was formed in 2009 as an initiative of the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) with the goal to create a robust payment and settlement infrastructure.

UPI operates on top of the Immediate Payment Service (IMPS) which was created by the NPCI for immediate fund transfers.

What is IMPS?

|

Working of the UPI

What is the current status of UPI and Digital Transactions?

‘Prime Time For Real Time 2022’ report states that India’s real-time payments include the Immediate Payment Service (IMPS) and Unified Payments Interface (UPI). Both of them have seen increased usage in the last few years.

India accounted for the largest number of real-time transactions in 2021 (48.6 billion). The next highest transactions were in China (18 billion transactions). Thus, transactions in India were 2.7 times that of China. The magnitude is even more contrasting when compared with other countries e.g., the number of transactions in India were almost seven times greater than the combined real-time payments volume of the world’s leading economies: the US, Canada, the UK, France and Germany (7.5 billion).

The report also forecasted that the share of all transactions occurring via real time instrument was expected to increase to 70.7% in 2026 from the present 31.3%.

The number of banks that are live on UPI has increased from 21 in April 2016 to 330 in June 2021. The number of transactions has reached historic high of 5.96 billion in May 2022 before falling to 5.86 billion in June 2022.

Why are the reasons for wide adoption of UPI?

First, there is no Merchant Discount Rate (MDR) charges for merchants that are levied on card based transactions. This incentivizes merchants to accept UPI transcations.

Second, the UPI is convenient to use. The users only require a smartphone connected to the internet. Users prefer UPI instead of using devices like the Point-of-Sale card-swiping machines.

Third, the UPI is supported by a robust ecosystem which makes funds transfer seamless and efficient. This includes the presence of high-speed internet in many parts of the country, technologies that power a smartphone, cloud computing and modern software engineering technologies that fulfill a transaction in a few seconds.

Fourth, it offers a significant degree of security to avoid misuse. The security of a UPI transaction is tied to the user’s authentication with the mobile phone. There is a mobile personal identification number (MPIN) for the UPI application and there is one more layer of security when the bank’s online transaction PIN is to be keyed in as part of every UPI transaction. In case a mobile number is blocked due to theft, then the UPI transactions on that mobile number will also be halted.

Fifth, the COVID-19 pandemic significantly boosted digital transactions in wake of SMS (Sanitize, Mask and Social Distance) protocols and lockdowns. This also made UPI more popular with the masses.

What recent innovations have been done in UPI?

The NPCI has come up with multiple new innovations over the past few years: recurring payments for monthly bills, international payments, linking UPI to credit cards etc. Further it has introduced 123PAY that allows people without smartphones to use UPI using missed calls.

Introduction of Dynamic QR codes. It allows one-time payment by letting a merchant generate a QR (Quick Response) code that is valid for just that specific transaction and many more features. The dynamic QR code is a great boost to security and trust because there is no risk of someone tampering with a static QR code. A static QR code is widely prevalent.

What are the benefits associated with UPI?

First, widespread adoption of real-time payments helped Indian businesses and consumers save approximately US$ 12.6 billion in payment transaction cost. Digital payments improve the cash flow situation of the businesses as the payments are instantaneous. It helps increase the number of transactions and thus economic activity. It also unlocked US$ 16.4 billion or 0.56% of the Indian Gross Domestic Product (GDP) output.

Second, with digitalization, the amount of black money in the market can be reduced leading to greater compliance and more tax revenue.

Third, it enhanced consumer faith in digital transactions and encouraged them to shun the usage of cash.

Fourth, The UPI has had a huge impact on the banks and the fintech industry. It provides banks with a low-cost alternative to cash and helps them save on merchant onboarding costs.

The data acquired through digital transactions also enables banks to market other services, have a better understanding of the spending pattern, and serve consumers better. The open architecture helps fintech firms to drive innovation and develop newer products and unique services.

What are the challenges in further scaling-up UPI?

First, some experts fear it would be difficult to sustain UPI in the long run without levy of MDR to fund its infrastructure. Currently, neither customer nor merchant pays any extra price.

Second, although the use of cash has decreased since the advent of UPI, cash transactions are still significant. People still prefer to use cash due fear of tax terrorism and its greater acceptance as a mode of payment.

Third, still there is not 100% penetration of internet and smartphones amongst the population which makes it nearly impossible to do UPI transactions.

Fourth, there is a lack of digital literacy in masses due to which they are unable to use the UPI system. Further, use of mainly english language in UPI apps reduces their adoption.

What steps can be taken going ahead?

First, it is time to accelerate efforts and expand UPI’s impact beyond the top-tier metropolitan areas, and replicate its success for the benefit of the entire country, especially rural areas.

Second, cost savings from the reduction in hassles and overheads for banks (by supporting UPI) can be used to bear the cost of operating UPI in the long run.

Third, initiatives like Bharat Net project (for internet connection) and PMGDisha (for digital literacy) should be implemented with full vigor and support.

Fourth, India must share this technology with fellow countries in order to earn additional forex and also to enhance its soft power across the globe. UPI has already been rolled out in UAE, Singapore and Nepal.

In 2019, Google requested the U.S. Federal Reserve to develop a solution similar to India’s UPI citing the thoughtful planning, design and implementation behind it. India can support the U.S in this regard.

Conclusion

India is the poster child for real-time payments and a shining example of how a coordinated, collective, nationwide effort can unlock huge economic and social potential. Keeping this in mind, the reach and acceptability of UPI need to be enhanced further to further unlock economic value.

Source: The Hindu, Business Standard, Fortune India, Outlook