ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 19 April. Click Here for more information.

ForumIAS Answer Writing Focus Group (AWFG) for Mains 2024 commencing from 24th June 2024. The Entrance Test for the program will be held on 28th April 2024 at 9 AM. To know more about the program visit: https://forumias.com/blog/awfg2024

Contents

| For 7PM Editorial Archives click HERE → |

Introduction

The Government had changed the status of Jammu and Kashmir 3 years ago. The region was reorganised into Union Territory of Jammu and Kashmir and Union Territory of Ladakh. The long-term strategy of the Government is transform the region and enable its economy to reach its full potential. The Government had formulated the Jammu and Kashmir Industrial Policy 2021-30 for ushering investments in J&K and promote industrial growth in the region.

Fiscal Status Prior to Reorganization

In 2018-19, the expenditure of the State Government was 57% of Gross State Domestic Product (28% for Himachal Pradesh). This was largely financed by the Union Government, indicating dismal state of affairs. 40% of State’s revenue receipts came from the Union Government. ~25% of the receipts were consumed in the salaries and pensions.

J&K’s per capita net State State Domestic Product (INR 94,000 per person per year) was almost half of that of Himachal Pradesh (INR 176,000 per person per year). It’s road density was less than 20% of Himachal Pradesh (with similar terrain), and State had not been able to leverage its huge hydropower potential.

This was an unsustainable scenario. To transform the region it was necessary to attract private enterprise and investments to create livelihood opportunities and improve income levels. This necessitated an appropriate economic strategy for transforming the region.

Framing Economic Policies

Jammu and Kashmir has a difficult terrain. The region suffers cost disadvantages due to high transportation costs. As a result the goods produced in the regions have higher prices. Thus, the appropriate strategy for the region is to promote production of good and services of niche area segments where customers are willing to pay a premium. This can compensate for disadvantages of higher transportation costs. These products/services can be related to the strengths of the region due to its natural endowments. It can also include products/services that have evolved with the local knowledge and traditional skills.

Both the types of goods/services are abundantly available in the region. These include: (a) Handicrafts with exquisite quality that are internationally renowned; (b) High quality agro-based products like apples, walnuts, saffron etc.; (c) Abundant Hydropower sources; (d) Rare minerals.

New investor-friendly industrial policies, designed and adopted in conjugation with the Union Government, take cognisance these natural strength to usher in investments in J&K.

Attracting investments

The J&K Industrial Policy 2021-30 is the flagship policy with respect to investment, industrial and economic growth in J&K. Its promise of a higher incentive for investment in remote areas will help balanced economic development in J&K to leverage its land abundance in areas hitherto neglected.

The choice of industries focused upon under the policy are heavily labour-intensive in nature and where the products/services are high in value. These include both the J&K’s traditional strengths e.g., tourism, handicrafts and horticulture as well as new sectors like IT, ITES, healthcare, etc. The Industrial Policy also focuses on synergies with existing strengths like post-harvest management of Horticulture as well as Film Tourism as an add-on to Tourism.

The Industrial Policy has a special focus on extending financial support. Past policies too tried to usher in investments in J&K. through generous subsidies and tax exemptions. However, these investments were not linked to J&K’s natural strengths. Hence, they were not sustainable without financial support by the Government. The new Policy focuses on natural strengths to avoid repetition of this scenario. The Policy has an explicit service sector positive list eligible for financial benefits like tourism, film tourism, healthcare, education and skill development etc. These services contribute ~50% to regions economy.

Budgetary provisions have also supplemented the core philosophy of the Industrial Policy. The aim of the budgetary provisions has been to amplify and strengthen the intent of the Policy. Budgetary provisioning is expected to yield disproportionately high returns. This year’s budget is specifically suited to usher in investments and support economic development in J&K.

Tourism

J&K has beautiful picturesque landscape, and region has been long associated with tourism. However, the region has never figured among top 10 States/UTs in terms of tourist arrivals. The current Budget has provided resources for the development of 75 new destinations. It seeks to expand region’s tourism economy. Smart convergence is being undertaken with other initiatives like: (a) Revival of traditional fairs and Sufi festivals, many in remote, lesser-known destinations; (b) J&K Tourist Village Network Scheme to incenticise local youth to promote rural tourism; (c) Targeted public investments in road and urban infrastructure to make the locations more accessible and increasing the sustainable carrying capacity of these destinations.

