ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 27th May. Click Here for more information.

Contents

Source: The post is based on the article “A sweet export story: How India’s sugar shipments to the world are surging” published in the Indian Express on 20th March 2023.

Syllabus: GS – 3: storage, transport and marketing of agricultural produce and issues and related constraints.

Relevance: About India’s sugar shipments.

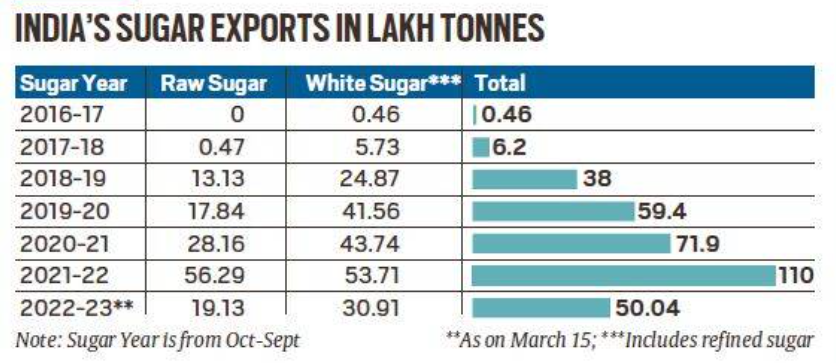

News: India’s sugar shipments in 2016-17 and 2017-18 sugar years (Oct-Sept) were a mere 0.46 lakh tonnes (lt) and 6.2 lt respectively. At present, they had increased to 110 lt by 2021-22.

About India’s sugar shipments

According to the International Sugar Organization, India has become the world’s No. 2 in sugar shipments, next only to Brazil (255.40 lt) and way ahead of Thailand (79.86 lt) and Australia (25.67 lt). The biggest importers of Indian raw sugar were Indonesia (16.73 lt), Bangladesh (12.10 lt), Saudi Arabia (6.83 lt), Iraq (4.78 lt) and Malaysia (4.15 lt).

What are the various types of India’s sugar shipments?

India exports both raw and white sugar. International Commission for Uniform Methods of Sugar Analysis is a measure of the purity of sugar based on colour. The lower the value, the more the whiteness.

Raw sugar: Raw sugar is what mills produce after the first crystallisation of juice obtained from the crushing of cane. This sugar is rough and brownish in colour. It has an ICUMSA value of 600-1,200 or higher.

Much of the world’s sugar trade is in ‘raws’ and they can be transported in bulk vessels. This is because the raw sugar requires no bagging or containerisation and can be loaded in bulk. The buyer of raw sugar is the refiner, not the end-consumer.

Refined sugar: Raw sugar is processed in refineries for the removal of impurities and de-colourisation. The end product is refined white cane sugar having a standard ICUMSA value of 45. The sugar used by industries such as pharmaceuticals has ICUMSA of less than 20.

Whites sugars are usually packed in 50-kg polypropylene bags and shipped in container cargoes over shorter distances.

Note: Till 2017-18, India hardly exported any raw sugar. It mainly shipped plantation white sugar with 100-150 ICUMSA value. This was referred to as low-quality whites or LQW in international markets.

| Read more: Implications of Cheap Sugar in India – Explained, Pointwise |

What are the advantages of Indian raw sugar?

A joint committee visited Indonesia, Malaysia, South Korea, China and Bangladesh in 2018. Their mission is to promote exports of raw sugar from India. The committee found the following advantages of Indian raw sugar. These are,

The time window of Indian production: The refineries in Indonesia, Malaysia, South Korea, China and Bangladesh import raw sugar from Brazil. Brazilian mills operate from April to November, whereas India’s crushing is from October to April. Hence, they are utilising Indian raw sugar during Brazil’s off-season.

Freight cost savings: The voyage time from Kandla, Mundra or JNPT to Ciwandan Port of Indonesia is 13-15 days, compared to 43-45 days from Brazil’s Port of Santos.

Indian sugar is free of dextran: Dextran is a bacterial compound formed when sugarcane stays in the sun for too long after harvesting. Indian raw sugar has no dextran, as it is produced from fresh cane crushed within 12-24 hours of harvesting. On the other hand, the cut-to-crush time is 48 hours or more in Brazil.

India can supply raw sugar with high polarisation: Polarisation is the percentage of sucrose present in a raw sugar mass. The more the polarisation the easier and cheaper it is to refine.

Indian mills could supply raw sugar with a very high polarisation of 98.5-99.5%. But it is only 96-98.5% in raw sugar from Brazil, Thailand and Australia.

How did Indian raw sugar advantages increase in India’s sugar shipments?

Awareness created by the committee: The committee created awareness about the quality of Indian raw sugar. So much so that Indian raw sugar today fetches a 4% premium over the global benchmark price.

Measures by Indonesia: In 2019, Indonesia agreed to tweak its ICUMSA norms and reduced its import duty on Indian raw sugar from 15% to 5% to enable imports from India.

Lower stocks, production dipping and concerns about domestic availability and food inflation have led the government to cap India’s exports in the current sugar year to 61 lt. Of that, 50 lt have already been dispatched. The government should understand that overseas markets lost aren’t easy to regain.