Horticulture

The budget’s accent on horticulture addresses both the productivity and the income issue of the horticulture sector. The thrust of the budget initiatives has been on: (a) Cold storage capacity expansion; (b) Increase in productivity of apple through high-intensity orcharding; (c) Support to high value and low volume agro-products like aromatic and cash crops and vegetables. If productivity is increased to international standards, it can lead to the quadrupling of the size of this sector. Enhancing value addition to fruits (currently very low) can significantly increase employment and economic development in J&K.

Foreign Trade and Investment

A unique strand of the strategy has been to seek leveraging of India’s recent Comprehensive Economic Partnership Agreement (CEPA) with the UAE to seek markets, investments and tourists. Given the proximity and familiarity of UAE with J&K, the Gulf Investment strategy seeks to build on these links.

Impact on J&K Bound Investment

There has been a heightened interest in the region by investors due to: (a) End of constitutional uncertainty in the region; (b) Improving law and order situation; (c) Thrust on infrastructure; (d) Focused strategy for ushering investments and economic development in J&K.

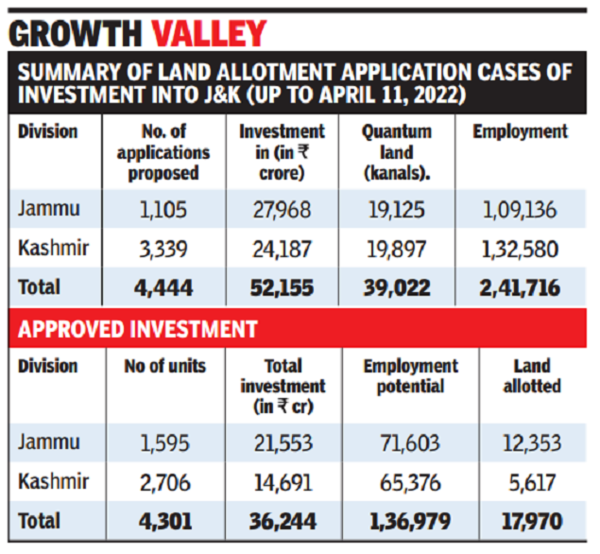

The UT Government has reported that it has received investment proposals worth around INR 51,000 crores. The employment potential of these investments is ~2.37 lakhs. The total spending of the Industrial Policy is ~ INR 28,400 crores spread over 10 years. This has a huge potential of ushering investments in J&K. Overseas investors have also shown interest especially from the UAE.

Source: The Times of India

Appropriate Investor Strategy

The investors always look for profitability. Profitability of investments in J&K will depend on close linkage of the business plan with natural, traditional and human capital endowments of the region. Such investments do not require fiscal incentives from the Government for long. J&K has witnessed huge rush of tourists this season. This demonstrates the profitability of the tourism sector. Start-ups in horticulture and post-harvest value addition can be another profitable area. Investments in both areas leverage the natural endowments of the UT amplified with local knowledge and tradition.

Other upcoming promising areas are IT and ITES, which can take advantage of the region’s considerable local talent pool. Services sector especially Education, Health and Holistic Wellness sectors offer lot of promise as well.

Towards a Bright Future

The aim of the Government’s economic strategy has been to effect transformational economic development in J&K. The new J&K will be host to world-class tourist destinations. Its horticulture sector will develop to produce best-in-quality fruit products. It will enhance the exports of handicrafts that are a product of millennia of experience and culture. It will eventually generate ~33% of India’s hydropower. It will be home to many IT, ITES, Pharma and textiles based industries, with a robust education, health and wellness ecosystem.

The strategy of the government is so designed to make the above possible. Private investors would we will rewarded if they align their investment strategy accordingly and make their investment in the UT profitable.

Syllabus: GS III, Indian Economy and issues related to growth; Inclusive growth and issues arising from it, Challenges to Internal Security.

Source: Yojana September 2022